Canadian Dollar Advances As Oil Prices Gain

04 Novembre 2024 - 2:05PM

RTTF2

The Canadian dollar climbed against its major counterparts in

the New York session on Monday, as oil prices rose after OPEC+

agreed to push back its December production increase by at least a

month, prioritizing price support over regaining market share.

Crude for December delivery rose $1.68 to $71.17 per barrel.

The group led by Saudi Arabia and Russia was supposed to begin a

series of monthly production increases by adding 180,000 barrels a

day from December.

Now, the decision has been postponed due to recent pressure on

prices from weak demand growth, especially in China and Europe.

Oil prices also remain supported by persisting Middle East

tensions and expectations of China's fiscal stimulus.

Iran's Supreme Leader Ayatollah Ali Khamenei has vowed that

Israel and the U.S. would face a "teeth-breaking response" for

their actions against the country.

The Wall Street Journal reported that Iran is planning a complex

attack on Israel, which may include missiles with high-powered

warheads.

The loonie edged up to 0.9146 against the aussie and 1.5117

against the euro, from an early 10-day low of 0.9205 and more than

a 2-month low of 1.5170, respectively. The currency is poised to

challenge resistance around 0.90 against the aussie and 1.49

against the euro.

The loonie touched 1.3875 against the greenback, setting a

10-day high. If the loonie rises further, it is likely to test

resistance around the 1.36 region.

The loonie rebounded to 109.56 against the yen, off an early low

of 109.00. The currency is likely to locate resistance around the

110.5 level.

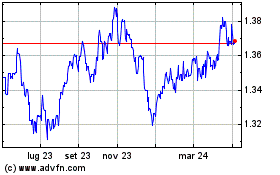

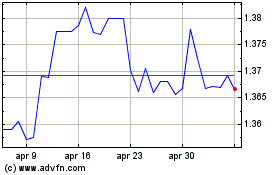

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Dic 2023 a Dic 2024