Interim Results - Amendment

28 Giugno 2005 - 3:26PM

UK Regulatory

RNS Number:1565O

Hardide PLC

28 June 2005

Press Release 28 June 2005

The following replaces the Interim Results announcement released today at 7.00am

under RNS number 1174O.

In the Proforma Profit and Loss Account '000 has been removed from the column

headings.

The full amended release appears below.

Hardide plc

Interim Results for the Period to 4 April 2005

Hardide plc ("Hardide" or "the Company"), the provider of unique surface

engineering technology, announces its maiden set of interim results. The

interim results cover the trading of Hardide plc from its formation on 27

January 2005 to completion of the AIM admission and fundraising on 4 April 2005.

The pro forma results cover the trading of the operating subsidiary Hardide

Coatings Limited for the six months to 31 March 2005, which was acquired by

Hardide plc on 7 March 2005.

Financial highlights

* Turnover #496,134 (H1 2004 #124,633)

* Operating Loss reduced to #281,222 (H1 2004 #519,204)

* Loss before Tax reduced to #273,364 (H1 2004 #531,204)

* Successful listing on AIM in April 2004 raising net proceeds of #1.4

million

* Supplier status attained with BAE Systems

* Appointment of Financial Controller

Commenting on the results, Jim Murray-Smith, Chief Executive of Hardide plc,

said:

"I am delighted to report the maiden set of interim results for Hardide. Our

successful flotation on AIM which raised #1.4 million will help Hardide achieve

its strategic goals. We are particularly encouraged by the number of new

customers who are adopting Hardide as a solution provider. Our approved supplier

status with BAE Systems is another excellent endorsement of our product. I am

confident that our good performance outlined in these results will continue in

the months ahead."

For further information:

Hardide plc

Jim Murray Smith, Chief Executive Tel: +44 (0) 1869 353 830

jmurray-smith@hardide.com www.hardide.com

Seymour Pierce

Sarah Wharry / Jeremy Porter, Corporate Finance Tel: +44 (0) 207 107 8000

Media enquiries:

Abchurch

Peter Curtain / Chris Lane Tel: +44 (0) 207 398 7700

chris.lane@abchurch-group.com www.abchurch-group.com

Chairman's Statement

The six months to 31 March 2005 have been an exceptionally busy period in the

Company's short history.

Your Board took the decision in December 2004 to list the Company on AIM to

raise its profile and to raise funds to accelerate expansion. The Company

appointed advisers early in the New Year and was admitted to trading on AIM on 4

April 2005, having raised #1.75 million, before costs. The funds raised will

enable Hardide to reach the next stage in its development, expand into other

geographical markets and consolidate on the Company's success to date.

I must pay a special vote of thanks to your executive directors, Jim

Murray-Smith and Yuri Zhuk for their hard work. Jim's drive and enthusiasm

ensured a successful fundraising and float without the Company's trade

performance suffering.

The Board is confident of the Company's trading for the remainder of the

financial year as the customer base expands.

David Chestnutt

Chairman

Chief Executive's Report

I am pleased to have this opportunity to comment on Hardide's first set of

interim accounts since its admission to AIM on 4 April this year. You will note

that the Interim Report reflects the position of the listed Plc Company, which

of course acquired the business of Hardide Ltd (now Hardide Coatings Ltd)

immediately prior to the flotation, and therefore, the Plc accounts as filed

allow no opportunity for comparison with previous trading periods. In order for

our progress to be clearly seen I have had added a Pro Forma Profit and Loss

Account relevant to the operational business for the past three six-month

periods.

Consequently I am able to report solid progress both in the continued

development of our customer base across our chosen fields of operation and also

success in consolidating our position as a reliable and worthy supplier to what

are now becoming our established customers. This progression is clearly

demonstrated by steady increases in turnover over the past three six-month

periods.

