RNS Number:1528O

Citadel Holdings PLC

20 July 2000

Part 1

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR

IN PART IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR

JAPAN

CLS Holdings plc ("CLS" or "the Company")

Merger by way of recommended offer for Citadel Holdings

plc ("Citadel")

The CLS Independent Directors, on behalf of CLS, and

the Citadel Independent Directors are pleased to

announce that they have reached agreement on the terms

and conditions of a merger by way of a recommended

offer ("the Merger Offer") to be made by HSBC

Investment Bank plc ("HSBC") on behalf of CLS for the

whole of the issued and to be issued share capital of

Citadel not already owned by CLS.

The Merger Offer will be on the basis of 3 New CLS

Shares for every 5 Citadel Shares.

CLS also announced today its interim results for the

six months ended 30 June 2000 and reported NAV per

share of 284.0 pence (up 16.4 per cent. since 31

December 1999). Profit before taxation was #13.1

million (1999: #9.9 million) and basic earnings per

share were 12.4 pence (1999: 8.3 pence).

The CLS Directors are intending to make a tender offer

buy-back in lieu of dividend for the six months ended

30 June 2000, of a total of approximately #4.35

million following completion of the Merger Offer.

This is equivalent in cash terms to an interim

dividend of 3.92 pence per CLS Share in the Enlarged

Group (1999: 2.85 pence per share), an increase of

37.5 per cent.

Citadel also announced today its interim results for

the six months ended 30 June 2000 and reported NAV per

share of 152.5 pence after notional exercise of share

warrants held by CLS over Citadel Shares (up 10.4 per

cent. since 30 June 1999). Profit before taxation was

#2.2 million (1999: #1.9 million) and basic earnings

per share were 5.8 pence (1999: 5.2 pence).

Due to the Merger Offer, the Citadel Directors have

not declared an interim dividend for the six months

ended 30 June 2000. However, Citadel Shareholders

will be entitled to participate in CLS's intended

tender offer buy-back, on any CLS Shares they receive

under the Merger Offer in lieu of dividend for the six

months ended 30 June 2000.

Based on CLS's Closing Price of 177.5 pence on 19 July

2000 (the last dealing day prior to the date of this

announcement), the Merger Offer:

- values each Citadel Share at approximately 106.5

pence;

- values the whole of Citadel's existing issued

share capital at approximately #35.7 million; and

- represents a discount of approximately 4.5 per

cent. to the Closing Price of 111.5 pence per

Citadel Share on 19 July 2000, the last dealing

day prior to the date of this announcement.

CLS has received irrevocable undertakings from Citadel

Directors in respect of a total of 21.5 per cent. of

Citadel's issued share capital and non-binding letters

of intent, in the absence of a competing offer, to

accept the Merger Offer in respect of a further 25.3

per cent. of Citadel's issued share capital. The

irrevocable undertakings will cease to be binding if

the Merger Offer lapses or is withdrawn.

As at 30 June 2000, the combination of these two

companies would create a real estate investor with a

gross portfolio value in excess of #640 million and

enhanced geographical coverage with strategic holdings

in the three European markets of the United Kingdom,

Sweden and France.

Enquiries:

CLS Holdings plc

Sten Mortstedt Executive Chairman 020 7582 7766

Glyn Hirsch Chief Executive 020 7582 7766

Citadel Holdings plc

Gavin Kelly Chairman of the 020 7578 7070

Citadel Independent

Directors

HSBC Investment Bank plc

Jonathan Gray 020 7336 9983

Teather & Greenwood Limited 020 7426 9534

Russell Cook

This summary should be read in conjunction with and is

subject to the full text of the attached press

announcement.

HSBC Investment Bank plc, which is regulated in the United

Kingdom by The Securities and Futures Authority Limited,

is acting exclusively for CLS Holdings plc and no-one else

in connection with the Merger Offer and will not be

responsible to anyone other than CLS Holdings plc for

providing the protections afforded to customers of HSBC

Investment Bank plc or for providing advice in relation to

the Merger Offer or any other matter referred to herein.

Teather & Greenwood Limited, which is regulated in the

United Kingdom by The Securities and Futures Authority

Limited, is acting exclusively for Citadel Holdings plc,

acting through the Citadel Independent Directors, and for

no-one else in connection with the Merger Offer and will

not be responsible to anyone other than Citadel Holdings

plc, acting through the Citadel Independent Directors, for

providing the protections afforded to customers of Teather

& Greenwood Limited or for providing advice in relation to

the Merger Offer or any other matter referred to herein.

The Merger Offer will not be made, directly or indirectly,

in or into the United States, Australia, Canada or Japan.

Accordingly, copies of this announcement are not being,

and must not be, distributed or sent in, into or from the

United States, Canada, Australia or Japan (whether by

means of the mail or by any means or instrumentality of

interstate or foreign commerce), including, without

limitation, to any Citadel Shareholders or participants in

the Citadel Share Option Scheme with registered addresses

in the United States, Canada, Australia or Japan or to

persons whom CLS knows to be trustees, nominees or

custodians holding Citadel Shares for such persons.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR

IN PART IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR

JAPAN

For immediate release on 20 July 2000

CLS Holdings plc ("CLS" or "the Company")

Merger by way of recommended offer for Citadel Holdings

plc ("Citadel")

1. Introduction

The CLS Independent Directors, on behalf of CLS, and the

Citadel Independent Directors are pleased to announce that

they have reached agreement on the terms and conditions of

a merger by way of recommended offer ("the Merger Offer")

to be made by HSBC on behalf of CLS for the issued and to

be issued share capital of Citadel not already owned by

CLS.

