Embargoed: 0700hrs 27 February 2004

CLS HOLDINGS PLC

PRELIMINARY FINANCIAL RESULTS FOR THE YEAR TO

31 DECEMBER 2003

FINANCIAL HIGHLIGHTS

Adjusted Net Asset Value (NAV) per share 445.7 pence, up 9.1 per cent

(Statutory NAV per share 439.2 pence up 11.2 per cent).

Retained profit (after tax and minority interest) �18.8 million up 22.9 per

cent.

Profit before tax �17.6 million up 2.9per cent.

Total return to shareholders 12.8 per cent based on increase in adjusted NAV

per share and distributions in the year (15.1 per cent based on statutory NAV).

Intended distribution by way of a tender offer buy-back of 1 in 36 shares at

360 pence being 10.0 pence per share making a total distribution to

shareholders of 16.5 pence per share for the year, up 14.6 per cent.

Property portfolio valued at �882.4 million up 3.9 per cent.

Net rental income (including associates and JVs) �63.8 million up 5.8 per cent.

Year end cash �56.7million down 13.7 per cent.

Key statistics and other financial information

31 Dec 31 Dec

2003 2002

PROFIT AND LOSS

Adjusted earnings per share* 20.0 p17.3 p Up 15.6 %

Earnings per share 20.7 p 15.7 p Up 31.8 %

Net rental income (including associates and JVs) �63.8 m �60.3 m Up 5.8 %

Operating profit (including associates and JVs) �46.4 m �46.1 m Up 0.7 %

Net interest payable �30.7 m �28.9 m Up 6.2 %

Core profit before tax (see page 10) �21.4 m �19.7 m Up 8.6 %

Profit before taxation �17.6 m �17.1 m Up 2.9 %

Retained profit �18.8 m �15.3 m Up 22.9 %

BALANCE SHEET

Adjusted NAV per share* 445.7 p 408.7 p Up 9.1 %

Statutory NAV per share 439.2 p 394.9 p Up 11.2 %

Distribution per share from tender offer 16.5 p 14.4 p Up 14.6 %

buy-backs

Property portfolio �882.4 m �848.9 m Up 3.9 %

Net asset value �385.0 m �371.7 m Up 3.6 %

Cash �56.7 m �65.7 m Down %

13.7

Adjusted gearing* 125.1% 119.6% Up 5.5 %

Statutory gearing 126.9% 123.8% Up 3.1 %

Solidity (net assets as a ratio of gross assets) 39.5% 39.6% Down 0.1 %

Shares in issue (000's) 87,644 94,129 Down 6.9 %

FRS13 fair value adjustment after tax (see page 20.7 p 23.6 p Down %

16) 12.3

* FRS19 requires a tax provision to be made in respect of capital allowances to

the extent that they are not covered by available tax losses brought forward.

In practice we consider it unlikely that the benefit of these capital

allowances will not continue to be available whether or not the properties are

sold in the future. The Board has complied with pronouncements from the APB,

ASB and Listing Authority in showing NAV and Earnings per share including the

FRS19 provision with equal prominence as adjusted figures. The effect of FRS 19

has been excluded from those statistics that are indicatedby an asterisk, a

reconciliation of which is set out on the final page of this document.

At 31 December 2003 the FRS 19 deferred tax credit included in the profit and

loss account was �0.6 million and the cumulative reduction to net assets was �

5.7 million (31 December 2002: charge to tax of �1.5 million and �13.0 million

respectively). The accounting policies are as set out in the Group's 2002

Annual Report and Accounts.

BUSINESS HIGHLIGHTS

Planning permission received for the 1,014 foot (309 metres) London Bridge

Tower, the tallest building in Europe.

Acquisition of New London Bridge House by way of 50:50 JV for �39.5 million.

Sale of Coombe Hill House, New Malden; Colne House, Watford; Larkhall Lane, SW4

and Vauxhall Street, SE11 at a profit of �1.9 million.

Acquisition of two properties on Bondway, Vauxhall Cross for �4.2 million

consolidating our strategic position on this site.

Expansion into Luxembourg in January 2004 by the acquisition of a government

let property at a cost of �6.7 million.

Re-financing at Solna, Sweden raised �21.3 million.

CHAIRMAN'S STATEMENT

This May will mark the 10th anniversary of the listing of CLS Holdings plc on

the main market of the London Stock Exchange and I would therefore like to take

this opportunity to look back over the last ten years and share with you my

thoughts as I look forward to the future.

Review of the last ten years and future strategy.

Our approach since flotation has been to make carefully researched investment

decisions that are risk averse with a view to ensuring that our portfolio

remains secure and performs consistently.

Over the last ten years our net assets have grown from �127.7 million to �385.0

million, an increase of 201.5 per cent, a growth rate of 11.7 per cent compound

per annum and 13.8 per cent compound per annum over the last five years.

Since flotation net asset value per share has increased from 129.0 pence to

445.7 pence 13.2 per cent compound per annum. Our property assets, based in the

UK, Sweden and France have increased from �287.0 million to �882.4 million, an

increase of 207.5 per cent.

This growth has resulted in our shares outperforming the FTSE Real Estate Index

by 129 per cent and the FTSE All Share Index by 153 per cent since flotation

(as at 25 February 2004).

The closing price of our shares on 25 February 2004 was 305 pence compared to a

price of 111 pence on flotation, an increase of 174.8 per cent.

This success is a testament to the strong partnerships that have been forged

over this period between CLS and our shareholders, tenants, lending

institutions, local councils, professional advisers, suppliers and employees.

I would like to thank all who have been involved with the Company during this

period and would like to say a few words to each of these stakeholders.

Shareholders

I would particularly like to thank both our institutional and private

shareholders, of whom many have held shares since flotation, for their loyalty

and active support. Although some institutions are reluctant to invest in

companies with a large proprietorial shareholding, in my view such companies

offer a much stronger recognition of shareholders' interests as a whole, given

that as investors we are all interested in increasing capital value and

distributions.

During the last ten years, we have distributed �83.0 million pro-rata to

shareholders, progressively rising from �3.2 million in 1995 to �14.1 million

in 2003. In addition we have made market purchases of shares for cancellation

of �35.7 million, making a total of �118.7 million paid to shareholders during

this period.

Tenants

We are long-term investors in property and seek long-term relationships with

our tenants of whom over 39 per cent are government organisations. We neither

trade in nor develop properties for short*term gain. We do however carry out

substantial enhancements to our properties for the benefit of our tenants.

Our aim is to provide tenants with high-quality, well-managed premises

providing both the flexibility and facilities required by today's occupiers to

enhance their own businesses. To this end, we keep abreast of technological

developments so that we can deliver state-of-the-art services to our

customers. It is important to us to be responsive toour customers'

requirements and to deliver value for money.

Lending institutions

The support of our bankers and other lending institutions has been crucial to

our success and growth. Our portfolio of 109 properties valued at �882.4

million is financed by �540.5 million of loans provided by 17 different

financial institutions, a number of whom have worked with us for more than ten

years. Additionally we have �56.7 million deposited with various banks. We look

forward to continuing our strong, risk averse and mutually beneficial

relationship with our banking partners for the foreseeable future.

