TIDMCLI

RNS Number : 4646G

CLS Holdings PLC

04 March 2015

Release date: 4 March

2015

Embargoed

until: 07:00

CLS HOLDINGS PLC

("CLS", THE "COMPANY" OR THE "GROUP")

ANNOUNCES ITS FULL YEAR FINANCIAL REPORT

FOR THE 12 MONTHS TO 31 DECEMBER 2014

A record year for the Group

CLS is a property investment company with a diverse portfolio of

GBP1.31 billion modern, well-let properties in the UK, France,

Germany and Sweden. CLS's properties have been selected for their

potential to add value and to generate high returns on capital

investment through active asset management.

FINANCIAL HIGHLIGHTS

-- EPRA net assets per share up 39.9% to 1,774.1 pence (2013: 1,268.4 pence)

-- Profit after tax up 208.4% to GBP194.9 million (2013: GBP63.2 million)

-- EPRA earnings per share up 16.9% to 77.4 pence (2013: 66.2 pence)

-- Portfolio value GBP1,310.1 million (2013: GBP1,132.9 million), up 15.8% in local currencies

-- Robust interest cover of 3.3 times (2013: 3.2 times)

-- Weighted average cost of debt remains low at 3.64% (2013:

3.64%) - one of the lowest in the property sector - and has fallen

to 3.58% since 1 January 2015

-- Distributions to shareholders up 6.4% in the year,

like-for-like, with a proposed GBP10.4 million by way of tender

offer buy-back: 1 in 80 at 1,950 pence, equivalent to 24.4 pence

per share

-- Total shareholder return of 206.6% in five years

-- Entered the FTSE 250 index in December 2014

OPERATIONAL HIGHLIGHTS

Investment Property Portfolio:

-- Three selective acquisitions for GBP29.7 million providing a

blended net initial yield of 6.7%

-- Two opportunistic disposals generating proceeds of GBP37.5

million at a blended yield of 2.9%

-- Vacancy rate at an all-time low of 3.0% (2013: 4.4%)

-- EPRA net initial yield of 6.5%, 290 basis points above cost

of debt, one of the highest differentials in the listed property

sector

Developments:

-- Completion of the GBP55 million development of Spring Mews, SE11 comprising:

o 378 room student accommodation opened and fully let in

September

o 93 room Staybridge Suite Hotel opened in January

-- Completion of the redevelopment 2,769 sqm of office space at 138 Fetter Lane, EC4

-- Further planning consent for design enhancements at Vauxhall Square, SW8

-- Planning consent gained on Westminster Tower, SE1 for 3

additional storeys and 23 luxury riverside apartments

Key Financings:

-- GBP97 million refinancing of Spring Gardens for 6 years at low swap rates

-- EUR24 million acquisition financing of Harburg properties for

7 years at an all in cost fixed at less than 2%

Sten Mortstedt, Executive Chairman of CLS, commented:

"In 2014 we continued to make substantial progress, with the

completion of two important developments in central London,

opportunistic acquisitions, selective disposals, the extension of

our development pipeline, and the lowest ever vacancy rate across

the Group.

"Our portfolio benefited from a 15.8% revaluation uplift, EPRA

NAV rose by 39.9% to a record 1,774.1 pence per share and our

strategy, to invest in attractive, high-yielding office properties

in major cities, should continue to serve the Group well in

2015."

-ENDS-

For further information please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Sten Mortstedt, Executive

Chairman

Henry Klotz, Executive

Vice Chairman

Fredrik Widlund, Chief

Executive Officer

John Whiteley, Chief

Financial Officer

Kinmont Limited +44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants

Limited +44 (0)20 7360 4900

Alex Simmons

Liberum Capital Limited +44 (0)20 3100 2222

Tom Fyson

Charles Stanley Securities +44 (0)20 7149 6000

Mark Taylor

Hugh Rich

CLS will be presenting to analysts at 8.30am on Wednesday, 4

March 2015, at Smithfield Consultants, 10 Aldersgate Street,

London, EC1A 4HJ.

Conference call dial in numbers as follows:

Participant telephone +44(0)20 3427 1912 (UK Toll)

number:

Confirmation code: 2636578

Please dial in at least 5 minutes prior to the start of the

meeting and quote the above confirmation code when prompted.

Chairman's Statement

OVERVIEW In 2014 we continued to make substantial progress in a

number of areas. These included the completion of two important

developments in central London, opportunistic acquisitions in

Germany and London and selective disposals in London and Paris.

Furthermore, we extended our development pipeline, and the benefits

from our active in-house asset management resulted in our lowest

ever vacancy rate across the Group.

At the year end our property portfolio benefited from a 15.8%

annual revaluation uplift to GBP1.31 billion, the highest ever

level in our history. EPRA NAV rose 39.9% to a record 1,774.1 pence

per share and following a five year compound Total Shareholder

Return of over 25% per annum, in December 2014 we entered the FTSE

350 index.

The Group places a strong emphasis on cash generation. Our

portfolio produces a net initial yield of 6.5% and is financed by

debt with a weighted average cost of 3.64%. In 2014 our rental

income rose 11.1% to GBP84.4 million (2013: GBP76.0 million),

benefiting from the effect of a full year's income from the Neo

portfolio which was acquired last year, and EPRA earnings per share

rose 16.9% to 77.4 pence (2013: 66.2 pence).

Our strategy of running a diversified, modern and efficient

property portfolio with in-house asset management has continued to

prove successful. We operate in close cooperation with our

customers to meet their occupational needs, and this is reflected

in a Group vacancy rate of 3.0%, well below the sector average.

During the year we selectively acquired investments in Germany

and the UK at an aggregate cost of GBP29.7 million, generating a

net initial yield of 6.7% and financed by debt at 1.97%. We also

made some opportunistic disposals in London and Paris at low

yields, thereby recycling our capital for an enhanced return.

The UK market continued to grow in 2014. In London, demand from

overseas investors searching for prime yielding properties remained

robust, with increasing interest beyond the traditional West End

and City locations. In Germany and France the markets were

characterised by low interest rates, a low level of new completions

and improvement in occupier demand. Germany continued to offer the

more attractive opportunities. The Swedish market displayed lower

yields and a high level of activity, driven mainly by domestic

property investors, and we continued to find better value

elsewhere.

PROPERTY PORTFOLIO The increase in EPRA net assets per share was

driven by a significant increase in values across our London

portfolio, particularly in our Vauxhall heartland. The Group's

property portfolio grew by GBP177.2 million or 15.6% over the

period to GBP1.31 billion, due predominantly to a revaluation

uplift of GBP186.5 million. France and Germany contributed

positively, but the vast majority of the increase came from the

London portfolio, particularly from developments and long leases

with secure Government income.

At the year end the contracted rent roll was GBP87.5 million

(2013: GBP85.6 million), of which 68% came from governments and

major corporations and 58% was index-linked.

At Spring Mews SE11, our first student and hotel development

scheme reached completion. The student accommodation was completed

in September, in time for the start of the academic year, and all

378 rooms were let. We have already started letting rooms for

2015/16. At Clifford's Inn, Fetter Lane EC4, construction was

completed at the end of 2014 and we are actively marketing the

2,769 sqm of new office space in a very strong mid-town office

market. We have also secured detailed planning consent to convert

and extend Westminster Tower SE1, providing luxury riverside

apartments overlooking the Houses of Parliament, with a small

amount of office space to be retained on the lower floors.

At Vauxhall Square we have secured further planning consent for

design enhancements, and agreed commercial terms to acquire

additional adjoining land and properties. In January 2014 we

entered into a conditional agreement to grant a long lease in

relation to the student site in Miles Street, on which an enhanced

planning consent has also been achieved. These enhancements have

contributed positively to the uplift in value. During 2015 we will

explore all our available options for this major regeneration

project to make a constructive start in 2017.

