TIDMBIRD

RNS Number : 0717V

Blackbird PLC

29 November 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

29 November 2019

Blackbird plc

("Blackbird" or the "Company")

Placing to raise approximately GBP5.54 million

and

Notice of General Meeting

Blackbird plc (AIM: BIRD), developer and seller of the patented

market-leading cloud video editing platform Blackbird, is pleased

to announce an oversubscribed placing of 39,552,893 new ordinary

shares of 0.8 pence each in the Company ("Placing Shares") at a

price of 14 pence per share (the "Placing Price") to raise

approximately GBP5.54 million before expenses (the "Placing"), to

be undertaken in two tranches. The Placing was conducted by Allenby

Capital Limited ("Allenby Capital").

Transaction Highlights

-- The Placing Shares have been placed with existing and new

institutional investors, including existing shareholders, certain

Directors and family of the Directors.

-- Directors and family of the Directors have agreed to

subscribe for approximately GBP0.43 million in the second tranche

of the Placing.

-- Of the funds raised, approximately GBP1.49 million is

conditional, inter alia, on the approval of shareholders, at a

General Meeting of the Company to be held at 10:00 a.m. on 16

December 2019 (the "GM") of a resolution (the "Resolution") to

provide authority to the Directors to allot new ordinary shares

otherwise than on a pre-emptive basis, further details of which are

set out below.

-- The Placing Shares will represent approximately 11.80 per

cent. of the issued share capital of the Company as enlarged by the

issue of the Placing Shares.

-- The estimated net proceeds of the Placing, which will be

GBP5.22 million, will be used by the Company to:

o increase marketing expenditure in the U.S. and grow the

Company's presence there on the back of recent contract wins;

o bolster the team in the following areas: U.S. Sales,

Operations, Support and R&D;

o continue to develop the Company's product offering and

maintain a competitive advantage; and

o strengthen the Company's balance sheet, facilitating

longer-term deals with new customers.

-- The Directors believe that the Placing will significantly

enhance the ability of the Company to deliver on its strategic

plan.

Ian McDonough, Chief Executive Officer of Blackbird, said:

"These are very exciting times for Blackbird as we gain serious

traction with some of the world's largest and most high-profile

content producers. Our US focus is really bearing fruit as

demonstrated by the longer term deals at the US Department of State

and the recent announcement of our integration across the global

Bloomberg operation. We hope this will continue to blossom as our

OEM strategy really takes off. Early signs with IMG, Deltatre and

particularly TownNews show that they can scale up very quickly.

"The raising of funds is primarily to strengthen our balance

sheet as we enter into larger and longer contracts with bigger

companies. In addition, we want to build on the momentum to raise

our profile in the US market, to strengthen the team in key pinch

points across the organisation including US sales, operational

delivery, support and an additional head in the development

team."

A circular (the "Circular"), containing information in relation

to the Placing and a notice convening the General Meeting, is

expected to be sent to shareholders today. The General Meeting will

be held at 10.00 a.m. on 16 December 2019 at Tuition House, 27-37

St. George's Road, London SW19 4EU. The Circular will also shortly

be posted on the Company's website: www.blackbird.video.

Contacts

Blackbird plc Tel: +44 (0)20

8879 7245

Ian McDonough, Chief Executive Officer

Adrian Lambert, Marketing Director

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20

and Broker) 3328 5656

Nick Naylor

Nicholas Chambers

About Blackbird plc

Blackbird operates in the fast-growing SaaS and cloud video

market and has created the world's most advanced suite of

cloud-native computing applications for video, all underpinned by

its lightning-fast codec. Blackbird's patented technology allows

for frame accurate navigation, playback, viewing and editing in the

cloud. Blackbird underpins multiple applications, which are used by

rights holders, broadcasters, sports and news video specialists,

esports, live events and content owners, post-production houses,

other mass market digital video channels and corporations.

Since it is cloud-native, Blackbird removes the need for costly,

high end workstations and can be used from almost anywhere on

almost any device. It also allows full visibility on multi-location

digital content, improves time to market for live content such as

video clips and highlights for social media distribution, and

ultimately results in much more effective monetisation.

Blackbird(R) is a registered trademark of Blackbird plc.

Websites

www.blackbird.video

Social media

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

Further details of the Placing

The information contained below has been extracted from, and

should be read in conjunction with, the Circular. Terms defined in

the Circular shall have the same meanings where used in this

announcement.