Local Councils

Over the period we have developed excellent working relationships with a

variety of local councils and I would like to thank them for their support for

our ongoing projects to upgrade the environment for local communities adjacent

to our investments. We very much look forward to continuing to work with them

to improve our living and working environment.

Professional Advisers and Suppliers

I am very much aware of the valuable contribution that has been made by the

many architects, designers, agents and other professional advisers and

suppliers with whom we have worked over the years. Through their creativity

and quality of input ourproperties have been developed, refurbished and

maintained to a high standard.

Staff

I very much appreciate the competence, energy and support our staff have shown

over the years, and enjoy our informal but professional working culture. Our

outlook is also influenced by the thirteen different nationalities we employ

in three European locations and this I believe gives us a competitive advantage

in the way we think and operate.

The Mortstedt family strategy

I thought it would be helpful to reiterate the position of the Mortstedt

family. We have been involved in property investment for over sixty years and

have found it to be a stable and secure business as long as it is managed

conservatively.

Many readers will be aware that my brother Bengt and I together own just over

fifty per cent of the shares in the Company, similar to the proportion held

when the Company was floated. Our strategic objective is simple: to maintain

and grow a safe and secure business that generates long-term shareholder value

for all who have invested in the Company. It is our intention to retain our

holding in the Company for the foreseeable future.

The Future

We all know that the future is impossible to predict. CLS is a very different

and a much improved company today than ten years ago. The organisation is more

professional and our knowledge of commercial property more comprehensive.

Our properties are of a higher quality and standard overall and we now have

three main home markets - London, Sweden and France. We are not therefore

dependent on one market alone.

Our conservative and risk averse strategy has worked successfully and we have

high calibre personnel at all levels. CLS is in a strong financial position,

is cash rich, has financial flexibility and its financial controls are robust.

The tenants, our customers, today know that we are long term property owners

and that they can trust us. We endeavour to provide them with the best service

available at a reasonable price.

CLS is an energetic and very determined company and will use its resources and

knowledge in the best interest for all its stakeholders, now and in the future.

I therefore believe the company will continue to grow in a controlled way and

look forward to the future withthe utmost confidence.

Review of 2003

I am pleased to report not only a further increase in adjusted net asset value

per share for the ninth successive year - up 9.1 per cent to 445.7 pence per

share (statutory NAV per share up 11.2 per cent to 439.2 pence) - but also a

further increase in profit before taxation to �17.6 million. We have

continued to benefit from ongoing capital allowances giving an overall current

tax charge on this year's profit of �0.7 million, an effective tax rate of just

4.0 per cent. Earnings per share increased to 20.7 pence, up 31.8 per cent and

retained profit amounted to �18.8 million, an increase of 22.9 per cent.

The share price of CLS increased by 26.2 per cent in the year to 31 December

2003 compared to an increase of 14.8 per cent in the FTSE All-Share Index. The

closing share price on 25th February 2004 of 305 pence represents an increase

of 42.5 per cent since 1 January 2003.

During the year, we have continued to pursue our strategy of improving and

enhancing the value of our investment properties and have invested �21.9

million during this period on the refurbishment of our portfolio.

During the summer of 2003 we took advantage of historically low long-term

interest rates to convert a number of our loans to fixed-interest rates and to

prolong the fixed rate interest period on others, thus reducing our exposure to

further interest rate increases. At the end of the year, 47.5 per cent of our

borrowing was on fixed rates at an average interest rate of 6.7 per cent,

compared to 32.5 per cent at the end of 2002 at an average interest rate of 7.9

per cent.

A major achievement in the year was the grant of planning consent for the

construction of London Bridge Tower following a comprehensive planning

enquiry. The proposed development, in which we have a one third interest, will

comprise a mixture of offices, residential, retail and leisure, and will be

Europe's tallest building. We do not intend to commence construction until a

substantial pre*letis achieved and/or until a large element of the residential

accommodation has been pre-sold. Meanwhile, the existing building on the site

remains fully let and income-producing. Although the grant of planning consent

is likely to have enhanced the value of our interest, we have not taken any

potential development value into our results for 2003.

We were also successful in obtaining planning consent for 6,412 sq m (69,030 sq

ft) of offices opposite our Spring Gardens office complex in Vauxhall.

As I predicted in my statement last year, a feature of the past twelve months

has been the continuing strength of the investment market in London for

commercial property. We took advantage of this strong demand and sold four

investment properties with limited potential for future capital growth at a

profit of �1.9 million.

Despite few opportunities for new acquisitions in London at prices which meet

our investment criteria, we completed the purchase of a 50 per cent interest in

New London Bridge House, valued at �39.5 million, which adjoins the site of the

proposed London Bridge Tower development. We also purchased two properties on

Bondway, Vauxhall Cross for �4.2 million thereby consolidating our strategic

position on this site.

At Solna Business Park in Stockholm, we have completed a number of lettings in

what has been an extremely competitive market. Coop have now completed their

fit out and moved into Frasaren 11, which is now 90 per cent let.

In France, we have also seen a strengthening in the investment market, which

has made yields less attractive than in previous years. We made one small

acquisition during the year.

Whilst occupational demand for offices has been poor during 2003 in each of our

three markets, we have nonetheless managed to contain the vacancy rate to 7.1

per cent by area at the end of the year, compared to 5.6 per cent for 2002. In

part, this is attributable to a combination of our long lease length in the UK

(an average of 11.1 years unexpired) and the factthat 38.9 per cent of rent is

secured on the UK, Swedish and French governments. Furthermore, we have no

exposure to the City of London office market, where there is a considerable

over-supply of offices. Overall, our net rental income has increased by 5.8

per cent to �63.8 million, and our annualised gross rental income at the end of

year was �76.8 million.

Moreover, we have seen significant increased tenant interest in vacant space

throughout our portfolio since the end of 2003, and look forward with

confidence to reducing our vacancy rate and increasing our rental income during

2004.

Our investment division has made losses of �2.9 million after tax and minority

interest. We have made substantial operational improvements within a number of

investee companies and will continue to improve their performance. We have

also accounted in a conservative manner for our investments, a number of which

it is hoped will make a positive contribution to profit in 2004.

The CLS share price still remains at a significant discount to net asset value,

and consequently the Board continues to believe in the benefit of distributing

cash by way of tender offer buy*backs, as they enhance the net asset value of

the remaining shares in issue and are tax beneficial for many shareholders.

The Board therefore intends to recommend a tender offer buy*back of one in

thirty six shares at a price of 360 pence per share, resulting in a total

distribution for the year of 16.5 pence per share, an increase of 14.6 per cent

on the previous year.

Since the year end, we have purchased a government*let building in Luxembourg

for �6.7 million ( Euro9.7 million) at a yield of 11.4 per cent based on the lower

euro interest rates. We will continue to consider other opportunities in

Europe outside our core markets of London, Sweden and France.

I believe that CLS is well placed to increase its profits during 2004 whilst

continuing to incur only a small taxation liability.

