Interim Results

30 Agosto 2006 - 9:01AM

UK Regulatory

RNS Number:1937I

Clarkson PLC

30 August 2006

CLARKSONS

Interim results for the six months ended 30 June 2006

Clarkson PLC ('Clarksons'), the world's leading shipping services group, today

announces unaudited interim results for the six months ended 30 June 2006.

* Revenue #52.6 million (2005: #53.9 million).

* Profit before taxation #9.3 million (2005: #13.2 million).

* Earnings per share - continuing operations 37.5p (2005: 49.4p).

* Interim dividend increased to 12.0p (2005: 10.0p).

Tim Harris, Chairman of Clarkson PLC, commented:

"I am pleased to announce another strong interim result.

"The company is well placed to produce another excellent result in 2006."

30 August 2006

For further information please contact:

Richard Fulford-Smith, Chief Executive, Clarkson PLC: 0774 704 3139

Rob Ward, Finance Director, Clarkson PLC: 020 7334 0000

Overview

The company has generated an interim pre-tax profit of #9.3 million from

continuing operations. In addition a further #1.1 million of profit resulted

from the release of provisions which are no longer required. Earnings per share,

in aggregate, were 44.2 pence per share. Revenue was #52.6 million.

These results reflect the continuing growth of our underlying business despite a

decline in freight rates and related shipping markets in the first half of the

year.

During the first half of 2006 the company acquired three more businesses - a

specialised products broker team with the acquisition of Plowrights, a financial

services team and a sale and purchase team. The company has also commenced

management of a shipping hedge fund. These moves are intended to broaden the

earnings base of the company in activities which are related to our core skills.

The company's strategy remains the continuing development of its shipping

services activities. Clarkson's brand combined with the competitive advantage

provided by its market intelligence, gives it an edge.

Review of operations

Dry bulk chartering

Dry bulk markets in the first half of 2006 were significantly weaker than the

comparable period in 2005, however recent improvements suggest that our global

dry bulk team will generate better results in the second half. In particular, we

are encouraged by the level of forward order book business being written across

all vessel size categories. There is growing confidence in dry bulk markets

going forward with minerals demand from China and India being the major drivers

on the demand side.

Container chartering

We continue to reorganise our container broking operations around the three

centres of London, Singapore and Shanghai.

In addition we are developing Global Slot Network. This new system will enable

ocean carriers, container ship owners, shipping and leasing companies to

exchange slot capacity through a neutral platform. It is anticipated that this

platform will be launched during the second half of 2006.

Deep sea chartering

Our tanker teams globally continue to increase their market share. We are

particularly pleased to have established ourselves on the panels of all of the

major oil companies and traders which provides us with a broad spread of

business across all sectors.

Specialised products chartering

The Plowrights acquisition was completed in January 2006 and the integration

into the London broking team has been successfully achieved. There is a

substantial increase in revenues in this business sector and although we have

not yet determined how best to deal with our 25% interest in Panasia we are

resolved to continue to grow in this market sector.

In August we completed the acquisition of Genchem for an initial consideration

of #8.6 million which will further enhance the results of this activity in the

second half.

Gas chartering

The team of LPG specialists, recruited in 2005, are helping to deliver improved

revenues and results, thereby improving operating margins.

Sale and purchase broking

We have encountered a significant lull in activity on the secondhand side with

no substantial transactions (unlike in the first half of 2005) to support our

otherwise steady stream of income.

The newbuilding market, however, has continued to surprise with unexpectedly

high levels of contracting. As much of this revenue is collectable over the life

of the contract, this has little impact on our 2006 earnings, although

significantly enhances our forward order book.

This sector of the market is particularly important for our business. In May

2006 we recruited a team of sale and purchase brokers from our competitors who

will bring a wealth of knowledge and experience to the sale and purchase

division. The full benefit of this acquisition will only become apparent as

members of the team commence their employment with the company.

Futures broking

Despite adverse market conditions our futures desk is performing well. The dry

desk is maintaining its position but the wet desk is striving to move into more

specialised areas of its business. During the first half we reduced the fixed

level of overheads, the full effect of which will emerge in the second half.

CIF (a platform for trading forward freight agreements) is expected to be

launched for live trading in September.

Research and IT services

Research continues to develop into a global integrated research operation and is

moving forward rapidly on the globalisation of our IT systems.

