Euro Weakens Ahead Of ECB Rate Decision

15 Ottobre 2024 - 3:17PM

RTTF2

The euro declined against its most major counterparts in the New

York session on Tuesday, ahead of the European Central Bank meeting

that is widely expected to deliver another interest rate cut after

recent data signaled continued weakness in the euro zone

economy.

The ECB is widely anticipated to reduce interest rates by 25

basis points, which would bring the deposit facility rate to 3.25

percent.

Headline inflation dropped below the ECB's target in September,

bolstering the possibility of rate cuts in October and

December.

ECB policymakers, including President Christine Lagarde, hinted

at further monetary easing amid easing inflationary pressures.

Germany's wholesale prices fell at the steepest pace in five

months in September, while investor confidence in the country

improved for the first time in four months, separate data

revealed.

The euro reached as low as 0.9381 against the franc. If the

currency falls further, it is likely to test support around the

0.92 region.

The euro fell to near a 2-week low of 0.8325 against the pound

and a 4-day low of 162.34 against the yen, off its early highs of

0.8353 and 163.43, respectively. The currency is seen finding

support around 0.82 against the pound and 158.00 against the

yen.

The euro touched a 6-day low of 1.7875 against the kiwi. The

currency may challenge support around the 1.74 level.

Against the loonie, the euro eased and was trading at 1.5031,

down from an early multi-week high of 1.5096. The currency is

likely to locate support around the 1.48 level.

In contrast, the euro edged up to 1.6266 against the aussie. The

currency is poised to challenge resistance around the 1.67

level.

After falling to more than a 2-month low of 1.0884 against the

greenback in the previous session, the euro moved up to 1.0916.

Immediate resistance for the currency is seen around the 1.12

level.

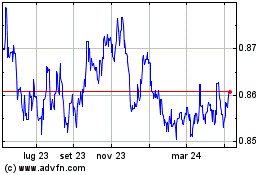

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Ott 2024 a Nov 2024

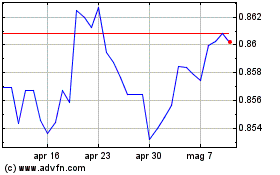

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Nov 2023 a Nov 2024