Introduction

The Company announced earlier today a proposed placing to raise

approximately GBP5.54 million (before expenses) through the issue

of 39,552,893 new Ordinary Shares at the Placing Price in two

tranches: the First Placing Shares and the Second Placing

Shares.

The allotment of the Second Placing Shares is conditional, inter

alia, upon the passing of the Resolution to be proposed at the

General Meeting to provide sufficient authority to enable the

allotment of the Second Placing Shares and disapply statutory

pre-emption rights which would otherwise apply to the allotment of

the Second Placing Shares. Notice of the General Meeting, at which

the Resolution will be proposed, is set out at the end of this

document.

This document also contains the Directors' recommendation that

Shareholders vote in favour of the Resolution. The Directors intend

to vote in favour of the Resolution in respect of their own

beneficial holdings in the Company (including in the case of the

Investing Directors their respective family interests) which amount

in aggregate to 85,634,224 Ordinary Shares and represent

approximately 28.96 per cent. of the Company's Existing Ordinary

Shares.

The Directors believe that the Placing is the most appropriate

way to raise additional funds for Blackbird. The Directors consider

that the Placing provides greater certainty than other available

means of raising additional funds in a timely fashion and minimises

transactional costs.

The Placing Shares to be issued pursuant to the Placing are to

be admitted to trading on AIM, which, in the case of the First

Placing Shares, is expected to take place on 4 December 2019 and,

in the case of the Second Placing Shares and assuming that the

Resolution is passed at the General Meeting, is expected to take

place on 18 December 2019.

Business overview

Blackbird operates in the fast-growing SaaS and cloud video

market. It has created an advanced suite of cloud-native computing

applications for video, all underpinned by its lightning-fast

codec. The Company's patented technology allows for frame accurate

navigation, playback, viewing, editing and publishing in the cloud.

Blackbird's target audience is the news and sports sectors.

Since it is cloud-native, Blackbird removes the need for costly,

high end workstations and can be used from almost anywhere on

almost any device. It also allows full visibility of multi-location

digital content, improves time to market for live content such as

video clips and highlights for social media distribution, and

ultimately results in much more effective monetisation.

Current trading and prospects

Revenue increased by 27 per cent. to GBP0.48 million for the

six-month period ended 30 June 2019 compared to the corresponding

period last year. Deferred revenue and contracted order book were

GBP1.21 million at 30 June 2019, an increase of 86 per cent.

compared to 30 June 2018 and of 113 per cent. compared to 31

December 2018.

In North America, revenue for the six-month period ended 30 June

2019 increased by 152 per cent. year on year to GBP0.16 million

whilst revenue for the period from the sports sector increased by

64 per cent. year on year to GBP0.20 million reflecting the

Company's strategic focus on the sector.

Operating costs for the period were GBP1.42 million versus

GBP1.29 million in the corresponding period last year, net of

capitalised development costs of GBP0.20 million (2018: GBP0.11

million). The increase in costs has been driven through the

strengthening of the Company's staffing resources. The EBITDA loss

for the period was GBP1.02 million versus GBP0.97 million in the

corresponding period last year, whereas the loss for the period was

GBP1.19 million versus GBP1.27 million due to a lower amortisation

charge compared to the prior period.

Cash used in operations in the period was GBP1.04 million versus

GBP0.90 million in the same period last year.

Financial and commercial outlook

Blackbird started the second half of the year in a strong

position with contracted orders and deferred revenue at the highest

level in the Company's history at GBP1.21 million compared with

GBP0.57 million at 31 December 2018. This includes the new

multi-year deals with A+E Networks, which started post the period

end, and the extensions with TownNews and IMG.

At the end of September 2019, Blackbird was chosen by the U.S.

Department of State for video production, including the publishing

of fast turnaround digital news to its own and other online news

outlets. The contract awarded to Aperture Solutions Group,

Blackbird's U.S. partner, was for one year with multi-year

extension options. The contract value is a six-figure U.S. dollar

amount each year of the contract.

Recognition of Blackbird continues to grow. Blackbird exhibited

at the Google Cloud Partner Pavilion during the IBC conference, one

of the world's leading media, entertainment and technology shows,

in Amsterdam in September 2019. At this show Blackbird won a "What

caught my eye" award which was only presented to six of the

seventeen hundred exhibitors. In partnership with IMG, Blackbird

was also nominated for a "Best in fan engagement" award at the

Sports OTT summit in Madrid in November 2019 for its work on the

Open Golf Championship.