Many of the Research publications are released in the first half of the year

which has an impact on the timing of revenues.

Logistics

The Pacific Dhow continues to operate profitably though we continue to seek

efficiencies and improved volumes.

The CFF Seine, after its time in dry dock earlier in the year, has now found

profitable employment.

At the end of 2005 significant provisions were established to cover the likely

closure costs of Channel Freight Ferries. Extensive negotiations on many of the

potential liabilities have been successfully concluded with the result that

there are provisions we no longer require. These provisions have been released

as profit on discontinued activities.

Fund management

The Clarkson Shipping Fund was launched in the first half with US$20 million of

investment from the company. A further US$10 million has been subscribed by

external investors.

The Clarkson Shipping Fund has started well with a good result on its portfolio

of shipping equity and derivative investments, compared with the general

performance of the hedge fund industry during May and June 2006, and performance

remains positive in the period to date.

Property services

Since February 2006, St Magnus House has been fully let and is generating a

useful return from our many sub-tenants.

Financial services

In January 2006 we recruited a financial services team. The team have achieved

considerable success in structuring a shipping project, completing various

timecharters and operating a vessel in the first half. The majority of this

income, however, will only arise in the second half of 2006.

Finance

Tax

We estimate that the overall effective tax rate for the whole of 2006 will be

32.5% (2005 full year: 33.2%) and have applied this rate for the first half of

the year. The tax rate reflects the impact of disallowable trading expenses.

Dividend

The board has decided to increase the interim dividend by 2.0p per share from

10.0p to 12.0p per share.

The interim dividend will be paid on Friday 22 September 2006 to shareholders on

the register at close of business on Friday 8 September 2006.

Foreign exchange

The US dollar is the major trading currency of the group. The average sterling

exchange rate for the six month period was US$1.80. At 30 June 2006 the sterling

exchange rate was US$1.85.

Cash flow

Cash generation remains a key strength of the group.

However, net funds fell from #46.9 million at 31 December 2005 to #4.1 million

at 30 June 2006 reflecting the payment of #32.6 million of bonus relating to the

year 2005; #7.5 million relating to the acquisition of Plowrights and a US$20.0

million (#10.8 million) investment in the newly launched shipping hedge fund.

Directors

At the annual general meeting in May 2006, Rob Ward indicated his intention to

retire in December 2006 after being with the company for some 16 years.

Outlook

It is never easy to predict the timing or balance of supply and demand in the

shipping market. However, trading in the first six months of 2006 has not been

quite as difficult as originally anticipated and we are optimistic about the

company's performance in the second half of the year.

With fund management, financial services and property services all now fully

established our revenue base has broadened and should provide additional

consistency to our earnings.

Your company is well placed to produce another excellent result in 2006 and to

continue to generate increased returns for shareholders.

Tim Harris CHAIRMAN

Richard Fulford-Smith CHIEF EXECUTIVE

30 August 2006

Consolidated income statement

Half year to Half year to Year to

30 June 30 June 31 December

2006 2005 2005

#m #m #m

Revenue - continuing operations 52.6 53.9 115.9

Administrative expenses (45.8) (42.0) (92.2)

Operating profit - continuing operations 6.8 11.9 23.7

Share of profits of associates and joint venture 0.2 0.2 0.5

Finance revenue 2.2 0.9 1.6

Finance costs (0.5) - (0.1)

Other finance revenue - pensions 0.6 0.2 1.1

Profit before taxation - continuing operations 9.3 13.2 26.8

Taxation (3.0) (5.1) (8.9)

Profit for the period - continuing operations 6.3 8.1 17.9

Profit for the period from discontinued operations 1.1 8.0 5.7

Profit for the period 7.4 16.1 23.6

Attributable to:

Equity holders of the parent 7.4 12.7 19.1

Minority interests - 3.4 4.5

7.4 16.1 23.6

Earnings per share

Basic - continuing operations 37.5p 49.4p 108.9p

Diluted - continuing operations 37.2p 49.4p 107.7p

Basic - profit for the period 44.2p 77.5p 116.8p

Diluted - profit for the period 43.8p 77.5p 115.5p

Consolidated statement of recognised income and expense

Half year to Half year to Year to

30 June 30 June 31 December

2006 2005 2005

#m #m #m

Actuarial gain/(loss) on employee benefit schemes - net of tax 5.9 (2.7) (2.6)