I am pleased that we have confirmed the appointment of Tom Thomson as Chief

Executive, who has been Acting Chief Executive of CLS for two years and has

been associated with the company since 1987. I also take the opportunity of

welcoming the recent appointment to the Board of Per Sj�berg, who is the

Group's Development Director. Anna Seeley has stepped down from her executive

role as Group Property Director in order to be able to devote more time to her

young family. However I am delighted that we will continue to benefit from her

expertise in her new role as a non*executive director of CLS.

Finally I would like to reiterate my thanks to my fellow directors, our staff,

advisers, lenders and shareholders for their continued support during the year.

Sten Mortstedt

Executive Chairman

FINANCIAL REVIEW

Introduction

The Group has continued to deliver strong growth in shareholder value from its

portfolio of properties, of which a significant proportion are let to

government tenants on long leases.

Adjusted NAV of 445.7 pence per share (December 2002: 408.7 pence), grew by 9.1

per cent during 2003 (Statutory NAV of 439.2 pence per share grew by 11.2 per

cent over the same period). In the last five years the adjusted net asset value

per share has grown by 19.4 per cent compound per annum, or a total of 142.2

per cent (Statutory NAV has shown a similar growth throughout that period). The

organic growth in adjusted net asset value per share over the period (taking

into account the effect of tender offer buy-backs but excluding growth

attributable to the purchase of shares on the market for cancellation) has been

113.6 per cent (Statutory NAV has shown similar growth throughout that period).

If all share options were to be exercised, the dilutive effect would be to

reduce adjusted NAV per share by 2.6 pence (Statutory NAV by 2.5 pence).

At the year end the post-tax FRS 13 disclosure, showing the effect of restating

fixed interest loans to fair value, amounted to 20.7 pence per share (December

2002: 23.6 pence).

The return in the year to shareholders based on the increase in adjusted NAV

per share and distributions by way of tender offer buy back was 12.8 per cent

(December 2002: 15.5 per cent). Based on Statutory NAV the return is 15.1 per

cent (December 2002: 15.4 per cent).

During the year the Company distributed �14.1 million (15.4 pence per share) to

shareholders by way of tender offer buy-backs. The Company also purchased 1.5

million shares on the market for cancellation (1.6 per cent of the shares in

issue as at 1 January 2003) at a cost of �2.9 million, an average price per

share of 198 pence; a total payment to shareholders in the year of �17.0

million.

Net assets grew by �13.3 million to �385.0 million in the year, including

positive foreign exchange translation movements of �15.1 million (relating to

the Group's Swedish and French net assets). This arises because although each

property is funded by loans in local currency, the equity in the property is

exposed to movements in foreign exchange rates when translated into sterling.

Net asset growth is calculated after taking into account the cost of tender

offer buy-back distributions and market repurchases made during the year, which

totalled �17.0 million.

Adjusted gearing at the year end increased to 125.1 per cent (2002: 119.6 per

cent) (statutory gearing was 126.9 per cent - 2002: 123.8 per cent). Tender

offer buy-backs during the year and the purchase of shares in the market had

the impact of increasing gearing by 4.4 per cent and the positive effect of

foreign exchange translation of overseas net assets during 2003 reduced gearing

by 4.9 per cent.

The Group held �56.7 million cash as at 31 December 2003 (December 2002: �65.7

million), the decrease being attributed as follows:

�m

Cash inflow from operations 52.4

Net interest and other finance costs (29.0)

Taxation (1.4)

Net funding of cable companies (5.4)

Funding of New London Bridge House (5.1)

Funding of Teighmore Limited (0.7)

Properties purchased and enhanced (22.6)

New loans 25.5

Properties sold 23.6

Loans repaid (29.2)

Tender offer payment to shareholders (14.1)

Market purchase of shares for cancellation (2.9)

Other (0.1)

(9.0)

In January 2003 the Group purchased 75.5 per cent of a Scottish telecoms

operator, WightCable North Limited (formerly Omne Communications Limited), that

had capital assets of �50 million and an established customer base. The

initial cash outlay amounted to �4.1 million and a further �1.9 million was

injected during the year. The revenue projections on which we based our

purchase have not been achieved and therefore it is likely we will need to make

limited further funds available.

WightCable South Limited, a similar operator in which we have invested is at

the point of reaching self sufficiency in funding operations and is expected to

break even on an EBITDA basis in April of 2004.

Other existing equity investments held amounted to �4.0 million (after

provisions this year of �1.2 million). The majority of these are unlisted

investments which continue to be carried at the lower of cost and net

realisable value, and represent only 0.4 per cent of the gross assets of the

Group. A number of these investments are performing very well and it islikely

that they will make positive contributions to profits during the forthcoming

year.

The underlying elements of the growth in equity shareholders' funds are set out

below:

�m

Equity shareholders' funds at 31 December 2002 371.7

Direct investment

Income from investments in property 62.5

Lossesin equity investments (1.4)

Cable company losses (4.6)

Administrative expenses (8.2)

Net interest payable (30.7)

Profit before taxation 17.6

Taxation - current (0.7)

- deferred 0.6

Equity minority interest 1.3

Retained profit 18.8

Indirect investment

Revaluations (3.0)

Exchange and other movements 15.0

Increase in equity due to direct and indirect investment 30.8

Other equity movements

Capital Distributions by tender offer buy-backs (14.1)

Other share buy backs and associated costs (3.0)

Share Issues 0.5

Minority interest (0.9)

Equity shareholders' funds at 31 December 2003 385.0

Core profit generated by the Group rose by 8.6 per cent. This has been

calculated to show the profit arising solely from property rental as set out

below :

2003 2002

Restated

�m �m

Profit before tax 17.6 17.1

Deduct:

Losses in equity investments (1.4) (3.1)

Cable company losses (4.6) (0.7)

Profit/(loss) on sale of properties 1.9 (0.2)

Lease surrenders and variations 0.3 0.5

Back-dated rent settlement - 1.2

Negotiated settlement in France - (0.1)

Fees re aborted purchase - (0.2)

(3.8) (2.6)

Core profit 21.4 19.7

Increase on previous year 8.6% 43.8%

REVIEW OF THE PROFIT AND LOSS ACCOUNT

Financial Results by Location

The results of the Group have been analysed by location and main business

activity as set out below:

2003 Equity

Total UK* Sweden France investments 2002

�m �m �m �m �m �m

Net rental income 63.8 32.0 14.5 17.3 - 60.3

Less income in JVs (1.4) (1.4) - - - (0.9)

Other income 3.9 0.5 0.6 0.1 2.7 1.3

Net rental and property related income

(excluding JVs) 66.3 31.1 15.1 17.4 2.7 60.7

Operating expenses (19.6) (5.7) (4.0) (2.0) (7.9) (12.3)

Losses and write-downs on equity investments (1.4) - - - (1.4) (3.1)

Associates / JVs operating profit 1.1 1.4 - - (0.3) 0.8

Operating profit 46.4 26.8 11.1 15.4 (6.9) 46.1

Gain/(loss) from sale of investment 1.9 1.9 - - - (0.1)

properties

Net interest payable and related charges (30.7) (15.9) (9.8) (4.3) (0.7) (28.9)

Profit on ordinary activities before tax 17.6 12.8 1.3 11.1 (7.6) 17.1

Taxation (0.1) (2.8) - (0.7) 3.4 (2.1)

Minority interest 1.3 - - - 1.3 0.3

Retained profit 18.8 10.0 1.3 10.4 (2.9) 15.3

Retained profit 31 December 2002 15.3 10.1 1.2 7.8 (3.8)

Increase/(decrease) in retained profit 3.5 (0.1) 0.1 2.6 0.9

Percentage change in retained profit 22.9% (0.1)% 8.3% 33.3% 23.7%

* Results relating to Germany were immaterial in the context of the overall

results of the Group and have therefore been included within the UK.