On 26 November 2019, Blackbird signed a multi-year deal with

Bloomberg Media. Bloomberg Media, a leading multi-platform global

business and financial media company, will utilise Blackbird for

simple, fast, collaborative video editing and publishing from the

cloud. Annual revenues from this deal will be significant for

Blackbird. After closing this deal, Blackbird's contracted order

book and deferred revenue stands at GBP2.01 million, a record level

for the Company and three and a half times larger than at 31

December 2018.

Blackbird has a track record of landing and expanding with

customers post contract wins. TownNews is on its fourth deployment

of Blackbird in the last 18 months, and, by the end of the year,

will be in forty-five local news stations compared to three in the

summer of 2018. IMG, a leading global producer and distributor of

sports media had already expanded before a new agreement earlier

this year which was the first multi-year deal and for increased

annual fees. Peloton, the Global fitness provider, started using

Blackbird to edit its on-demand virtual classes in one studio in

early 2019 and is now in four studios and a fifth one is planned.

The Company is confident that, as Blackbird is deployed, this land

and expand trend will continue with its recent contract wins.

Blackbird's commercial team continue to i) directly sell

Blackbird as a key infrastructure component in the technology stack

of major media and entertainment businesses and ii) pursue deals

with Original Equipment Manufacturers ("OEMs"), where Blackbird is

sold as part of an end-to end solution to the OEMs' customers. The

Company has a strong pipeline with multiple ongoing discussions

with large companies around the globe in these areas. As cloud

adoption becomes more prevalent, with its strong Blackbird platform

offering and with the right commercial team in place, the Company

is well positioned to exploit this.

Reasons for the Placing and use of proceeds

Pursuant to the Placing, the Company will receive gross proceeds

of approximately GBP5.54 million. The net proceeds from the

Placing, which will be approximately GBP5.22 million, will be used

by the Company to:

-- increase marketing expenditure in the U.S. and grow the

Company's presence there on the back of recent contract wins;

-- bolster the team in the following areas: U.S. Sales, Operations, Support and R&D;

-- continue to develop the Company's product offering and

maintain a competitive advantage; and

-- strengthen the Company's balance sheet, facilitating

longer-term deals with new customers.

The Directors believe that the net proceeds of the Placing will

significantly enhance the ability of the Company to deliver on its

strategic plan.

Details of the Placing and Admission

Under the Placing, the Company has conditionally raised

approximately GBP5.54 million (before expenses) through a placing

of 39,552,893 new Ordinary Shares at 14 pence per share with

institutional and other investors, including the Investing

Directors. The Company has entered into a Placing Agreement with

Allenby Capital under which Allenby Capital has agreed to use its

reasonable endeavours to procure Placees for the Placing Shares at

the Placing Price. The Placing has not been underwritten.

The Placing Shares will represent approximately 11.80 per cent.

of the Enlarged Share Capital. The Placing Price represents a

discount of approximately 21.13 per cent. to the closing mid-market

price on AIM of 17.75 pence per Existing Ordinary Share on 27

November 2019, being the last dealing day prior to publication of

this document.

The Company currently has limited authority to issue new

Ordinary Shares for cash on a non-pre-emptive basis. Accordingly,

the Placing is being conducted in two tranches.

The first tranche of the Placing, to raise a total of

GBP4,051,253.64 by the issue of 28,937,526 Ordinary Shares (being

the First Placing Shares) at the Placing Price, has been carried

out within the Company's existing share allotment authorities.

Application has been made for the First Placing Shares to be

admitted to trading on AIM and it is expected that admission (First

Admission) will take place on 4 December 2019. The allotment of the

First Placing Shares is conditional, inter alia, upon First

Admission and the Placing Agreement becoming unconditional in

respect of the First Placing Shares and not being terminated in

accordance with its terms prior to First Admission.