In the second half of the year, the Group acquired Berkeley

House in Datchet, Berkshire for GBP2.2 million on a net initial

yield of 10.75%. We also unconditionally exchanged contracts to

acquire two modern, multi-let, office buildings in Harburg, a

waterfront district in the southern part of Hamburg, Germany for

EUR32.4 million before costs. We completed the acquisitions shortly

after the year end. These high-quality offices are located in a

district which is seeing significant investment in infrastructure

and is developing into a popular mixed-use location.

In April the Group took advantage of a strong demand for

development opportunities, and disposed of Cambridge House W6 for

GBP29.5 million. The price was 32% above the December 2013

valuation and corresponded to an initial yield of 2.34%. Part of Le

Quatuor in Montrouge, Paris was sold for EUR9.9 million, 23% above

the June 2014 valuation, to accommodate the Grand Paris Express

project to improve the railway system. The station will be a major

transportation hub which will benefit our remaining holding.

RESULTS EPRA net assets per share have risen by 39.9% to 1,774.1

pence (2013: 1,268.4 pence), and net assets per share by 39.0% to

1,521.1 pence (2013: 1,094.1 pence). Profit after tax grew by

208.4% to GBP194.9 million (2013: GBP63.2 million) and

shareholders' funds rose by 35.8% to GBP652.9 million, after

distributions to shareholders of GBP15.5 million. The balance sheet

remains strong, with cash and liquid resources of GBP162.0

million.

Recurring interest cover increased to 3.3 times (2013: 3.2

times), as the Group continued to enjoy a very low weighted average

cost of debt of just 3.64% (2013: 3.64%), one of the lowest in the

listed property sector. At 31 December 2014 the weighted average

loan to value of our secured debt was 49.7% (2013: 56.3%).

FINANCING The Group continues its strategy of having a wide

variety of financing from banks and other debt providers, and of

ring-fencing debt against individual properties where appropriate.

We secured financing for the Harburg acquisitions with a seven-year

fixed interest rate loan below 2% for the first time. Since the end

of 2014 we have refinanced our largest individual property loan on

Spring Gardens in Vauxhall for 6 years, and this, together with the

Harburg loan, has reduced our pro forma weighted average cost of

debt further to 3.58%. Diversity of financing is important to

reduce risk and we enjoy active lending relationships with 23 debt

providers. Interest rates have remained very low, with further

reductions in the Eurozone. We expect this will remain the case for

an extended period and as a consequence, 68% of our debt is at

floating rates, with 41% being protected against rising interest

rates through interest rate caps.

The Group's corporate bond portfolio has continued to be a

valuable part of our cash management strategy. The portfolio

outperformed the bond market during the year, delivering a total

return of GBP7.7 million, or 8.7% on capital. At the year end the

portfolio consisted of 27 bonds valued at GBP61.8 million with a

running yield of 7.4% on market value, and a weighted average

duration of 15 years.

SUSTAINABILITY During the past twelve months we have continued

our objective to further improve the quality of our portfolio

through carbon reduction programmes, investments in renewable

technology and social engagement within the communities in which we

invest. We have achieved two SKA Gold ratings and three BREEAM Very

Good ratings through our refurbishment programme, and we have

reduced the consumption of electricity, gas and water in our

properties.

More details of these initiatives are set out in the Corporate,

Social and Environmental Responsibility Report in the 2014 Annual

Report and Accounts. In addition we have, in line with our Green

Charter established in 2011, committed additional resources to our

in-house sustainability team to help minimise the impact the Group

and its customers have on the environment.

BOARD CHANGES During the year Tom Thomson, Brigith Terry and

Claes-Johan Geijer retired as non-executive directors and I wish to

record our thanks for their contribution to our success. We have

welcomed Lennart Sten and Elizabeth Edwards who have joined us in

their place. Richard Tice resigned as Chief Executive Officer in

February and, following a successful search by an executive search

firm, we were pleased to welcome Fredrik Widlund as his replacement

in November. Fredrik joins us after a long career at GE

Capital.

DISTRIBUTIONS TO SHAREHOLDERS In 2014, the Group distributed

through tender offer buy-backs GBP10.0 million in May, equivalent

to 22.65 pence per share, and GBP5.5 million in September,

equivalent to 12.61 pence per share. Similarly, the Board is

proposing a tender offer buy-back of 1 in 80 shares at 1,950 pence

per share in April 2015, to distribute GBP10.4 million to

shareholders, equivalent to 24.4 pence per share. This will bring

total distributions for the year to GBP15.9 million, an annual

increase of 6.4% and corresponding to an implied yield of 2.7%,

based on the average market capitalisation for the Group in the

year. A circular setting out the details will be sent to

shareholders with the Annual Report and Accounts.

OUTLOOK Although its forthcoming general election may cause some

temporary political uncertainty, we expect the UK's economy to

continue to grow and the commercial property market to continue to

perform well in 2015.

We also believe that the positive trends seen in London,

including increasing rents and declining vacancies, will cascade

into other parts of the country during the year. The Group's

portfolio is well-positioned to benefit from a continuing strong UK

market.

Even though we expect economic growth in the Eurozone to remain

slow, we believe our overseas assets will continue to benefit from

record low interest rates and a pick-up in demand. Our strategy, to

invest in attractive, high-yielding office properties in secondary

areas of major cities, should continue to serve the Group well in

2015.

Sten Mortstedt

Executive Chairman

4 March 2015

PRINCIPAL RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties which

could have a material impact on the Group's performance and could

cause the results to differ materially from expected or historical

results. The management and mitigation of these risks are the

responsibility of the Board.

Risk Areas of impact Mitigation

--------------------------------------------------------- ------------------- -----------------------------

Property investment

risks

Underperformance Cash flow Senior management

of investment portfolio Profitability has detailed knowledge

due to: Net asset value of core markets

* Cyclical downturn in property market Banking covenants and experience

gained through

many market cycles.

* Inappropriate buy/sell/hold decisions This experience

is supplemented

by external advisors

and financial models

used in capital

allocation decision-making.

--------------------------------------------------------- ------------------- -----------------------------

Rental income The Group's property

* Changes in supply of space and/or occupier demand Cash flow portfolio is diversified

Vacancy rate across four countries.

Void running The weighted-average

costs unexpired lease

Bad debts term is 6.4 years

Net asset value and the Group's

largest occupier

concentration

is with the Government

sector (46.8%).

--------------------------------------------------------- ------------------- -----------------------------

Rental income Property teams

* Poor asset management Cash flow proactively manage

Vacancy rate customers to ensure

Void running changing needs

costs are met, and review

Property values the current status

Net asset value of all properties

weekly. Written

reports are submitted

monthly to senior

management on,

inter alia, vacancies,

lease expiry profiles

and progress on

rent reviews.

--------------------------------------------------------- ------------------- -----------------------------

Risk Areas of impact Mitigation

------------------------------------- -------------------- ---------------------------

Other investment

risks

Corporate bond investments: Net asset value In assessing potential

* Underperformance of portfolio Liquid resources investments, the

Treasury department

undertakes research

* Insolvency of bond issuer on the bond and

its

issuer, seeks third-party

advice, and receives

legal advice on

the terms of the

bond, where appropriate.

The Treasury department

and Executive Directors

receive updates

on bond price movements

and third party

market analysis

on

a daily basis,

and reports on

corporate bonds

to the full Board

on a monthly basis.

The Executive Directors

formally review

the corporate bond

strategy monthly.

------------------------------------- -------------------- ---------------------------

Development risk

Failure to secure Abortive costs Planning permission

planning permission Reputation is sought only

after engaging

in depth with all

stakeholders.

------------------------------------- -------------------- ---------------------------

Contractor solvency Reduced development Only leading contractors

and availability returns are engaged. Prior

Cost overruns to appointment,

Loss of rental contractors are

revenue the subject of

a due diligence

check and assessed

for financial viability.

------------------------------------- -------------------- ---------------------------

Downturn in investment Net asset value Developments are

or occupational markets Cash flow undertaken only

Profitability after an appropriate

level of pre-lets

have been sought.

------------------------------------- -------------------- ---------------------------

Risk Areas of impact Mitigation

----------------------- ----------------------- ----------------------------

SUSTAINABILITY

RISKS

Increasing building Rental income, Continual assessment

regulation and cash flow, of all properties against

obsolescence vacancy rate, emerging regulatory

net asset changes. Fit-out and

value, profitability, refurbishment projects

liquid resources benchmarked against

third party schemes.

