Final Results

16 Marzo 2005 - 8:00AM

UK Regulatory

RNS Number:7973J

Clarkson PLC

16 March 2005

CLARKSONS

Preliminary results

Clarkson PLC ('Clarksons'), the holding company for Clarksons, the world's

largest shipbroker and shipping services group, today announces preliminary

results for the twelve months ended 31 December 2004.

Results for 2004

Year ended Year ended

31 December 2004 31 December 2003

Turnover #87.4m #58.7m

Profit before taxation #20.2m #12.1m

Earnings per share 83.8p 48.6p

Dividends per share 25.0p 17.5p

* Record results.

* Increase in dividend.

* Continued global expansion.

* A good start to 2005.

Tim Harris, Chairman of Clarkson PLC, commented:

"The result reflects the company's ability to continue growing strongly its

principal business.

"2005 has started well. Freight rates remain significantly above long-term

averages with Chinese growth continuing to be a major driver.

"The company is well placed to produce another excellent result in 2005."

For further information please contact:

Richard Fulford-Smith, Chief Executive, Clarkson PLC: 0774 704 3139

Robert Ward, Finance Director, Clarkson PLC: 020 7334 0000

Notes to editors

Background to Clarkson PLC

Clarkson PLC (which is listed on the London Stock Exchange) is acknowledged as

the world's leading shipping services group. Through its unrivalled and

extensive global network of offices it is able to give its clients unique access

to a wide range of shipping services. Clarksons covers shipbroking, research,

publications, derivatives and logistics. Clarksons' strategy is to expand and

develop the group around these key activities.

For further information on Clarkson PLC, please visit the company's website at

www.clarksons.com

Chairman's statement

In my first annual review as chairman, I am delighted to report that your

company has produced another record profit.

The result reflects the company's ability to continue growing strongly its

principal business and the chief executive's review gives a broad outline of the

progress made during the year, sector by sector. An expanding team operating

globally has attracted an exceptionally broad spread of talented individuals

with core competence and knowledge. We are seeing the benefits in the results.

Returns and cash flows have again been strong reflecting a sound underlying

ability to generate cash.

Strategy

The company's strategy is to continue developing shipbroking activities

globally, following our customers to where the business is best served and

broadening our product range. Our expansion is focused in sectors where there is

potential to increase market share. We remain committed to investing further in

shipping service activities in which the Clarkson brand and our competitive

advantage of market intelligence give us an edge. An advantage of these shipping

service activities such as publishing, logistics and derivatives is that they

should be less closely linked to the shipping cycle and should therefore

increasingly improve the consistency and predictability of our earnings.

Dividend

The company is committed to maintaining a progressive dividend policy but is

also funding significant growth in its business. Major cash spends are referred

to in the finance director's review. Costs have been incurred with the now

enlarged offices in Shanghai, Singapore, Athens and London and our strategic

intent is to commit further funds to shipping service activities including

logistics.

The board and staff

In 2004 I took over as chairman from Michael Beckett who retired at the annual

general meeting. Richard Fulford-Smith rejoined the board as chief executive

officer of the group in April 2004. Gary Weston resigned in April 2004 after

many years service and I would like to thank both Michael and Gary for their

excellent past service to the company. In September we strengthened the board

further with the appointment of Dr Martin Stopford. Martin is an extremely

well-known public figure in shipping circles and heads up our expanding research

and publications unit.

On behalf of the company I would like to thank all our employees who have

contributed so strongly to another excellent performance. Their role is critical

in a people business such as Clarksons and their hard work, great skill and good

humour is highly appreciated.

Outlook

2005 has started well. Freight rates remain significantly above long-term

averages with Chinese growth continuing to be a major driver. At present the

only negative factor is continuing dollar weakness. A strong forward order book

and the close relationship between income and our main cost, staff remuneration,

reduces earnings volatility year to year. Developing shipping service activities

such as publishing, logistics and derivatives will give greater consistency to

earnings. Your company is well placed to produce another excellent result in

2005 and to continue to generate increased returns to its shareholders.

