easyJet plc (EZJ)

Trading Update for the year ended 30 September 2023 and Proposed Aircraft Purchase

12-Oct-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

12 October 2023

This release contains inside information

easyJet plc

('easyJet')

easyJet Trading Update for the year ended 30 September 2023 and Proposed Aircraft Purchase

easyJet delivers record Q4 PBT, thereby achieving in FY2023 its existing financial targets. Business momentum now

allows the setting of new, ambitious, medium-term targets, a proposed new aircraft order and resumption of dividends.

-- Record Q4 headline profit before tax expected to be between GBP650 - GBP670 million

? Passenger growth +8% YoY

? RPS +9% YoY vs guidance of c. 10%

? Ticket yield per passenger +9% YoY

? Ancillary yield per passenger +14% YoY

? CPS ex fuel flat YoY

-- Record H2 headline profit before tax expected to be between GBP850 - GBP870 million

? Passenger growth +7% YoY

? RPS +15% YoY

? CPS ex fuel reduced 1.3% YoY vs guidance of flat

-- FY23 headline PBT between GBP440 - GBP460 million

? easyJet holidays continues to outperform and is expected to deliver around GBP120 million PBT for FY23

-- Q1 FY24 Guidance

? Capacity c.15% ahead YoY

? Yields ahead YoY with load factors broadly in line

? Airline CPS ex fuel expected to slightly reduce YoY

-- New medium-term targets with the ambition to deliver >GBP1bn PBT

? Group PBT1 per seat of GBP7-10

? High teen ROCE2

? Holidays PBT1 to >GBP250m

? Capacity growth c.5% CAGR to 2028

-- Proposed aircraft purchase

? 157 firm orders for delivery between FY29 and FY34 and 100 Purchase Rights, subject to shareholder

approval

? Existing order book of 158 aircraft for delivery by FY29

? Conversion of 35 A320neo deliveries into A321neos within existing order

? 315 aircraft now on order for delivery by FY34 alongside a further 100 purchase rights

-- Proposed new shareholder returns policy, commencing with FY23 results, payable early 2024

? FY23 payout ratio of 10% of headline PAT

? FY24 payout ratio expected to rise to 20% of headline PAT

? Potential to increase level of future returns to be assessed over the coming years

Johan Lundgren, CEO of easyJet, said:

"We have delivered a record summer with strong demand for easyJet's flights and holidays with customers choosing us for

our network, value and service.

"This performance has demonstrated that our strategy is achieving results and so today we have set out an ambitious

roadmap to serve more customers and deliver attractive shareholder returns, underpinned by a continued focus on costs

and operational excellence. Our new medium-term targets provide the building blocks to deliver a PBT greater than GBP1

billion. This will be driven by reducing winter losses, upgauging our fleet and growing easyJet holidays. As part of

our commitment to shareholder returns, the Board intends to reinstate dividends commencing with the FY23 results.

"We have also reached a proposed agreement with Airbus for an additional 157 aircraft order and a further 100 purchase

rights. This will enable easyJet's fleet modernisation and growth to continue beyond 2028 while providing substantial

benefits including cost efficiencies and sustainability improvements."

Summary

easyJet expects its FY23 Group headline profit before tax to be between GBP440 million and GBP460 million with easyJet

holidays contributing around GBP120 million. Demand for easyJet's primary airport network has remained strong, delivering

a record financial performance for the Group this summer. Moving into the 2024 financial year, booking momentum is

continuing and we expect Q1 capacity to grow by c.15%. Ticket yields are ahead year on year with load factors broadly

in line. Our continued focus on cost alongside productivity and utilisation gains are expected to result in the Airline

cost per seat excluding fuel slightly reducing year on year in the December quarter.

Moving forward, easyJet has today updated its capital allocation framework to underpin the business's focus on serving

customers well whilst delivering attractive shareholder returns. Executing the four pillars of our strategy involves:

building Europe's best network, transforming revenue, delivering ease and reliability and driving our low-cost model

alongside capital discipline and disciplined growth. This, supported by easyJet's strong balance sheet, provides the

platform to deliver long term shareholder value with sustainable returns.

New medium-term targets

Having largely achieved easyJet's current medium term financial targets (mid-teen EBITDAR, easyJet holidays to deliver

>GBP100 million profit before tax and a low to mid teen ROCE), easyJet has today launched new, and ambitious, medium-term

targets, providing the building blocks to achieve a Group PBT per seat of between GBP7 to GBP10. The levers to achieving

this are reducing winter losses, growing easyJet holidays to deliver over GBP250 million of PBT and the cost savings that

our current Airbus order book will deliver from fleet efficiency and upgauging. In addition to the delivery of our

strategy, these targets are integral to achieving easyJet's ambition to deliver more than GBP1 billion PBT.

