Euro Climbs Amid Risk Appetite

21 Marzo 2023 - 9:51AM

RTTF2

The euro advanced against its major counterparts in the European

session on Tuesday amid risk appetite, as fears over a banking

crisis eased, and investors awaited the Federal Reserve's

interest-rate decision.

The Fed kicks off its two-day meeting today, with markets

expecting a 25-bps rate hike on Wednesday.

The focus will be on Fed Chair Jerome Powell's forward guidance

and dot-plot projections, especially in light of the recent banking

turmoil.

UBS' state-backed acquisition of Credit Suisse eased some of the

concerns about a global banking crisis and triggered demand for

riskier assets.

German bond yields rose, with the yield on the 10-year Bund

touching 2.421 percent.

Data from Eurostat showed that Eurozone construction output

rebounded sharply in January and at the fastest pace in nearly two

years amid robust growth in both building construction and civil

engineering.

Construction output rose 3.9 percent month-on-month in January,

reversing a 2.3 percent fall in the previous month.

The euro appreciated to a 5-week high of 1.0780 against the

greenback, 6-day high of 142.55 against the yen and an 8-day high

of 1.7398 against the kiwi, from its early lows of 1.0703, 140.41

and 1.7134, respectively. The euro may locate resistance around

1.11 against the greenback, 145.00 against the yen and 1.76 against

the kiwi.

The euro firmed to a 5-day high of 0.8796 against the pound and

near a 3-week high of 0.9978 against the franc, off its early lows

of 0.8725 and 0.9942, respectively. The next possible resistance

for the euro is seen near 0.90 against the pound and 1.05 against

the franc.

The euro jumped to 1-week highs of 1.4724 against the loonie and

1.6132 against the aussie, following its prior lows of 1.4638 and

1.5940, respectively. Next immediate resistance for the euro is

seen around 1.51 against the loonie and 1.65 against the

aussie.

U.S. existing home sales for February are scheduled for release

in the New York session.

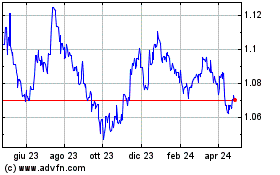

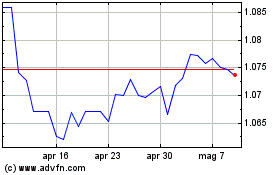

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Nov 2024 a Dic 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Dic 2023 a Dic 2024