Pound Falls Ahead Of U.K. Autumn Budget Statement

30 Ottobre 2024 - 8:47AM

RTTF2

The British pound weakened against other major currencies in the

European session on Wednesday, as traders await the U.K. budget

declaration, where the Labour administration is anticipated to

increase taxes and expenditure.

The United Kingdom's (U.K.) Autumn Forecast Statement is set to

be released at 8.30 am ET. Chancellor of the Exchequer Rachel

Reeves is anticipated to announce a tax increase on various

income-generating sources and provide increased spending plans to

encourage investment in what will be Labour's first budget

presentation in more than 15 years.

Investors also expect the Bank of England (BoE) to cut interest

rates by 25 basis points (bps) in its upcoming policy meeting on

November 7.

European stocks traded lower as investors assessed a batch of

mixed earnings and awaited regional growth data as well as the U.K.

government's budget for direction.

In the European trading now, the pound fell to nearly a 2-week

low of 0.8354 against the euro, from an early high of 0.8314. The

pound may test support around the 0.84 area.

Moving away from an early 9-day high of 1.3027 against the U.S.

dollar, the pound dropped to 1.2695. The next possible downside

target for the pound is seen around the 1.28 region.

Against the Swiss franc and the yen, the pound edged down to

1.1243 and 198.27 from early highs of 1.1291 and 199.58,

respectively. If the pound extends its downtrend, it is likely to

find support around 1.11 against the franc and 194.00 against the

yen.

Looking ahead, U.S. MBA weekly mortgage approvals data, U.S. GDP

data for the third quarter, U.S. core price index for the third

quarter, pending home sales data for September and U.S. EIA crude

oil data are slated for release in the New York session.

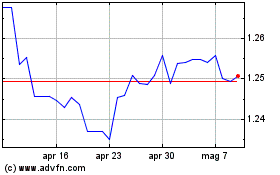

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Ott 2024 a Nov 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Nov 2023 a Nov 2024