CLS Holdings PLC - Re Tender Offer

06 Novembre 1998 - 8:30AM

UK Regulatory

RNS No 3162c

CLS HOLDINGS PLC

6th November 1998

The Tender Offer is not being made directly or indirectly in or into the

United States, Canada, Australia, South Africa, the Republic of Ireland or

Japan and this announcement should not be sent in or into the United States,

Canada, Australia, South Africa, the Republic of Ireland or Japan.

Proposed purchase of up to 2,890,966 Ordinary Shares

by way of a Tender Offer

Introduction

The Company announced on 25 September 1998 that the Board had decided, subject

to shareholders' approval, to purchase by way of a Tender Offer at 125p per

share up to 2,890,966 Ordinary Shares, representing approximately 1 Ordinary

Share for every 40 Ordinary Shares in issue.

In addition it is the Board's current intention to purchase up to 11,297,900

Ordinary Shares in accordance with the authority given to the Company at the

Company's last annual general meeting (in addition to the Ordinary Shares to

be re purchased pursuant to the Tender Offer).

The Company is today posting a document, together with a Tender Form, to

shareholders in connection with the Tender Offer.

Background to and reasons for the Tender Offer

The Company's shares are trading at a significant discount to its published

net assets per share of 160.8p as shown in the Company's unaudited interim

statement for the six months ended 30 June 1998. In addition, the Company has

free cash resources and the Board is of the view that the Tender Offer would

be an appropriate means of effecting a return of value to Shareholders. The

Board believes that non-participating shareholders will also benefit from the

Company purchasing Ordinary Shares since it expects that the Tender Offer will

enhance the Company's net assets per share. This should not be interpreted to

mean that net assets per share will necessarily be greater than in any

previous year.

The Tender Offer

The Board is proposing that the Company should make a Tender Offer to purchase

up to 2,890,966 Ordinary Shares, representing approximately 2.5 per cent of

the current issued ordinary share capital of the Company, at 125p per share.

This compares to the average middle market price of the Ordinary Shares for

the ten business days ending on 5 November 1998 of 105.9 p per share. In

addition, the interim dividend of 2.4p (net) per Ordinary Share in respect of

the six months ended 30 June 1998 will be paid on 27 November 1998 to

shareholders on the Company's share register at the close of business on 9

October 1998.

The Tender Offer will be open to all holders of Ordinary Shares on the

Company's share register on the Record Date who may participate in the Tender

Offer by tendering either all or a proportion of their registered holdings of

Ordinary Shares. Each Shareholder will be entitled to sell under the Tender

Offer up to 1 Ordinary Share for every 40 Ordinary Shares registered in his

name on the Record Date, rounded down to the nearest whole number of Ordinary

Shares. The Tender Offer will also present tendering Shareholders with an

opportunity to sell more than their pro rata entitlement of Ordinary Shares to

the extent that other Shareholders tender less than their pro rata

entitlement. If the number of Ordinary Shares validly tendered exceeds

2,890,966 and if and to the extent that any Shareholders have tendered less

than their pro rata entitlement under the Tender Offer, surplus tenders will

be accepted in proportion to the number of additional Ordinary Shares tendered

so that the total number of Ordinary Shares purchased pursuant to the Tender

Offer does not exceed 2,890,966.

No Ordinary Shares will be purchased in relation to the Tender Offer unless

the Resolutions to be proposed at the EGM of the Company to be held on 1

December 1998 are passed. The Tender Offer will be void if less than 1 per

cent of the issued ordinary share capital of the Company in aggregate is

tendered.

Tenders may only be made on Tender Forms which are personal to the

shareholder(s) named on it and may not be assigned or transferred.

A Tender Form once submitted cannot be withdrawn. To be valid, Tender Forms

must be received by the Receiving Agent no later than 3.00 pm on 27 November

1998.

Directors Intentions

The Directors have indicated their intention to tender 1 Ordinary Share for

every 40 Ordinary Shares in which they are beneficially interested.

Notification of Interests

Under section 198 of the Act, certain substantial Shareholders are required to

notify their interests in Ordinary Shares to the Company. Following the

Company's purchase of Ordinary Shares in relation to the Tender Offer, the

nominal value of the Ordinary Shares in which a Shareholder is interested when

taken as a percentage of the nominal value of the Company's issued ordinary

share capital may change giving rise to an obligation on the Shareholder to

notify the Company within two days of becoming aware of such change.

Extraordinary General Meeting

An extraordinary general meeting has been convened to be held at 6 Spring

Gardens, Citadel Place, Tinworth Street, London SE11 5EH on 1 December 1998 at

10.00 am at which the following Resolutions will be proposed:

(a) a special resolution to authorise the Company to purchase Ordinary Shares

pursuant to the Tender Offer;

(b) an ordinary resolution to approve purchases from Directors pursuant to

section 320 of the Act;

(c) an ordinary resolution on which a poll will be taken to approve the waiver

by the Panel of any Rule 9 obligation which may otherwise arise as a result of

such purchases; and

(d) an ordinary resolution on which a poll will be taken to approve the waiver

by the Panel of any Rule 9 obligation which may arise as a result of the

exercise by Glyn Hirsch of his share options.

Due to their interest in the Tender Offer, the Directors and their families

will abstain from voting on the ordinary Resolutions to approve the waivers by

the Panel at the EGM in respect of their combined interests of 53,249,739

Ordinary Shares representing approximately 46 per cent of the Company's issued

ordinary share capital.

Recommendation

The Directors, who have been so advised by HSBC Investment Banking, consider

that the Tender Offer and the other proposals described in the document to

shareholders are in the best interests of the Company and its shareholders as

a whole. In providing advice to the Directors, HSBC Investment Banking has

taken into account the Directors' commercial assessments. Accordingly, the

Directors unanimously recommend that shareholders vote in favour of the

Resolutions as they intend to do (other than in relation to the Resolutions to

approve the waivers by the Panel on which, due to their interests, they will

abstain from voting) in respect of their own holdings of 53,249,739 Ordinary

Shares, representing approximately 46 per cent of the issued ordinary share

capital of the Company.

S A Mortstedt

Executive Chairman

For further information, please contact:

Glyn Hirsch, Chief Executive, CLS Holdings plc 0171 582 7766

Brian Basham, Chris Skyrme, Basham and Coyle 0171 253 3300

In connection with the transactions described in this document, HSBC

Investment Banking, a division of HSBC Investment Bank plc which is regulated

by the Securities and Futures Authority Limited, is acting for CLS Holdings

plc and is not acting for anyone else and will not be responsible to anyone

other than CLS Holdings plc for providing protections afforded to customers of

HSBC Investment Banking or for advising them in relation to such transactions.

END

MSCAVUWKWKKARAA

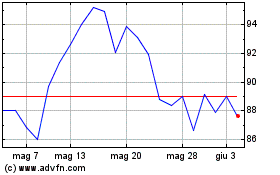

Grafico Azioni Cls (LSE:CLI)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Cls (LSE:CLI)

Storico

Da Lug 2023 a Lug 2024