The successful fundraising in April, which was oversubscribed, means we are well

positioned to maintain our combined strategy of growing the business by new

customer conversion and continuing to improve our customer performance. The

funds are being used mainly for investment in new plant, recruitment and

marketing to take advantage of opportunities in the energy and general

engineering sectors. This investment, coupled with the IPO, will help raise our

profile to reposition the Company as a global participant in the surface

technology market.

The flotation has enabled the Company to put additional infrastructure in place,

including the appointment of a Financial Controller with a proven track record

in industry. Peter Davenport was previously a Financial Controller at the UK arm

of Valspar Corporation, a NYSE-listed company involved in the manufacture of

coatings.

Recent additions to our Sales, Accounting and Production teams, together with

further investment in state-of-the-art measurement and pre-treatment equipment,

underscore your management's commitment to driving the business forward in an

efficient and professional manner. We are much encouraged by the number of new

customers evaluating and adopting Hardide as a solution provider and by the

position these organisations fill in their respective markets.

Our intention, announced on 25 April, to establish a sales and manufacturing

facility in Houston, Texas, was well received by our customers both in the US

and elsewhere. The investment will address the growing demand for Hardide's

products in the oil and gas sector. The official opening of the Houston sales

office took place on 27 June. To reinforce supply to UK and European customers

and to meet the increasing demand for our products, we have also commissioned a

new pre-treatment plant at Bicester.

Supply relationships with our key customers are advancing and I am delighted to

report that Hardide has recently received approval to act as a supplier to BAE

Systems.

Interest shown in the Company among potential customers and business partners

during and since the Offshore Technology Conference in Houston, USA, in May

2005, has been most encouraging, and we look forward to extending our customer

base through these potential opportunities.

We are confident that our positive performance will continue in the months

ahead.

Jim Murray-Smith

Chief Executive

HARDIDE COATINGS LIMITED (FORMERLY HARDIDE LIMITED)

PROFORMA PROFIT AND LOSS ACCOUNT

SIX MONTHS ENDED 31 MARCH 2005

Six months Six months Six months

ended 31 ended 30 ended 31

March 2005 September 2004 March 2004

(unaudited) (unaudited) (unaudited)

# # #

Turnover 496,134 206,368 124,633

Cost of Sales (204,781) (163,984) (130,016)

Gross Profit 291,353 42,384 (5,384)

Administrative Expenses (618,553) (554,680) (540,320)

Other Income 45,978 26,500 26,500

Operating Loss (281,222) (485,797) (519,204)

Interest receivable 9,952 8,000 -

Interest payable and similar charges (2,094) (6,668) (12,000)

Loss on ordinary activities before

taxation (273,364) (484,465) (531,204)

GROUP PROFIT AND LOSS ACCOUNT

FOR THE PERIOD FROM 27 JANUARY 2005 TO 4 APRIL 2005

27 January 2005

to 4 April 2005

(unaudited)

Notes #'000

Turnover 100

Cost of sales 30

Gross profit 70

Administrative expenses (158)

Operating loss (88)

Profit on disposal of operations -

Income from other fixed assets investments -

Other income 23

Loss on ordinary activities before

investment income, interest and taxation (65)

Other interest receivable 4

Interest payable and similar charges -

Loss on ordinary activities before

taxation (61)

Taxation on loss on ordinary activities -

Loss on ordinary activities after

taxation (61)

Minority interest: equity -

Dividends received -

Loss for the financial year attributable

to members of the parent company (61)

Loss per share: basic and diluted (pence

per share) 2 (0.05)

There are no recognised gains or losses other than the loss for the period.