----------------------- ----------------------- ----------------------------

Climate change Net asset Board responsibility

value, profitability, for environment. Dedicated

liquid resources specialist personnel.

Increased due diligence

when making acquisitions.

Investment in energy

efficient plant and

building mounted renewable

energy systems.

----------------------- ----------------------- ----------------------------

Increasing energy Net asset Investment in energy

costs and regulation value, profitability, efficient plant and

liquid resources building mounted renewable

energy systems.

----------------------- ----------------------- ----------------------------

Funding risks

Unavailability Cost of borrowing The Group has a dedicated

of financing Ability to Treasury department

at acceptable invest or and relationships are

prices develop maintained with some

23 banks, thus reducing

credit and liquidity

risk. The exposure on

refinancing debt is

mitigated by the lack

of concentration in

maturities.

----------------------- ----------------------- ----------------------------

Adverse interest Cost of borrowing The Group's exposure

rate movements Cost of hedging to changes in prevailing

market rates is largely

hedged on existing debt

through interest rate

swaps and caps, or by

borrowing at fixed rates.

----------------------- ----------------------- ----------------------------

Breach of borrowing Cost of borrowing Financial covenants

covenants are monitored by the

Treasury department

and regularly reported

to the Board.

----------------------- ----------------------- ----------------------------

Foreign currency Net asset Property investments

exposure value are partially funded

Profitability in matching currency.

The difference between

the value of the property

and the amount of the

financing is generally

unhedged and monitored

on an ongoing basis.

----------------------- ----------------------- ----------------------------

Financial counterparty Loss of deposits The Group has a dedicated

credit risk Cost of rearranging Treasury department

facilities and relationships are

Incremental maintained with some

cost 23 banks, thus

of borrowing reducing credit and

liquidity risk. The

exposure on re-financing

debt is mitigated by

the lack of concentration

in maturities.

----------------------- ----------------------- ----------------------------

Risk Areas of impact Mitigation

------------------- ------------------- -------------------------------

Taxation risk

Increases in Cash flow The Group monitors legislative

tax rates or Profitability proposals and consults

changes to the Net asset external advisors to

basis of taxation value understand and mitigate

the effects of any such

change.

------------------- ------------------- -------------------------------

Political and

economic risk

Break-up of Net asset Euro-denominated liquid

the Euro value resources are kept to

Profitability a minimum. Euro property

assets are largely financed

with euro borrowings.

------------------- ------------------- -------------------------------

Economic downturn Cash flow The Group's property

Profitability portfolio is diversified

Net asset across four countries.

value The weighted-average

Banking covenants unexpired lease term

is 6.4 years and the

Group's largest customer

concentration is with

the Government sector

(46.8%). 58.2% of rental

income is subject to

indexation.

------------------- ------------------- -------------------------------

Going concern

The Group will Pervasive The Directors regularly

not have adequate stress-test the business

working capital model to ensure the

to remain a Group has adequate working

going concern capital.

for the next

12 months.

------------------- ------------------- -------------------------------

business review

The main activity of the Group is the investment in commercial

real estate across five European regions - London, the rest of the

United Kingdom, France, Germany and Sweden - with a focus on

providing well-managed, cost-effective offices for cost-conscious

occupiers in key European cities.

The Group's total property interests have increased to

GBP1,382.1 million at 31 December 2014, comprising the wholly-owned

property investment portfolio valued at GBP1,310.1 million, a hotel

with a value of GBP21.3 million, vacation sites valued at GBP20.5

million (the Group's share), and a 13.5% interest in Swedish listed

property company Catena AB, valued at GBP30.2 million.

PROPERTIES

OVERVIEW At 31 December 2014, the directly held investment

property portfolio was independently valued at GBP1,310.1 million

(31 December 2013: GBP1,132.9 million). This increase of GBP177.2

million primarily comprised new acquisitions and development

expenditure of GBP79.8 million in aggregate, and a GBP186.5 million

valuation uplift; the effects of these were mitigated by disposals

of GBP28.6 million, the transfer of the recently-completed Spring

Mews hotel to Property, Plant and Equipment, and the GBP37.8

million negative impact of exchange rate movements. In local

currencies, the portfolio rose by 15.8%, after acquisitions and

development expenditure. The driver was the outstanding performance

of the London portfolio, which increased in value by 34.1%; Germany

rose by 2.9% and France by 1.7%, whilst the rest of UK fell by 0.3%

and Sweden by 15.8%.

Over 40% of the uplift in the value of the London portfolio came

from four development schemes, of which two reached practical

completion in the second half of the year, a third, Westminster

Tower SE1, gained planning consent, and the fourth, Vauxhall

Square, moved twelve months closer to our gaining vacant possession

in early 2017. The medium-term development programme was extended

during the year, with the planning consent gained on Westminster

Tower, and with two French properties providing the opportunity for

redevelopment.

Of the GBP31.6 million spent on acquisitions in the year,

GBP27.4 million related to two modern, multi-let office buildings

in a suburb of Hamburg. Cambridge House, Hammersmith was sold in

April for GBP29.5 million, 32% above its valuation four months

earlier. Contracted rent rose in the twelve months by 1.7% on a

like-for-like basis, whilst the annualised rent rose by 2.3%,

including GBP3.5 million of income from the completed developments.

The increase in the capital values of the London properties far

outstripped the increase in their rents, reducing the net initial

yield of the overall investment property portfolio (excluding

developments) at 31 December 2014 to 6.5% (2013: 7.0%). The average

rent across the Group remained very affordable at GBP158 per sqm,

and the average capital value was also low at just GBP2,352 per

sqm. This was very close to replacement cost, meaning that the land

element of our investments in key European cities was minimal. This

also highlights how successful the Group can be in attracting

occupiers with cost-effective rents.

The bedrock of the Group's rental income is strong, with 47%

being paid by government occupiers and 21% from major corporations,

and 58% of our rents are subject to indexation. The weighted

average lease length at 31 December 2014 was 6.4 years, or 5.1

years to first break. Some over-rented leases expire in 2015,

notably in Sweden, and thereafter the portfolio is broadly let at

current market rents.

The overall vacancy rate reached an all-time low at just 3.0%

(2013: 4.4%), including a reduction in France of more than a half,

from 10.6% to 5.1%. This is testament to the benefit of active

in-house asset and property management, and of maintaining strong

links with our occupiers to ensure we understand and respond to

their needs.

The benefits of the Group's geographical diversification remain

self-evident: there is strong growth in the London portfolio, at a

time when there are good investment opportunities and readily

available debt in Germany.

The Group maintains its strong commitment to sustainability,

which has benefited both occupiers and the Group. The Corporate,

Social and Environmental Responsibility Report in the 2014 Annual

Report and Accounts provides more detail.

LONDON

The UK economy remains relatively robust - GDP growth was 2.6%

in 2014 and a similar level is forecast for 2015, unemployment is

5.7% and set to fall, and inflation is under control - and London

is the engine which drives it. The property market in London

benefits from these conditions. It continues to show an imbalance

of demand exceeding supply, in both the investment and the

occupancy markets, and this has manifested in a fall in investment

yields and in a rise in rental values, both within Central London

and across its suburbs.

In the two years to 31 December 2013, the Group took advantage

of buying opportunities in suburban London, investing GBP40.9

million at an average net initial yield of 9.9%. A subsequent

significant increase in competition for such offices, coupled with

more readily available bank finance, has since reduced yields by

some 200 basis points. Whilst we continued actively to compete in

these markets in 2014, we restricted our attention to opportunities

in which we could see the better returns, and acquired Berkeley

House, Datchet for GBP2.2 million plus costs, generating a net

initial yield of 10.75%.

We have, however, taken the opportunity to dispose selectively

of certain types of property. Following the sale in late 2013 of

Ingram House, John Adam Street, WC2 for GBP13.2 million at a

capital value before refurbishment costs of over GBP10,000 per sqm,

in April we sold Cambridge House W6 for GBP29.5 million at a net

initial yield of 2.34%, which, considered a development site,

reflected its 50% vacancy.