Net rental income

Net rental income has increased by 5.8 per cent to �63.8 million and reflects

further letting successes at Solna, Sweden (�3.0 million) and increased rentals

in France due to indexation and lease restructuring (�0.5 million) and a full

year contribution of the Hervet portfolio acquired in June 2002. UK net rental

income fell by �2.3 million of which �1.2 million was represented by the

receipt of a back-dated rent review at New Printing House Square in 2002 and a

reduction in current year rent of �1.1 million related to the vacancy of One

Leicester Square.

Other income

Other incomeof �3.9 million (2002: �1.3 million) mainly comprised the

consolidation of gross margins of telecoms subsidiaries of �2.7 million and a

lease surrender of �0.3 million at Great West House, Brentford. Of the

remainder, gym membership fees generated from the Solna development increased

to �0.5 million.

Administrative expenditure

Administrative expenditure relating to the core property business amounted to �

7.6 million, a decrease of �0.3 million over the previous year. A further �7.4

million related to the consolidation of operating costs for WightCable South

Limited and WightCable North Limited which was purchased in January 2003 and �

0.4 million related to other non-property related overheads.

Net property expenses

Net property expensesof �4.2. million (2002: �4.0 million) included an amount

of �0.7 million of depreciation of which �0.4 million related to completion of

the amortisation of a short leasehold interest. In addition the marketing

campaign initiated in 2002 at Solna has continued, at a cost of �0.5 million.

Of the remainder, operating costs of the gym at Solna amounted to �0.6

million, void costs were �0.7 million (mainly One Leicester Square and Vista

Office Centre, Hounslow), and repairs and maintenance costs of �0.6 million

related to the refurbishment of properties in V�nerparken and Paris.

Other operating losses

Other operating lossesamounted to �1.4 million. Within that figure, �1.2

million is represented by a write off of �0.7 million and provisions of �0.5

million against unlisted investments, to comply with BVCA valuation

guidelines.

2003 2002

�m �m

Losses relating to listed investments (0.2) -

Write downsof unlisted investments (1.2) (3.1)

(1.4) (3.1)

Net interest and financial charges

Net interest and financial chargesamounted to �30.7 million and showed an

increase of �1.8 million over net expenditure in 2002, reflecting the

re-financing of Solna.

The Company's policy is to expense all interest payable to the profit and loss

account, including interest incurred in the funding of refurbishment and

development projects

A breakdown of the net charge is set out below:

2003 2002 Difference

�m �m �m

Interest receivable 1.7 1.6 0.1

Foreign exchange 0.4 0.3 0.1

Interest receivable and similar income 2.1 1.9 0.2

Interest payable and similar charges (32.8) (30.8) (2.0)

Net interest and financial charges (30.7) (28.9) 1.8)

Interest payable and similar charges of �32.8 million (2002 : �30.8 million)

included joint venture interest of �1.1 million (2002: �0.9 million) relating

to the Group's interest in Teighmore Limited, owner of Southwark Towers, and

New London Bridge House Limited which was acquired in September 2003,

depreciation of interest rate caps amounting to �0.9 million (2002: �0.8

million) and amortisation of issue costs of loans of �0.9 million (2002: �1.0

million).

The average cost of borrowing for the Group at December 2003 is set out below :

December 2003 UK Sweden France Total

Average interest rate on fixed rate debt 8.1 % 6.1 % 4.6 % 6.7 %

Average interest rate on variable rate debt 5.5 % 4.4 % 3.5 % 4.7 %

Overall weighted average interest rate 6.7 % 5.3 % 4.0 % 5.6 %

December 2002

Average interest rate on fixed rate debt 9.9% 6.2 % 4.9 % 7.9 %

Average interest rate on variable rate debt 5.4% 5.6 % 4.4 % 5.2 %

Overall weighted average interest rate 6.6% 5.9 % 4.6 % 6.0 %

Taxation

The Group's current taxation charge has benefited from the utilisation of

losses, significant capital allowances and amortisation deductions. These

factors will have less effect in the future as corporation tax losses are used

against expected profits and as allowances and amortisation deductions decrease

in existing subsidiaries. We do however anticipate utilising capital

allowances on assets held by recently acquired subsidiary companies.

REVIEW OF THE BALANCE SHEET

Tangible Assets

The tangible assets of the Group (including plant and machinery)have increased

to �889.3 million (2002: �852.4 million). The net increase of �36.9 million

included expenditure on refurbishments of �17.0 million of which �13.1 million

was expended at Solna. Foreign exchange translation gains on Swedish and

French property holdings amounted to �36.7 million in the year. After taking

account of the effect of foreign exchange translation on loans to finance these

assets, the net effect was a gain of �15.1 million.

Two new properties were purchased at a cost of �4.2 million in order to

consolidate our site at Vauxhall Cross, SE11. During the year in the UK, four

properties with a book value of �17.7 million, fourteen of eighteen flats at

Coventry House, Haymarket with a book value of �3.5 million (the remaining

flats are held as an investment) and one small property in France with a book

value of �0.5 million were sold.

The value of tangible assets relating to WightCable North Limited was �3.1

million, other additions were �1.5 million and depreciation was �1.5 million.

Revaluation movements on the Group's investment properties were as follows:

Revaluation of property 2003 2002

�m �m

UK (0.6) (5.7)

Sweden(6.9) 4.3

France 4.5 9.3

Total revaluation (3.0) 7.9

Based on the valuations at 31 December 2003 and annualised contracted rent

receivable at that date of �69.4 million (2002: �70.8 million), the portfolio

shows a yield of 7.2 per cent (2002:7.9 per cent).

An analysis of the location of investment property assets and related loans is

set out below:

Total

Balance

Sheet UK * Sweden France

December 2003 �m % �m % �m % �m %

Investment Properties 882.4 100.0 408.9 46.3 241.1 27.3 232.4 26.3

Loans (540.5) 100.0 (268.0) 49.5 (136.5) 25.3 (136.0) 25.2

Equity in Property 341.9 100.0 140.9 41.2 104.6 30.6 96.4 28.2

Assets

Other 43.1 100.0 43.8 101.6 (8.1) (18.8) 7.4 17.2

Net Equity 385.0 100.0 184.7 48.0 96.5 25.0 103.8 27.0

Equity in property

assets as a percentage

of investment 38.7% 4.5% 3.4 % 1.5%

�m �m �m �m

Opening Equity 371.7 178.9 101.5 91.3

Increase during 2003 13.3 5.8 * (5.0) 12.5

Closing Equity 2003 385.0 184.7 96.5 103.8

Results relating to Germany were immaterial in the context of the overall

results of the Group and have therefore been included within the UK. The

following exchange rates` were used to translate assets and liabilities at the

year end : SEK/GBP 12.885 : Euro/GBP 1.417

* Net assets were reduced by payments for share purchases, tender offer

distributions and deferred tax provisions totalling �16.4 million which are

included within the results of the UK.

