Regulatory News:

Veolia Environnement (Paris:VIE) announces the launch of a new

employee shareholding operation. This operation, offered to

approximately 190,000 Group employees, aims to involve them in

Veolia's development and performance. The settlement and delivery

of the new shares to be issued is expected to take place on

September 13, 2024.

The main terms of this transaction are described below.

Issuing company

Veolia Environnement, a public limited company incorporated

under French law Listing: Euronext Paris (France) Ordinary share

ISIN code: FR0000124141 VIE

Objectives of the operation

This shareholding plan is part of the Group's policy of

developing employee shareholding and aims to strengthen the

position of employees as the company's largest shareholder. With

this operation, which offers the possibility of subscribing

directly or indirectly to Veolia Environnement shares, Veolia

wishes to involve its employees even more closely in the Group's

development, and in particular in the implementation of its new

GreenUp strategic plan, which aims to accelerate the deployment of

solutions in favor of decarbonization, depollution and regeneration

of resources.

Framework of the operation - Securities offered

The offer is proposed within the framework of the Veolia

Environnement group savings plan and international group savings

plan in accordance with Articles L. 3332-18 et seq. of the French

Labour Code and on the basis of the shareholders' authorisation

granted by the 19th resolution of the combined general meeting of

April 25, 2024. Implementation of the offering on the basis of the

resolution referred to above has been decided by the Board of

Directors on May 13, 2024. The offer concerns a maximum number of

14,508,233 shares (i.e. approximately 2% of the share capital at

the date of the combined general meeting of April 25, 2024).

The dates of the subscription/revocation period and the

subscription price will be determined by a decision of the Chief

Executive Officer, acting by delegation of the Board of Directors,

scheduled for July 31, 2024. The subscription price shall be equal

to the average of the closing prices of the Veolia Environnement

share on Euronext Paris during the twenty (20) trading days

preceding the aforementioned decision of the Chief Executive

Officer (reference price), less a discount of 15% and rounded up to

the next euro cent.

The new shares will carry immediate dividend rights.

Indicative timetable of the transaction

The timetable below is provided for information purposes only

and may be modified due to events affecting the proper conduct of

the transaction.

Reservation period: from June 3, 2024 to June 21, 2024

(inclusive) Subscription price setting: July 31, 2024

Subscription/revocation period: August 1 to 6, 2024 (inclusive)

Settlement and delivery of the offer: September 13, 2024

Terms and conditions of subscription

Beneficiaries of the offer

The offer is made pursuant to Articles L. 3332-18 et seq. of the

French Labour Code, within the framework of the Group Savings Plan

(PEG) and the International Group Savings Plan (PEGI) of Veolia

Environnement. In the United Kingdom, employees can also invest in

Veolia Environnement shares under the Share Incentive Plan.

It is open to employees of Veolia Environnement SA and

participating subsidiaries in France and in 53 jurisdictions

worldwide, with at least three months' service with the Group at

the closing date of the revocation period.

Retired and early-retired former employees who have retained

assets in the PEG since leaving the Group are eligible for the

operation, without the benefit of the matching contribution.

Subscription formulas

Beneficiaries can subscribe to Veolia Environnement shares

through two distinct offers, a secured offer with leverage effect

and a classic offer:

- The secured offer with leverage effect: the subscriber benefits

from a gross matching contribution of 100% of his/her personal

contribution up to a limit of 300 euros, a guarantee of his/her

total investment, including the matching contribution, and the

higher of either (i) a minimum guaranteed return at predetermined

rate on his/her investment, including the matching contribution, or

(ii) a multiple of the possible increase in the Veolia

Environnement share price.

- The classic offer: the subscriber invests in Veolia

Environnement shares with a 15% discount on the reference price.

The investment made in the classic offer presents a risk of capital

loss insofar as it will follow the evolution of the Veolia

Environnement share price, both upwards and downwards.

Method of holding the shares

Subscriptions are made through an FCPE or, in some countries,

through direct shareholding.

The voting rights attached to the securities held in the FCPE

will be exercised by the FCPE's Supervisory Board. Voting rights

relating to securities held directly will be exercised by the

subscriber.

