U.S. Dollar Falls; All Eyes On U.S. Jobs Data

05 Luglio 2024 - 5:24AM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Friday, as traders now await the release of

crucial U.S. monthly jobs report later in the day for cues on the

outlook for interest rates.

Softer-than-expected recent U.S. economic data fueled

speculation that the U.S. Fed could slash interest rates in

September.

The U.S. job's data would also shed light on how much the

world's largest economy has slowed in 2024.

The dollar also weakened as the U.S. markets were closed

Thursday for Independence Day holiday.

In the Asian trading today, the U.S. dollar fell to more than a

3-week low of 1.0825 against the euro and a 2-day low of 1.2777

against the pound, from yesterday's closing quotes of 1.0810 and

1.2757, respectively. If the greenback extends its downtrend, it is

likely to find support around 1.09 against the euro and 1.29

against the pound.

Against the Swiss franc and the U.S. dollar, the greenback

dropped to 1-week lows of 0.8980 and 160.53 from Thursday's closing

quotes of 0.9001 and 161.25, respectively. The greenback may test

support near 0.88 against the franc and 158.00 against the yen.

Against the Australia, the New Zealand and the Canadian dollars,

the greenback slid to a 6-month low of 0.6740, a 2-day low of

0.6125 and a 1-1/2-month low of 1.3602 from yesterday's closing

quotes of 0.6727, 0.6117 and 1.3613, respectively. On the downside,

0.69 against the aussie, 0.63 against the kiwi and 1.35 against the

loonie are seen as the next support levels for the greenback.

Looking ahead, Eurozone retail prices data for May is due to be

released in the European session on 5:00 am ET.

In the New York session, U.S. and Canada jobs data for June,

Canada leading index for June and Canada Ivey's PMI for June and

U.S. Baker Hughes oil rig count data are slated for release.

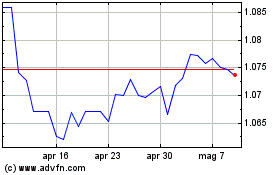

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Dic 2024 a Gen 2025

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Gen 2024 a Gen 2025