Proposed aircraft purchase and conversion

easyJet already has 69 A320neo family aircraft within its fleet and an existing order book with Airbus to FY29 for a

further 158 A320neo family aircraft still to be delivered. Alongside this, easyJet has now entered into conditional

arrangements with Airbus to secure the delivery of a further 157 aircraft (56 A320neo & 101 A321neo) between FY29 -

FY34 as well as 100 purchase rights (the "Proposed Purchase"). This provides easyJet with the ability to complete its

fleet replacement programme of A319 aircraft and replace approximately half of the A320ceo aircraft, alongside

providing the foundation for disciplined growth. The Company is in exclusive negotiations with CFM for the supply of

engines for the Proposed Purchase.

easyJet has also agreed to exercise conversion rights within its current order book to convert 35 A320neo deliveries

into A321neo aircraft (the "Conversion"). This alongside the Proposed Purchase will deliver lower fuel burn, CO2

emissions and operating costs per seat.

The Board believes the Proposed Purchase and the Conversion is in the interest of easyJet's shareholders, will support

positive returns for the business and is a core part of the delivery of our strategic objectives.

-- Commercial Terms: The financial terms of the agreement reached with Airbus for the Proposed Purchase are

attractive. They are the result of a comprehensive, detailed and competitive process which has been run over the

course of the last 12 months. This process covered both airframe (Airbus and Boeing) and engine (CFM and Pratt and

Whitney) manufacturers. The Board believes the terms secured represent extremely attractive value with improved

economics for future deliveries based on the commercial terms and fleet mix.

-- Securing Certainty of Aircraft Supply: The Group's ability to sustain its route network, maintain

desirable airport slots and to grow depends on the timely delivery of aircraft. Delivery slots for narrow body

aircraft with circa 200 seats are very limited until at least 2029 from both Airbus and Boeing. easyJet anticipates

that this limitation will extend into 2030 and beyond within the next year. By placing an order now, easyJet

ensures a supply of future delivery slots between FY29 and FY34 to retain its current scale through replacing

aircraft leaving the fleet and this enables easyJet to execute its disciplined growth strategy.

-- Maintaining Operational Scale: A proportion of the new aircraft will be used to replace older aircraft as

they reach the end of their useful life at easyJet. These aircraft will become economically unviable for our high

intensity low-cost operation and will need to be replaced if we are to maintain the current scale of our business.

-- Enabling Future Growth: The Proposed Purchase and Conversion provides easyJet with the opportunity to

grow its capacity through a combination of incremental aircraft and accelerated upgauging. This flexible fleet

planning means easyJet will have the opportunity to utilise the firm orders and the extension of leases of aircraft

within the existing fleet to increase the size of the airline should market conditions support growth. The 100

purchase rights provide easyJet with an opportunity to further grow depending on when they are delivered.

-- Cost Benefits of New Generation Technology: The new aircraft will continue the modernisation of the

easyJet fleet, with the average aircraft age dropping by 1.5 years from 9.9 years in FY23 to 8.4 years in FY33. The

new aircraft will deliver between a 13% to 30% unit fuel burn efficiency improvement (depending on which aircraft

they replace). The costs of carbon emissions are expected to increase over the coming years, and increased fuel

efficiency will lead to a proportional reduction in carbon emissions. Additionally, some airports provide

discounted fees for new generation aircraft, further enhancing the economic benefits.

-- Increased Aircraft Size: The Proposed Purchase and Conversion will accelerate the upgauging of the

airline, with the airline significantly increasing its proportion of 235 seat A321neo aircraft by FY33 through the

101 firm A321neos in the Proposed Purchase and 35 A320neo to A321neo conversions. This will result in further

improvements in cost efficiency, with the fixed costs of each flight spread across a greater number of passengers.

These economics see the A321 optimally deployed on a subset of the network where the A321neo's higher trip costs

are more than offset by its ability to capture additional revenue on routes which are typically high demand, slot

constrained or longer in sector length. The access to additional A321neo aircraft will also provide easyJet with

the opportunity to continue to grow in slot constrained airports.

-- Sustainability Benefits: The new aircraft are aligned with easyJet's sustainability strategy, with the

adoption of the more efficient new technology aircraft being a core component of easyJet's path to net zero

emissions. Alongside this, the new aircraft are significantly quieter, with half the noise footprint of the older

aircraft they are replacing.

Based on latest list prices for aircraft published in January 2018, the Proposed Purchase and the Conversion are

expected to result in an aggregate commitment of approximately USD19.9 billion, which will be spread over a number of

years. The aggregate actual price for the aircraft would be substantially lower because of certain price concessions

granted by Airbus.

