French Manufacturers' Sentiment Falls Slightly In March

28 Marzo 2023 - 10:57AM

RTTF2

Despite the ongoing pension reform strikes, French

manufacturers' confidence weakened only slightly in March to mark

the first fall in four months as their view about past and future

production deteriorated, survey data from the statistical office

Insee revealed Tuesday.

The manufacturing confidence index dropped to 104 in March from

105 in the previous month. The reading was forecast to fall to 103

from February's originally estimated value of 104. The score

remained above the long-run average of 100.

The sub-index measuring manufacturers' views towards past

production weakened to 10 in March from 16 in February, while the

overall order book balance rose somewhat to -12 from -14.

General production expectations deteriorated to a negative level

in March with the corresponding index falling to -1 from 0.

The index reflecting the personal production expectations of

manufacturers declined to 11 from a stable score of 14.

The finished-goods inventory balance also worsened at the end of

the first quarter with the corresponding index falling by 5 points

to 13.

The index for the expected trend in selling prices in the next

three months remained stable though at a high level in March. The

relevant index stood at 29.

Business managers' concerns about economic conditions tightened

after easing a month ago with the corresponding index rising to 34

from 32.

The overall business confidence index that comprises the

responses of business leaders from sectors namely manufacturing,

construction, services, retail trade, and wholesale trade, also

worsened slightly from 104 to 103 in March.

The business climate has deteriorated a bit in most activity

sectors except in wholesale trade, the survey said. The survey in

wholesale trade is conducted bimonthly.

The latest survey confirmed that activity in France is resilient

even if the outlook for the coming quarters remains moderate, ING

economist Charlotte de Montpellier said.

The impact of global slowdown on exports, high inflationary

pressure, tight monetary policy and the recent banking sector

turbulence will have negative impact on the economic activity, the

economist noted.

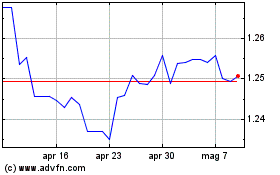

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Nov 2024 a Dic 2024

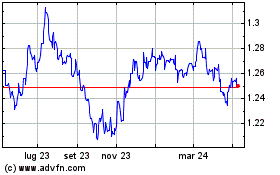

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Dic 2023 a Dic 2024