Debt Structure

Borrowings are raised by the Group to finance holdings of investment

properties. These are secured, in the main, on the individual properties to

which they relate. All borrowings are taken up in the local currencies from

specialist property lending institutions.

Financial instruments are held by the Group to manage interest and foreign

exchange rate risk. Hedging instruments such as interest rate caps are

acquired from prime banks. The Group has thereby hedged all of its interest

rate exposure and a significant proportion of its foreign exchange rate

exposure.

The activities of the Group are mainly financed through share capital, reserves

and long term loans, which are secured against the properties to which they

relate.

Total UK Sweden France

Net Interest Bearing �m % �m % �m % �m %

Debt

Fixed Rate Loans (256.9) 47.5 (120.6) 45.0 (73.8) 54.0 (62.5) 46.0

Floating Rate Loans (283.6) 52.5 (147.2) 55.0 (62.9) 46.0 (73.5) 54.0

(540.5) 100.0 (267.8) 100.0 (136.7) 100.0 (136.0) 100.0

Bank and investments 56.7 41.9 3.7 11.1

Net Interest Bearing (483.8) 100.0 (225.9) 46.7 (133.0) 27.5 (124.9) 25.8

Debt

2002 (460.5) 100.0 (235.5) 51.1 (106.6) 23.2 (118.4) 25.7

Non interest bearing debt, represented by short-term creditors, amounted to �

35.8 million (December 2002: �30.8 million)

Floating rate loan caps Total UK Sweden France

% % % %

2003

Percentage of net floating rate loans capped 100.0 100.0 100.0 100.0

Average base interest rate at which loans 6.2 6.4 6.0 6.0

are capped

Average tenure 2.9 3.4 1.7 3.0

years years years years

2002

Percentage of net floating rate loans capped 100 100 100 100

Average base interest rate at which loans 6.3 6.3 6.2 6.4

are capped

Average tenure 3.2 3.5 2.4 3.1

years years years years

During 2003 the Group has continued its financial strategy; to fund part of its

portfolio on a floating rate basis, hedged with interest rate caps. As at 31st

December 2003 the average period to maturity of the caps was 2.9 years. Should

the interest rates rise to the cap rate, then the increased interest charged

would be �4.8 million per annum for the group, down from �6.9 million last

year.

During the year loans with a counter-value of �129.8 million were fixed until

2008. The majority of this fixing was carried out in June and July 2003 at very

attractive long-term rates; �77.3 million were converted from floating interest

hedged with caps and �52.5 million were prolongation of existing fixed funding.

After this restructuring, the Group's net debt is 52.5 per cent fixed and 47.5

per cent floating with interest rate caps.

New Printing House Square was financed in 1992 through a securitisation of its

rental income by way ofa fully amortising bond, which has a current

outstanding balance of �39.1 million at an interest rate of 10.8 per cent with

a maturity date of 2025; and a zero coupon bond, with a current outstanding

balance of �4.5 million, with matching interest rateand maturity date. This

debt instrument has a significant adverse effect on the average interest rate

and the FRS 13 adjustment.

The net borrowings of the Group at 31 December 2003 of �483.8 million showed an

increase of �23.3 million over 2002, reflecting the refinancing of our assets

at Solna, refurbishments and acquisitions.

Under the requirements of FRS13, which addresses among other things, disclosure

in relation to derivatives and other financial instruments, if our loans were

held at fair value, the Group's fixed rate debt at the year end would be in

excess of book value by �25.9 million (2002: �31.7 million) which net of tax at

30 per cent equates to �18.1 million (2002: �22.2 million).

The contracted future cash flows from the properties securing the loans are

currently well in excess of all interest and ongoing loan repayment

obligations. Only �17.5 million (3.2 per cent) of the Group's total bank debt

of �540.5 million is repayable within the next 12 months, with �274.5 million

(50.8 per cent) maturing after five years.

Share Capital

The share capital of the Company totalled �21.9 million at 31 December 2003,

represented by 87,644,067 ordinary shares of 25 pence each which are quoted on

the main market of the London Stock Exchange.

A capital distribution payment by way of tender offer buy-back was made both in

May and November of 2003 resulting in the purchase of 5.4 million shares and

providing a distribution of �14.1 million to shareholders, together with costs

of �0.2 million. As the shares continued to trade at a discount to NAV, the

Group bought back a total of 1.5 million shares in the market for cancellation

at an average cost per share of 198 pence, representing 1.6 per cent of opening

shares. This has involved atotal cash expenditure of �2.9 million.

A total of 46.8 million shares have been purchased at a total cost of �93.9

million since the programme of buy-backs started in 1998. The average cost of

shares purchased for cancellation over this period was 201 pence per share.

The weighted average number of shares in issue during the year was 90,791,078

(2002: 97,427,913)

The average mid-market price of the shares traded in the market during the year

ended 31 December 2003 was 228 pence with a high of 284 pence in December 2003

and a low of 188 pence in February 2003.

Should the proposed tender offer buy back be fully taken up, the number of

shares in issue would be reduced by 2,434,557 to 85,209,510.

An analysis of share movements during the year is set out below:

No of shares No of shares

Million Million

2003 2002

Opening shares 94.1 99.3

Tender offer buy back (5.4) (4.6)

Buybacks in the market for cancellation (1.5) (0.6)

Shares issued for the exercise of options 0.4 -

Closing shares 87.6 94.1

In total 21,261,700 million shares were traded in the market during 2003. The

share price on 25 February 2004 was 305 pence.

An analysis of the ownership structure is set out below:

Number of shares Percentageof shares

Institutions 39,264,494 44.8

Private investors 1,467,935 1.7

The Mortstedt family 44,794,694 51.1

Other 2,116,944 2.4

Total 87,644,067 100.0

The Company operates share option schemes to enable its staff to participate in

the prosperity of the Group. At 31 December 2003 there were 879,000 options in

existence with an average exercise price of 181.0 pence.

Distribution

As the current share price remains at a considerable discount to net asset

value, your Board is intending to propose a further tender offer buy-back of

shares in lieu of paying a cash dividend, on the basis of 1 in 36 shares at a

price of 360 pence per share. This will enhance net asset value per share and

is equivalent in cash terms to a final dividend per share of 10.0 pence,

yielding a total distribution in cash terms of 16.5 pence per share for the

year (2002: 14.4 pence).

Corporate Structure

The aim has been to continue to hold individual properties within separate

subsidiary companies, each with one loan on a non-recourse basis.