The effect on easyJet's assets and liabilities will depend on the ownership structure of the aircraft which is decided

closer to the time of delivery. The payments under the Proposed Purchase and the Conversion will be financed over a

number of years through a combination of easyJet's internal resources, cash flow, sale and leaseback transactions and

debt. While the Board will regularly review optimal sources of financing, given the strength of easyJet's balance

sheet, there is currently no expectation that shareholders will be asked to fund any aspect of the Proposed Purchase

and the Conversion.

The scale of the Proposed Purchase means it is conditional on shareholder approval at a general meeting of the

shareholders (the "General Meeting"). A circular will be published in due course giving further details of the Proposed

Purchase and seeking shareholder approval at a General Meeting. easyJet is targeting completing the shareholder

approval process by the end of this calendar year.

Shareholder Returns

During FY23 the company has focussed on reducing debt. This has included the repayment of a EUR500 million bond in

February 2023 and the refinancing of the GBP1.4 billion UKEF facility where an additional USD950 million of gross debt was

repaid.

Given the financial performance in FY23 alongside easyJet's strong liquidity position, the board intends to pay a

dividend of 10% of FY23's headline profit after tax, payable in early 2024. The expectation is that this will rise to

20% of headline profits after tax in FY24, payable in early 2025. The Board is committed to maintaining regular returns

to shareholders, with the level of future return to be assessed over the coming years, taking into account market

conditions, capex requirements and progress towards the Group's new medium-term targets.

Capacity

During Q4 easyJet flew 28.6 million seats, a 9% increase on the same period last year when easyJet flew 26.3 million

seats. Load factor was 92% (Q4 FY22: 92%).

Passenger3 numbers in the quarter increased to 26.2 million (Q4 FY22: 24.3 million).

July August September Q4 Q4

2023 2023 2023 FY23 FY22

Number of flights 53,552 54,246 52,677 160,445 148,214

Peak operating aircraft 318 319 319 319 319

Passengers3 (thousand) 8,831 8,945 8,412 26,188 24,271

Seats flown (thousand) 9,540 9,667 9,384 28,591 26,299

Load factor4 93% 93% 90% 92% 92% Revenue, Cost and Liquidity

Total group revenue and headline costs for the fourth quarter

are expected to be around GBP3,120 million and around GBP2,460

million respectively. Pricing remained ahead year on year during

the quarter for both ticket and ancillary revenue, demonstrating

the continued success of easyJet's network optimisation and

ancillary products.

Significant fuel price increases year on year and the

strengthened USD have resulted in sterling fuel cost per seat being

+24% (+GBP4.59) vs the same period last year. Airline headline cost

per seat ex fuel was flat in the quarter due to inflationary

pressure within airports & ground handling and employee costs

compared to the same period last year being offset by capacity

increases driving utilisation benefits. The H2 airline cost per

seat ex fuel reduced 1.3% YoY compared to guidance of broadly

flat.

Financing costs reduced in the fourth quarter, due to the

increased interest rates on cash holdings, alongside the

significant reduction in gross debt year on year. Within financing

costs is a non-operating, non-cash FX loss of circa GBP10 million

(Q4 FY22: GBP30 million loss) from balance sheet revaluations.

easyJet continues to have one of the strongest, investment

grade, balance sheets in European aviation. As at 30 September 2023

our net cash position was c.GBP40 million (30 September 2022:

GBP670 million net debt). During the 2023 financial year,

c.GBP1.2bn of gross debt has been repaid. Given the current

liquidity and strong trading performance, easyJet intends to repay

the EUR500 million Eurobond maturing in October 2023.

(GBP'm) Low High

Q4 Group headline EBITDAR range GBP815 GBP835

Q4 Group headline EBIT range GBP655 GBP675

Q4 Group headline profit before tax range GBP650 GBP670

FY23 Group headline EBITDAR range GBP1,120 GBP1,140

FY23 Group headline EBIT range GBP460 GBP480

FY23 Group headline profit before tax range GBP440 GBP460

FY23 Company compiled consensus - Group headline profit before tax GBP451m

FY23 and Q4'23 numbers are circa and rounded to the middle of the range provided Q4'23 Q4'22 FY23 FY22

above and remain subject to audit

Passenger revenue (GBP'm) 1,970 1,679 5,220 3,816

Airline ancillary revenue (GBP'm) 790 641 2,170 1,585

Holidays revenue5 (GBP'm) 360 196 780 368

Group revenue (GBP'm) 3,120 2,516 8,170 5,769

Fuel costs (GBP'm) (675) (500) (2,030) (1,279)

Airline headline EBITDAR costs ex fuel (GBP'm) (1,315) (1,174) (4,345) (3,596)