Tim Harris

Chairman

16 March 2005

Chief executive's review of operations

Overview

In my first review of operations as chief executive officer, I am pleased to

report on a year of continuing growth, both in our business and profits.

In the interim statement we indicated our intention to grow the business

organically and through acquisition. We have done both.

We have previously made known our desire to reduce the vulnerability of earnings

given freight market volatility. In part, this is already achieved by our

shipbroking staff accepting that a significant part of their total remuneration

package will always be linked to underlying profitability. In addition we have a

significant amount of forward income in derivatives, period charters and

newbuilding contracts which will underpin earnings into the future. We are

committed to the expansion of our non-cyclical businesses through investment in

logistics, publications and shipping related financial services.

Our Shipbroking business is the base platform from which we continue to operate.

It is supported by our Research and Futures businesses. In combination, these

three areas of core competence have created strong brand recognition. We are

acknowledged in our industry as being a one-stop shop with unrivalled market

knowledge and intelligence.

In the last year we have expanded robustly. The anticipated acquisition of

Ferrobulk in Genoa, the opening of a new office in Dubai and almost doubling the

size of our offices in Shanghai, Athens and Houston, all of which extends

further our global reach. The group will shortly employ more people overseas

than in London. Although London is unlikely to feature heavily in our expansion

plans in the near future many new initiatives emanate from this centre and our

new premises adjacent to London Bridge will house a record number of employees.

The Clarkson product base has been enhanced by a number of new initiatives and

ideas. In December 2004 we acquired Oilfield Publications Limited (OPL). This

company specialises in publications for the offshore oil and energy sectors. It

will therefore add significantly to our range of publications and will bring

additional publishing skills that complement our market information and database

expertise. Our office in Houston has been joined by a team from Normarine

Offshore Consultants which will increase our competence in the offshore markets.

Through OPL and with greater emphasis from Research we will be capable of

expanding our services to the energy markets generally.

In the last year we have brought to the market a new sale and purchase

derivatives product - Sale and Purchase Forward Agreements - as well as

providing a new risk management service to the freight sector.

As we have already indicated, our greatest assets are our staff. Our commitment

to staff is reflected by our desire to provide them with superior resources to

work even more effectively. To this end we are investing heavily in IT and

developing a global information gathering and dissemination network. We compete

primarily with unregulated, unlisted private companies who operate in a less

accountable environment than a public company. To compete we must pay

competitive salaries and bonuses and our trading teams are given responsibility

to understand and control the key financial elements of their costs and income.

Review of operations

Dry bulk

With the exception of Houston, all of our offices have a dry cargo chartering

presence. London continues to maintain its leading role but due to the growing

influence of emerging dry bulk markets, such as China, Italy and Greece, we have

invested significantly in these booming centres. Apart from our associated

companies in Paris and San Francisco all our other offices worldwide now operate

under the Clarksons name. Organising our teams to operate globally by product

type remains a key ambition.

Our lead position in dry bulk derivative broking places our clients in a

particularly strong position to manage their market exposure more effectively.

We are constantly addressing ways to improve our spot income and the addition of

new cargo-based broking teams will assist in this. We are particularly excited

by the anticipated addition of Ferrobulk in this respect.

The average 2004 earnings for a modern capesize vessel was US$70,400 per day

(2003: US$41,300 per day); modern panamax vessels achieved on average US$33,900

per day (2003: US$19,100 per day) and handymax vessels earned on average

US$28,100 per day (2003: US$14,900 per day).

The year has started positively and dry cargo will benefit significantly from

the substantial timecharter book written last year.

Tanker chartering

Our deepsea and product teams also operate globally concentrated in the three

main centres of activity - Houston, London and Singapore. Their influence has

grown substantially and we operate on the panels of most oil majors.

With the support of our growing team of energy analysts and database compilers

in Research we are able to offer oil major clients an unrivalled service. In

transacting their business we offer them the comfort of being a public,

transparent company with access to unrivalled market knowledge and full quality

systems accreditation.

A proper understanding of the derivatives business is central to our capability

to provide a complete service to both shipowners and oil charterer clients. We

have grown our tanker derivatives broking teams both in London and Singapore

which gives us a unique position in this rapid and constantly changing market.