CLS already owns 5,827,310 Citadel Shares representing

approximately 17.4 per cent. of Citadel's existing issued

ordinary share capital. CLS also has the ability under

the CLS Warrant to subscribe for a further 8 million

Citadel Shares. However, CLS currently has no intention

of exercising the CLS Warrant. In addition, CLS Directors

and their connected persons own a total of 7,175,861

Citadel Shares and options over 230,000 Citadel Shares.

The Merger Offer values the current issued ordinary share

capital of Citadel at approximately #35.7 million, based

on the Closing Price of a CLS Share of 177.5 pence on 19

July 2000 (the last dealing day prior to the date of this

announcement).

In view of the involvement of Sten Mortstedt, Dan

Baverstam and Glyn Hirsch in the management and equity of

both Citadel and CLS, these directors have been excluded

from participating in decisions taken by the Citadel

Independent Directors relating to the Merger Offer. The

remaining Directors, Richard Lockwood and Gavin Kelly, are

the Citadel Independent Directors, and have taken

responsibility for formulating and discussing the Merger

Offer on behalf of Citadel Shareholders.

In view of the involvement of Sten Mortstedt and Glyn

Hirsch in the management and equity of both Citadel and

CLS, as stated above, these directors have also been

excluded from participating in decisions taken by the CLS

Independent Directors. Thomas Lundqvist has been excluded

due to his involvement in the equity of both CLS and

Citadel. Bengt Mortstedt has also been excluded in view

of his connection with his brother Sten Mortstedt. The

remaining non-executive Directors, Keith Harris, James

Dean and Patrik Gransater are the CLS Independent

Directors, and have taken responsibility for formulating

and discussing the Merger Offer on behalf of CLS.

The Merger Offer is conditional, inter alia, upon the

approval of CLS Shareholders, which will be sought at an

extraordinary general meeting. Further details of the

approvals required are set out in paragraph 10 below.

2. The Merger Offer

On behalf of CLS, HSBC will offer to acquire, on the terms

and subject to the conditions set out or referred to in

this announcement, all the Citadel Shares not already

owned by CLS on the following basis:

for every 5 Citadel Shares 3 New CLS Shares

and so on in proportion for any other number of Citadel

Shares held (any resulting fractional entitlement being

aggregated and sold in the market and the net proceeds of

sale accruing to the benefit of the Enlarged Group.)

On the basis of the Closing Price of a CLS Share of 177.5

pence on 19 July 2000 (the last dealing day prior to the

date of this announcement), the Merger Offer values each

Citadel Share at 106.5 pence and the current issued

ordinary share capital of Citadel, at approximately #35.7

million. This represents a 4.5 per cent. discount over

the Closing Price of a Citadel Share of 111.5 pence on 19

July 2000, the last dealing day prior to the date of this

announcement.

The Merger Offer represents a discount to Citadel's net

asset value of 152.5 pence (after notional exercise of the

CLS Warrant) at 30 June 2000, as stated in its latest

interim statement, of 30.2 per cent. on the basis of the

Closing Price of a CLS Share of 177.5 pence on 19 July

2000, being the last dealing day prior to the date of this

announcement.

Citadel also announced today its interim results for the

six months ended 30 June 2000. Citadel Shareholders are

advised to read the full text of both these results in the

Merger Offer documentation which will be despatched to

them as soon as practicable.

Due to the Merger Offer, the Citadel Directors have not

declared an interim dividend for the six months ended 30

June 2000. However, Citadel Shareholders will be entitled

to participate in CLS's intended tender offer buy-back, in

lieu of dividend for the six months ended 30 June 2000, on

the CLS Shares they receive under the Merger Offer. The

CLS Directors are intending to distribute a total of

approximately #4.35 million following completion of the

Merger Offer by way of tender offer buy-back in November

2000, in lieu of dividend for the six months ended 30 June

2000. This would be on the basis of 235 pence per share

for 1 in 60 of the CLS Shares and the New CLS Shares to be

issued. In view of the timescale, the details of the

tender offer will be circulated later and the CLS

Directors may increase the share price and alter the ratio

if market conditions change. This is equivalent in cash

terms to an interim dividend of 3.92 pence per CLS Share

in the Enlarged Group (1999: 2.85 pence per share), an

increase of 37.5 per cent.

The Merger Offer extends to all Citadel Shares

unconditionally allotted or issued on the date of the

Merger Offer and any further Citadel Shares

unconditionally allotted or issued while the Merger Offer

remains open for acceptance. CLS will make appropriate

proposals to holders of options under the Citadel Share

Option Scheme.

The Citadel Shares are to be acquired by CLS under the

Merger Offer fully paid and free from all liens, charges,

encumbrances and other third party rights of any nature

whatsoever and together with all rights attaching thereto,

including the right to receive and retain any dividends

and other distributions declared, made or paid hereafter.

The Merger Offer will be made subject to the conditions

and further terms set out in Appendix I, and to be set out

in full in the Offer Document and the Form of Acceptance.

3. Recommendation by the Citadel Independent Directors

and change in Nominated AIM Adviser

The Citadel Independent Directors, who have been so

advised by Teather & Greenwood, consider the terms and

conditions of the Merger Offer to be fair and reasonable

so far as Citadel Shareholders are concerned and in the

best interests of Citadel and of Citadel Shareholders as a

whole. In providing advice to the Citadel Independent

Directors, Teather & Greenwood has taken into account the

Citadel Independent Directors' commercial assessments of

the transaction in the circumstances as set out in

Appendix IV.