PROPERTY REVIEW

Introduction

Our continuing Group strategy is to focus upon low risk high return properties

in our core locations of London, France and Sweden. We believe that our

emphasis on actively managingthe portfolio maximises long term capital

returns. The Group now owns 109 properties with a total lettable area of

564,581 sq m (6,077,298 sq ft), of which 44 properties are in the UK, 23 in

Sweden and 42 in France. We have 496 commercial tenants and 1,328 residential

tenants.

Strategy

Our strategy is to target above average returns on equity through acquisition,

active management, refurbishment, and selective sales.

An analysis of contracted rent, book value and yields is set out below:

Contracted Net Book Yield Yield

Rent rent Value on net when

rent fully let

�000 % �000 % �000 % % %

London City Fringes 280 0.4% 280 0.4% 2,245 0.3% 12.5%

London Mid town 6,951 10.0% 6,951 10.9% 102,100 11.6% 6.8%

London West End 3,198 4.6% 3,044 4.8% 58,140 6.6% 5.2%

London West 4,780 6.9% 4,521 7.1% 56,979 6.4% 7.9%

London South Bank 8,998 13.0% 8,982 14.1% 131,775 14.9% 6.8%

London South West 1,204 1.7% 1,084 1.7% 14,500 1.6% 7.5%

London North West 3,175 4.6% 3,051 4.8% 39,050 4.4% 7.8%

Outside London 350 0.5% 350 0.5% 2,400 0.3% 14.6%

Total UK 28,936 41.7% 28,263 44.4% 407,189 46.1% 6.9% 7.6%*

Germany 228 0.3% 210 0.3% 1,835 0.2% 11.4%

Total Germany 228 0.3% 210 0.3% 1,835 0.2% 11.4% 11.4%

Sweden Gothenburg 6,335 9.1% 3,171 5.0% 42,685 4.8% 7.4%

Sweden Stockholm 11,259 16.2% 9,955 15.6% 148,776 16.9% 6.7%

Sweden Vanersborg 4,660 6.7% 4,069 6.4% 49,592 5.6% 8.2%

Total Sweden 22,254 32.1% 17,195 27.0% 241,053 27.3% 7.1% 7.4%*

France Paris 14,376 20.7% 14,376 22.6% 191,826 21.7% 7.5%

France Lyon 2,643 3.8% 2,643 4.2% 30,628 3.5% 8.6%

France Lille 561 0.8% 561 0.9% 5,830 0.7% 9.6%

France Antibes 390 0.6% 390 0.6% 4,080 0.5% 9.5%

Total France 17,970 25.9% 17,970 28.3% 232,364 26.4% 7.7% 8.3%

Group Total 69,388 100.0% 63,638 100.0% 882,441 100.0% 7.2% 7.7%

Conversion rates : SEK/GBP 12.885 Euro/GBP 1.417

- Contracted rent is defined as gross annualised rent supported by a signed

contract.

- Net rent is defined as contracted rent less net service charge costs.

- Yields on net rents have been calculated by dividing the net rent by the book

value.

*- Yield when fully let is calculated by dividing net rent plus unlet and

refurbished space at ERV by the book value based on the assumption that the

book values at 31 December 2003 will increase by refurbishment expenditure of

approximately �1.1 million in respect of projects in the UK.

*- Yield when fully let is calculated by dividing net rent plus unlet and

refurbished space at ERV by the book value based on the assumption that the

book values at 31 December 2003 will increase by refurbishment expenditure of

approximately �23.7million in respect of the projects at Solna, Sweden.

Rent analysed by length of lease and location

Contracted Contracted Unlet Space under

aggregate But not Space refurbishment

rental income at ERV or with

producing planning

consent Total Total

Sq. m Sq.ft �000 �000 �000 �000 �000 %

UK >10 yrs 62,599 673,832 13,053 475 - - 13,528 42.54%

UK 5-10 yrs 42,222 454,489 8,977 163 - - 9,140 28.74%

UK < 5 yrs 29,531 317,879 6,268 -- 25 6,293 19.79%

Development Stock 1,359 14,629 - - 59 - 59 0.19%

Vacant 12,867 138,504 - - 2,778 - 2,778 8.74%

Total UK 148,578 1,599,333 28,298 638 2,837 25 31,798 100.00%

Germany < 5 yrs 3,095 33,315 228 - - - 228 100.00%

Total Germany 3,095 33,315 228 - - - 228 100.00%

Sweden > 10 yrs 51,090 549,946 4,227 2,009 - - 6,236 24.33%

Sweden 5-10 yrs 23,917 257,449 1,859 152 - - 2,011 7.85%

Sweden < 5 yrs 184,813 1,989,376 13,811 196 - - 14,007 54.64%

Refurbished space 6,178 66,502 - - - 1,751 1,751 6.83%

Vacant 20,649 222,271 - - 1,628 1,628 6.35%

Total Sweden 286,647 3,085,544 19,897 2,357 1,628 1,751 25,633 100.00%

France > 10 yrs 1,073 11,550 185 - - - 185 0.96%

France 5-10 yrs 50,792 546,738 7,779 - - - 7,779 40.58%

France < 5 yrs 67,920 731,109 10,006 - - - 10,006 52.19%

Vacant 6,476 69,709 - - 1,202 - 1,202 6.27%

Total France 126,261 1,359,106 17,970 - 1,202 - 19,172 100.00%

Group > 10 yrs 114,762 1,235,328 17,465 2,484 - - 19,949 25.96%

Group 5-10 yrs 116,931 1,258,676 18,615 315 - - 18,930 24.64%

Group < 5 yrs 285,359 3,071,679 30,313 196 - 25 30,534 39.74%

Refurbished space 6,178 66,502 - - - 1,751 1,751 2.28%

Development Stock 1,359 14,629 - - 59 - 59 0.08%

Vacant 39,992 430,484 - - 5,608 -5,608 7.30%

Group Total 564,581 6,077,298 66,393 2,995 5,667 1,776 76,831 100.00%

The above table shows rental income by category and the future potential income

available from new lettings and refurbishments.

We estimate that open market rents are approximately 2.3 per cent lower than

current contracted rents receivable, which represents a potential decrease of �

1.6 million. This excludes the additional rents we will receive as a result of

our refurbishment programme. An analysis of the net decrease is set out below:

Contracted Rent Estimated Rental Value Reversionary Element

� Million � Million %

UK & Germany 29.2 27.1 (7.2)

Sweden 22.2 21.1 (5.0)

France 18.0 19.6 8.9

Total 69.4 67.8 (2.3)

The total potential gross rental income (comprising contracted rentals, and

estimated rental value of unlet space and refurbishment) of the portfolio is �

76.8 million p.a.

UK Portfolio

Our focus throughout 2003 has been to maximise rental income from the existing

portfolio and make strategic acquisitions to provide new opportunities for the

future.

One of the highlights of the year was the Secretary of State's decision to

grant planning consent for London Bridge Tower in which we have a one third

interest. At 309m (1,014 ft) high, London Bridge Tower will be the tallest

building in Europe and is unique in that it provides a combination of

residential, office, hotel, retail and leisure accommodation (including a

viewing gallery) within a single building.