GROUP BALANCE SHEET

FOR THE PERIOD FROM 27 JANUARY 2005 TO 4 APRIL 2005

Unaudited

4 April

2005

Notes #'000

Fixed assets

Intangible assets 9,772

Tangible assets 1,032

-----

10,804

-----

Current assets

Stock 35

Debtors 4 390

Cash at bank and in hand 1,909

-----

2,334

Creditors: amounts falling due within one year (578)

-----

Net current assets 1,756

-----

Creditors: amounts falling due after one year (73)

-----

Net assets 12,487

=====

Capital and reserves

Called up share capital 1,275

Share premium reserve 11,273

Profit and loss account (61)

-----

Total shareholders' funds 5 12,487

The interim financial report was approved by the board of directors on 27 June

2005 and was signed on their behalf by:

J S Murray-Smith

Director

GROUP CASH FLOW STATEMENT

AT 4 APRIL 2005

Notes 27 January 2005

to 4 April 2005

(unaudited)

#'000

Cash outflow from operating

activities 6 (47)

_________

Returns on investment and servicing of finance

Interest element of finance lease rental payments -

Interest received -

Dividends received -

__________

-

__________

Taxation

Taxation paid -

__________

Capital expenditure and financial investment

Payments to acquire tangible fixed

assets (48)

Payments to acquire intangible fixed assets

__________

(48)

__________

Acquisitions and disposals

Net cash transferred with subsidiary

undertakings 454

__________

-

__________

Net cash inflow before financing (359)

__________

Financing

Issue of shares 1,550

__________

1,550

__________

Increase in cash 1,909

NOTES TO THE INTERIM REPORT

FOR THE PERIOD ENDED 4 APRIL 2005

1. ACCOUNTING POLICIES

(i) Basis of preparation

The interim report for the period ended 4 April 2005 is unaudited and does not

constitute statutory accounts within the meaning of Section 240 of the Companies

Act 1985. It has been prepared under the historical cost convention and on a

basis consistent with the accounting policies used to prepare audited accounts

of the company's wholly owned subsidiary Hardide Coatings Limited for the year

ended 30 September 2005.

(ii) Basis of consolidation

The group financial statements consolidate the financial information of the

company and of its subsidiaries. The financial information for each company in

the group has been prepared to 4 April 2005.

2. EARNINGS PER SHARE

The calculation of basic and diluted loss per share is based on loss of #61,000

the period ended 4 April 2005 and on the weighted average number of ordinary

shares in the period of 127,493,242.

3. INVESTMENTS

(a) Subsidiary Undertakings

Company No. of Type of Share Nominal Nature of

business

Shares Shares Capital Value

#

Hardide Coatings

Limited 1,927,706 Ordinary 100% 0.10 Surface Coating

4. DEBTORS Unaudited

4 April

2005

#'000

Trade debtors 265

Other debtors 125

__________

390

__________

NOTES TO THE INTERIM REPORT (continued)

FOR THE PERIOD ENDED 4 APRIL 2005

5. RECONCILIATION OF MOVEMENT IN EQUITY SHAREHOLDERS' FUNDS

Unaudited

4 April

2005

#'000

Group

(Loss)/profit for the period (61)

On issue of shares 12,548

On share for share exchange -

__________

------------

Increase in shareholders' funds 12,487

Opening shareholders' funds -

__________

-------------

Closing shareholders' funds 12,487

6. RECONCILIATION OF OPERATING LOSS TO NET CASH OUTFLOW FROM OPERATING

ACTIVITIES

Unaudited

4 April

2005

#'000

Operating loss (20)

Depreciation of tangible fixed assets 17

Increase in operating debtors and prepayments (93)

Increase in stocks (18)

Increase in operating creditors and accruals 67

Amortisation of goodwill -

__________

Cash inflow from operating activities 47

7. COPIES OF THE INTERIM REPORT

Copies of this Interim Report will be posted to shareholders and further copies

will be available from the Company's office at Unit 11, Wedgwood Road, Bicester,

Oxfordshire OX26 4UL.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EADKPAFLSEFE

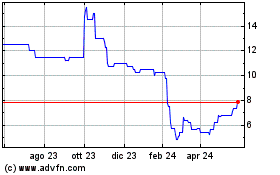

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

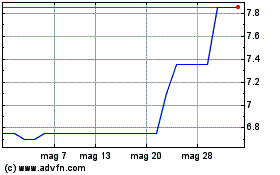

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024