As HSBC are acting for CLS in the Merger Offer, they have

resigned with immediate effect as Citadel's Nominated AIM

Adviser. Teather & Greenwood, who are Rule 3 advisers to

the Citadel Independent Directors for the purposes of the

Code, have assumed this role with immediate effect.

4. Background to and reasons for recommending the Merger

Offer

Set out in Appendix IV to this announcement is a letter

from the Citadel Independent Directors, setting out the

background to and reasons for recommending the Merger

Offer. This letter will be despatched to Citadel

Shareholders with copies of the Citadel interim results

and this announcement shortly.

5. Irrevocable undertakings and letters of intent

CLS has received irrevocable undertakings from the Citadel

Directors in respect of their entire beneficial holdings

of, in aggregate, 7,201,130 Citadel Shares, representing

approximately 21.5 per cent. of the existing issued share

capital of Citadel. This includes 10,000 Citadel Shares

held by the Citadel Independent Directors, representing

approximately 0.03 per cent of the existing issued share

capital of Citadel.

CLS has also received non-binding letters of intent, in

the absence of a competing offer, to accept the Merger

Offer from other Citadel Shareholders in respect of

8,483,751 Citadel Shares owned or controlled by them,

representing 25.3 per cent. of the existing issued share

capital of Citadel.

These irrevocable undertakings and non-binding letters of

intent to accept are in addition to CLS's existing holding

of 5,827,310 Citadel Shares representing 17.4 per cent.

The irrevocable undertakings detailed in this paragraph,

will all cease to be binding if the Merger Offer lapses or

the Merger Offer is withdrawn.

Save for the Citadel Shares comprised in the undertakings

to accept the Merger Offer and the Citadel Shares and

options over Citadel Shares held by CLS Directors as

disclosed in paragraph 6 below, neither CLS nor any

subsidiary of CLS, nor any CLS Director, nor, so far as

CLS is aware, any person acting in concert with CLS, owns

or controls any Citadel Shares, securities convertible

into Citadel Shares, rights to subscribe for Citadel

Shares, options (including traded options) in respect of

Citadel Shares and derivatives referenced to Citadel

Shares.

6. Interests of CLS Directors in Citadel Shares

The following CLS Directors and their connected persons

hold the following beneficial interests in Citadel Shares

and options over Citadel Shares.

Number of Exercise price

Number of options and period for

Citadel over options over

Shares Citadel Citadel Shares

Shares

Sten Mortstedt 7,149,854 115,000 100p

23/7/2000 -

22/7/2004

Glyn Hirsch 20,920 115,000 100p

23/7/2000 -

22/7/2004

Thomas Lundqvist 5,087 - -

7. New CLS Shares

Full acceptance of the Merger Offer, assuming no exercise

of the CLS Warrant but the exercise in full of options

over Citadel Shares while the Merger Offer remains open

for acceptance, would require the issue of approximately

17.0 million New CLS Shares, representing approximately

17.3 per cent. of the issued share capital of the Enlarged

Group.

The New CLS Shares to be issued will be credited as fully

paid and will rank pari passu in all respects with the

existing CLS Shares, which are listed on the Official

List, including the right to participate in CLS's intended

tender offer buy-back, in lieu of dividend in respect of

the six months ended 30 June 2000 and any other dividends

and other distributions declared, made or paid hereafter.

The New CLS Shares will be issued free from all liens,

charges, encumbrances and other third party rights of any

nature whatsoever. Application will be made to the UK

Listing Authority for the New CLS Shares to be admitted to

the Official List. Application will also be made to the

London Stock Exchange for the New CLS Shares to be

admitted to trading on the London Stock Exchange's main

market for listed securities.

Fractions of New CLS Shares will not be allotted or issued

to Citadel Shareholders. Entitlements to fractions of New

CLS Shares will be aggregated and sold in the market and

the net proceeds of sale will accrue to the benefit of the

Enlarged Group.

8. Background to and reasons for the Merger Offer

CLS's approach has been to seek opportunities to enhance

shareholder value via strategic investment in the

following:

high quality property acquisitions and investments,

including those outside the United Kingdom. As part

of this strategy, the CLS Group increased its

shareholding in Citadel in May 1999 from 12.3 per

cent. to 17.4 per cent.;

refurbishment of existing properties in the United

Kingdom; and

investment in a diversified share investment

portfolio.

In common with many smaller listed property companies, CLS

and Citadel have suffered from a lack of investor

interest. This has been reflected in the closing prices

of their shares as at 19 July 2000, being the last dealing

day prior to the date of this announcement, representing

discounts of 37.5 and 31.7 per cent. respectively to their

net asset values at 30 June 2000.

As at 30 June 2000, the combination of these two companies

would create a real estate investment company with a gross

portfolio value in excess of #640 million and enhanced

geographical coverage with strategic holdings in the three

European markets of the United Kingdom, Sweden and France.

The CLS Independent Directors are of the opinion that the

Enlarged Group may attract increasing investor interest,

with the prospect of decreasing the share price discount

to net asset value for the Enlarged Group. In addition,

the scale of the Enlarged Group may bring benefits

including the efficiency of managing the Enlarged Group

from one corporate entity and increased financial

strength, which will support future investment. The board

of CLS believe that the Enlarged Group has good prospects

for asset growth in the foreseeable future.

9. Financing of the Merger Offer

The consideration under the Merger Offer will be satisfied

entirely by the issue of the New CLS Shares to the Citadel

Shareholders.

