Yen Falls As Traders Bet On Japan's LDP Election Results

27 Settembre 2024 - 5:56AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Friday, as traders started speculating the Japan's

New Prime Minister to be decided by the Liberal Democratic Party's

presidential election.

Speculations of political pressure on monetary policy paved the

way for traders to bet on the election results.

Meanwhile, no candidate secured majority in the first round of

LDP voting. Top candidates are former Defense Chief Shigeru Ishiba,

former Environment Minister Shinjiro Koizumi, and Economic Security

Minister Sanae Takaichi, who secured 154, 136, and 181 votes,

respectively. The needed majority was supposed to be 368 votes.

This means that Ishiba and Takaichi will now face off in the

run-off vote.

Asian stock markets traded higher, following the broadly

positive cues from Wall Street overnight, as traders continue to

bet on further reductions in interest rates by the U.S. Fed, and on

hopes about more stimulus measures from the Chinese government to

spur growth in the world's second largest economy.

In economic news, overall consumer prices in the Tokyo region of

Japan were up 2.2 percent on year in September, the Ministry of

Internal Affairs and Communications said on Friday. That was in

line with forecasts and was down from 2.6 percent in August. Core

CPI, which excludes the volatile costs of food, rose an annual 2.0

percent - again matching expectations and slowing from 2.4 percent

in the previous month.

In the Asian trading today, the yen fell to nearly a 1-1/2-month

low of 163.50 against the euro and nearly a 2-month low of 195.96

against the pound, from yesterday's closing quotes of 161.83 and

202.00, respectively. The yen is likely to find support around

170.00 against the euro and 202.00 against the pound.

Against the U.S. dollar and the Swiss franc, the yen slipped to

more than 3-week lows of 146.49 and 172.53 from Thursday's closing

quotes of 144.80 and 171.10, respectively. On the downside, 151.00

against the greenback and 176.00 against the franc are seen as the

next support levels for the yen.

Against Australia, the New Zealand and the Canadian dollars, the

yen dropped to nearly a 2-month low of 100.72, more than a 2-month

low of 92.29 and more than a 3-week low of 108.56 from yesterday's

closing quotes of 99.84, 91.61 and 107.54, respectively. If the yen

extends its downtrend, it is likely to find support around 106.00

against the aussie, 96.00 against the kiwi and 112.00 against the

loonie.

Looking ahead, German unemployment data for September, Eurozone

economic sentiment survey results for September and the

Confederation of British Industry's U.K. Distributive Trades survey

results for September are due to be released in the European

session.

In the New York session, Canada GDP data for July, U.S. personal

income and spending data for August, goods trade balance for

August, PCE price index for August, retail an wholesale inventories

for August, U.S. University of Michigan's consumer sentiment for

September, Canada budget balance for July and U.S. Baker Hughes

weekly oil rig count data are slated for release.

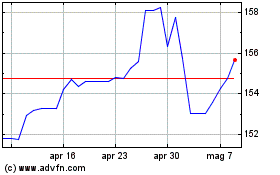

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Dic 2023 a Dic 2024