Falcon Oil & Gas Ltd. - Filing of Interim Financial Statements

28 Novembre 2024 - 8:00AM

UK Regulatory

Falcon Oil & Gas Ltd. - Filing of Interim Financial Statements

FALCON OIL & GAS LTD.

(“Falcon” or

“Company”)

Filing of Interim Financial

Statements

28 November 2024 - Falcon Oil & Gas Ltd.

(TSXV: FO, AIM: FOG) announces that it has filed its interim

financial statements for the three and nine months ended 30

September 2024 and the accompanying Management’s Discussion and

Analysis (“MD&A”).

The following should be read in conjunction with

the complete unaudited unreviewed interim financial statements and

the accompanying MD&A for the three and nine months ended 30

September 2024, which are available on the Canadian System for

Electronic Document Analysis and Retrieval (“SEDAR+”) at

www.sedarplus.ca and on Falcon’s website at

www.falconoilandgas.com

2024 financial highlights and other

financial updates

- Debt free with cash of $10

million at 30 September 2024 (31 December 2023: $8 million).

- Continued focus on cost management

and the efficient operation of the portfolio.

Ends.

CONTACT DETAILS:

|

Falcon Oil & Gas Ltd.

|

|

|

Philip O'Quigley, CEO |

+353 87 814 7042 |

|

Anne Flynn, CFO |

+353 1 676 9162 |

Cavendish Capital Markets Limited (NOMAD

& Broker)

|

Neil McDonald / Adam Rae |

+44 131 220 9771 |

Interim Condensed Consolidated Statement

of Operations and Comprehensive Loss

(Unaudited)

|

|

Three months ended 30

September 2024

$’000 |

Three months ended 30

September 2023

$’000 |

Nine months ended 30

September 2024

$’000 |

Nine months ended 30

September 2023

$’000 |

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

Oil and natural gas revenue |

- |

- |

- |

- |

|

|

- |

- |

- |

- |

| |

|

|

|

|

|

Expenses |

|

|

|

|

| Exploration and

evaluation expenses |

(44) |

(39) |

(130) |

(129) |

| General and

administrative expenses |

(523) |

(739) |

(1,601) |

(1,914) |

| Foreign exchange

gain |

91 |

38 |

133 |

85 |

|

|

(476) |

(740) |

(1,598) |

(1,958) |

|

|

|

|

|

|

| Results

from operating activities |

(476) |

(740) |

(1,598) |

(1,958) |

| |

|

|

|

|

| Finance

income |

365 |

43 |

193 |

155 |

|

Finance expense |

(132) |

(352) |

(393) |

(647) |

|

Net finance income / (expense) |

233 |

(309) |

(200) |

(492) |

|

|

|

|

|

|

|

Loss and comprehensive loss for the period |

(243) |

(1,049) |

(1,798) |

(2,450) |

|

|

|

|

|

|

| Loss and

comprehensive loss attributable to: |

|

|

|

|

| |

|

|

|

|

| Equity holders of

the company |

(247) |

(1,046) |

(1,798) |

(2,444) |

| Non-controlling

interests |

4 |

(3) |

- |

(6) |

|

|

|

|

|

|

|

Loss and comprehensive loss for the period |

(243) |

(1,049) |

(1,798) |

(2,450) |

|

|

|

|

|

|

Loss per share attributable to equity holders of the company:

|

|

|

|

|

|

Basic and diluted |

(0.000 cent) |

(0.001 cent) |

(0.002 cent) |

(0.002 cent) |

Interim Condensed Consolidated Statement of Financial

Position

(Unaudited)

