U.S. Dollar Rises As China Economy Grows

14 Ottobre 2024 - 5:18AM

RTTF2

The U.S. dollar strengthened against other major currencies in

the Asian session on Monday, as a Japanese holiday reduced

liquidity and made China's very lackluster weekend stimulus

measures the center of attention for the market.

China's finance ministry flagged more fiscal stimulus over the

weekend but left out key details on the overall size of the

package. Meanwhile, China's consumer inflation unexpectedly eased

in September, while producer price deflation deepened, raising

concerns about weak domestic demand.

Traders react to the report showing producer prices in the U.S.

were unexpectedly unchanged in September, reinforcing optimism the

U.S. Fed will continue lowering interest rates in the coming

months, although hopes for another 50-basis point cut next month

largely evaporated.

"After an upside surprise from the September CPI report,

producer prices came in below expectations and provide support for

a 25bps rate cut in November," said Matthew Martin, a Senior U.S.

Economist at Oxford Economics.

Crude oil prices saw a modest pullback after surging in the

previous session. West Texas Intermediate crude for November

delivery dipped $0.29 or 0.4 percent to $75.56 a barrel. Despite

the pullback on the day, the price of crude oil jumped by 1.6

percent for the week.

In the Asian trading today, the U.S. dollar rose to 4-day highs

of 1.0915 against the euro, 149.37 against the yen and 0.8587

against the Swiss franc, from Friday's closing quotes of 1.0937,

149.13 and 0.8570, respectively. The greenback may test resistance

around 1.08 against the euro, 154.00 against the yen and 0.87

against the franc.

Against the pound, the greenback edged up to 1.3041 from

Friday's closing value of 1.3066. On the upside, 1.29 is seen as

the next resistance level for the greenback.

Against the Australia and the New Zealand dollars, the greenback

advanced to 4-day highs of 0.6722 and 0.6082 from last week's

closing quotes of 0.6750 and 0.6109, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 0.66

against the aussie and 0.59 against the kiwi.

The greenback climbed to nearly a 2-1/2-month high of 1.3789

against the Canadian dollar, from Friday's closing value of 1.3762.

The next possible upside target for the greenback is seen around

the 1.39 region.

Looking ahead, U.S. NY Fed 1-Year Consumer Inflation

Expectations for September is due to be released in the New York

session.

Canadian markets will remain closed in observance of the

Thanksgiving day holiday.

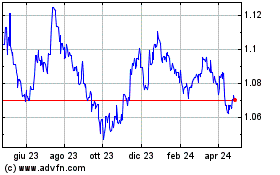

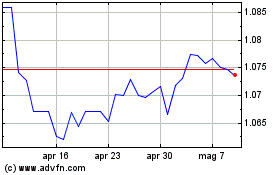

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Ott 2024 a Nov 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Nov 2023 a Nov 2024