Pound Slides As U.K. Inflation Hits Three-year Low

16 Ottobre 2024 - 8:01AM

RTTF2

The British pound weakened against other major currencies in the

European session on Wednesday, after U.K. inflation fell below the

2 percent target and also hit the lowest in more than three years

in September, piling pressure on the Bank of England to ease policy

at the November meeting.

Data from the Office for National Statistics showed that

consumer price inflation weakened more-than-expected to 1.7 percent

in September from 2.2 percent in August. This was the lowest since

April 2021. Prices were forecast to climb 1.9 percent.

On a monthly basis, the consumer price index remained flat after

rising 0.3 percent in the prior month. Economists had expected a

0.2 percent increase.

Core inflation that excludes prices of energy, food, alcohol and

tobacco, softened to 3.2 percent from 3.6 percent in the previous

month. The core rate also remained below forecast of 3.4

percent.

Data showed that services inflation eased notably to 4.9 percent

from 5.6 percent. At the same time, goods prices slid 1.4

percent.

The BoE had maintained its benchmark rate at 5.00 percent at the

September meeting after lowering it by a quarter-point in August,

which was the first reduction since 2020. The next policy

announcement is due on November 7.

Another report from the ONS showed that output prices declined

for the first time in eight months in September. Output prices

dropped 0.7 percent annually, reversing a 0.3 percent rise in

August. Economists had forecast prices to fall 0.6 percent.

On a monthly basis, the decline in output prices deepened to 0.5

percent from 0.3 percent in the prior month. Prices were expected

to fall again by 0.3 percent.

Input prices decreased 2.3 percent on a yearly basis, following

a revised 1.0 percent fall in August. Monthly input prices were

down 1.0 percent after a 0.3 percent drop in August. Input prices

were expected to drop only by 0.5 percent.

European shares traded lower with weak earnings and caution

ahead of a European Central Bank (ECB) policy meeting on Thursday

denting investor sentiment.

The ECB is likely to deliver another interest rate cut after

recent data signaled continued weakness in the euro zone

economy.

In the European trading now, the pound fell to nearly a 2-month

low of 1.2982 against the U.S. dollar and a 6-day low of 193.70

against the yen, from early highs of 1.3078 and 195.30,

respectively. If the pound extends its downtrend, it is likely to

find support around 1.28 against the greenback and 191.00 against

the yen.

Against the euro and the Swiss franc, the pound dropped to a

5-day low of 0.8380 and a 2-day low of 1.1193 from early highs of

0.8327 and 1.1280, respectively. The pound may test support near

0.84 against the euro and 1.11 against the franc.

Looking ahead, U.S. MBA mortgage approvals data, Canada housing

starts for September, manufacturing sales data for August, U.S.

import and export prices for September, are slated for release in

the New York session.

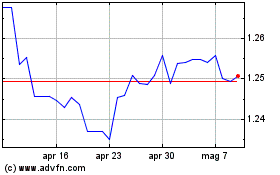

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Ott 2024 a Nov 2024

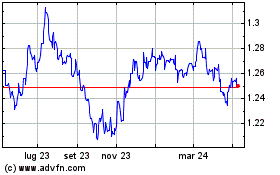

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Nov 2023 a Nov 2024