The London occupancy market strengthened in 2014, and with a

lack of new developments to satisfy this demand, rental values

rose. On average, new lettings were achieved at 8.2% above the ervs

of 31 December 2013. During 2014 ervs of the London portfolio rose

by 9.7%, and at 31 December 2014 the London portfolio was net

reversionary. Those leases which were reversionary were GBP4.1

million or 11.6% under-rented; of the GBP1.3 million (3.7%) of

over-renting in London, more than GBP0.9 million was on leases

which expire in 2022 or later. The vacancy rate for London remains

very low at just 3.3%, excluding development stock (2013: 3.2%).

During 2014, 6,365 sqm became vacant and we let or renewed leases

on 5,661 sqm.

Of the developments in Central London, two have completed, a

third continues to make good progress, and a fourth was added

during the year. At Spring Mews, Vauxhall SE11, practical

completion was reached on the 20,800 sqm mixed-use scheme,

comprising a 378 bed student accommodation building, and a 93

bedroom suite hotel, together with retail and office space. The

student accommodation was ready for the start of the academic year

in September and achieved full occupancy in its first year. At the

hotel a franchise agreement is in place with Intercontinental Hotel

Group for a Staybridge branded suite hotel, run by specialist

franchise operator, Cycas Hospitality. Following the fit-out, the

hotel opened for business shortly after the year end. The 245 sqm

of retail and 1,000 sqm of offices within the scheme are expected

to be let in 2015. Under IFRS, the hotel element of the scheme is

carried in the balance sheet at market value within Property, Plant

and Equipment.

Investment Properties Spring Mews

hotel

---------------------------- ---------------------- ----------------

Value GBP705.0 million GBP21.3 million

Group's property interests 51% 2%

No. of properties 34 1

Lettable space 158,892 sqm 93 rooms

EPRA net initial yield(1) 5.2% n/a

Vacancy rate 3.3% n/a

Valuation uplift 34.1% n/a

Government and major 72% n/a

corporates

Average unexpired lease 7.0 years n/a

length

To first break 6.1 years n/a

---------------------------- ---------------------- ----------------

(1) excluding developments

The comprehensive refurbishment of Clifford's Inn, EC4 was

completed towards the end of the year to provide 2,769 sqm of top

quality office space and eight new residential apartments. The

offices were launched on the occupational market in January 2015

and the eight apartments are to be marketed later in the year.

The Nine Elms/Vauxhall district of London continues to be the

most industrious development area in the capital. The developments

of the new American and Dutch embassies are well advanced, as is

the demolition of Market Towers by Chinese developer Dalian Wanda

Group, in preparation for the development of One Nine Elms, a five

star hotel and high-end residential scheme. Developments are well

advanced at Riverlight, Embassy Gardens and Battersea Power

Station, other developers have started on site in the past twelve

months, such as Sainsbury's/Barratt Homes and Bellway Homes, both

on Wandsworth Road, and Keybridge House on South Lambeth Road was

bought by developer Mount Anvil/A2 Dominion in November.

In early 2017 we are due to gain vacant possession of the site

which comprises Vauxhall Square, SW8, which, adjacent to the main

transport hub, is the gateway into Nine Elms/Vauxhall. We have

continued to make good progress during the year on this 143,000 sqm

mixed-use development scheme in the heart of Vauxhall. In January

2014 we entered into a conditional long lease with a specialist

student housing developer/operator to build and manage the 359

student room building adjacent to the main Vauxhall Square site,

and we continue to make progress to satisfy the conditionality.

Planning consent was granted during the year to reconfigure this

building to provide 454 student rooms. Consent was also granted to

upgrade one of the hotels in our scheme from a mid-market offer to

a four-star hotel with conferencing facilities.

At Westminster Tower, SE1, on the south side of Lambeth Bridge,

detailed planning consent was granted for a major refurbishment of

the existing 14 storey building, the addition of three further

stories, and the conversion from an office building to 34

residential units (of which 11 will be of shared ownership) and

1,441 sqm of offices. Vacant possession is expected to be secured

in the medium term.

The 34.1% uplift in the values of the London portfolio reflected

both strong growth in the value of underlying investment properties

and very strong growth in the values of the four developments. The

let investment properties benefited from an uplift of 9.7% in ervs

in the twelve months, and from a reduction in the true equivalent

yields of 90 bps, which together contributed to a 27.8% uplift in

values. The increase in value of the developments reflected profits

recognised for the first time on completed developments, the

granting of planning consent on Westminster Tower, and the

continued strength of the Nine Elms/Vauxhall area. The valuation of

Vauxhall Square benefited from a 5.5% increase in residential

values reflecting price movements across the Nine Elms/Vauxhall

area, office yields tightened by 50 bps and rents rose by over 15%.

In total the four developments of Spring Mews, Clifford's Inn,

Westminster Tower and Vauxhall Square shared an uplift of 48.3% in

the twelve months after capital expenditure, representing 44% of

the total uplift in London in the year. Of the remaining GBP104.2

million of London's uplift, two properties with long leases to

Central Government departments added GBP63.8 million - an uplift of

30.6% - and the rest of the London portfolio rose by 16.4%. At 31

December 2014 the valuation of the London portfolio, except

Vauxhall Square, was undertaken by DTZ for the first time; Vauxhall

Square continued to be valued by Knight Frank.

REST OF UK

Value GBP97.6 million

Group's property interests 7%

No. of properties 32

Lettable space 98,086 sqm

EPRA net initial yield 12.8%

Vacancy rate 0.9%

Valuation fall -0.3%

Government and major corporates 100%

Average unexpired lease length 6.6 years

To first break 4.1 years

--------------------------------- ----------------

The Rest of UK portfolio was acquired in September 2013 as part

of the Neo portfolio of government-occupied offices across the

UK.

The portfolio is 99% let to 14 government departments. In 2014,

we renewed two leases, at 12.2% above their ervs of 31 December

2013, and agreed five index-linked rent reviews at an average of

17.7% above previous rents; in aggregate GBP265,000 was added to

the rent roll.

The UK economic recovery driven by London has begun to reach

other areas around the UK, and in 2014 ervs rose in the Rest of UK

portfolio. However, the portfolio has a concentration of lease

expiries and breaks in March 2018 and the external valuers are

required by their professional rules to assume that each event

affects the value as if it will be exercised. This negatively

affected the value of the Rest of UK portfolio, increasing its true

equivalent yield by 97 bps, which offset the impact of new lettings

and erv growth, and the portfolio fell marginally in the year by

0.3%. At 31 December 2014 the valuation of the Rest of UK portfolio

was undertaken by DTZ for the first time.

FRANCE

The French economy stagnated in the first half of 2014 before

picking up slightly over the summer. GDP growth is projected to

continue at a slow pace in 2015, helped by lower energy prices, a

favourable exchange rate and improvements in the global

environment.

With an undersupply of new developments, and an increase in the

number of projects on hold, headline rents in Paris stabilised

following their fall in 2013. However, vacancy rates in the markets

of La Defense and the Western Crescent of Paris now stand at

12%.

It is in these difficult conditions that the French team managed

to more than halve our vacancy rate in France to only 5.1% (2013:

10.6%). Whilst 15,949 sqm of space was subject to expiries or

vacancies in the year, 19,317 sqm was let. This was achieved at a

weighted average rent of less than 1.5% below ervs at 31 December

2013.

In August we disposed of Blocks C and D of Le Quatuor, 168

Avenue Jean Jaurès, Montrouge under a compulsory purchase order to

facilitate the expansion of the local train station to accommodate

the Grand Paris project. The disposal was made at a gain of GBP1.7

million above the 2013 external valuation, and Blocks A and B which

remain in our ownership will benefit in the fullness of time from

the improvements to the area which this new railway line will

bring.