10. CLS Shareholder approvals

CLS Shareholder approval is required in view of the size

of the Merger Offer under the rules of the UK Listing

Authority. It is also required to approve the purchase of

Citadel Shares from certain CLS Directors and to create

and authorise the allotment of New CLS Shares. In

addition, in view of the fact that Sten Mortstedt, a

director and a substantial shareholder of CLS, is a

shareholder of Citadel, the Merger Offer is a transaction

with a related party under the Listing Rules. Accordingly

the Merger Offer is conditional upon the approval of CLS

Shareholders, excluding Sten Mortstedt who will abstain

from voting and take all reasonable steps to ensure that

his associates will abstain.

CLS is also seeking CLS Shareholders' approval to grant an

authority for the Company to purchase up to a maximum of

10 per cent. of CLS's issued ordinary share capital

following the issue of New CLS Shares pursuant to the

Merger Offer. The CLS Directors believe that such

purchases could enhance the Company's net assets per

share. This should not be interpreted to mean that net

assets per CLS Share will necessarily be greater than in

any previous year.

Following completion of the Merger Offer, under the rules

of the Code, any increase in the percentage shareholding

in the Enlarged Group by Sten Mortstedt individually or in

the combined interests of Sten Mortstedt and Bengt

Mortstedt or any person connected to them as a result of

any purchases by CLS of its own shares pursuant to the

authority given to CLS at the EGM could oblige Sten

Mortstedt individually or Sten Mortstedt and Bengt

Mortstedt collectively to make a general offer to all CLS

Shareholders pursuant to Rule 9 of the Code. However, the

Panel has agreed, subject to the approval of independent

CLS Shareholders on a poll, to waive this requirement.

The independent CLS Shareholders are the CLS Shareholders

other than Sten Mortstedt and Bengt Mortstedt and their

respective interests.

For the avoidance of doubt, CLS may continue to purchase

its own shares during the Offer Period under its existing

authority granted at the annual general meeting of the

Company held on 3 May 2000 which authorised the Company to

make market purchases of a maximum of 9,616,952 CLS

Shares. CLS has already purchased 2,185,670 CLS Shares

under this existing authority.

11. Information on CLS

CLS is a property company involved in the investment in,

development and management of commercial properties and

the investment in the shares of high technology and

internet companies.

For the year ended 31 December 1999, CLS reported turnover

of #33.7 million (1998: #28.8 million), profit before

taxation of #16.9 million (1998: #11.1 million) and basic

earnings per share of 14.0p (1998: 8.8p). On 31 December

1999, CLS had net assets of #248.7 million (1998: #207.6

million).

CLS also announced today its interim results for the six

months ended 30 June 2000 and reported NAV per share of

284.0 pence (up 16.4 per cent. since 31 December 1999).

Profit before taxation was #13.1 million (1999: #9.9

million) and basic earnings per share were 12.4 pence

(1999: 8.3 pence). Net assets as at 30 June 2000 were

#268.5 million (1999: #226.5 million).

The CLS Directors believe CLS has good prospects for asset

growth in the foreseeable future. Further details of the

CLS Group's recent financial performance and operational

developments are set out in the separate announcement of

the unaudited interim statement for the six months ended

30 June 2000.

12. Information on Citadel

Citadel is a property company involved in the investment

in and management of office properties in Paris and Lyon.

For the year ended 31 December 1999, Citadel reported

turnover of #9.5 million (1998: #5.8 million), profit

before taxation of #3.7 million (1998: #3.1 million) and

basic earnings per share of 11.2p (1998: 7.8p). On 31

December 1999, Citadel had net assets of #50.6 million

(1998: #47.0 million).

Citadel also announced today its interim results for the

six months ended 30 June 2000 and reported NAV per share

of 152.5 pence after notional exercise of the CLS Warrant

(up 10.4 per cent. since 30 June 1999). Profit before

taxation was #2.2 million (1999: #1.9 million) and basic

earnings per share were 5.8 pence (1999: 5.2 pence). Net

assets as at 30 June 2000 were #54.7 million (1999: #48.3

million).

Further details of the Citadel Group's recent financial

performance and operational developments are set out in

the separate announcement of the unaudited interim

statement for the six months ended 30 June 2000.

13. Continuation of the Citadel business

The CLS Directors intend to continue to conduct the

business of Citadel in the same manner as it is currently

conducted and there are no plans to introduce any

substantial change in the business or in employees' terms

of contract.

14. Management and employees

CLS has given assurances to the Citadel Independent

Directors that the existing employment rights of all

management and employees of Citadel will be fully

safeguarded.

15. Citadel Share Option Scheme

Citadel Share Optionholders will be offered the

opportunity to release their options over Citadel Shares

in consideration for the grant of equivalent options over

CLS Shares, using the same valuation as for the Merger

Offer itself. Citadel Share Optionholders who do not

accept this opportunity will be entitled under the terms

of the Citadel Share Option Scheme to exercise their

options when the Merger Offer has become or been declared

unconditional in all respects, and will be able to accept

the Merger Offer while it is open for acceptance. The

Merger Offer will remain open for acceptance for at least

14 days after the date on which it is declared

unconditional in all respects. These proposals will be

circulated to Citadel Share Optionholders in due course.

16. Listing and dealings

Application will be made to the UK Listing Authority for

the New CLS Shares to be admitted to the Official List.

Application will also be made to the London Stock Exchange

for the New CLS Shares to be admitted to trading on the

London Stock Exchange's main market for listed securities.

It is expected that Admission will become effective and

that dealings, for normal settlement, in the New CLS

Shares will commence on the London Stock Exchange on the

first dealing day following the date on which the Merger

Offer becomes or is declared unconditional in all respects

(save for the condition relating to Admission and

admission to trading on the London Stock Exchange's main

market for listed securities).