The average 2004 earnings derived on the spot market for a modern double hull

VLCC was US$96,100 per day (2003: US$52,400 per day); modern suezmax vessels

earned on average US$75,000 per day (2003: US$41,600 per day); modern aframax

tankers earned on average US$49,600 per day (2003: US$ 34,200 per day).

The clean and dirty products sectors saw increases in average daily earnings of

33% and 48% respectively.

Chemicals

Now globally established in three major chemical centres of London, Houston and

Singapore, Chemicals continues to expand its business primarily through long

term contracts and time charters. We run and manage contracts on behalf of many

of the major participants in the chemical sector and place emphasis on the

quality of our support services, research and analysis.

We believe the expanding shipowning base in this specialised market sector will

require support which represents an opportunity for our business to grow further

given its excellent platform of knowledge and experience.

Gas

Our LNG ('Liquified Natural Gas') team is recognised for its significant

contribution with knowledge based solutions in assisting new players and gas

producers/traders. The new sources of gas and an ample supply of shipping should

create a free market environment where gas can be openly and transparently

traded which should ultimately result in consumers being confident they can

secure reasonably priced gas.

Our LNG joint venture with BRS of Paris has prospered in 2004 in a challenging

environment and the improving trend should continue into 2005 with many

newbuildings delivering and a growing timecharter book.

We are likely to witness the same increases in the LPG ('Liquified Petroleum

Gas') supply chain as for LNG as this product is set for substantial growth and

also expected to become a more competitive energy feedstock.

Our ammonia activities have prospered in 2004 and we have been particularly

successful in building our forward order book. With team expansion and firming

rates in LPG/ammonia we expect to significantly grow our income in this market

sector during the coming year.

Containers

Clarksons was a late entrant in this important market area. We are leaders in

the provision of core data, fleet and newbuild registers and market intelligence

and are now building new broking teams in London and Shanghai.

We are writing significant volumes of business in the time-charter, newbuild and

secondhand markets. This mostly benefits our forward order book and fuels our

ability to grow the team and its income.

Secondhand and newbuilding

Our Secondhand team produced an excellent result in 2004 due to a combination of

the strong price levels and our concentration on high quality business with

major clients. This resulted in a series of significant transactions confirming

our position at the forefront of this sector of the market.

Our share of newbuilding business continued to grow and we remain entrusted with

the management of some of the world's leading shipyard/owner relationships.

During the year we introduced a new team in Greece and we are growing our

presence in the Asian market particularly China.

We continue to face significant competition in this important area of our

business. Regulation is non existent and the opportunism of boutique shops who

add little or no value is still richly rewarding for them.

Offshore

With a new team from Normarine in Houston and with the acquisition of OPL, both

of which I referred to earlier, we are seeking to become a meaningful force in

the offshore markets.

We have already arranged a number of rig deals and some support vessel

contracts. We intend to expand further in Singapore, Houston and London.

Futures

Clarksons was the original creator of the FFA ('Forward Freight Agreement'). The

product is now widely used and it is not surprising, given our experience,

support and understanding of the product, that we remain the world's foremost

arranger of FFA trades.

Much of the business undertaken is still over-the-counter with contracting

parties bearing the counterparty risk, but we welcome the interest shown by

several institutions who have expressed a desire to offer a cost effective

clearing mechanism to the FFA market.

The volatility of dry and wet freight markets has led to increased recognition

of the value of these derivative products. Shipping operators increasingly use

FFAs to hedge freight market exposures; cargo interests provide a natural

counterparty while traders provide liquidity. Over the last twelve months we

have seen a significant growth of tanker contracts. Given the increasing

relevance of freight in energy markets, proprietary investment banks are

increasingly active as are the lending banks.

Research

Research had a busy year. Turnover continues to move ahead with digital products

continuing to perform particularly strongly, now accounting for a third of

revenue. Publications now account for 43 per cent of turnover with customer

services making up the balance. The acquisition of OPL took place in December

and the two businesses are being merged to leverage off their respective

strengths. During the year the company's IT function, which was previously

outsourced, was integrated with the Research IT team. The aim is to develop an

organisation with more depth to serve both Research's clients and the company as

a whole.

