Clarkson PLC Interim Management Statement (4025S)

07 Novembre 2013 - 8:00AM

UK Regulatory

TIDMCKN

RNS Number : 4025S

Clarkson PLC

07 November 2013

7 November 2013

CLARKSON PLC

("Clarksons" or "the Group")

Interim Management Statement

Clarksons, the world's leading shipping services group, today

announces its Interim Management Statement published in accordance

with the UK Listing Authority's Disclosure and Transparency Rules,

for the period from 1 July 2013 to 6 November 2013 ("the

period").

Trading

Clarksons trading has been encouraging over the period against

global shipping markets which, although demonstrating some early

signs of improvement still remain challenging. This is evidenced by

the ClarkSea index which for the second half of 2013 to date was up

19% against the first half of the year and for the average of the

year to date was flat against the same period in 2012. Trading in

Q3 was up year on year.

The Group's performance has continued in line with the Board's

expectations. Whilst the Group started the year with a forward

order book $10m down on the previous year, the strength and breadth

of our offer and expertise of our teams has enabled us to

capitalise on the opportunities in our markets, achieving strong

spot growth to mitigate the lower forward order book brought

forward.

Broking

The positive indicators of improvement in our markets

highlighted at the half year have started to bear results and we

have seen some improvement in rates and asset values. Our broking

teams have worked hard to take full advantage, ensuring we are at

the forefront of all activity and we have seen particularly good

performances across offshore, tankers and specialised products as

well as an improvement in new building contracts.

Financial

Across our derivatives broking business, the improvement in

rates has resulted in strong volumes. Whilst rates softened again

towards the end of the third quarter, year to date losses in

derivative broking have seen a notable improvement year on year.

This performance, built on a recovery in the market for a short

period demonstrates the strategic rationale and opportunity for

this area of our business. Clarkson Capital Markets has also

performed well. Our teams are working on a number of active

mandates and continue to leverage client relationships across the

business through our full service offer.

Support

Trading in our Port Services business has continued to be

impacted by reduced grain exports as a result of the poor 2012

harvest and the decrease in activity of offshore oil and gas

projects in the North Sea. However, trading across the rest of our

support businesses have been in line with expectations.

On 1 November 2013, we announced the purchase of Gibb Tools, a

leading specialist tool supplier to the industrial maritime and

offshore sectors, for a maximum total consideration of GBP12.7m.

The acquisition allows Clarkson Port Services to further extend its

Port and Agency client offer into the important tool supply market,

bringing with it a wealth of complementary client relationships and

allowing us to tender for larger contracts. It is estimated that

Gibb Tools will enhance CPS's pre-tax profit by GBP2.0m per annum

before acquisition related costs.

Research

We continue to grow and develop the breadth and depth of our

Research offer which underpins all of Clarkson's services and have

seen an increase year on year in underlying revenue from research

activities during the period.

Outlook

Whilst the markets continue to be challenged, the recent

improvement in rates demonstrates that as trading conditions

improve, Clarksons has the right strategy, structure and teams in

position to take full advantage of recovery and we remain confident

in the outlook for the remainder of 2013 and the Board's

expectations are unchanged.

Enquiries:

Clarkson PLC 020 7334 0000

Andi Case, Chief executive

Jeff Woyda, Finance director

Hudson Sandler 020 7796 4133

Andrew Nicolls

Kate Hoare

Katie Matthews

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSBFBRTMBJMBAJ

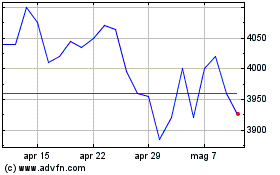

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Giu 2024 a Lug 2024

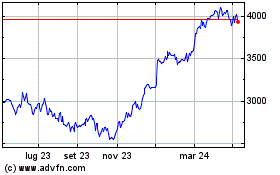

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Lug 2023 a Lug 2024