17. Offer Document and Circular

The Offer Document containing the full terms and

conditions of the Merger Offer, together with a Form of

Acceptance and a copy of the Listing Particulars, will be

despatched to Citadel Shareholders and, for information

only, to participants in the Citadel Share Option Scheme

as soon as practicable.

A Circular (and the Listing Particulars with, for

information only, the Offer Document) will be despatched

to CLS Shareholders describing the Merger Offer and giving

notice to convene an extraordinary general meeting of CLS

Shareholders at which ordinary resolutions will be

proposed to approve the terms of the Merger Offer, to

authorise the CLS Directors to allot the New CLS Shares

pursuant to section 80 of the Act, to waive pre-emption

rights in respect of the New CLS Shares and to approve the

purchase of Citadel Shares from certain CLS Directors. A

special resolution will also be proposed to authorise the

purchase by the Company of its own shares (including,

specifically, the purchase of its own shares from a

Director or person connected with him) and an ordinary

resolution will be proposed to approve the waiver of the

requirements of the Code as a result of the purchase by

the Company of its own shares.

18. Overseas Shareholders

The making of the Merger Offer in, or to persons resident

in or who are citizens, residents or nationals of,

jurisdictions outside the UK may be affected by the laws

of the relevant jurisdiction. Citadel Shareholders who

are not resident in the UK or who are citizens or

nationals of countries outside the UK should inform

themselves about and observe any applicable legal

requirements. It is the responsibility of any such

Citadel Shareholder wishing to accept the Merger Offer to

satisfy himself as to the full observance of the laws of

the relevant jurisdiction in connection therewith,

including the obtaining of any governmental, exchange

control or other consents which may be required, the

compliance with other necessary formalities and the

payment of any issue, transfer or other taxes due in such

jurisdiction.

In particular, the Merger Offer will not be made directly

or indirectly in or into, or by use of the mails of or by

any means or instrumentality of interstate or foreign

commerce of, or of any facilities of a national securities

exchange of, the United States, Australia, Canada or

Japan. This includes, but is not limited to, the post,

facsimile transmission, telex and telephone. Furthermore,

copies of this announcement are not being and must not be

mailed or otherwise distributed or sent in or into or from

the United States, Australia, Canada or Japan including to

Citadel Shareholders or participants in the Citadel Share

Option Scheme with registered addresses in the United

States, Australia, Canada or Japan, or to persons whom CLS

knows to be nominees holding Citadel Shares for such

persons.

The New CLS Shares to be issued pursuant to the Merger

Offer will not be registered under the United States

Securities Act of 1933 (as amended) nor under the

securities laws of any jurisdiction of the United States

nor under any of the relevant securities laws of

Australia, Canada or Japan. No prospectus in relation to

the Merger Offer or the New CLS Shares to be issued

pursuant thereto has been lodged with, or registered by,

the Australian Securities and Investments Commission. The

relevant clearances have not been and will not be obtained

from the Securities Commission of any province or

territory of Canada. Accordingly, unless an exemption

under the relevant securities law of such jurisdictions is

available, the New CLS Shares may not be offered, sold, re-

sold or delivered, directly or indirectly, in or into the

United States, Australia, Canada or Japan. All Citadel

Shareholders (including nominees, trustees or custodians)

who would, or otherwise intend to forward this

announcement, should read the further details in this

regard which will be contained in the Offer Document which

will be issued in due course before taking any action.

19. General

Certain terms used in this announcement are defined in

Appendix III.

This announcement does not constitute an offer or

invitation to purchase any securities.

Further details of the Merger Offer to be made will be

contained in the Offer Document, which will be despatched

to Citadel Shareholders and, for information only, to CLS

Shareholders, together with the Listing Particulars, as

soon as practicable. A circular to CLS Shareholders

containing a notice convening the EGM and providing

information on the Merger Offer, will be despatched to CLS

Shareholders as soon as practicable.

Enquiries:

CLS Holdings plc

Sten Mortstedt Executive Chairman 020 7582 7766

Glyn Hirsch Chief Executive 020 7582 7766

Citadel Holdings plc

Gavin Kelly Chairman of the 020 7578 7070

Citadel Independent

Directors

HSBC Investment Bank plc

Jonathan Gray 020 7336 9983

Teather & Greenwood 020 7426 9534

Russell Cook

HSBC Investment Bank plc, which is regulated in the United

Kingdom by The Securities and Futures Authority Limited,

is acting exclusively for CLS Holdings plc and no-one else

in connection with the Merger Offer and will not be

responsible to anyone other than CLS Holdings plc for

providing the protections afforded to customers of HSBC

Investment Bank plc or for providing advice in relation to

the Merger Offer or any other matter referred to herein.

Teather & Greenwood, which is regulated in the United

Kingdom by The Securities and Futures Authority Limited,

is acting exclusively for Citadel Holdings plc, acting

through the Citadel Independent Directors, and for no-one

else in connection with the Merger Offer and will not be

responsible to anyone other than Citadel Holdings plc,

acting through the Citadel Independent Directors, for

providing the protections afforded to customers of Teather

& Greenwood or for providing advice in relation to the

Merger Offer or any other matter referred to herein.

The CLS Directors accept responsibility for the

information contained in this announcement, except for the

information in this announcement concerning Citadel, its

subsidiaries and their respective businesses, the Citadel

Directors and their connected persons and persons acting

in concert with, and associates of, Citadel. Subject to

this, to the best of the knowledge and belief of the CLS

Directors (who have taken all reasonable care to ensure

that such is the case), the information contained in this

announcement for which they are responsible is in

accordance with the facts and does not omit anything

likely to affect the import of that information.