Logistics

Towards the end of 2003 we announced the launch of Channel Freight Ferries (CFF)

to provide a regular daily service between Southampton in the UK and Radicatel

in France. CFF commenced daily sailings in January 2004. Hauliers have been

slower than anticipated to take up the more cost effective service provided on

this route and the business is therefore correspondingly behind in its business

plan. We are in the process of tailoring our commitment to our customers' needs

consistent with their level of support.

The logistics division has a 58% equity stake in Pasir Bulk Carriers (Pasir) in

Singapore. Throughout 2004 Pasir owned two 75,000 dwt combination carriers which

continued to operate profitably on bareboat charter. Since the year end Pasir

Bulk Carriers has sold one of its two vessels.

We are taking steps to expand our logistics activities, including utilising the

monies arising on the sale of the Pasir 1. Further investments are intended to

generate earnings which are more stable than those derived from freight markets.

Richard Fulford-Smith

Chief Executive

16 March 2005

Finance director's review

Results

Profit before taxation rose to #20.2 million, compared with #12.1 million in

2003, an increase of 67%. These profits are a record for this company and the

highest since it was listed on the London Stock Exchange in 1986. Earnings per

share were 83.8 pence per share (2003: 48.6 pence per share).

Turnover, which is primarily derived in US dollars, increased to #87.4 million

in 2004 (2003: #58.7 million). At constant exchange rates, the increase would

have been 66%.

Taxation

The overall effective tax rate was 32.1% (2003: 33.7%). The tax rate is higher

than the standard rate of UK tax of 30.0% due to the impact of disallowable

trading expenses.

Dividends

The directors are recommending that the dividend for the year increases to 25.0

pence per share (2003: 17.5 pence per share); this dividend represents a 43%

increase on last year and is now more than a sixfold increase over that declared

five years ago. The final dividend of 16.0 pence per share will be paid to

shareholders on 18 June 2005.

Foreign exchange

The US dollar is the major trading currency of the group. The average sterling

exchange rate for the period was US$1.84 (2003: US$1.65). At the year end the

exchange rate had reached US$1.92. The group benefited from the use of forward

currency contracts to mitigate its exposure to variations in currency exchange

rates during the year and thereby reduced the adverse impact of the weaker US

dollar on our 2004 results.

Balance sheet

During 2005 the principal operating company will move to new London headquarters

at St Magnus House, near London Bridge. This will inevitably result in an

additional capital spend over that incurred in a more usual year.

Since the year end, Pasir Bulk Carriers has sold one of its combination carriers

of which our share of the profit will be approximately #2.5 million.

Trade debtors have risen to #12.6 million from #7.2 million reflecting higher

freight rates and increased volumes.

Creditors include provision for bonuses which have accumulated during the year

for payment early in the following year - referred to under cash flow. Other

accruals and related creditors have increased in line with the overall expansion

of the business.

The company issued 76,000 shares during 2004 for a total consideration of

#490,200 to meet obligations to new employees. The capital redemption reserve

arose from various share buybacks in 1997 and 1998. Under the Urgent Issues Task

Force Abstract 38 'Accounting for ESOP Trusts', shares owned by the Executive

Share Purchase Trust are now stated as part of shareholders' funds and the 2003

comparatives have been amended accordingly.

Cash flow

Cash generation remains a key strength of the group. During the year the group

accumulated cash as profit linked bonus entitlements are accrued; bonuses are

paid in February following the end of the financial year. The group continued to

pay off bank borrowings that were secured on the two combination bulk carriers.

At the end of the financial year the aggregate cash balance was #44.1 million

(2003: #32.0 million). Subsequent to the year end a number of significant

payments will be made including #21.9 million in staff bonuses and a #10.0

million contribution into the group's pension scheme to repair a deficit which

has arisen.

Acquisitions

In December 2004 the group acquired OPL, the offshore publications business for

#3.3 million. Also in December 2004 the group acquired the business of

Khedivial, the forerunner to our new business based in Dubai, for a

consideration of #0.3 million satisfied in shares. These have generated

additional goodwill of #3.5 million resulting in a cumulative balance at the end

of 2004 of #5.5 million.