Foreign exchange differences on retranslation of foreign (1.4) 1.0 1.5

operations

Total recognised directly in equity 4.5 (1.7) (1.1)

Profit for the period 7.4 16.1 23.6

Recognised income and expense for the period 11.9 14.4 22.5

Restatement for the effects of adopting IAS 39 - - 0.5

Settlement of forward currency contracts - - (0.1)

Total recognised income and expense 11.9 14.4 22.9

Attributable to:

Equity holders of the parent 11.9 11.0 18.4

Minority interests - 3.4 4.5

11.9 14.4 22.9

Consolidated balance sheet

30 June 30 June 31 December

2006 2005 2005

#m #m #m

Non-current assets

Property, plant and equipment 20.7 13.7 21.3

Investment property 0.4 - 0.4

Intangible assets 35.3 11.6 17.7

Investments in associates and joint venture 1.0 1.0 1.0

Trade and other receivables 0.7 - 0.5

Investments 15.7 0.8 2.1

Employee benefits 8.7 - -

Deferred tax asset 2.5 3.5 3.3

85.0 30.6 46.3

Current assets

Trade and other receivables 26.8 22.5 25.7

Cash and short-term deposits 37.2 37.6 55.1

64.0 60.1 80.8

Current liabilities

Interest-bearing loans and borrowings (0.7) (4.3) (3.4)

Trade and other payables (39.6) (31.2) (55.6)

Provisions (1.7) - (3.9)

Income tax payable (3.0) (9.9) (4.8)

(45.0) (45.4) (67.7)

Net current assets 19.0 14.7 13.1

Non-current liabilities

Interest-bearing loans and borrowings (32.4) - (4.8)

Trade and other payables (5.0) (1.6) (4.4)

Provisions (0.3) - (0.2)

Employee benefits - (1.5) (0.4)

Deferred tax liability (4.7) - (1.8)

(42.4) (3.1) (11.6)

Net assets 61.6 42.2 47.8

Capital and reserves

Issued capital 4.5 4.3 4.3

Share premium 17.5 11.1 11.1

ESOP reserve (1.4) (2.6) (0.5)

Deferred share consideration 1.1 1.9 1.9

Capital redemption reserve 2.0 2.0 2.0

Profit and loss 38.2 22.6 27.9

Currency translation reserve (0.3) 0.7 1.1

Clarkson PLC group shareholders' and total equity 61.6 40.0 47.8

Minority interests - 2.2 -

Total equity 61.6 42.2 47.8

Consolidated cash flow statement

Half year to Half year to Year to

30 June 30 June 31 December

2006 2005 2005

#m #m #m

Cash flows from operating activities

Operating profit 6.8 11.9 23.7

Adjustments for:

Profit before tax from discontinued operations 1.1 9.8 5.6

Depreciation 1.3 1.0 2.4

Profit on sale of property, plant and equipment - (11.0) (11.4)

Profit on sale of investments - - (0.6)

Difference between ordinary pension contributions paid (0.1) - (0.1)

and amount recognised in the income statement

9.1 11.7 19.6

Decrease/(increase) in trade and other receivables 1.7 (5.2) (7.0)

Prior year related bonus payments (32.6) (21.9) (21.9)

Increase in trade and other payables 14.1 22.6 43.1

(Decrease)/increase in provisions (2.1) - 3.2

Cash (utilised)/generated from operations (9.8) 7.2 37.0

Income tax paid (4.9) (5.6) (6.5)

Interest paid (0.5) - (0.1)

Net cash flow from operating activities (15.2) 1.6 30.4

Cash flows from investing activities

Interest received 0.9 0.6 1.3

Purchase of property, plant and equipment (1.5) (11.2) (20.7)

Proceeds from sale of investments - - 0.8

Proceeds from sale of property, plant and equipment 0.1 14.5 15.2

Purchase of investments (16.5) (0.1) (1.2)

Special contributions to pension schemes (6.7) (10.0) (10.0)

Investment in an associate (0.1) - -

Acquisition of a subsidiary, net of cash acquired (0.9) (2.6) (3.2)

Dividends received from associates and joint venture 0.3 - 0.3

Dividends received 1.3 0.2 0.3

Net cash flow from investing activities (23.1) (8.6) (17.2)

Cash flows from financing activities

Payments to minority interests - - (5.7)