The Citadel Directors accept responsibility for the

information contained in this announcement, except for the

information in this announcement concerning CLS, its

subsidiaries and their respective businesses, the Citadel

Directors and their connected persons and persons acting

in concert with, and associates of, CLS, with the

exception of expressions of opinion and the recommendation

of the Citadel Independent Directors. Subject to this, to

the best of the knowledge and belief of the Citadel

Directors (who have taken all reasonable care to ensure

that such is the case), the information contained in this

announcement for which they are responsible is in

accordance with the facts and does not omit anything

likely to affect the import of that information.

The Citadel Independent Directors accept responsibility

for expressions of opinion and their recommendation set

out in this announcement. To the best of the knowledge

and belief of the Citadel Independent Directors (who have

taken all reasonable care to ensure that such is the

case), the information contained in this announcement for

which they are responsible is in accordance with the facts

and does not omit anything likely to affect the import of

that information.

Appendix I

Conditions and certain further terms of the Merger Offer

The Merger Offer, which will be made by HSBC Investment

Bank on behalf of CLS, will comply with the applicable

rules and regulations of the UK Listing Authority and the

City Code, will be governed by English law and will be

subject to the jurisdiction of the Courts of England and

to the terms and conditions set out below and to be set

out in the Offer Document and the Form of Acceptance.

Part A: Conditions of the Merger Offer

The Merger Offer is subject to the following conditions:

(a)valid acceptances being received (and not, where

permitted, withdrawn) by 3.00 p.m. on the first

closing date of the Merger Offer (the "First Closing

Date") (or such later time(s) and/or date(s) as CLS

may, subject to the rules of the Code, decide) in

respect of not less than 90 per cent. in nominal value

(or such lower percentage as CLS may decide) of the

Citadel Shares to which the Merger Offer relates,

provided that this condition will not be satisfied

unless CLS shall have acquired or agreed to acquire,

whether pursuant to the Merger Offer or otherwise,

Citadel Shares carrying, in aggregate, more than 50

per cent. of the voting rights then exercisable at a

general meeting of Citadel including for this purpose,

to the extent (if any) required by the Panel, any such

voting rights attaching to any Citadel Shares that may

be unconditionally allotted or issued before the

Merger Offer becomes or is declared unconditional as

to acceptances, whether pursuant to the exercise of

any outstanding conversion or subscription rights or

otherwise and, for this purpose:

(i)the expression "Citadel Shares to which the Merger

Offer relates" shall be construed in accordance

with sections 428 to 430F of the Act; and

(ii) Citadel Shares which have been

unconditionally allotted shall be deemed to carry

the voting rights which they will carry upon

issue;

(b)the UK Listing Authority and the London Stock Exchange

announcing their decision to admit to the Official

List and to trading on the London Stock Exchange's

main market for listed securities (respectively) the

New CLS Shares and such admission becoming effective

in accordance with paragraph 7.1 of the Listing Rules

or the admission standards of the London Stock

Exchange (as appropriate), or (if determined by CLS

and subject to the consent of the Panel) the UK

Listing Authority agreeing to admit to the Official

List and the London Stock Exchange agreeing to admit

to trading on its main market for listed securities

such shares subject only to

(i)the allotment of such shares and/or

(ii) the Merger Offer becoming or being declared

unconditional in all respects;

(c)the passing at the EGM of such resolution or

resolutions as may be necessary or incidental to

approve, implement and effect the terms of the Merger

Offer;

(d)it having been established in terms reasonably

satisfactory to CLS that neither the proposed

acquisition of Citadel by CLS nor any matter arising

from that acquisition will be referred to the

Competition Commission;

(e)no government, government department or governmental,

quasi-governmental, supranational, statutory or

regulatory body, court, trade agency, association,

institution or professional body or any other person

or body whatsoever in any jurisdiction (each a

"Relevant Authority") having, prior to the date when

the Merger Offer would otherwise become unconditional,

instituted, implemented, threatened or communicated to

Citadel its decision to take any action, proceeding,

suit, investigation or enquiry or made, proposed or

enacted any statute, regulation, decision or order or

taken any other steps and there not continuing to be

outstanding any statute, legislation, regulation,

decision or order thereof which would or might:

(i)make the Merger Offer, or the acquisition by CLS

of any shares in, or control of, Citadel, void,

illegal and/or unenforceable or, to a material

extent, restrain, prohibit, restrict, or delay the

Merger Offer or impose additional and material

conditions or obligations or otherwise challenge

or interfere therewith to a material extent;

(ii) result in any material delay or limitation

in the ability of CLS, or render CLS unable, to

acquire some or all of the Citadel Shares;

(iii) require or prevent the divestiture by

Citadel or any of its subsidiaries, or any

company, partnership or joint venture in which any

member of the Citadel Group has a substantial

interest (the "wider Citadel Group") of all or any

material part of their respective businesses,

assets or property or, to an extent which is

material, impose any limitation on the ability of

any member of the wider Citadel Group to conduct

all or any material part of their respective

businesses or own all or any material part of

their respective assets or property;

(iv) require any member of the wider Citadel

Group to offer to acquire any shares in any member

of the wider Citadel Group owned by any third

party; or

(v)otherwise adversely affect the business, profits

or prospects of any member of the wider Citadel

Group to an extent which is material in the

context of the Citadel Group;

and all applicable waiting and other time periods

during which any such Relevant Authority could decide

to take, institute, implement or threaten any such

action, proceeding, suit, investigation or enquiry

having expired, lapsed or been terminated;