Planning consentwas also secured for a mixed use development totalling 7,446

sq m (80,143 sq ft) at 2-10 Tinworth Street, London SE11. The focal point of

this scheme is a striking self contained office building providing 6,412 sq m

(69,030 sq ft) of fully specified offices. This site is immediately adjacent to

our existing 15,144 sq m (163,000 sq ft) Spring Gardens development which is

fully let to the UK Government.

Four properties were sold during the year for a total consideration of �19.6

million, resulting in a net profit of �1.9 million. The properties sold were

Coombe Hill House, New Malden, Surrey; Colne House, Watford; Oval Court,

Vauxhall Street, London SE11 and 157 Larkhall Lane, London SW8.

New properties added to the portfolio include two adjacent buildings in

Vauxhall, London at 80-84 Bondway, 86 Bondway and 18-20 Miles Street, acquired

for �4.2 million. These acquisitions complete the site assembly at Hoskyn's

House thereby generating additional value to the location.

A further significant acquisition was made in September. Through a 50:50 joint

venture company with Sellar Property Group we acquired the freehold interest of

New London Bridge House, a 12,170 sq m (131,000 sq ft) office building located

immediately adjacent to the proposed London Bridge Tower development and London

Bridge Station. The joint venture paid �39.5 million for the fully let

building, reflecting an initial net yield of 8.5 per cent. The property is let

to five tenants including Standard Chartered Bank, Coutts and Coand

PricewaterhouseCoopers on leases expiring in 2009.

At the start of the year the UK portfolio had a vacancy rate of 7.3 per cent by

net floor area. This rose to 8.6 per cent at the half year stage and 8.7 per

cent by the year end.

The most significant lettings were at Great West House in Brentford where we

signed new leases with Allianz Cornhill Insurance Plc, British Sky Broadcasting

Limited, Steria Limited and Cara Information Technology. Totalling 6,437 sq m

(69,290 sq ft), these lettings generated an overall rent of �1.0 million per

annum.

Although originally intended to be held as refurbished apartments for letting,

we took advantage of increased demand towards the end of the year to sell

fourteen of the new apartments at Coventry House, Haymarket, SW1 generating

gross receipts of �4.4 million. Four are being retained by the Group as letting

investments.

At 1 Leicester Square, we are looking forward to a positive outcome to the

planning appeal being heard in April 2004 that will enable us to complete the

letting of the lower three floors of the building to Viacom UK Limited for use

as an MTV studio. Three further floors totalling 1,090 sq m (11,733 sq ft) have

been let subject to the grant of a public entertainment licence and there is

strong interest in the remaining top three floors providing a further 975 sq m

(10,500 sq ft).

A significant proportion of our UK portfolio remains let to central or local

government on long leases. Through our acquisitions and planning consents, we

have added some exciting opportunities to the portfolio which we hope will

provide new income and value as markets improve.

Swedish Portfolio

We have continued to improve the quality of our portfolio at Solna Business

Park, L�vg�rdet and V�nerparken, and have attracted new tenants where vacant

space is available.

Solna Business Park

During the year we let a further 5,654 sq m of space, Fr�saren 11 is now 90

per cent let and the complex as a whole is 84 per cent let. Coop has moved in

and the only outstanding work at Fr�saren 11 is the hotel which is scheduled

for completion in May 2004.

We are in the process of erecting a new fa�ade, entrances and lifts at Smeden,

another of the large buildings at Solna. When finished, Solna Business Park

will include a business hotel, business centre, gym, restaurant, shops and

conference centre, in all comprising just under 150,000 sq m (1.6 million sq

ft)

Our area has now officially changed its name to Solna Business Park, and is now

on its way to becoming well known in greater Stockholm.

The market in Stockholm is still weak. Our vacant space is, however, much

better than the average and we look forward with confidence to a continued

improvement. It is our opinion that the market will not declineduring 2004 and

that increased demand for space will be noticeable in 2005.

L�vg�rdet, Gothenburg

We have continued to increase our services to the tenants. During the year 39

flats have been totally refurbished. All the 1,280 flats are let and the leases

are now considerably longer.

Of the retail contracts 76 per cent are let until 2014. We are now negotiating

an extension of a further 2,652

sq m (28,546 sq ft) which is equivalent to 8 per cent of the commercial space

of 33,150 sq m (356,824 sq ft).

V�nerparken

Three years ago we sold some land to developers. They have now built and sold

75 flats of a very high standard. This further improves the image for our area.

The marina has been selected by boating organisations as one of the three best

marinas in Sweden 2003. We look very positively upon V�nerparken as a long term

management project.

French Portfolio

For the last three years French economic growth has slowed. Commercial real

estate followed the same pattern, demand shrank, supply rose and prices fell.

Nevertheless, the slowdown has been relatively gentle and investment levels

have been higher than ever showing how much confidence players still have in

the French property market.

Citadel's portfolio which is wholly owned by CLS, has continued to perform well

in 2003 despite a more difficult market on the letting side.

Due to active management and close contacts with our letting teams and existing

tenants, we have contained the portfolio average vacancy rate over the year to

just 5 per cent compared to the average recorded of 6.8 per cent.

During the year, we have let new space or restructured leases covering 12,289

sq m (132,282 sq ft)or 9.73 per cent of the portfolio; these transactions

represented an average increase of Euro184.4K (�130.2K) or 8.4 per cent.

Lease indexation also produced a rental increase of Euro 561.5K (�396.4K) during

the year equating to 2.2 per cent. The resultant overall uplift in rental

income from lease restructuring and indexation was 2.9 per cent.

Renovation works were carried out to improve the common parts of several

properties such as the entry hall of Rue de La Ferme in Boulogne, the landings

of the Atria property in Rueil 2000, the entry hall of Chorus in Antibes and

the landings of Front de Parc in Lyon.

During the year we acquired a 538 sq m (5,791 sq ft) fully let property in

North Paris, adjacent to the Gare du Nord/Eurostar terminal, in rue Stephenson

at a cost of Euro1.1 million (�0.8 million).

In line with our continuing strategy of selling some smaller properties

acquired as part of the Hervet portfolio that do not meet our normal investment

criteria, we sold a 490 sq m (5,274 sq ft)vacant lot in Nanterre - rue de

l'Abb� Hazard - generating a small profit of Euro56K (�38K).

According to most operators, the market should recover in 2004 even if the

vacant stock is still significant which will necessarily exercise a certain

pressure on rental levels and rent free periods granted by the Landlords.