Holidays EBITDAR costs5 (GBP'm) (305) (168) (665) (325)

Group headline EBITDAR costs (GBP'm) (2,295) (1,842) (7,040) (5,200)

Group headline EBITDAR (GBP'm) 825 674 1,130 569

Airline depreciation & amortisation (GBP'm) (159) (137) (655) (562)

Holidays depreciation & amortisation (GBP'm) (1) (1) (5) (4)

Group headline EBIT (GBP'm) 665 536 470 3

Airline financing costs excluding balance sheet revaluations (GBP'm) 0 (26) (57) (118)

Holidays financing costs excluding balance sheet revaluations (GBP'm) 5 1 10 1

Balance sheet revaluations (GBP'm) (10) (30) 27 (64)

Group headline PBT (GBP'm) 660 481 450 (178)

Airline passenger revenue per seat (GBP) 68.90 63.85 56.37 46.80

Airline ancillary revenue per seat (GBP) 27.51 24.36 23.47 19.43

Total airline revenue per seat (GBP) 96.41 88.21 79.84 66.23

Total airline RASK (p) 7.67 7.07 6.52 5.54

Airline headline cost per seat ex fuel (GBP) (51.84) (51.94) (54.30) (53.20)

Airline headline CASK ex fuel (p) (4.12) (4.16) (4.44) (4.45)

Airline fuel cost per seat (GBP) (23.60) (19.01) (21.95) (15.68)

Airline headline total cost per seat (GBP) (75.44) (70.95) (76.25) (68.88)

Group headline PBT per seat 23.08 18.28 4.86 (2.19)

Sector length (km) 1,258 1,248 1,224 1,193

Cash and money market deposits (GBP'bn) 2.9 3.6

Net cash/(debt) (GBP'm) 40 (670)

Fuel & FX Hedging (as at 06.10.23)

Jet Fuel H1'24 H2'24 H1'25 USD H1'24 H2'24 H1'25

Hedged position 73% 46% 17% Hedged position 73% 45% 18%

Average hedged rate (USD/MT) 866 822 821 Average hedged rate (USD/GBP) 1.22 1.24 1.25

Current spot (USD/MT) at 11.10.23 c.950 Current spot (USD/GBP) at 11.10.23 c.1.23

Conference call

There will be an Investor and analyst presentation at 09:00am

GMT on 12 October 2023 at Nomura, One Angel Lane, London, EC4R

3AB.

Alternatively, a webcast of the presentation will be available

both live and for replay (please register on the following link):

https://stream.brrmedia.co.uk/broadcast/651bf8e186684bfe61813beb

Dial in details are as follows: 0808 109 0700/+44 (0) 33 0551

0200 quoting easyJet trading update when prompted.

For further details please contact easyJet plc:

Institutional investors and analysts:

Michael Barker Investor Relations +44 (0) 7985 890 939

Adrian Talbot Investor Relations +44 (0) 7971 592 373

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Olivia Peters Teneo +44 (0) 20 7353 4200

Harry Cameron Teneo +44 (0) 20 7353 4200

A copy of this Trading Statement is available at

http://corporate.easyjet.com/investors

1) Headline result before non-headline items

2) ROCE is calculated by taking headline profit/loss before

interest and tax, applying tax at the prevailing UK corporation tax

rate at the end of the financial year, and dividing by the average

capital employed. Capital employed is shareholders equity,

excluding the hedging and cost of hedging reserves, plus net

debt.

3) Represents the number of earned seats flown. Earned seats

include seats which are flown whether or not the passenger turns

up, as easyJet is a no refund airline and once a flight has

departed, a no-show customer is generally not entitled to change

flights or seek a refund. Earned seats also include seats provided

for promotional purposes and to staff for business travel.

4) Represents the number of passengers as a proportion of the

number of seats available for passengers. No weighting of the load

factor is carried out to recognise the effect of varying flight (or

"sector") lengths.

5) easyJet holidays numbers include elimination of intercompany

airline transactions.

FY23 numbers are circa and rounded to the middle of the range

provided above and remain subject to audit.

This announcement may contain statements which constitute

'forward-looking statements'. Although easyJet believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct. Because these statements involve risks

and uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

The information contained within this announcement is deemed by

the company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended) ("UK MAR"). Upon the publication

of this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B7KR2P84

Category Code: TST

TIDM: EZJ

LEI Code: 2138001S47XKWIB7TH90

Sequence No.: 277470

EQS News ID: 1746979

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1746979&application_name=news

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

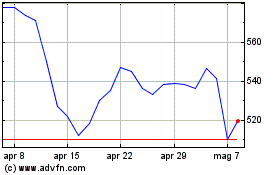

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Lug 2023 a Lug 2024