(f)all necessary filings having been made and all

appropriate waiting periods under any applicable

legislation or regulations of any jurisdiction having

expired, lapsed or been terminated in each case in

respect of the Merger Offer and the acquisition of

Citadel Shares or of control of Citadel by CLS and all

authorisations, orders, recognitions, grants,

consents, licences, confirmations, clearances,

permissions and approvals ("Authorisations") which in

the opinion of CLS, acting reasonably, are necessary

or appropriate for or in respect of the Merger Offer

or the proposed acquisition of any shares in, or under

the control of, Citadel by CLS having been obtained on

terms and in a form reasonably satisfactory to CLS

from all appropriate Relevant Authorities and all such

Authorisations, together with all Authorisations which

in the opinion of CLS, acting reasonably, are

necessary or appropriate to carry on the business of

any member of the Citadel Group, the absence of which

would be material in the context of the Merger Offer,

remaining in full force and effect and there being no

intimation of an intention to revoke or not to renew

the same and all necessary statutory or regulatory

obligations in any relevant jurisdictions having been

complied with;

(g)save as fairly disclosed in writing to CLS or its

professional advisers prior to the date of this

announcement, there being no provision of any

arrangement, agreement, licence or permit, franchise

or other instrument to which any member of the wider

Citadel Group is a party or by or to which any such

member or any of its assets, which are material to its

business may be bound, entitled or subject and which,

in consequence of the Merger Offer or the proposed

acquisition of any Citadel Shares or control of

Citadel by CLS or otherwise, would or might reasonably

be expected to result (to an extent which is

materially adverse in the context of the Citadel

Group) in:

(i)any such arrangement, agreement, licence or

instrument being terminated or modified or any

action being taken or any obligation arising

thereunder;

(ii) any assets or interests of any such member

being or failing to be disposed of;

(iii) the interest or business of any such member

in or with any firm or body or person being

terminated or materially and adversely modified or

affected;

(iv) any such member ceasing to be able to carry

on business under any name under which it

presently does so;

(v)any monies borrowed by or other indebtedness

(actual or contingent) of any such member being or

becoming capable of being declared repayable

immediately or prior to its stated maturity or the

ability of such member to incur any indebtedness

being withdrawn or inhibited;

(vi) the creation of any mortgage, charge or

other security interest over the whole or any part

of the business, property or assets of any such

member or any such mortgage, charge or other

security becoming enforceable; or

(vii) the financial or trading position or

prospects of any such member being affected;

(h)except as disclosed in the annual report and accounts

of Citadel for the year ended 31 December, 1999, or as

(a) fairly disclosed in writing to CLS or its

professional advisers prior to the date of this

announcement or in the interim financial statements of

Citadel for the six months ended 30 June 2000 or (b)

announced via the London Stock Exchange Companies

Announcements Office prior to the date of this

announcement, no member of the wider Citadel Group

having since 31 December, 1999 (other than by way of

transactions between Citadel and wholly owned

subsidiaries of Citadel or between two or more such

wholly owned subsidiaries):

(i)issued or agreed to issue or authorised or

proposed the issue of additional shares of any

class, or securities convertible into, or rights,

warrants or options to subscribe for or acquire,

any such shares or convertible securities (save

for options granted, and for any Citadel Shares

allotted upon exercise of options granted, prior

to the date when the Merger Offer would otherwise

become unconditional, under the Citadel Share

Option Scheme) or redeemed, purchased, reduced or

made any other change to any part of its share

capital or to vary any rights attached to any

class of its share capital;

(ii) recommended, declared, paid, made or

proposed to recommend, declare, pay or make any

bonus in respect of shares, dividend or other

distribution whether payable in cash or otherwise;

(iii) implemented or authorised or proposed or

announced its intention to effect any

reconstruction, amalgamation, merger or demerger

or acquisition or disposal of assets or any right,

title or interest in any assets or shares or any

change in its share or loan capital (other than

pursuant to the exercise of options granted under

the Citadel Share Option Scheme) in each case

which would be material in the context of the

Citadel Group taken as a whole;

(iv) entered into any transaction, contract or

commitment (whether in respect of capital

expenditure or otherwise) which is of a long-term,

onerous or unusual nature or which involves or

could involve an obligation of a nature or

magnitude which is material in the context of the

Citadel Group taken as a whole;

(v)issued or proposed the issue of any debenture or

incurred any contingent liability or incurred any

indebtedness which is material in the context of

the Citadel Group as a whole;

(vi) disposed of or transferred, mortgaged, or

encumbered any material assets or assets which

together are material in the context of the

Citadel Group taken as a whole or any right, title

or interest in any such asset;

(vii) waived or compromised any claim which is

material in the context of the Citadel Group taken

as a whole;

(viii)entered into or varied the terms of any service

agreement with any Citadel Director;

(ix) taken any action or had any order made for

its winding-up, dissolution or reorganisation, or

for the appointment of a receiver, administrative

receiver, trustee or similar officer of all or any

of its assets which are material to its business

or revenues;

(x)entered into any agreement which restricts to a

material extent the size or nature of the business

of any member of the wider Citadel Group in each

case which will or might be material to the

Citadel Group as a whole;

(xi) terminated or varied the terms of any

agreement between any member of the Citadel Group

and any other person in a manner which would or

might reasonably be expected to have a material

adverse effect on the position or prospects of the

Citadel Group taken as a whole; or

(xii) entered into any agreement or commitment or

passed any resolution with respect to or announced

an intention to effect any of the transactions or

events referred to in this paragraph;

(i)since 31 December 1999 and prior to the date when the

Merger Offer becomes otherwise unconditional, except

as disclosed in the annual report and accounts of

Citadel for the year ended 31 December 1999 or the

interim financial statements of Citadel for the six

months ended 30 June 2000 or, save as (a) fairly

disclosed in writing to CLS or its professional

advisers prior to the date of this announcement or (b)

announced via the London Stock Exchange Companies

Announcements Office prior to the date of this

announcement:

(i)there having been no material adverse change in

the financial or trading position of the Citadel

Group taken as a whole;

(ii) there not having been instituted or

threatened in writing any litigation, arbitration

proceedings, prosecution or other legal

proceedings to which any member of the Citadel

Group or associated person is a party (whether as

plaintiff, defendant or otherwise) which would or

might reasonably be expected to have a material

effect on the Citadel Group taken as a whole and

no such proceedings remaining outstanding;

(iii) no claim or liability (contingent or

otherwise), having arisen in respect of any member

of the wider Citadel Group which would or might

reasonably be expected to have a material and

adverse effect on the Citadel Group taken as a

whole;

(iv) there having been no receiver or

administrative receiver appointed over a material

part of the assets of any member of the wider

Citadel Group or analogous proceedings or steps

having been taken place under the laws of any

relevant jurisdiction and there having been no

petition presented for the administration of any

member of the wider Citadel Group or any

equivalent proceedings or steps taken under the

laws of any relevant jurisdiction;

(j)CLS not having discovered prior to the date when the

Merger Offer becomes otherwise unconditional that:

(i) any past or present member of the wider

Citadel Group has not complied with all applicable

laws of any relevant jurisdiction relating to

environmental matters, or

(ii) that there has been an emission, release,

disposal, discharge, deposit, spillage or leak of

waste or hazardous or harmful substances on or

about or from any land or other asset now or

previously owned, occupied or operating which is

likely to give rise to any liability (whether

actual or contingent) or cost (which would in each

case be material in the context of the Citadel

Group taken as a whole) for any member of the

wider Citadel Group; and

(k)CLS not having discovered prior to the date when the

Merger Offer becomes otherwise unconditional that:

(i)the financial or business information concerning

the wider Citadel Group as contained in the

information publicly disclosed at any time by any

member of the wider Citadel Group contains a

material misrepresentation of fact or omits to

state a fact necessary to make the information

contained therein not materially misleading and

which was not, if material, corrected by a

subsequent public announcement prior to the date

of this announcement which misrepresentation or

omission has or might reasonably be expected to

have a material adverse effect on the wider

Citadel Group; or

(ii) any member of the wider Citadel Group which

is not a subsidiary of Citadel is subject to any

liability (except for any liability arising in the

ordinary course of trading since 31 December

1999), contingent or otherwise which is not

disclosed in the annual report and accounts of

Citadel for the year ended 31 December 1999 or the

interim financial statements of Citadel for the

six months ended 30 June 2000, such liability

being material in the context of the Citadel Group

taken as a whole.

CLS reserves the right to waive, in whole or in part, all

or any of the conditions other than conditions (a), (b)

and (c). Condition (b) and (c) must be fulfilled.

Otherwise CLS shall be under no obligation to waive or

treat as satisfied any of the conditions (a) to (k) by a

date earlier than the latest date specified below for the

satisfaction thereof, notwithstanding that the other

conditions of the Merger Offer may at such earlier date

have been waived or fulfilled and that there are at such

earlier date no circumstances indicating that any such

conditions may not be capable of fulfilment.

If CLS is required by the Panel to make an offer for

Citadel Shares under the provisions of Rule 9 of the Code,

CLS may make such alterations to the above conditions,

including that in condition (a) above, and the other terms

of this Merger Offer as are necessary to comply with the

provisions of that Rule.

The Merger Offer will lapse unless the conditions set out

above (other than condition (a)) are fulfilled (and remain

fulfilled) or if capable of waiver are waived by midnight

on the 21st day after the first closing date of the Merger

Offer and the date on which the Merger Offer becomes or is

declared unconditional as to acceptances, whichever is the

later, or such later date as the Panel may agree.

The Merger Offer will also lapse if the proposed

acquisition of the entire issued share capital of Citadel

is referred to the Competition Commission before the later

of 3.00 p.m. on the first closing date of the Merger Offer

and the date on which the Merger Offer becomes or is

declared unconditional as to acceptances, in which event

not only will the Merger Offer cease to be capable of

further acceptance but also Citadel Shareholders and CLS

will thereafter cease to be bound by prior acceptances.

Part B: Certain further terms of the Merger Offer

Fractions of New CLS Shares will not be allotted or issued

to Citadel Shareholders. Entitlements to fractions of New

CLS Shares will be aggregated and sold in the market and

the net proceeds of sale will accrue to the benefit of the

Enlarged Group.

The making of the Merger Offer in, or to persons resident

in or who are citizens, residents or nationals of,

jurisdictions outside the UK may be affected by the laws

of the relevant jurisdiction. Citadel Shareholders who

are not resident in the UK or who are citizens or

nationals of countries outside the UK should inform

themselves about and observe any applicable legal

requirements. It is the responsibility of any such

Citadel Shareholder wishing to accept the Merger Offer to

satisfy himself as to the full observance of the laws of

the relevant jurisdiction in connection therewith,

including the obtaining of any governmental, exchange

control or other consents which may be required, the

compliance with other necessary formalities and the

payment of any issue, transfer or other taxes due in such

jurisdiction.

MORE TO FOLLOW

OFFGLGDRRDDGGGG

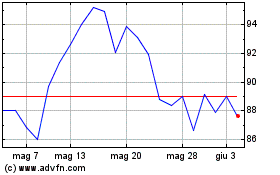

Grafico Azioni Cls (LSE:CLI)

Storico

Da Ago 2024 a Set 2024

Grafico Azioni Cls (LSE:CLI)

Storico

Da Set 2023 a Set 2024