U.S. Dollar Advances On Middle East Tensions, Strong ADP Data

02 Ottobre 2024 - 3:39PM

RTTF2

The U.S. dollar firmed against its major counterparts in the New

York session on Wednesday, amid heightened geopolitical tensions in

the Middle East and stronger-than-expected ADP employment data for

September.

Israeli Prime Minister Netanyahu vowed to retaliate against Iran

following missile strikes on Tel Aviv.

Iran fired nearly 200 missiles at Israel on Tuesday in

retaliation for the killing of Hezbollah leader Hassan Nasrallah

last week.

Iran warned that any Israeli response to the missile attacks

would trigger further escalation of the conflict.

Data from payroll processor ADP showed that private sector

employment climbed by 143,000 jobs in September after rising by an

upwardly revised 103,000 jobs in August.

Economists had expected private sector employment to advance by

120,000 jobs compared to the addition of 99,000 jobs originally

reported for the previous month.

The greenback strengthened to near a 3-week high of 1.1032

against the euro and a 6-day high of 0.8507 against the franc, off

its early lows of 1.1082 and 0.8449, respectively. The currency is

seen finding resistance around 1.08 against the euro and 0.90

against the franc.

The greenback climbed to a 5-day high of 146.26 against the yen

and a 6-day high of 0.6261 against the kiwi, from its early lows of

143.42 and 0.6313, respectively. The currency is poised to

challenge resistance around 149.00 against the yen and 0.60 against

the kiwi.

The greenback rose to 1.3245 against the pound. Immediate

resistance for the currency is seen around the 1.28 level.

The greenback recovered to 0.6877 against the aussie following

the data. The currency is likely to locate resistance around the

0.64 level.

In contrast, the greenback fell to a 5-day low of 1.3472 against

the loonie. The currency may challenge support around the 1.32

level.

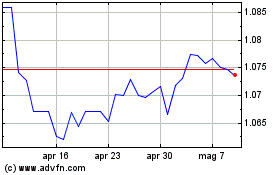

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Nov 2024 a Dic 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Dic 2023 a Dic 2024