Clarkson PLC AGM and Interim Management Statement (4461E)

10 Maggio 2013 - 1:00PM

UK Regulatory

TIDMCKN

RNS Number : 4461E

Clarkson PLC

10 May 2013

10 May 2013

CLARKSON PLC

("Clarksons" or "the Group")

AGM and Interim Management Statement

Clarksons, the world's leading shipping services group, today

announces its Interim Management Statement published in accordance

with the UK Listing Authority's Disclosure and Transparency Rules,

for the period from 1 January 2013 to 9 May 2013 ("the

period").

At the Annual General Meeting to be held in London today, Bob

Benton, Chairman of Clarksons, will make the following

statement:

Trading

Shipping markets remained suppressed throughout the period with

rates and asset values under pressure, reflecting the backdrop of

continued global economic uncertainty.

Against these difficult trading conditions the expertise of our

teams and strength of our research offer, underpinned by our global

footprint, once again demonstrated their value to clients and we

have continued to make good progress towards our strategic

goals.

Broking

Freight rates have been under increasing pressure since the

start of the year with the average ClarkSea Index for Q1 2013 down

9% and the Baltic Dry Index down 13%. However, the strength and

breadth of our teams has meant we have been at the forefront of any

activity and continued to build volumes and market share across

most sectors. We have also begun to see more activity in underlying

assets which is encouraging, albeit the associated revenues will

not all be recognised in 2013.

Financial

Following the management actions taken towards the end of last

year, our Financial businesses are now operating at a reduced level

of overall losses as we continue to build their capability for the

long term. Revenue growth derived from our new equity sales and

trading team in New York has started to gain momentum and should be

further supported by several key hires made during the period.

Support

The year has started well for our port and agency businesses

which are benefiting from the completed integration of the Port

Services and EnShips acquisitions made at the end of 2011.

Research

Research underpins all of Clarksons' services and in challenging

trading conditions the value it offers our clients is more

important than ever. We continue to grow and develop the breadth

and depth of our offer and have seen an increase in underlying

revenue from research activities during the period.

Board Changes

As previously announced on 25 March 2013 Philip Green has been

appointed Senior Independent Director and will succeed me as

Chairman on 1 August 2013, when I retire from the role, remaining

on the Board until November 2013. Philip brings with him a wealth

of experience and on behalf of the Board I would like to wish him

every success in his new role.

Outlook

The industry outlook remains challenging with the continued

focus on the spot market limiting visibility. The delivery profile

of our newbuild and offshore activities will result in a weighting

in performance to the second half this year. Nevertheless group

trading in 2013 is in line with the Board's expectations.

Our business model has shown itself to be robust in this

environment. In these difficult times our customers value our

market leading offer more than ever and our proven strategy and

strong balance sheet give us continued confidence in Clarksons'

prospects.

Enquiries:

Clarkson PLC:

Andi Case, Chief Executive

Jeff Woyda, Finance Director 020 7334 0000

Hudson Sandler:

Kate Hoare

Katie Matthews 020 7796 4133

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGUAPAUPWGUU

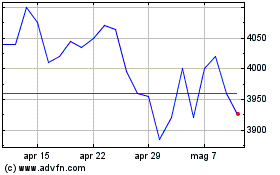

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Set 2024 a Ott 2024

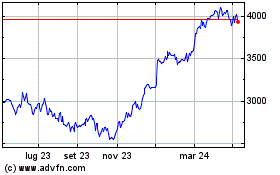

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Ott 2023 a Ott 2024