Value GBP225.1 million

Group's property interests 16%

No. of properties 26

Lettable space 92,147 sqm

EPRA net initial yield(1) 6.2%

Vacancy rate 5.1%

Valuation uplift 1.7%

Government and major corporates 56%

Average unexpired lease length 5.2 years

To first break 2.6 years

--------------------------------- -----------------

(1) excluding developments

The French portfolio valuation rose by 1.7% in the year in local

currency, but fell by 4.9% in sterling. The underlying portfolio of

24 of our 26 properties rose in value by 2.7%, reflecting the fall

in vacancies across the portfolio, offset by a fall in ervs in the

year of 1.1%. The values of the other two properties fell by 9.1%

in aggregate. These properties were the Group's most central

property in Paris, 1,800 sqm of offices directly opposite the

Banque de France in Rue Croix des Petits Champs, and 3,700 sqm of

offices in Rue Eugène Ruppert in Luxembourg. Both became empty

during the year and provide excellent opportunities to carry out

significant refurbishments or developments in the next few

months.

Top 10 Customers

The ten customers which contribute most rental income to the

Group account for 48.7% of the rent roll, and comprise:

London

Government

* National Crime Agency

Government

* Trillium

Major Corporation

* Cap Gemini

Major Corporation

* BAE Systems

Rest of UK

Government

* Secretary of State

Germany

Government

* City of Bochum

Major Corporation

* BrainLab

Major Corporation

* E.ON

Sweden

Government

* Västra Götaland Country Council

Government

* Vänersborg Kommun

GERMANY

In 2014, Germany's GDP growth of 1.5% remained relatively weak

and it is projected to grow only gradually, its otherwise robust

labour market and expansionary monetary policy being constrained by

weakness in its trading partners.

We continue to see good investment value in German real estate,

supported by favourable financing conditions. Last year we bought

Bismarckallee 18/20 in Freiburg, and in December 2014 we

unconditionally exchanged on the acquisition of Schellerdamm 2 and

Schellerdamm 16, two modern, multi-let office buildings in the

Harburg district of Hamburg providing 18,665 sqm of lettable space

and 287 car parking spaces. Completion took place shortly after the

year end at a price of EUR32.35 million plus costs, generating a

net initial yield of 6.4%, which we financed with a seven-year loan

from a local Sparkasse bank at a cost fixed at less than 2% per

annum.

During 2014, lettings and renewals totalled 6,023 sqm whilst

only 2,256 sqm were vacated by occupiers, and as a consequence the

vacancy rate fell to 2.6% (2013: 3.5%); two years ago the German

portfolio was 7.4% vacant. New leases and renewals were achieved at

an average of 4.1% above ervs at the end of 2013.

The valuation of the German portfolio rose by 2.9% in local

currencies, but fell by 3.4% in sterling. However, the underlying

portfolio of 16 out the 18 properties rose in value by 4.8%, partly

due to the reduction in voids, and partly because the equivalent

yield fell by 20 bps; ervs were virtually unchanged in the year. Of

the other two properties, Harburg was acquired at the end of the

year and rose by 1.4% after costs, and Kapellenstrasse 12,

Feldkirchen fell by 16.6% after the sole tenant announced its

intention to vacate the building when its lease expires at the end

of 2016. The value of this building is unlikely to fall

significantly further in value before then.

Value GBP235.5 million

Group's property interests 17%

No. of properties 19

Lettable space 170,743 sqm

EPRA net initial yield 6.7%

Vacancy rate 2.6%

Valuation uplift 2.9%

Government and major corporates 39%

Average unexpired lease length 7.1 years

To first break 7.0 years

--------------------------------- -----------------

SWEDEN

Investment Property

Value GBP46.9 million

Group's property interests 3%

No. of properties 1

Lettable space 45,354 sqm

EPRA net initial yield 8.5%

Vacancy rate 0.8%

Valuation fall -15.8%

Government and major corporates 96%

Average unexpired lease length 2.8 years

To first break 2.8 years

--------------------------------- ----------------

Financial Investment

Value in Catena GBP30.2 million

Group's property interests 2%

Interest in Catena 13.5%

---------------------------- ----------------

Property, Plant & Equipment

Value in First Camp GBP5.9 million

Group's property interests 2%

Interest in First Camp 58.0%

Gross value of assets GBP35.4 million

Share of gross value of assets GBP20.5 million

-------------------------------- ----------------

The Group's interests in Sweden consist of two operating

segments: Investment Properties and Other Investments. The Other

Investments are an equity stake in a financial investment and a

subsidiary, both of which invest in Swedish real estate, and as

they operate against the same economic backdrop, are considered

together with the directly-held Swedish investment property in this

Strategic Review.

Sweden's economy has continued to show signs of robustness.

Inflation is running at marginally below 0%, unemployment is around

7%, and the Riksbank has reduced its Repo rate to 0% and expects

GDP growth of 2.6% in 2015. The direct property market in Sweden

has remained dominated by domestic demand with readily available

finance, and in 2014 we have been able to find better returns

elsewhere in the areas in which we invest.

At the 45,354 sqm office complex, Vänerparken, near Gothenburg,

negotiations have progressed with the main local government

occupier on lease renewals in mid-2015 which currently account for

SEK 47.0 million of the SEK 71.3 million rental income from the

property. It is likely that this occupier will remain only in part

of the building complex, vacating in particular much of the

basement and storage areas, and at a rent per square metre well

below the current over-rented levels. Ervs at 31 December 2014 have

fallen by 24.5% from their levels twelve months earlier and this is

the primary reason for the fall in the property's market value by

15.8% in local currency (25.6% in sterling) in the year.

Catena AB's share price rose by 5.8% in 2014 to SEK 105.75 per

share, but as sterling appreciated against the krona by 12.4% the

sterling carrying value of the investment fell by a net 7.4%.

Catena remains very profitable and we received a dividend of GBP0.7

million in the year.

At 31 December 2013, the Group held a 44.2% interest in its

associate, Cood Investments AB. During the year the interest in

Cood was sold, and certain income-producing assets of Cood were

acquired by First Camp Sverige Holding AB, a newly-formed

subsidiary in which the Group holds a 58% interest. The assets,

predominantly camp sites in Sweden, were valued at GBP35.4 million

(Group's share: GBP20.5 million) at 31 December 2014, and the

Group's share in the net assets of First Camp at that date was

GBP5.9 million.

Exchange rates to the GBP

EUR SEK

--------------------- ------- --------

At 31 December 2012 1.2317 10.5677

2013 average rate 1.1779 10.1926

At 31 December 2013 1.2041 10.6562

2014 average rate 1.2410 11.2984

At 31 December 2014 1.2876 12.1654

--------------------- ------- --------

RESULTS FOR THE YEAR

HEADLINES Profit after tax of GBP194.9 million (2013: GBP63.2

million) generated EPRA earnings per share of 77.4 pence (2013:

66.2 pence), and basic earnings per share of 449.0 pence (2013:

146.9 pence). Gross property assets at 31 December 2014 were

GBP1,310.1 million (2013: GBP1,132.9 million), EPRA net assets per

share were 39.9% higher at 1,774.1 pence (2013: 1,268.4 pence), and

basic net assets per share rose by 39.0% to 1,521.1 pence (2013:

1,094.1 pence).

A key feature of the Group is its ability to generate cash

through the yield on its portfolio far exceeding its cost of debt,

and the low vacancy rate driven by in-house asset management. Net

cash flow from operating activities, including interest received,

was GBP34.5 million which represented a cash return of 7.2% on

opening net assets.

Approximately 50% of the Group's business is conducted in the

reporting currency of sterling, around 45% in euros, and the

balance is in Swedish kronor. Compared to last year, sterling

strengthened against the euro by 5.4% and against the krona by

10.8%, reducing profits accordingly. Likewise, at 31 December 2014

the euro was 6.9% weaker and the krona 14.2% weaker against

sterling than twelve months previously, reducing the sterling

equivalent value of non-sterling net assets.

