SMCP - Press Release- 2023 Q3 Sales

2023 third quarterPress release -

Paris, October 26th, 2023

Resilient sales in a deteriorating

environment A quarter in line with adjusted

guidance

- Q3 2023 sales

at €295m, -1% at constant exchange rates (-2% on an organic basis)

vs 2022, against strong comparables

- 9M 2023 sales

at €905m, +5% at constant exchange rates (+4% on an organic basis)

vs 2022

- Consumption

slowdown throughout the quarter in Europe and America; slow and

weak recovery of China’s economy and more positive trend in other

Asian markets

- Consistent

trend across all brands

- Maintained

discount rate policy; stabilization of the discount rate despite a

competitive environment and after two consecutive years of

improvement

- Digital sales

trend in line with B&M

- Network

expansion (46 net openings in Q3) to reach 1,704 points of

sales

- Ongoing

savings plan delivers positive effects

- Liquidity

secured thanks to the extension of financing until 2026/2027,

obtained last July

- Significant

focus on controlling inventory levels

-

Confirmation of full-year guidance revised in

September:

- mid-single

digit growth of sales at constant FX vs. 2022

- adjusted EBIT

margin between 7% and 9%

Commenting on these results, Isabelle

Guichot, CEO of SMCP, stated: “As expected, in a

deteriorating economic environment, with a slowdown in consumer

spending in Europe and America, a slow recovery in the Chinese

economy and despite a more positive trend in the rest of Asia, we

recorded a slight decline in sales over the quarter. In this

context, since several months we have been implementing an action

plan based on pursuing our full-price strategy, prioritizing our

investments, enhancing the quality of our physical and digital

networks, and improving the productivity of our teams. This action

plan is starting to bear fruit, and we expect to see an increasing

impact in the fourth quarter. Despite the macroeconomic

environment, we are confident that our action plan, supported by

our dedicated teams and the strong desirability of our brands, will

enable us to pursue our growth trajectory.”

| €m

except % Unaudited figures |

Q3 2022 |

Q3 2023 |

Organicchange |

ReportedChange |

|

9M 2022 |

9M 2023 |

Organicchange |

Reported change |

|

Sales by region |

|

|

|

|

|

| France |

99.1 |

97.5 |

-1.6% |

-1.6% |

|

293.8 |

301.4 |

+2.6% |

+2.6% |

| EMEA |

98.6 |

96.5 |

-2.0% |

-2.2% |

|

272.0 |

285.6 |

+5.2% |

+5.0% |

| America |

49.0 |

42.7 |

-6.5% |

-12.9% |

|

132.1 |

123.0 |

-4.7% |

-6.9% |

|

APAC |

61.6 |

58.2 |

+1.2% |

-5.6% |

|

175.8 |

194.7 |

+12.9% |

+10.7% |

|

Sales by Brand |

|

|

|

|

|

| Sandro |

150.2 |

143.3 |

-2.2% |

-4.6% |

|

416.9 |

438.8 |

+6.0% |

+5.2% |

| Maje |

119.9 |

112.4 |

-3.2% |

-6.3% |

|

343.8 |

340.9 |

+0.2% |

-0.9% |

| Other

brands1 |

38.3 |

39.2 |

+2.4% |

+2.3% |

|

113.0 |

125.0 |

+10.7% |

+10.6% |

|

TOTAL |

308.4 |

294.9 |

-2.0% |

-4.4% |

|

873.8 |

904.7 |

+4.3% |

+3.5% |

SALES BY

REGION

In France, nine-month sales

reached €301m, up +3% organic vs 2022. The third quarter saw a

slight decline of -2% on a high basis of comparison. The period was

impacted by lower traffic due to persistent inflation, which

mechanically affects the purchasing power of both local consumers

and tourists. However, the Group outperformed market indicators

(IFM, Banque de France), consolidating its competitive position.

Digital sales posted a positive like-for-like growth. The POS

network remained stable over the quarter.

In EMEA, nine-month sales

reached €286m, up +5% on an organic basis vs 2022. Sales in the

third quarter slightly declined by -2%, impacted by inflation,

consumption slowdown in the UK and Italy and a decrease of tourist

flow. However, in the Middle East, the trend remained positive.The

network grew by 20 points of sale in Q3 with the opening of a new

country Egypt through local partner, in addition to some openings

in key EMEA retail markets in B&M and digital.

In America, after an

outstanding performance in 2022, nine-month sales reached €123m,

-5% organic. Third quarter sales were down by -7% vs 2022 with

contrasted performances by country. While the activity in Canada is

still heavily impacted by the deep reconstruction of the retail

market environment and the lack of tourism, sales in the US were

more resilient despite a complex economic context. With positive

results in key cities (like Miami and Houston), the Group is well

positioned compared to market trends. The network regained growth

momentum with nine net openings in Q3.

In APAC, nine-month sales

reached €195m, i.e. an organic growth of +13% vs 2022. Third

quarter sales were up by +1%. In a context of slow and weak

economic recovery, sales in Greater China were slightly up in Q3;

the trend remains more favorable in some other Asian markets (like

Singapore and Malaysia). Finally, the network continued its

sustained expansion with 17 openings, mainly in South Korea, China

and Vietnam.

