Russia Hikes Interest Rate By 200 Bps; Signals Another Hike

25 Ottobre 2024 - 10:00AM

RTTF2

Russia's central bank raised its benchmark rate by

larger-than-expected 200 basis points and also hinted at another

hike next month as inflation expectations increased and additional

fiscal spending lifted proinflationary effects.

The board of directors, led by Governor Elvira Nabiullina,

raised the key rate to a record 21.00 percent from 19.00

percent.

The bank has raised the key interest rate by 1,350 basis points

since July 2023.

The board observed that further tightening of monetary policy is

required to ensure the return of inflation to the target and reduce

inflation expectations. "The Bank of Russia holds open the prospect

of increasing the key rate at its upcoming meeting," the bank said

in a statement.

Inflation is expected to be in the range of 8.0 percent to 8.5

percent by the end of 2024. Annual inflation is projected to slow

to 4.5 percent -5.0 percent next year and 4.0 percent in 2026, and

stay at the target further on.

The bank noted that inflation expectations increased

considerably mainly as a reaction to the current high inflation.

Further, growth in domestic demand is outstripping the capabilities

to expand the supply of goods and services.

Moreover, additional fiscal spending and the related expansion

of the federal budget deficit in 2024 have proinflationary effects,

policymakers observed.

Today's hike is evidence that despite President Putin's efforts

at this week's BRICS summit to portray Russia's economy as

watertight - the war is creating significant challenges for

policymakers, Capital Economics' economist Nicholas Farr said.

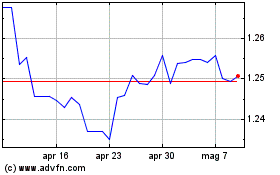

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Ott 2024 a Nov 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Nov 2023 a Nov 2024