Consolidated Profit and Loss Account

for the year ended 31 December 2003

2003 2002

�000 �000

Net rental income (including associates & joint 63,833 60,328

ventures)

Continuing operations 63,319 60,328

Acquisitions 514 -

Less: Joint venture (continuing operations) (907) (907)

Joint venture (acquisitions) operations) (514) -

Group net rental income 62,412 59,421

Other income 3,903 1,289

66,315 60,710

Administrative expenses (15,437) (8,342)

Net property expenses (4,179) (3,998)

(19,616) (12,340)

Other operating losses (1,406) (3,054)

Group operating profit 45,293 45,316

Continuing operations 48,623 45,316

Acquisitions (3,330) -

Share of joint venture's operating profit (continuing 832 883

operations)

Share of joint venture's operating profit 511 -

(acquisitions)

Share of associate's operating loss (continuing (344) (93)

operations)

Share of associate's operating profit (acquisitions) 86 -

Operating profit including joint ventures and 46,378 46,106

associates

Gains/(losses) from sale of investment property 1,932 (153)

Profit on ordinary activities before interest 48,310 45,953

Interest receivable and similar income:

Group 2,135 1,915

Joint venture 3 1

Associate- -

Interest payable and similar charges:

Group (31,777) (29,925)

Joint venture (1,098) (860)

Associate - (17)

Profit on ordinary activities before taxation 17,573 17,067

Tax on profit on ordinary activities:

Group - current (655) (648)

- deferred 591 (1,497)

Joint ventures (21) -

Associates - -

Eferfered ta

Profit on ordinary activities after taxation 17,488 14,922

Equity minority interest 1,285 388

Retained profit for the year 18,773 15,310

Basic Earnings per Share 20.7 p 15.7 p

Diluted Earnings per Share 20.5 p 15.5 p

Consolidated Balance Sheet

at 31 December 2003

2003 2002

�000 �000

Fixed assets

Tangible assets 889,289 852,354

Investments:

Interest in joint ventures:

Share of gross assets 38,337 17,024

Share of gross liabilities (29,838) (14,257)

8,499 2,767

Interest in associates 3,225 1,730

Other investments 171 301

901,184 857,152

Current assets

Debtors - amounts falling due after more than one year 3,695 4,354

Debtors - amounts falling due within one year 7,976 9,156

Investments 3,963 4,580

Cash at bank and in hand 56,693 65,650

72,327 83,740

Creditors: amounts falling due within one year (53,249) (48,182)

Net current assets 19,078 35,558

Total assets less current liabilities 920,262 892,710

Creditors: amounts falling due after more than one year (529,575) (507,735)

Provisions for liabilities and charges (5,713) (13,255)

Net Assets 384,974 371,720

Capital and reserves

Called up share capital 21,911 23,532

Share premium account 68,928 68,551

Revaluation reserve 222,022 218,837

Capital Redemption Reserve 11,693 9,975

Other reserves 28,096 22,637

Profit and loss account 33,224 28,468

Total equity shareholders' funds 385,874 372,000

Equity minority interests (900) (280)

Capital employed 384,974371, 720

Consolidated Cash Flow Statement

for the year ended 31 December 2003

2003 2002

�000 �000

Net cash inflow from operating activities 52,432 52,143

Returns on investments and servicing of finance

Interest received 1,678 1,541

Interest paid (29,235) (26,598)

Issue costs on new bank loans (1,216) (2,196)

Interest rate caps purchased (225) (1,062)

Net cash outflow from returns on investments

and servicing of finance (28,998) (28,315)

Taxation (1,391) (223)

Capital expenditure and financial investment

Purchase and enhancement of properties (22,604) (90,270)

Sale of investment properties 23,562 1,802

Purchase of other fixed assets (4,208) (945)

Net cash outflow for capital expenditure

and financial investment (3,250) (89,413)

Acquisitions and disposals

Investment in associate/joint venture (6,664) (461)

Purchase of subsidiary undertaking (1,814) (92)

Cash acquired on purchase of subsidiary undertaking 572 228

Net cash inflow/(outflow) before use of

liquid resources and financing 10,887 (66,133)

Management of liquid resources

Cash released from/(placed on) short term deposits 2,004 (8,364)

Financing

Issue of ordinary share capital 474 90

New loans 25,485 113,935

Repayment of loans (29,230) (24,231)

Purchase of own shares (17,212) (14,007)

Net cash (outflow)/inflow from financing (20,483) 75,787

(Decrease)/increase in cash (7,592) 1,290

Statement of Total Recognised Gains & Losses

for the year ended 31 December 2003

2003 2002

�000 �000

Profit for the financial year 18,773 15,310

Unrealised (deficit)/surplus on revaluation of

properties (3,035) 7,530

Share of joint venture unrealised surplus on

revaluation of properties - 333

Release of revaluation deficit on property

disposal 20 443

Currency translation differences on foreign

currency net investments 15,091 11,489

Other recognised gains relating to the year 12,076 19,795

Total recognised gains and losses relating

to the year 30,849 35,105

Reconciliation of Historical Cost Profits & Losses

For the year ended 31 December 2003

2003 2002

�000 �000

Reported profit on ordinary activities

before taxation 17,573 17,067

Realisation of property revaluation gains

of previous years 3,432 -

Historical cost profit on ordinary

activities before taxation 21,005 17,067

Historical cost profit for the year retained

after taxation and minority interests 22,205 15,310

Reconciliation of Movements in Shareholders' Funds

for the year ended 31 December 2003

2003 2002

�000 �000

Profit for the financial year 18,773 15,310

Other recognised gains relating to the year 12,076 19,795

New share capital issued 474 90

Reduction in minority interest (237) -

Purchase of own shares (17,036) (13,831)

Expenses of share issue/purchase of own shares (176) (176)

Net additions to shareholders' funds 13,874 21,188

Opening shareholders' funds 372,000 350,812

Closing shareholders' funds 385,874 372,000

Reconciliation of Statutory to disclosed 'Adjusted' statistics

Statutory Deferred tax

figure adjustment Adjusted

figure

Net Assets �385.0 m �5.7m �390.7 m

NAV per share 439.2 p 6.5 p 445.7p

Earnings per share 20.7 p (0.7) p 20.0 p

Diluted earnings per 20.5 p (0.7) p 19.8 p

share

Gearing 126.9 % (1.8) % 125.1 %

Basis of preparation and accounting policies

The information contained in this preliminary statement does not constitute

accounts as defined by section 240 of the Companies Act 1985. The un-audited

results for the year to 31 December 2003 have been prepared in accordance with

UK generally accepted accounting principles. The accounting policies applied

are those set out in the Group's 2002 Annual Report and Accounts. The

information relating to the year ended 31 December 2002 is an extract from the

latest published accounts, which have been delivered to the Registrar of

Companies. The audit report on the published accounts was unqualified and did

not contain a statement under section 237 (2) or section 237 (3) Companies Act

1985.

For further information please contact:

Sten Mortstedt

Executive Chairman, CLS Holdings Plc

Tel. +44 (0)20 7582 7766

Tom Thomson

Vice Chairman and Chief Executive

Steven Board

Chief Operating Officer

Adam Reynolds / Ben Simons

Hansard Communications

Tel. +44 (0)20 7245 1100

END

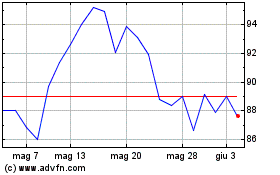

Grafico Azioni Cls (LSE:CLI)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Cls (LSE:CLI)

Storico

Da Lug 2023 a Lug 2024