Dividends paid (3.8) (2.6) (4.2)

Proceeds from borrowings 25.5 2.6 6.5

Net cash flow from financing activities 21.7 - (3.4)

Net (decrease)/increase in cash and cash equivalents (16.6) (7.0) 9.8

Cash and cash equivalents at start of period 55.1 44.0 44.0

Net foreign exchange difference (1.3) 0.6 1.3

Cash and cash equivalents at end of period 37.2 37.6 55.1

Notes to the interim financial report

1 Basis of preparation and accounting policies

The interim financial report has been prepared using the same accounting

policies and bases as those followed in the preparation of the group's annual

financial statements for the year ended 31 December 2005.

2 Segmental information

Revenue Results

Half Half year Year to Half year Half year Year to

year to to 30 31 to 30 to 30 31

30 June June December June June December

Continuing operations 2006 2005 2005 2006 2005 2005

#m #m #m #m #m #m

Dry bulk chartering 12.8 16.7 31.9 2.0 4.1 7.1

Container chartering 1.4 1.1 2.4 0.3 0.2 0.5

Deep sea chartering 12.0 9.8 20.2 2.8 2.2 4.8

Specialised products chartering 4.3 1.5 4.0 0.6 0.1 0.6

Gas chartering 2.6 1.1 3.4 0.6 0.1 0.2

Sale and purchase broking 9.6 12.4 32.4 1.7 3.8 9.4

Futures broking 3.6 6.1 12.3 0.8 1.8 3.6

Research services 2.9 2.4 4.5 0.8 0.3 0.8

Logistics 1.2 1.1 1.1 (0.4) 0.6 (0.4)

Fund management 0.1 - - (0.6) - (0.4)

Financial services - - - (0.2) - -

Property services 3.1 2.6 5.5 0.3 (0.1) 0.3

53.6 54.8 117.7

Less property services revenue arising (1.0) (0.9) (1.8)

within the group

Segment revenue/results 52.6 53.9 115.9 8.7 13.1 26.5

Head office costs and foreign exchange (1.9) (1.2) (2.8)

differences

Share of profits of associates and 0.2 0.2 0.5

joint venture

Finance revenue 2.2 0.9 1.6

Finance costs (0.5) - (0.1)

Other finance revenue - pensions 0.6 0.2 1.1

Profit before taxation 9.3 13.2 26.8

Taxation (3.0) (5.1) (8.9)

Profit after taxation 6.3 8.1 17.9

The share of profit of associates and joint Half year Half year Year to

venture is as follows: to 30 to 30 31

June June December

2006 2005 2005

#m #m #m

Dry bulk chartering - 0.2 0.2

Sale and purchase broking 0.2 - 0.3

0.2 0.2 0.5

3 Taxation

The taxation charge is calculated by applying the directors' best estimate of

the annual effective tax rate to the profit for the period.

4 Earnings per share

The calculation of the basic and diluted earnings per share is based on the

following data:

Half year to Half year Year to 31

to

30 June 30 June December

2006 2005 2005

#m #m #m

Earnings - continuing operations 6.3 8.1 17.9

Profit for the period 7.4 12.7 19.1

Million Million Million

Weighted average number of ordinary shares 16.8 16.4 16.4

Diluted weighted average number of ordinary shares 16.9 16.4 16.6

5 Intangible assets

In January 2006 the group completed the acquisition of J O Plowright & Co (Holdings) Limited ('Plowrights'). Plowrights

has 26 staff predominantly serving the petrochemical, products, lubricant, gas, vegetable oil and molasses freight

markets.

During 2006 the group acquired a financial services business and a sale and purchase brokerage business.

The book and provisional fair values of the identifiable assets and liabilities of Plowrights, the financial services

business and the sale and purchase brokerage business at the date of acquisition were as follows:

Plowrights Financial services Sale and purchase

Book Fair Book value Fair Book Fair

value value value value value

#m #m #m #m #m #m

Trade receivables 0.4 0.4 - - - -

Other receivables 1.0 1.0 - - - -

Cash and short-term deposits 1.0 1.0 - - - -

2.4 2.4 - - - -

Trade and other payables (1.4) (1.5) - - - -

Taxation (0.9) (0.9) - - - -

Employee benefits (6.3) (6.7) - - - -

(8.6) (9.1) - - - -

(6.2) - -

Fair value of net assets (6.7) - -

Goodwill arising on acquisitions 8.2 0.8 8.6

1.5 0.8 8.6

Plowrights Financial Sale and Total

services purchase

#m #m #m #m

Discharged by:

Fair value of shares issued 0.7 0.8 3.3 4.8

Costs associated with acquisition, 0.8 - - 0.8

settled in cash

Deferred consideration - cash and shares - - 5.3 5.3

1.5 0.8 8.6 10.9

6 Employee benefits

The company now operates two defined benefit schemes. In January 2006 the company assumed responsibility for the assets

and liabilities of the Plowrights defined benefit pension scheme. Under the terms of the acquisition the accounting

deficit on the Plowrights scheme of #6.7 million was eliminated.

As at 30 June 2006 these schemes had a combined surplus of #8.7 million. The market value of the assets is #137.7

million and independent actuaries have assessed the present value of funded obligations at #129.0 million. The company

has provided deferred tax on this surplus amounting to #2.6 million.

A significant proportion of the improvement since the year end has arisen from the increased discount rate from 4.7% as

at 31 December 2005 to 5.2% as at 30 June 2006.

7 Analysis of net funds

31 Reallocation Cash flow Foreign 30 June

December exchange

#m #m differences 2006

2005

#m #m

#m

Cash and short-term deposits 55.1 - (16.6) (1.3) 37.2

Current interest-bearing loans and borrowings (3.4) (0.9) 3.6 - (0.7)

Non-current interest-bearing loans and (4.8) 0.9 (29.1) 0.6 (32.4)

borrowings

Net funds 46.9 - (42.1) (0.7) 4.1

8 Profit and loss reserve reconciliation

Half year

to

30 June

2006

#m

Profit and loss reserve at start of period 27.9

Profit for the period 7.4

Actuarial gain on employee benefit schemes - net of tax 5.9

Dividend paid in the period (3.8)

Deferred share consideration 0.8

Profit and loss reserve at end of period 38.2

9 30 June 2005 reconciliations

The effect of reclassifying discontinued activities is a decrease in revenue of #3.8 million, an increase in operating

profit of #1.1 million, a decrease in disposal of fleet interests of #11.0 million, a decrease in finance costs of #0.1

million and a decrease in taxation of #1.8 million.

Finance income of #2.7 million and finance costs of #2.5 million have also been reanalysed in respect of employee

benefits with the net revenue being shown as 'Other finance revenue - pensions'.

10 Post balance sheet event

In August 2006 the group announced the completion of the acquisition of Genchem Holdings Limited. A copy of this

announcement is available from www.clarksons.com.

11 Contingencies

A subsidiary company, H Clarkson & Company Limited, and six other parties are the defendants in a Commercial Court

action commenced by a client of the subsidiary. In the proceedings, the client is claiming between US$107 million and

US$144 million in damages. The subsidiary provided market commentary to the client prior to their acquisition of a

shipping company which subsequently suffered a financial collapse. The client alleges that it relied on the commentary

provided negligently by the subsidiary when evaluating this acquisition. The subsidiary has been advised its case is

strongly defensible and, accordingly, no provision has been made in these accounts.

A legal action has also been threatened against H Clarkson & Company Limited and various other defendants by a client

in connection with third party commissions on business transacted during the period 2001-2004 totalling approximately

US$33 million which the subsidiary is alleged to have improperly paid. The subsidiary acted throughout on instructions

of the client company's senior management at the time on which it relied. As such the subsidiary considers that should

such a claim be brought its case is strongly defensible and, accordingly, no provision has been made in these accounts.

12 Accounts

The figures for the six months ended 30 June 2006 and 30 June 2005 are unaudited and do not constitute full accounts

within the meaning of Section 240(5) of the Companies Act 1985. The statutory audited accounts for the year ended 31

December 2005, upon which the auditors have given an unqualified report, have been delivered to the Registrar of

Companies in England & Wales.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGGZRKLVGVZM

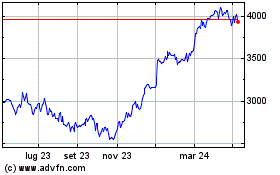

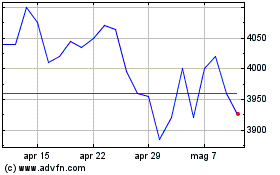

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Lug 2023 a Lug 2024