|

|

|

At 30 September

2024

$’000 |

At 31 December

2023

$’000 |

|

|

|

|

|

|

Assets |

|

|

|

| Non-current

assets |

|

|

|

| Exploration and

evaluation assets |

|

50,721 |

51,287 |

| Property, plant and

equipment |

|

- |

2 |

| Trade and other

receivables |

|

26 |

26 |

|

Restricted cash |

|

2,199 |

2,176 |

|

|

|

52,946 |

53,491 |

|

|

|

|

|

| Current

assets |

|

|

|

| Cash and cash

equivalents |

|

9,965 |

7,992 |

|

Trade and other receivables |

|

946 |

54 |

|

|

|

10,911 |

8,046 |

|

|

|

|

|

|

Total assets |

|

63,857 |

61,537 |

|

|

|

|

|

| Equity and

liabilities |

|

|

|

| |

|

|

|

|

Equity attributable to owners of the

parent |

|

|

|

| Share capital |

|

406,690 |

402,120 |

| Contributed

surplus |

|

47,444 |

47,379 |

|

Retained deficit |

|

(408,995) |

(407,197) |

|

|

|

45,139 |

42,302 |

|

Non-controlling interests |

|

697 |

697 |

|

Total equity |

|

45,836 |

42,999 |

|

|

|

|

|

|

Liabilities |

|

|

|

| Non-current

liabilities |

|

|

|

|

Decommissioning provision |

|

16,679 |

16,204 |

|

|

|

16,679 |

16,204 |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

Accounts payable and accrued expenses |

|

1,342 |

2,334 |

|

|

|

1,342 |

2,334 |

|

|

|

|

|

|

Total liabilities |

|

18,021 |

18,538 |

|

|

|

|

|

|

Total equity and liabilities |

|

63,857 |

61,537 |

Interim Condensed Consolidated Statement of Cash

Flow

(Unaudited)

| |

|

Nine months ended 30 September |

|

|

|

2024

$’000 |

2023

$’000 |

|

|

|

|

|

| Cash flows

from operating activities |

|

|

|

| Net loss for the

period |

|

(1,798) |

(2,450) |

| Adjustments

for: |

|

|

|

| Share based

compensation |

|

65 |

276 |

| Depreciation |

|

2 |

3 |

| Net finance

expense |

|

200 |

482 |

| Effect of exchange

rates on operating activities |

|

(133) |

(85) |

| Change in non-cash

working capital: |

|

|

|

| Increase in trade

and other receivables |

|

(893) |

(19) |

| Increase /

(decrease) in accounts payable and accrued expenses |

|

920 |

(36) |

|

Net cash used in operating activities |

|

(1,637) |

(1,829) |

| |

|

|

|

| Cash flows

from investing activities |

|

|

|

| Interest

received |

|

31 |

165 |

| Proceeds from sale

of ORRIs |

|

4,000 |

- |

| Exploration and

evaluation assets |

|

(5,153) |

(647) |

|

Net cash used in investing activities |

|

(1,122) |

(482) |

| |

|

|

|

| Cash flows

from financing activities |

|

|

|

|

Net proceeds from equity raised |

|

4,570 |

- |

Net cash generated from financing activities

|

|

4,570 |

- |

| Change in cash and

cash equivalents |

|

1,811 |

(2,311) |

| Effect of exchange

rates on cash and cash equivalents |

|

162 |

(320) |

| Cash and cash

equivalents at beginning of period |

|

7,992 |

16,785 |

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

9,965 |

14,154 |

All dollar amounts in this document are in

United States dollars “$”, except as otherwise indicated.

About Falcon Oil & Gas

Ltd.

Falcon Oil & Gas Ltd is an international oil

& gas company engaged in the exploration and development of

unconventional oil and gas assets, with the current portfolio

focused in Australia, South Africa and Hungary. Falcon Oil &

Gas Ltd is incorporated in British Columbia, Canada and

headquartered in Dublin, Ireland with a technical team based in

Budapest, Hungary.

For further information on Falcon Oil & Gas

Ltd. please visit www.falconoilandgas.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Certain information in this press release

may constitute forward-looking information. This information is

based on current expectations that are subject to significant risks

and uncertainties that are difficult to predict. Actual results

might differ materially from results suggested in any

forward-looking statements. Falcon assumes no obligation to update

the forward-looking statements, or to update the reasons why actual

results could differ from those reflected in the forward

looking-statements unless and until required by securities laws

applicable to Falcon. Additional information identifying risks and

uncertainties is contained in Falcon’s filings with the Canadian

securities regulators, which filings are available at

www.sedarplus.ca

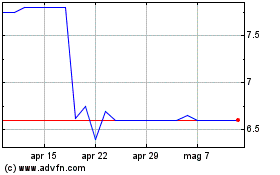

Grafico Azioni Falcon Oil & Gas (LSE:FOG)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Falcon Oil & Gas (LSE:FOG)

Storico

Da Dic 2023 a Dic 2024