RNS Number:5453V

Hardide PLC

13 December 2005

Press Release 13 December 2005

Hardide plc

("Hardide" or "the Company")

Preliminary Results for the Period to 30 September 2005

Hardide plc, the provider of unique surface engineering technology, announces

its maiden set of preliminary results which cover the trading of Hardide plc

from its formation on 27 January 2005 to the Company's year end on 30 September

2005. The pro forma results cover the trading of the operating subsidiary

Hardide Coatings Limited, which was acquired by Hardide plc on 7 March 2005, for

the twelve months to 30 September 2005.

Highlights

* Proforma turnover of #1,088,615 (2004: #330,878)

* Proforma operating loss reduced to #705,884 (2004: #1,005,202)

* Proforma loss before tax reduced to #701,490 (2004: #1,016,937)

* Strong order book

Commenting on the results, Jim Murray-Smith, Chief Executive of Hardide plc,

said: "This is an encouraging set of results with Company turnover increasing

three-fold on a proforma basis, and losses substantially reduced as expected.

"Demand for Hardide's product is strong and our order book places the Company on

a solid footing for 2006. The coming year will be another important period for

Hardide as we continue our impressive history of new customer acquisition. I

look to forward to updating shareholders in the near future."

For further information:

Hardide plc

Jim Murray Smith, Chief Executive Tel: +44 (0) 1869 353 830

jmurray-smith@hardide.com www.hardide.com

Seymour Pierce

Sarah Wharry / Jeremy Porter, Corporate Finance Tel: +44 (0) 20 7107 8000

Media enquiries:

Abchurch

Henry Harrison-Topham / Chris Lane Tel: +44 (0) 20 7398 7700

chris.lane@abchurch-group.com www.abchurch-group.com

Chairman's Statement

Hardide has made sound progress in the last year, which incorporated our listing

on the AIM market and has resulted in this solid set of Preliminary Results.

Notable was the success achieved in establishing relationships with leading

companies in the forefront of the drive for technologies that improve the life

of components and optimise performance. Market conditions in our target sectors

and a healthy order book augurs well for 2006.

The coming year will also see a significant uplift in the scale and complexity

of our operations. The challenge will be to build on the opportunities

presented by the strength of the oil & gas and aerospace markets and to

capitalise on our international potential. We are well placed to exploit these

prospects and have embarked on a strategic plan geared to the realisation of our

ambitions.

We remain firmly focused on growing our core business through a combination of

building new and existing customers, new technology, international expansion and

excellent customer service. Hardide has an exciting future and I am confident

that 2006 will see the Company achieve ever more significant growth.

The Board would like to thank the management team and staff for their hard work

and commitment during this time, in particular Chief Executive Officer, Jim

Murray-Smith, for his vision and dedication in steering the Company through a

challenging and exciting year. His leadership of the Company and employees

resulted in a smooth and successful flotation in a year that encompassed strong

growth in all of Hardide's core markets.

David Chestnutt

Chairman

Chief Executive's Report

I am delighted to report Hardide's maiden set of Preliminary Results since the

Company's flotation on AIM in April 2005, when we raised #1.4 million to enable

Hardide to move on to the next stage of its development.

This set of preliminary results covers the period of trading from Hardide plc's

formation on 27 January 2005 to the Company's year end on 30 September 2005.

For direct comparison, we have included 12 month pro forma accounts for

Hardide's sole operating subsidiary, Hardide Coatings Limited, for the period to

30 September 2005. This proforma set of accounts clearly demonstrates Hardide's

progress throughout the period.

Turnover for Hardide Coatings' has increased three-fold in the year ended 30

September 2005 to #1.09 million, with total income increasing to #1.2 million.

This solid performance is attributable to the generation of additional business

from existing customers, new customer gains as well as international expansion.

For the quarter ending 30 September 2005, Hardide's UK coatings business

achieved an EBITDA positive position and the UK manufacturing base and

headquarters at Bicester, Oxfordshire is now complete and fully operational.

I am pleased to report that such progress is being achieved with existing

customers in the UK and Europe. Its scale of advance is demonstrated by sales

more than trebling in the oil & gas, valve and pump sectors over the year. The

Company's developing US business has also made a significant contribution with

sales more than doubling. This growth in the US has been achieved in spite of

the extended supply line to the territory.

Post flotation, the Company invested #100,000 in a new pre-treatment plant at

Bicester. This has enabled the Company to expand the range of materials that

can be coated with Hardide, thereby opening up new markets and customers. The

in-house pre-treatment plant further improves reliability and speeds up customer

component turnaround time, resulting in enhanced productivity and greater

customer satisfaction.