INCOME STATEMENT At GBP84.4 million, rental income in 2014 was

GBP8.4 million higher than in 2013, largely through a full year's

impact of acquisitions made in 2013, which added GBP13.6 million,

offset by disposals of GBP2.0 million, and the strength of the

sterling which lowered rent by GBP2.4 million. First Camp added

GBP0.7 million of income for the first time, and net rental income

of GBP82.2 million was 12.4% higher than last year (2013: GBP73.1

million).

We monitor the administration expenses incurred in running the

property portfolio by reference to the income derived from it,

which we call the administration cost ratio, and this is a key

performance indicator of the Group. In 2014, retaining key staff

whilst expanding staff levels for the development programme and

property purchases, drove the increase in administration expenses

of the property segment of the Group to GBP12.8 million (2013:

GBP11.9 million). As a proportion of net rental income, the

administration cost ratio reduced to 15.7% (2013: 16.3%).

The net surplus on revaluation of investment properties of

GBP186.0 million was predominantly generated by the London

portfolio, which rose in value by GBP185.1 million. GBP80.9 million

(an uplift of 48.3%) of this reflected increases in the value of

the four developments mentioned above, GBP63.8 million (an uplift

of 30.6%) was generated on Spring Gardens, SE11 and 214/236 Gray's

Inn Road, WC1, both of which have long leases with Central

Government departments, and GBP40.4 million (an uplift of 16.4%)

came from the rest of the let portfolio.

The majority of the profit on sale of investment properties was

generated by the disposals of Cambridge House W6 and Blocks C and D

of Le Quatuor in Paris, which realised a gain of GBP8.5 million

after costs over their aggregate valuation at 31 December 2013 of

GBP28.6 million.

In August, the Group increased its interest in its associate,

Cood investments AB, from 44.2% to 58.0%, whereupon Cood was

reclassified as a subsidiary at fair value, generating a gain on

reclassification of GBP0.2 million. The increase of 13.8% was

acquired for a price below the fair value of the share of net

assets acquired, which produced a gain on acquisition of GBP1.2

million.

The majority of finance income of GBP7.7 million (2013: GBP7.6

million) was interest income of GBP6.1 million (2013: GBP6.3

million) from our corporate bond portfolio. At 31 December 2014,

this had a value of GBP61.8 million, and remained an important cash

management tool of the Group, earning a return on capital of 8.7%

in the year.

Finance costs of GBP28.1 million (2013: GBP23.7 million) were

higher than last year as they contained a GBP1.3 million loss on

redeeming 25% of the zero coupon note, and non-cash items - an

adverse movement in the fair value of derivatives of GBP0.9 million

(2013: favourable GBP3.3 million) - added GBP4.2 million. The

underlying interest cost, excluding these items, fell to GBP24.8

million (2013: GBP25.2 million), after capitalising interest of

GBP2.9 million (2013: GBP0.9 million) on Spring Mews and Clifford's

Inn, which will not recur next year. A full year of interest on the

GBP80 million secured notes issued in December 2013 to finance the

Neo acquisition added GBP2.9 million to gross interest costs in

2014. However, 68% of our debt is at floating rates to take

advantage of the low interest rate environment, and the fall in

Libor and its European equivalents reduced the cost of bank loans

by GBP0.6 million compared to 2013.

Investments in associates have been largely sold or written down

during the year, and at 31 December 2014 stood at only GBP1.5

million. We received a dividend from Bulgarian Land Development Plc

of GBP0.8 million, and provided GBP2.2 million for the full

impairment of the rest of the carrying value of the investment to

reflect the difficult conditions likely to prevail in the Bulgarian

residential holiday market.

Once again this year the tax charge of 17.7% was significantly

below the weighted average rate of the countries in which we do

business (22.1%), primarily due to indexation allowances available

on United Kingdom properties.

Overall, profit after tax attributable to owners of the Company

of GBP194.9 million (2013: GBP63.2 million) was GBP131.7 million

above that of last year. In 2013, the underlying profit after tax,

before gains on the sale of bonds (GBP14.1 million) and on the

reclassification of an associate (GBP14.9 million), was GBP34.2

million. EPRA profit after tax of GBP33.6 million (2013: GBP28.5

million) was 17.9% or GBP5.1 million higher in 2014, and the

property valuation, net of deferred tax, was GBP154.5 million

higher.

EPRA NET ASSET VALUE At 31 December 2014, EPRA net assets per

share (a diluted measure which highlights the fair value of the

business on a long-term basis) were 1,774.1 pence (2013: 1,268.4

pence), a rise of 39.9%, or 505.7 pence per share. The main reasons

for the increase were the uplift in the valuation of the investment

property portfolio which added 433.5 pence, and underlying profit

after tax which added 98.9 pence. Sundry fair value uplifts of

property, plant and equipment, equities and bonds added 24.0 pence,

but the strength of sterling against the euro and krona reduced

EPRA net assets per share by 45.0 pence.

CASH FLOW, NET DEBT AND GEARING At 31 December 2014, the Group's

cash balances of GBP100.2 million were GBP29.6 million lower than

twelve months previously. Operating activities generated GBP34.5

million, of which GBP15.5 million was returned to shareholders, and

proceeds from property disposals added GBP37.1 million. GBP45.2

million was spent on capital expenditure, particularly on the

developments at Spring Mews and Clifford's Inn, and repayment of

loans exceeded the proceeds from new ones by GBP32.6 million.

Gross debt fell by GBP54.3 million in a relatively quiet year

for completing financing deals, and half of the fall was through

retranslating non-sterling debt. One new loan of GBP22.5 million

was taken out to replace GBP18.7 million repaid, and GBP13.4

million of loans were acquired by First Camp. GBP24.8 million was

returned to the banks through amortisation, and a net GBP18.7

million of overdrafts were repaid. At the end of the year the

weighted average unexpired term of the Group's debt was 3.9 years.

Since the year end, the Harburg acquisition was financed with

EUR24.0 million for seven years at a fixed cost of 1.915% p.a., and

Spring Gardens was refinanced with GBP97 million for six years.

Balance sheet loan-to-value (net debt to gross assets less cash)

fell to 43.4% (2013: 52.8%), and the weighted average loan-to-value

on borrowings secured against properties was a comfortable 49.7%

(2013: 56.3%). Adjusted solidity was 48.0% (2013: 39.9%).

The weighted average cost of debt at 31 December 2014 was 3.64%,

which fell to a pro forma 3.58% after the financings of Harburg and

Spring Gardens in February 2015, and it remains one of the lowest

in the property sector. The cost of new bank financing has fallen

in the past few months, particularly in the UK, but notwithstanding

low medium-term rates, refinancing existing debts as they fall due

will probably gradually increase the average cost of debt of the

Group.

In 2014, our low cost of debt led to recurring interest cover of

a comfortable 3.3 times (2013: 3.2 times).

FINANCING STRATEGY The Group's strategy is to hold its

investment properties predominantly in single-purpose vehicles

financed primarily by non-recourse bank debt in the currency used

to purchase the asset. In this way credit and liquidity risk can

most easily be managed, around 75% of the Group's exposure to

foreign currency is naturally hedged, and the most efficient use

can be made of the Group's assets. Bank debt ordinarily attracts

covenants on loan-to-value and on interest and debt service cover.

The Group had 60 loans across the portfolio from 23 banks, plus a

debenture, a zero coupon note, secured notes and two unsecured

bonds.

To the extent that Group borrowings are not at fixed rates, the

Group's exposure to interest rate risk is mitigated by the use of

financial derivatives, particularly interest rate caps and swaps.

Since 2009, the Board has believed that interest rates were likely

to remain low longer than the forward interest curve would imply,

and, therefore, its policy has been to allow a majority of debt to

remain subject to floating rates. To mitigate the risk of interest

rates increasing more sharply than the Board expected, the Group

entered into interest rate caps. This policy has served the Group

well. At 31 December 2014, 32% of the Group's borrowings were at

fixed rates or subject to interest rate swaps, 41% were subject to

caps and 27% of debt costs were unhedged. With long-term rates now

at historically low levels, particularly for the euro, the Board

may seek to fix rates over the medium term with interest rate swaps

when the opportunity arises, such as on the recent Harburg

acquisition.

