Solvay first quarter 2024 results

07 Maggio 2024 - 7:00AM

Solvay first quarter 2024 results

Strong FCF supported by resilient EBITDA and discipline on costs

and capex

Brussels, May 7, 2024 – 7:00 am CEST -

regulated information

Highlights

- Net

sales for Q1 2024 at €1,201 million were down -11.9%

organically versus Q1 2023, with positive volume impact, for the

first time in seven quarters, in both Basic and Performance

Chemicals segments. Prices decreased, mostly reflecting the lower

energy and raw material costs.

-

Underlying EBITDA of €265 million for the first

quarter was -13.6% lower organically compared to a high Q1 2023,

with negative Net Pricing partially offset by positive volume

impact and lower fixed costs. The EBITDA margin remained solid at

22.1%, and improved sequentially.

- First cost savings

initiatives are already bearing fruit, with €19 million achieved in

Q1 2024.

- Underlying net

profit from continuing operations was €119 million in Q1

2024 vs. €187 million in Q1 2023.

- Free Cash

Flow1 was strong at €123 million in Q1

2024, from resilient EBITDA combined with discipline on working

capital, costs and capex.

- ROCE was 19.8% in

Q1 2024.

- Successful inaugural €1.5

billion bond issuance to refinance the bridge facility set

up at the end of 2023, in relation to the partial demerger,

bringing additional strength and stability to the balance

sheet.

- Underlying Net Debt at €1.6 billion,

implying a leverage ratio of 1.4x.

- 2024 Outlook:

Organic growth of the underlying EBITDA of -10% to -20% compared to

restated 2023; Free cash flow greater than €260 million

|

First quarter |

| Underlying (in €

million) |

2024 |

2023 |

% yoy |

% organic |

|

|

Net sales |

1,201 |

1,355 |

-11.3% |

-11.9% |

|

|

EBITDA |

265 |

365 |

-27.2% |

-13.6% |

|

|

EBITDA margin |

22.1% |

26.9% |

-4.8pp |

- |

|

|

FCF1 |

123 |

-130 |

n.m. |

- |

|

|

ROCE |

19.8% |

N/A |

n.m. |

- |

|

Philippe Kehren, Solvay CEO

“I’m proud of our performance in the first quarter, despite

challenging macroeconomic conditions, as we focused on what is

under our control: capex, costs and cash. Certain areas of our

business have shown promising momentum compared to the trough from

late 2023, but we cannot call it a recovery yet. We are rapidly

deploying cost-saving initiatives that have already started to

deliver. Looking ahead, we maintain confidence in meeting our

targets for 2024. Our simplified portfolio, clear operating model

and strong focus on cash are great assets to position Solvay for

sustained success in the years to come.”

2024 outlook

In the first quarter of 2024, while Solvay benefitted from

slight volume pick-up in some of its businesses, management has

maintained a strong focus on costs and cash. Looking ahead, the

company is confident that it can keep its fixed costs under

control. Despite green shoots in some segments in Q1, soft demand

combined with a volatile macro and geopolitical environment lead

Solvay to remain prudent. As a consequence the view on the rest of

the year is relatively unchanged at this stage.

Solvay confirms, for full year 2024, its guidance of organic

growth of the underlying EBITDA by -10% to -20% (translating into a

range of €925 million to €1,040 million at a 1.10 EUR/USD exchange

rate) and its guidance of Free Cash Flow to Solvay shareholders to

be greater than €260 million.

1 Free cash flow (FCF) is the free cash to Solvay

shareholders from continuing operations.

Safe harbor

This press release may contain forward-looking information.

Forward-looking statements describe expectations, plans,

strategies, goals, future events or intentions. The achievement of

forward-looking statements contained in this press release is

subject to risks and uncertainties relating to a number of factors,

including general economic factors, interest rate and foreign

currency exchange rate fluctuations, changing market conditions,

product competition, the nature of product development, impact of

acquisitions and divestitures, restructurings, products

withdrawals, regulatory approval processes, all-in scenario of

R&I projects and other unusual items. Consequently, actual

results or future events may differ materially from those expressed

or implied by such forward-looking statements. Should known or

unknown risks or uncertainties materialize, or should our

assumptions prove inaccurate, actual results could vary materially

from those anticipated. The Company undertakes no obligation to

publicly update or revise any forward-looking statements.

About Solvay

Solvay, a pioneering chemical company with a legacy rooted in

founder Ernest Solvay's pivotal innovations in the soda ash

process, is dedicated to delivering essential solutions globally

through its workforce of over 9,000 employees. Since 1863, Solvay

harnesses the power of chemistry to create innovative, sustainable

solutions that answer the world’s most essential needs such as

purifying the air we breathe and the water we drink, preserving our

food supplies, protecting our health and well-being, creating

eco-friendly clothing, making the tires of our cars more

sustainable and cleaning and protecting our homes. As a

world-leading company with €4.9 billion in net sales in 2023 and

listings on Euronext Brussels and Paris (SOLB), its unwavering

commitment drives the transition to a carbon-neutral future by

2050, underscoring its dedication to sustainability and a fair and

just transition. For more information about Solvay, please visit

solvay.com or follow Solvay on Linkedin.

|

Media relations Peter Boelaert+32 479 30 91 59 Laetitia

Van Minnenbruggen+32 484 65 30 47 Kimberly King+ 1 470 464

4336 Valérie Goutherot+33 6 77 05 04

79 media.relations@solvay.com |

Investor relations Boris Cambon-Lalanne+32 471 55 37

49 Geoffroy d’Oultremont+32 478 88 32 96 Vincent

Toussaint+33 6 74 87 85 65 investor.relations@solvay.com |

|

|

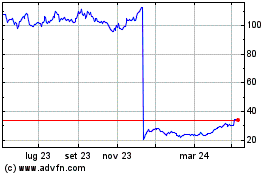

Grafico Azioni Solvay (EU:SOLB)

Storico

Da Gen 2025 a Feb 2025

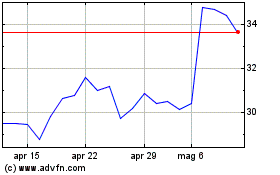

Grafico Azioni Solvay (EU:SOLB)

Storico

Da Feb 2024 a Feb 2025