Unavailability

The shares subscribed directly and the units of the FCPE will be

blocked until June 1st, 2029 unless one of the cases of early

release provided for by Articles L. 3332-25 and R. 3324-22 of the

French Labour Code, as applicable in the various countries where

the offer is deployed, occurs.

Hedging transactions

The secured leveraged offer implies that the counterparty bank

of the said offer will carry out hedging transactions, on and/or

off the markets, by means of purchases and/or sales of shares,

purchase of call options and/or any other transactions, at any time

and in particular as from the opening date of the period for

determining the subscription price and throughout the duration of

the operation.

Listing of the shares

Veolia Environnement shares are admitted to trading on Euronext

Paris. The newly issued Veolia Environnement shares will be listed

on the regulated market of Euronext Paris as soon as possible after

the completion of the capital increase. They will be admitted on

the same quotation line as the existing shares (ISIN code: FR

0000124141-VIE) and will be fully assimilated to them as soon as

they are admitted for trading.

Specific mention for the international market

This press release does not constitute an offer to sell or a

solicitation to subscribe for Veolia Environnement shares. The

offer of Veolia Environnement shares is strictly reserved for the

above-mentioned beneficiaries and will be made only in those

countries where, if applicable, such an offer has been registered

with or notified to the competent local authorities and/or

following the approval of a prospectus by the competent local

authorities, or in consideration of an exemption from the

obligation to prepare a prospectus or to register or notify the

offer.

More generally, the offer will only be made in countries where

all required registration procedures and/or notifications will have

been carried out and the necessary authorisations obtained.

The Veolia Environnement shares that may be acquired in this

offer are not subject to any recommendation by governmental market

or regulatory authorities. No advice or recommendation to invest is

given by Veolia Environnement or any employer. The investment

decision is a personal decision, which must be made by each

employee taking into account his/her or her financial resources,

investment objectives, personal tax situation, other investment

alternatives and the fact that the value of a listed share is

fluctuating. In this respect, beneficiaries are invited to consider

diversification of their investment portfolio to ensure that the

envisaged risk is not too concentrated in a single investment.

The offer is made on a voluntary basis by Veolia Environnement.

Neither Veolia Environnement nor the employers are obliged to

repeat the offer or to make similar offers in the future. The terms

and conditions of the offer do not form part of the employees'

employment contracts.

▁▁▁

ABOUT VEOLIA

Veolia's ambition is to become the benchmark company for

ecological transformation. With nearly 218,000 employees on five

continents, the Group designs and deploys useful, practical

solutions for managing water, waste and energy that help to

radically change the world. Through its three complementary

activities, Veolia contributes to developing access to resources,

preserving available resources and renewing them. In 2023, the

Veolia group served 113 million people with drinking water and 103

million with wastewater services, produced 42 terawatt-hours of

energy and recovered 63 million metric tons of waste. Veolia

Environnement (Paris Euronext: VIE) generated consolidated sales of

€45.3 billion in 2023. www.veolia.com

▁▁▁

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240602747506/en/

VEOLIA GROUP MEDIAS RELATIONS VEOLIA Laurent

Obadia - Evgeniya Mazalova Anna Beaubatie - Aurélien

Sarrosquy Tél.+ 33 (0) 1 85 57 86 25

presse.groupe@veolia.com

INVESTORS & ANALYSTS VEOLIA Ronald Wasylec -

Ariane de Lamaze Tél. + 33 (0) 1 85 57 84 76

investor-relations@veolia.com

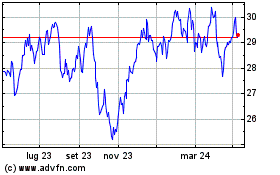

Grafico Azioni Veolia Environnement (EU:VIE)

Storico

Da Dic 2024 a Gen 2025

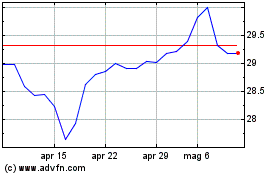

Grafico Azioni Veolia Environnement (EU:VIE)

Storico

Da Gen 2024 a Gen 2025