The Group's financial derivatives - predominantly interest rate

caps and interest rate swaps - are marked to market at each balance

sheet date. At 31 December 2014 they represented a net liability of

GBP7.3 million (2013: GBP5.2 million).

DISTRIBUTIONS TO SHAREHOLDERS In May 2014, GBP10.0 million was

distributed to shareholders by means of a tender offer buy-back of

1 in 66 shares at 1,495 pence per share. In September, a further

GBP5.5 million was distributed by means of a tender offer buy-back

of 1 in 119 shares at 1,500 pence per share, and a proposed tender

offer buy-back of 1 in 80 shares at 1,950 pence per share to return

GBP10.4 million will be put to shareholders at the Annual General

Meeting in April 2015. This represents a 7.6% uplift in

distribution per share over the equivalent distribution last

year.

SHARE CAPITAL At 1 January 2014, there were 46,856,893 shares in

issue, of which 2,903,103 were held as treasury shares. Shares were

cancelled during the year under the distribution policy of tender

offer buy-backs: in May, 665,966 shares were cancelled in exchange

for GBP10.0 million distributed to shareholders, and in September,

363,763 shares were cancelled in exchange for a distribution of

GBP5.5 million.

Consequently, at 31 December 2014, 42,924,061 shares were listed

on the London Stock Exchange, and 2,903,103 shares remained held in

Treasury.

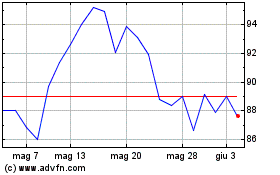

TOTAL RETURNS TO SHAREHOLDERS

In addition to the distributions and share cancellations

associated with the tender offer buy-backs, shareholders benefited

from a rise in the share price in the year from 1,379 pence on 31

December 2013 to 1,529 pence at 31 December 2014. Accordingly, the

total shareholder return in 2014 was 10.9%. In the five years to 31

December 2014, our total shareholder return of 206.6%, which

represented a compound annual return of 25.1%, was one of the best

performances in the listed real estate sector.

Since the Company listed on the London Stock Exchange, it has

outperformed the FTSE Real Estate and FTSE All Share indices.

KEY PERFORMANCE INDICATORS

Our performance against our key performance indicators is set

out in the 2014 Annual Report and Accounts.

Property Portfolio

Rental data

Gross Net

rental rental Contracted Vacancy

income income rent ERV rate

for for at at Contracted at

the the Lettable year year rent subject year

year year space end end to indexation end

GBPm GBPm sq m GBPm GBPm GBPm %

------------ -------- -------- --------- ----------- ------ --------------- --------

London 32.4 31.7 158,892 34.9 38.9 6.0 3.3%

Rest of

UK 13.3 13.3 98,086 13.3 9.8 6.1 0.9%

France 17.1 17.0 92,147 15.9 15.8 15.9 5.1%

Germany 15.3 14.9 170,743 17.5 16.9 17.1 2.6%

Sweden 6.3 4.6 45,354 5.9 3.7 5.9 0.8%

------------ -------- -------- --------- ----------- ------ ---------------

Total

Portfolio 84.4 81.5 565,222 87.5 85.1 51.0 3.0%

------------ -------- -------- --------- ----------- ------ ---------------

Valuation data

Valuation

movement

in the year

-----------------------

EPRA

Market topped

value EPRA up

of Foreign net net True

property Underlying exchange initial initial equivalent

GBPm GBPm GBPm yield yield Reversion Over-rented yield

------------ ---------- ----------- ---------- --------- --------- ---------- ------------ ------------

London 705.0 185.1 - 5.2% 5.2% 11.6% 3.7% 6.1%

Rest of

UK 97.6 (0.3) - 12.8% 12.9% 2.6% 30.3% 10.0%

France 225.1 4.0 (15.6) 6.2% 6.7% 3.0% 9.4% 6.6%

Germany 235.5 6.9 (15.2) 6.7% 6.8% 2.0% 8.1% 5.9%

Sweden 46.9 (9.2) (7.0) 8.5% 8.5% 2.3% 39.3% 7.0%

------------ ---------- ----------- ----------

Total

Portfolio 1,310.1 186.5 (37.8) 6.5% 6.6% 6.1% 12.0%

------------ ---------- ----------- ----------

Lease Data

Average Passing rent of

lease leases expiring ERV of leases expiring

length in: in:

----------------- ------------------------------ ------------------------------

Year Year

3 After 3 After

To To Year Year to year Year Year to year

break expiry 1 2 5 5 1 2 5 5

years years GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------ ------- -------- ------ ------ ------ ------ ------ ------ ------ ------

London 6.1 7.0 3.3 3.1 5.7 22.9 3.8 3.3 6.7 23.9

Rest of

UK 4.1 6.6 1.6 0.8 2.1 8.9 0.9 1.0 1.4 6.3

France 2.6 5.2 1.6 0.8 5.6 8.0 1.2 0.7 5.0 8.0

Germany 7.0 7.1 1.9 3.3 4.0 8.3 1.9 2.8 3.9 7.8

Sweden 2.8 2.8 3.9 0.2 0.5 1.3 1.7 0.2 0.5 1.3

------ ------ ------ ------ ------ ------ ------

Total

Portfolio 5.1 6.4 12.3 8.2 17.9 49.4 9.5 8.0 17.5 47.3

------ ------ ------ ------ ------ ------ ------

Responsibility statement

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the company and the undertakings included in the consolidation

taken as a whole;

-- the strategic report includes a fair review of the

development and performance of the business and the position of the

company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- the annual report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the company's performance,

business model and strategy.

This statement of responsibilities was approved by the Board on

4 March 2015.

By order of the Board

David Fuller BA FCIS

Company Secretary

4 March 2015

group income statement

for the year ended 31 December 2014

2014 2013

Notes GBPm GBPm

---------------------------------------- ------- -------- ----------

Continuing operations

Group revenue 99.6 91.2

---------------------------------------- ------- -------- --------

Net rental income 2 82.2 73.1

Administration expenses (13.6) (12.4)

Other expenses (4.9) (3.5)

---------------------------------------- ------- -------- --------

Group revenue less costs 63.7 57.2

Net movements on revaluation

of investment properties 8 186.0 (0.2)

Profit on sale of investment

property 8.7 4.5

Fair value gain on reclassification

of an associate as a subsidiary 24 0.2 -

Gain arising from acquisition 24 1.2 -

Profit on sale of joint venture 25 - 1.8

Net gain on sale of corporate

bonds and other financial investments - 14.1

Fair value gain on reclassification

of an associate as an investment - 14.9

---------------------------------------- ------- -------- --------

Operating profit 259.8 92.3

Finance income 3 7.7 7.6

Finance costs 4 (28.1) (23.7)

Share of loss of associates

after tax 11 (2.6) (4.8)

---------------------------------------- ------- -------- --------

Profit before tax 236.8 71.4

Taxation 5 (42.0) (8.2)

---------------------------------------- ------- -------- --------

Profit for the year 194.8 63.2

---------------------------------------- ------- -------- --------

Attributable to:

Owners of the Company 194.9 63.2

Non-controlling interests (0.1) -

---------------------------------------- ------- -------- --------

194.8 63.2

---------------------------------------- ------- -------- --------

Earnings per share from continuing

operations

(expressed in pence per share)

Basic 6 449.0 146.9

Diluted 6 449.0 146.7

---------------------------------------- ------- -------- --------

Group Statement of comprehensive income

for the year ended 31 December 2014

2014 2013

Notes GBPm GBPm

Profit for the year 194.8 63.2

-------------------------------------- ------- ------- -------

Other comprehensive income

Items that will not be reclassified

to profit or loss

Foreign exchange differences (14.7) 3.4

-------------------------------------- ------- ------- -------

Items that may be reclassified

to profit or loss

Fair value gains/(losses)

on corporate bonds and other

financial investments 12 3.2 (1.4)

Fair value losses/(gains)

taken to net gain on sale of

corporate bonds and other

financial investments 12 0.2 (11.2)