CONCLUSION AND

PERSPECTIVES

To cope with a deteriorating economic

environment, the Group is fully committed and focused on the

implementation of its action plan launched in July and articulated

around four key pillars:

- continuation of

the full price strategy;

- prioritization

of investments, with a particular focus on marketing and IT

expenditure;

- qualitative

expansion of the physical and digital network, with scope effects

expected to be more visible by the end of the year;

- and improvement

of store teams’ productivity, as well as the adjustment of the

recruitment policy for the in head office teams.

The savings plan is starting to deliver the

expected positive effects, which will be consolidated in the fourth

quarter. The Group is also focusing its attention on cash and

liquidity management: as a reminder, its financing facilities have

been extended until 2026/2027. Particular attention is being paid

to controlling inventory levels; aiming to stabilize the level at

year-end vs 2022.

Thanks to this action plan, supported by

committed teams and strong brand desirability, and provided that

the geopolitical situation and the macroeconomic and social context

do not deteriorate further in the fourth quarter, SMCP is confident

in its resilience, and confirms its annual targets revised in

September.

NEXT

PUBLICATION

End of February 2024 – 2023 Annual Results

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 9:00 a.m. (Paris

time).

Related slides will

also be available on the website (www.smcp.com), in the Finance

section.

APPENDICES

Breakdown of DOS

|

Number of DOS |

Q3-22 |

2022 |

H1-23 |

Q3-23 |

|

vs.H1 23 |

vs.2022 |

vs.Q3 22 |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

455 |

460 |

463 |

463 |

|

- |

+3 |

+8 |

| EMEA |

392 |

395 |

399 |

401 |

|

+2 |

+6 |

+9 |

| America |

167 |

166 |

167 |

171 |

|

+4 |

+5 |

+4 |

| APAC |

258 |

259 |

301 |

314 |

|

+13 |

+55* |

+56* |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

547 |

551 |

575 |

583 |

|

+8 |

+32 |

+36 |

| Maje |

453 |

457 |

477 |

485 |

|

+8 |

+28 |

+32 |

| Claudie

Pierlot |

203 |

201 |

206 |

206 |

|

- |

+5 |

+3 |

| Suite 341 |

2 |

2 |

- |

- |

|

- |

-2 |

-2 |

| Fursac |

67 |

69 |

72 |

75 |

|

+3 |

+6 |

+8 |

|

Total DOS |

1,272 |

1,280 |

1,330 |

1 349 |

|

+19 |

+69 |

+77 |

Breakdown of POS

|

Number of POS |

Q3-22 |

2022 |

H1-23 |

Q3-23 |

|

vs.H1 23 |

vs.2022 |

vs.Q3 22 |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

456 |

461 |

464 |

464 |

|

- |

+3 |

+8 |

| EMEA |

544 |

552 |

520 |

540 |

|

+20 |

-12 |

-4 |

| America |

198 |

198 |

200 |

209 |

|

+9 |

+11 |

+11 |

| APAC |

472 |

472 |

474 |

491 |

|

+17 |

+19 |

+19 |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

745 |

752 |

744 |

765 |

|

+21 |

+13 |

+20 |

| Maje |

620 |

627 |

615 |

633 |

|

+18 |

+6 |

+13 |

| Claudie

Pierlot |

236 |

233 |

227 |

231 |

|

+4 |

-2 |

-5 |

| Suite 341 |

2 |

2 |

- |

- |

|

- |

-2 |

-2 |

| Fursac |

67 |

69 |

72 |

75 |

|

+3 |

+6 |

+8 |

|

Total POS |

1,670 |

1,683 |

1,658 |

1 704 |

|

+46 |

+21 |

+34 |

|

o/w Partners POS |

398 |

403 |

328 |

355 |

|

+27 |

-48* |

-43* |

* Including the stores transferred from POS to DOS in Australia

and New Zealand from January 2023

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

Number of points of sale

(POS)

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly operated stores (DOS), including

free-standing stores, concessions in department stores,

affiliate-operated stores, outlets and online stores, and (ii)

partnered retail points of sale.

Organic sales growth

Organic sales growth is the total sales in a

given period compared to the same period in the previous year. It

is expressed as a percentage change between the two periods and is

presented at constant rates (sales for period N and period N-1 in

foreign currencies are converted at the average rate for year N-1)

and excluding the effects of changes in the scope of

consolidation.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year. Like-for-like points of sale for a given period

include all of the Group’s points of sale that were open at the

beginning of the previous period and exclude points of sale closed

during the period, including points of sale closed for renovation

for more than one month, as well as points of sale that changed

their activity (for example, Sandro points of sale changing from

Sandro Femme to Sandro Homme or to a mixed Sandro Femme and Sandro

Homme store). Like-for-like sales growth percentage is presented at

constant exchange rates.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros. In general, figures presented in

this press release are rounded to the nearest full unit. As a

result, the sum of rounded amounts may show non-material

differences with the total as reported. Note that ratios and

differences are calculated based on underlying amounts and not

based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties. These risks and

uncertainties include those discussed or identified under Chapter 3

“Risk factors and internal control” of the Company’s Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers - AMF) on 11 April 2023

and available on SMCP's website (www.smcp.com).This document has

not been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 47 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

| |

|

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

1 Claudie Pierlot and Fursac brands

- Press Release - SMCP - 2023 Q3 Sales

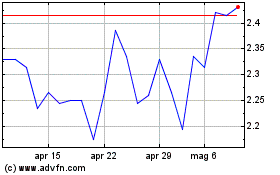

Grafico Azioni SMCP (EU:SMCP)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni SMCP (EU:SMCP)

Storico

Da Nov 2023 a Nov 2024