UK Job Placements Fall At Slowest Pace In More Than A Year: KPMG/REC Report

10 Giugno 2024 - 6:10AM

RTTF2

UK permanent staff appointments fell for the twentieth

consecutive month in May but the pace of decrease was the softest

since March 2023, a report compiled by S&P Global showed on

Monday.

Recruitment consultants cited delayed decision making and a lack

of demand amongst companies as reasons for the fall in recruitment

activity, the KPMG/REC Report on Jobs revealed.

Temp billings also decreased in May, with the decline the

weakest since January. Further, data showed that starting pay for

candidates increased in May amid reports of a competitive market

landscape, alongside evidence of a ripple impact on base pay rates

following increases in the national minimum and living wages.

Nonetheless, both permanent and temporary staff pay grew at a

slightly slower pace than seen in April.

Demand for staff dropped for the seven straight months in May.

The latest fall was exclusively led by permanent workers as temp

staff demand was unchanged in the survey period.

Further, there was another steep increase in staff availability

in May. The rate of growth was the sharpest since December

2020.

Redundancies, higher unemployment and reduced demand for staff

led to the broad rise in candidate availability.

"We know our labour market is resilient," Jon Holt, Chief

Executive and Senior Partner of KPMG in the UK, said.

"The big picture is that unemployment is historically low with

the ease of filling vacancies back to pre-pandemic levels," Holt

said.

Taken together with today's data and expected interest rate

cuts, inflation easing and increased consumer confidence over the

summer, Holt sees a better economic outlook for the second half of

2024.

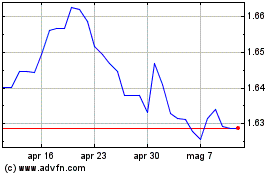

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Mag 2024 a Giu 2024

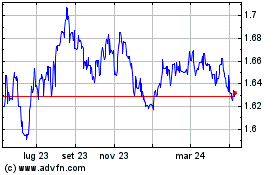

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Giu 2023 a Giu 2024