Revaluation of property, plant

and equipment 9 6.5 -

Deferred tax on net fair value

(gains)/losses 16 (1.3) 3.1

-------------------------------------- ------- ------- -------

Total items that may be reclassified

to profit or loss 8.6 (9.5)

-------------------------------------- ------- ------- -------

Total comprehensive income

for the year 188.7 57.1

-------------------------------------- ------- ------- -------

Total comprehensive income

attributable to:

Owners of the Company 187.5 57.1

Non-controlling interests 1.2 -

-------------------------------------- ------- ------- -------

188.7 57.1

-------------------------------------- ------- ------- -------

Group Balance Sheet

At 31 December 2014

2014 2013

Notes GBPm GBPm

---------------------------------- ------- -------- ----------

Non-current assets

Investment properties 8 1,310.1 1,132.9

Property, plant and equipment 9 60.4 2.8

Goodwill 10 1.1 1.1

Investments in associates 11 1.5 9.1

Other financial investments 12 99.9 104.3

Derivative financial instruments 18 - 0.4

Deferred tax 16 4.8 6.4

---------------------------------- ------- -------- --------

1,477.8 1,257.0

---------------------------------- ------- -------- --------

Current assets

Trade and other receivables 13 10.8 12.7

Derivative financial instruments 18 - 0.3

Cash and cash equivalents 14 100.2 129.8

---------------------------------- ------- -------- --------

111.0 142.8

---------------------------------- ------- -------- --------

Total assets 1,588.8 1,399.8

---------------------------------- ------- -------- --------

Current liabilities

Trade and other payables 15 (68.1) (40.3)

Current tax (7.7) (3.5)

Borrowings 17 (192.8) (77.5)

Derivative financial instruments 18 (1.0) -

---------------------------------- ------- -------- --------

(269.6) (121.3)

---------------------------------- ------- -------- --------

Non-current liabilities

Deferred tax 16 (105.9) (74.4)

Borrowings 17 (549.5) (717.3)

Derivative financial instruments 18 (6.3) (5.9)

---------------------------------- ------- -------- --------

(661.7) (797.6)

---------------------------------- ------- -------- --------

Total liabilities (931.3) (918.9)

---------------------------------- ------- -------- --------

Net assets 657.5 480.9

---------------------------------- ------- -------- --------

Equity

Share capital 19 11.5 11.7

Share premium 21 82.9 82.9

Other reserves 22 88.8 96.0

Retained earnings 469.7 290.3

---------------------------------- ------- -------- --------

Equity attributable to owners

of the Company 652.9 480.9

Non-controlling interests 4.6 -

---------------------------------- ------- -------- --------

Total equity 657.5 480.9

---------------------------------- ------- -------- --------

The financial statements of CLS Holdings plc (registered number:

2714781) were

approved by the Board of Directors and authorised for issue on 4

March 2015 and

were signed on its behalf by:

Mr S A Mortstedt Mr E H Klotz

Director Director

Group Statement of Changes in Equity

for the year ended 31 December 2014

Share Share Other Retained Non-controlling Total

capital premium reserves earnings Total interest equity

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------- ------ --------- --------- ---------- ---------- ------- ---------------- --------

Arising in 2014:

Total comprehensive

income for the year - - (7.4) 194.9 187.5 1.2 188.7

Adjustment arising

from change in

non-controlling

interest - - - - - 3.4 3.4

Purchase of own shares 19 (0.2) - 0.2 (15.4) (15.4) - (15.4)

Expenses thereof - - - (0.1) (0.1) - (0.1)

--------------------------- ------ --------- --------- ---------- ---------- ------- ---------------- --------

Total changes arising

in 2014 (0.2) - (7.2) 179.4 172.0 4.6 176.6

At 1 January 2014 11.7 82.9 96.0 290.3 480.9 - 480.9

--------------------------- ------ --------- --------- ---------- ---------- ------- ---------------- --------

At 31 December 2014 11.5 82.9 88.8 469.7 652.9 4.6 657.5

--------------------------- ------ --------- --------- ---------- ---------- ------- ---------------- --------

Share Share Other Retained Non-controlling Total

capital premium reserves earnings Total interest equity

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------ ------ --------- --------- ---------- ---------- ------- ---------------- --------

Arising in 2013:

Total comprehensive

income for the year - - (6.1) 63.2 57.1 - 57.1

Issue of share capital - 11.4 - 8.0 19.4 - 19.4

Expenses thereof - - - (0.4) (0.4) - (0.4)

Exercise of share

options - - - 1.4 1.4 - 1.4

Purchase of own shares 19 (0.3) - 0.3 (13.6) (13.6) - (13.6)

Expenses thereof - - - (0.1) (0.1) - (0.1)

------------------------ ------ --------- --------- ---------- ---------- ------- ---------------- --------

Total changes arising

in 2013 (0.3) 11.4 (5.8) 58.5 63.8 - 63.8

At 1 January 2013 12.0 71.5 101.8 231.8 417.1 - 417.1

------------------------ ------ --------- --------- ---------- ---------- ------- ---------------- --------

At 31 December 2013 11.7 82.9 96.0 290.3 480.9 - 480.9

------------------------ ------ --------- --------- ---------- ---------- ------- ---------------- --------

Group Statement of Cash Flows

for the year ended 31 December 2014

2014 2013

Notes GBPm GBPm

---------------------------------------------- ------ ------- --------

Cash flows from operating activities

Cash generated from operations 23 53.3 63.4

Interest paid (24.4) (22.2)

Income tax paid (2.5) (5.4)

---------------------------------------------- ------ ------- --------

Net cash inflow from operating

activities 26.4 35.8

---------------------------------------------- ------ ------- --------

Cash flows from investing activities

Purchase of investment property (4.2) (165.3)

Capital expenditure on investment

property (45.2) (34.3)

Net cash inflow from business 2.9 -

acquisition

Proceeds from sale of investment

property 37.1 13.2

Proceeds from sale of joint venture - 4.4

Interest received 8.1 11.2

Purchase of corporate bonds (70.9) (110.6)

Proceeds from sale of corporate

bonds 82.9 172.9

Purchase of equity investments (5.1) (3.3)

Dividends received from equity

investments 0.7 0.4

Proceeds from sale of equity investments 3.3 3.1

Purchase of interests in associate

undertakings - (0.3)

Loans to associate undertakings (1.0) (1.2)

Distributions received from associate

undertakings 0.8 0.3

Costs on foreign currency transactions (0.9) (1.7)

Costs of corporate disposals - (0.3)

Purchases of property, plant and

equipment (11.3) (0.3)

---------------------------------------------- ------ ------- --------

Net cash outflow from investing

activities (2.8) (111.8)

---------------------------------------------- ------ ------- --------

Cash flows from financing activities

Proceeds from issue of shares - 20.4

Purchase of own shares (15.5) (13.7)

New loans 32.6 207.4

Issue costs of new loans (0.2) (1.9)

Repayment of loans (65.0) (103.4)

Purchase or cancellation of derivative

financial instruments - (0.3)

---------------------------------------------- ------ ------- --------

Net cash (outflow)/inflow from

financing activities (48.1) 108.5

---------------------------------------------- ------ ------- --------

Cash flow element of net (decrease)/increase

in cash and cash equivalents (24.5) 32.5

Foreign exchange loss (5.1) (0.3)

---------------------------------------------- ------ ------- --------

Net (decrease)/increase in cash

and cash equivalents (29.6) 32.2

Cash and cash equivalents at the

beginning of the year 129.8 97.6

---------------------------------------------- ------ ------- --------

Cash and cash equivalents at the

end of the year 14 100.2 129.8

---------------------------------------------- ------ ------- --------

Notes to the group financial statements

31 December 2014

1 General Information

CLS Holdings plc (the "Company") and its subsidiaries (together

"CLS Holdings" or the "Group") is an investment property group

which is principally involved in the investment, management and

development of commercial properties, and in other investments. The

Group's principal operations are carried out in the United Kingdom,

France, Germany and Sweden.

The Company is registered in the UK, registration number

2714781, with its registered address at 86 Bondway, London, SW8

1SF. The Company is listed on the London Stock Exchange.