Pensions

The group operates a variety of pension schemes throughout the world, the

majority of which are defined contribution arrangements. The UK, however, has

both a defined contribution section and a defined benefit section within the

main UK pension scheme.

Defined benefit pension arrangements give rise to open ended commitments and

liabilities for the sponsoring company. As a consequence the company closed its

existing defined benefit section of the UK scheme to new entrants on 31 March

2004 and has now decided to close this section for further accrual to all

existing members as from 31 March 2006.

This defined benefit section was subject to a valuation as at 31 March 2004. At

that date the defined benefit section had a deficit of #11.9 million. In

response to this deficit and the decision to close this section of the scheme to

further accrual, the group decided to make a one-off cash contribution of #10.0

million into the scheme following the year end.

International financial reporting standards

Clarksons currently prepares its report and accounts under UK Generally Accepted

Accounting Principles (UK GAAP). The group is required, from 1 January 2005

onwards, including release of the Interim Report 2005, to report under

International Financial Reporting Standards (IFRS).

We have evaluated the possible impact on the information provided. The most

significant accounting changes are:

* The inclusion of any Pension Fund surplus or deficit in the balance sheet of

the company.

* Goodwill will no longer be amortised over its useful life.

* The proposed dividend will no longer be accrued at the year end.

There are other changes, including detailed additional disclosures, but these

are not considered likely to result in a material adjustment to previously

published information. Full details and reconciliations will be provided in the

2005 Interim Report and the 2005 Annual Report and Accounts. The group does not

anticipate amending any of its current procedures because of the affects of

IFRS.

Given the comparatively limited extent of the changes necessary, and the

disclosures already contained under UK GAAP, the company does not propose to

issue unaudited 2004 statements under IFRS.

Robert D Ward

Finance Director

16 March 2005

Consolidated profit and loss account

for the year ended 31 December 2004

2004 2003

#m #m

Turnover -

continuing operations 87.4 58.7

Administrative expenses (70.0) (46.8)

Group operating profit -

continuing operations 17.4 11.9

Share of operating profit in associates 0.8 0.2

Total operating profit 18.2 12.1

Loss on sale of fixed assets - (0.1)

Amounts written off investments - (0.8)

Interest receivable and similar income 2.1 1.1

Interest payable and similar charges (0.1) (0.2)

Profit before taxation 20.2 12.1

Taxation (6.5) (4.1)

Profit after taxation 13.7 8.0

Equity minority interests (0.3) (0.4)

Profit after taxation

attributable to the group 13.4 7.6

Dividends

Interim 9.0p (2003: 7.0p) (1.4) (1.1)

Final proposed 16.0p (2003: 10.5p) (2.6) (1.7)

(4.0) (2.8)

Retained profit for the year 9.4 4.8

Earnings per share 83.8p 48.6p

Comparatives have been restated where necessary to reflect the requirements of

UITF 38 (see note 1).

Consolidated balance sheet

As at 31 December 2004

2004 2003

#m #m

Fixed assets 13.6 10.2

Current assets

Debtors 18.0 10.0

Cash and deposits 44.1 32.0

62.1 42.0

Creditors

Amounts falling due within one year (43.3) (28.1)

Net current assets 18.8 13.9

Total assets less current liabilities 32.4 24.1

Creditors

Amounts falling due after more than one year (0.4) (2.1)

Provisions for liabilities and charges (0.9) (0.2)

(1.3) (2.3)

31.1 21.8

Capital and reserves

Equity shareholders' funds 29.9 20.9

Equity minority interests 1.2 0.9

31.1 21.8

Comparatives have been restated where necessary to reflect the requirements of

UITF 38 (see note 1)

Consolidated cash flow statement

for the year ended 31 December 2004

2004 2003

#m #m

Net cash inflow from

operating activities 24.3 22.4

Dividends from associates 0.2 0.1

Returns on investments and

servicing of finance 2.0 1.1

Taxation (4.7) (2.6)

Capital expenditure and

financial investment (1.4) (0.9)

Acquisitions and disposals (3.3) -

Equity dividends paid (3.1) (2.6)

Management of liquid resources

Increase in short term deposits (7.4) (6.0)

Financing (1.0) (1.0)

Increase in cash 5.6 10.5

Comparatives have been restated where necessary to reflect the requirements of

UITF 38 (see note 1).

