Canadian Dollar Falls As Oil Prices Drop

08 Novembre 2023 - 3:06PM

RTTF2

The Canadian dollar dropped against its most major counterparts

in the New York session on Wednesday, amid weak commodity

prices.

WTI crude oil fell below $76 a barrel on concerns over receding

demand in the United States and China.

The U.S. Energy Information Administration revised down its

petroleum consumption forecast for this year.

The EIA now expects total U.S. petroleum consumption to drop by

300,000 barrels per day, instead of its previous forecast of a

100,000 bpd increase.

On the economic front, data from Statistics Canada showed the

total value of building permits in Canada fell sharply by 6.1% from

a month earlier to $11.2 billion in September, reversing an

upwardly revised 4.3% growth in the prior month.

The loonie touched 1.4790 against the euro, its lowest level

since August 31. The currency may find support around the 1.50

level.

The loonie fell to 1.3814 against the greenback, hitting a 6-day

low. If the loonie drops further, it may find support around the

1.41 area.

The loonie retraced its early gains against the yen and was

trading at 109.32. This may be compared to its previous 5-day low

of 109.14. The next possible support for the loonie is seen around

the 106.00 level.

In contrast, the loonie was higher against the aussie, at

0.8848. On the upside, 0.86 is likely seen as the next resistance

level.

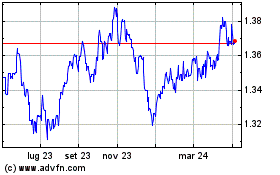

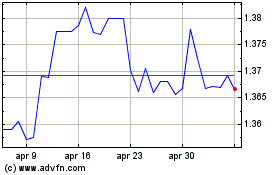

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Giu 2024 a Lug 2024

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Lug 2023 a Lug 2024