The second tranche of the Placing, to raise a total

GBP1,486,151.38 by the issue of 10,615,367 Ordinary Shares (being

the Second Placing Shares) at the Placing Price, is conditional

upon, inter alia, the passing of the resolution to be put to

shareholders of the Company at the General Meeting (granting the

Directors authority to allot the Second Placing Shares otherwise

than on a pre-emptive basis). In addition, the allotment of the

Second Placing Shares is conditional, inter alia, on the Placing

Agreement becoming unconditional in respect of the Second Placing

Shares and not being terminated in accordance with its terms prior

to Second Admission. It is expected that Second Admission will take

place on 18 December 2019.

The Placing Agreement contains, inter alia, customary

undertakings and warranties given by the Company in favour of

Allenby Capital as to the accuracy of information contained in this

document and other matters relating to the Company. Allenby Capital

may terminate the Placing Agreement in specified circumstances

prior to Admission, including, inter alia, for material breach of

the Placing Agreement or any other warranties contained in it and

in the event of certain force majeure events occurring.

The Placing Agreement is conditional so far as concerns the

First Placing upon, inter alia, First Admission occurring by not

later than 8.00 a.m. on 4 December 2019 (or such later time and/or

date as the Company and Allenby Capital may agree, not being later

than 8.00 a.m. on 18 December 2019). If such condition is not

satisfied or, if applicable, waived, the First Placing will not

proceed. The First Placing is not conditional upon the Second

Placing proceeding.

The Placing Agreement is conditional so far as concerns the

Second Placing upon, inter alia, Second Admission occurring by not

later than 8.00 a.m. on 18 December 2019 (or such later time and/or

date as the Company and Allenby Capital may agree, not being later

than 8.00 a.m. on 2 January 2020). If such condition is not

satisfied or, if applicable, waived, the Second Placing will not

proceed.

The Placing Shares will be issued credited as fully paid and

will rank pari passu in all respects with the Existing Ordinary

Shares, including the right to receive dividends and other

distributions declared on or after the date on which they are

issued.

It is expected that CREST accounts will be credited on the

relevant day of Admission and that share certificates (where

applicable) will be dispatched within 10 working days of each

Admission.

Related Party Transactions

Premier Miton Group plc ("Premier Miton"), which currently owns

57,766,728 Ordinary Shares representing 19.54 per cent. of the

Company's issued share capital at the date of this Circular, has

agreed to subscribe 5,000,000 Second Placing Shares as part of the

second tranche of the Placing. As a substantial shareholder of the

Company, Premier Miton is to be treated as a 'related party' in

accordance with the AIM Rules and its participation is a related

party transaction pursuant to Rule 13 of the AIM Rules. The

Directors of the Company, having consulted with Allenby Capital,

consider the terms of Premier Miton's participation in the Placing

to be fair and reasonable insofar as Shareholders are

concerned.

The following Directors have agreed to subscribe for Second

Placing Shares as part of the second tranche of the Placing:

At the date of this Following Second

Circular Admission

Number of Percentage No. of Number of Percentage

Ordinary of Existing Second Ordinary of Enlarged

Shares Ordinary Placing Shares Share

Investing Director held Shares Shares held Capital

Ian McDonough* 20,082,796 6.79% 2,670,008 22,752,804 6.79%

Stephen White - - 214,286 214,286 0.06%

Andrew Bentley 30,000 0.01% 71,429 71,429 0.03%

David Main* 1,035,714 0.35% 71,429 607,143 0.33%

Dawn Airey - - 71,429 71,429 0.02%

*and family interests

As directors of the Company, the Investing Directors are each to

be treated as a 'related party' in accordance with the AIM Rules.

Accordingly, the participation of the Investing Directors in the

Placing is a related party transaction pursuant to Rule 13 of the

AIM Rules. The Independent Director, having consulted with Allenby

Capital, considers the terms of the participation of the Investing

Directors in the Placing to be fair and reasonable insofar as

Shareholders are concerned.

Application for Admission

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is anticipated

that such admission will become effective and that dealings in the

First Placing Shares will commence at 8.00 a.m. on 4 December 2019

and that admission will become effective and dealings in the Second

Placing Shares will commence at 8.00 a.m. on 18 December 2019.

General Meeting

The notice convening the General Meeting to be held at Tuition

House, 27-37 St. George's Road, London SW19 4EU at 10.00 a.m. on 16

December 2019 is set out at the end of this document. At the

General Meeting, Shareholders will consider a resolution, to be

passed as a special resolution, to authorise the directors to allot

the Second Placing Shares and disapply Shareholders' statutory

pre-emption rights which would otherwise apply to the allotment of

the Second Placing Shares.