Consolidated statement of total recognised gains and losses

for the year ended 31 December 2004

2004 2003

#m #m

Profit on ordinary activities

after taxation 13.4 7.6

Foreign exchange differences (1.0) (0.8)

Total recognised gains relating to the year 12.4 6.8

Comparatives have been restated where necessary to reflect the requirements of

UITF 38 (see note 1).

Movement in equity shareholders' funds

for the year ended 31 December 2004

2004 2003

#m #m

Profit on ordinary activities

after taxation 13.4 7.6

Issue of new shares 0.5 0.5

Foreign exchange differences (1.0) (0.8)

Dividends (4.0) (2.8)

ESOP share proceeds 0.1 -

Total movements during the year 9.0 4.5

Equity shareholders' funds at 1 January 20.9 16.4

Equity shareholders' funds at 31 December 29.9 20.9

Comparatives have been restated where necessary to reflect the requirements of

UITF 38 (see note 1).

Notes to the accounts

1 Accounting policies and basis of preparation of preliminary statement

The preliminary statement has been prepared in accordance with the accounting

policies set out in the group's annual report and accounts for the year ended 31

December 2003 except for the adoption of Urgent Issues Task Force abstract 38

'Accounting for ESOP trusts' (UITF 38). In accordance with UITF 38, shares in

Clarkson PLC held by the Executive Share Purchase Trust are now deducted within

consolidated shareholders' funds. Previously, such shares were included within

fixed asset investments. Within the consolidated cash flow statement, the

purchase and sale of such shares is now presented as a financing transaction and

not within returns on investments. Dividend income arising on such shares has

been excluded from the group's profit and loss account and deducted from

dividends paid and proposed. The comparatives have been restated accordingly.

2 Dividends

The directors will be recommending a final dividend of 16.0 pence per share,

payable on 18 June 2005 to shareholders on the register at the close of business

on 4 June 2005, making a total dividend for the year of 25.0 pence per share

(2003: 17.5 pence per share).

3 Earnings per share

The earnings per ordinary share is based on profit after tax for the financial

period of #13.4 million (2003: #7.6 million) and 16,011,931 (2003: 15,729,514)

shares in issue throughout the period.

4 Analysis of net funds

At 1 Arising on Other Foreign At 31

January decon- Arising on non-cash exchange December

2004 Cash flow solidation acquisition movements differences 2004

#m #m #m #m #m #m #m

Cash 14.2 5.6 (0.2) - - (0.7) 18.9

Deposits 17.8 7.4 - - - - 25.2

32.0 13.0 (0.2) - - (0.7) 44.1

Debt due within one year (1.3) 1.3 - (0.1) (1.5) 0.1 (1.5)

Debt due beyond one year (1.9) - - - 1.5 0.1 (0.3)

Deferred consideration (0.3) - - - 0.2 - (0.1)

Net funds 28.5 14.3 (0.2) (0.1) 0.2 (0.5) 42.2

5 Accounts

It is anticipated that full accounts will be posted to shareholders on 6 April

2005. The figures for the year ended 31 December 2004 included in this

announcement are unaudited and do not constitute full accounts within the

meaning of Section 240(5) of the Companies Act 1985. The statutory audited

accounts for the year ended 31 December 2003, upon which the auditors have given

an unqualified report and which have been delivered to the Registrar of

Companies in England & Wales, have been restated in this report where necessary

to reflect the requirements of UITF 38 (see note 1).

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DELFFEXBZBBB

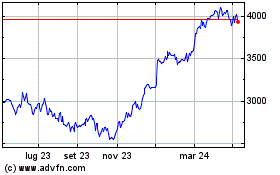

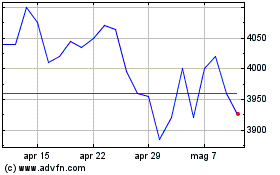

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Lug 2023 a Lug 2024