The Resolution, if passed, would also authorise the directors to

allot Ordinary Shares free of shareholders' pre-emption rights up

to an additional nominal value of GBP236,549 (representing 10 per

cent. of the Company's issued share capital as at today's date) to

maintain the level of the Directors' authority to allot Ordinary

Shares other than on a pre-emptive basis granted at the Company's

annual general meeting held earlier this year.

Action to be taken by Shareholders

You can submit your proxy electronically through the website of

the Company's registrars, Link Asset Services, at

www.signalshares.com. The electronic submission of proxy must be

received at least 48 hours before the time of the General Meeting.

To vote online you will need to log in to your share portal account

or register for the share portal if you have not already done so

and you will require your investor code. Once registered, you will

be able to vote immediately. Voting by proxy prior to the General

Meeting does not affect your right to attend the General Meeting

and vote in person should you so wish. Further information

regarding the appointment of proxies and online voting can be found

in the notes to the Notice of General Meeting.

Instructions for voting by proxy through CREST are set out in

paragraph 10 of the notes to the Notice of General Meeting.

In the case of non-registered Shareholders who receive these

materials through their broker or other intermediary, the

Shareholder should complete and send a letter of direction in

accordance with the instructions provided by their broker or other

intermediary.

In order for the Second Placing to proceed, Shareholders will

need to approve the Resolution set out in the Notice of General

Meeting. If the Resolution is not passed at the General Meeting,

the Second Placing will not proceed in the form currently

envisaged, with the result that the anticipated net proceeds of the

Placing will be reduced and the Company will be unable to implement

in full the anticipated use of funds set out above.

Directors' Recommendation

The Board of Blackbird considers the Placing to be in the best

interests of the Company and its shareholders as a whole and

therefore the Directors unanimously recommend that shareholders

vote in favour of the Resolution as they intend to do in respect of

their own shareholdings (including in the case of the Investing

Directors their respective family interests) of, in aggregate,

85,634,224 Ordinary Shares (representing approximately 28.96 per

cent. per cent. of the Company's existing issued share

capital).

Total Voting Rights

Following First Admission, the Company's enlarged issued share

capital will comprise 324,623,725 Ordinary Shares, with voting

rights. The Company does not hold any Ordinary Shares in treasury.

Therefore, the total number of Ordinary Shares in the Company with

voting rights will be 324,623,725.

Following Second Admission, the Company's enlarged issued share

capital will comprise 335,239,092 Ordinary Shares, with voting

rights. The Company does not hold any Ordinary Shares in treasury.

Therefore, the total number of Ordinary Shares in the Company with

voting rights will be 335,239,092.

These figures may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

MAR

The Market Abuse Regulations (EU) No. 596/2014 (MAR) became

effective from 3 July 2016. Market soundings, as defined in MAR,

were taken in respect of the Placing with the result that certain

persons became aware of inside information, as permitted by MAR.

That inside information is set out in this announcement and has

been disclosed as soon as possible in accordance with paragraph 7

of article 17 of MAR. Therefore, those persons that received inside

information in a market sounding are no longer in possession of

inside information relating to the Company and its securities.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the

"Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through

all distribution channels as are permitted by MiFID II (the "Target

Market Assessment"). Notwithstanding the Target Market Assessment,

investors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

Placing Shares offer no guaranteed income and no capital

protection; and an investment in Placing Shares is compatible only

with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, only investors who have met the criteria

of professional clients and eligible counterparties have been

procured. For the avoidance of doubt, the Target Market Assessment

does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of MiFID II; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

Placing Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEDMMZMGRFGLZZ

(END) Dow Jones Newswires

November 29, 2019 02:00 ET (07:00 GMT)

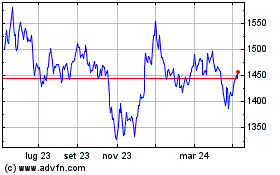

Grafico Azioni Ft Fbt (LSE:FBT)

Storico

Da Nov 2024 a Dic 2024

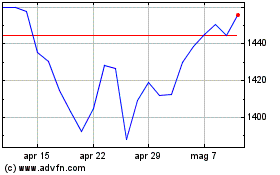

Grafico Azioni Ft Fbt (LSE:FBT)

Storico

Da Dic 2023 a Dic 2024