Hardide's patented technology is used in three main areas:

* Oil & Gas

* Valves and Pumps

* Aerospace

Oil & Gas

In the UK, the offshore oil & gas industry continues to be one of the most

important industrial sectors of the economy, both in contribution to economic

activity and capital expenditure. In 2005, oil prices surged to more than $70 a

barrel and the International Energy Agency also revised its 2010 oil price

forecast from last year's US $33 a barrel to US $45 a barrel, an increase of

more than a third.

In an environment where hydrocarbons are valued highly, the operating and

service companies (Hardide's customers) are driven to optimise the management

and productivity of existing oilfields to maximise the value that can be

extracted from these assets.

In this battle to exploit maximum value from both mature assets and from new

found oil and gas fields, the industry is seeing increasing problems developing

due to wear and corrosion of parts. The consequential costs are significant.

Components that benefit from Hardide's unique patented coating are now in use in

a large number of exploration and production (E&P) fields around the world. By

coating components with Hardide, their longevity is increased which in turn

helps to reduce downtime. This further reduces the challenges from high cost E&

P that operators face, thereby offering enormous operational and financial

benefits to oil companies, service companies and license holders.

Hardide exhibited at two of the world's largest energy events in 2005, namely

Offshore Technology Conference (Houston, USA) and Offshore Europe (Aberdeen,

Scotland). Our presence greatly raised international awareness of Hardide and

interest has been encouraging. Introductions made at the exhibitions have

resulted in customer trials which, I am happy to report, are progressing well.

These trials are the first step and a pre-requisite for sales.

Valves and Pumps

The Hardide coating is gaining acceptance as a proven technology in the UK and

European valve markets. The Company's business in this sector increased nearly

four-fold in 2005 and continues to grow with new customers being secured on a

monthly basis. The new pre-treatment plant has underpinned this growth as we

are now able to offer our customers fast turnaround times at premium prices.

Among the top four Houston-based valve manufacturers, annual sales are estimated

to be in excess of US $1 billion. Whilst the Company is currently in

development work with US-based customers, it will be extremely difficult to

achieve volume and highly profitable sales without a fully operational coating

facility in Houston that will enable us to match European turnaround times.

With most of the refining capacity around the world needing to be refurbished to

cope with increasing volumes of highly corrosive sour crude oil, the demand for

Hardide's tungsten carbide coating, which provides essential corrosion and wear

resistance to valves, is likely to increase dramatically. I am happy to report

that trials with suppliers to the refining industry are progressing well and

that we recently gained approved supplier status from a leading international

energy company from which we are already receiving revenue.

The pump market is an important part of the worldwide engineering business and

revenues from this sector have also increased more than three-fold in 2005. I

anticipate business from European customers in this sector to grow

substantially. The Company is working with, and receiving monthly orders from,

one of the world's leading pump manufacturers that is based in the US. However,

I firmly believe the potential of the US market can only be fully exploited with

the development of a domestic coating facility.

Aerospace

Since expanding into the aerospace sector in April 2005, Hardide has made

significant progress and has won approved supplier status from BAE Systems. We

also successfully completed our first orders to coat components for their

Eurofighter Typhoon. Other parts are under trial for BAE Systems and we are now

in discussions with other leading aircraft manufacturers, including a FTSE 100

aerospace and engineering firm.

Hardide can offer an unrivalled solution to improving performance and longevity

of components for both commercial and military aircraft, where the prevention of

corrosion and seizure is essential. I have been extremely encouraged by our

early exploration of this sector and look forward to it playing a major role in

our growth.

New Facility

In line with our strategy to invest for further growth, the Company's intention

to establish a sales and manufacturing facility in Houston, Texas was announced

in April 2005 and a sales office was established in July 2005. The production

facility will service the US oil & gas market as well as Hardide's existing

customers in the pump and valve sectors. Equipment supply lead times and

commissioning times are fairly extended at eight months; consequently your Board

is currently considering the timing and methodology of this next significant

step in the Company's growth. In the meantime, three key administration,

technical and sales positions have been filled to ensure seamless

knowledge-transfer from the UK and to handle the current level of enquiries that

are being received.

Health and Safety/Environment

Hardide is committed to maintaining the highest standards of health and safety

and protection of the environment. The Company's health and safety record is

exemplary.

Environmental protection is fundamental to the Company's operations and we are

continually looking for ways to eliminate the potential for any environmental

impact. The Company will aim to achieve ISO 14001, the internationally

recognised standard for Environmental Management Systems (EMS), accreditation in

the next year. I believe this to be a market-leading move for a smaller

organisation and one which will further enable us to work with the leading

international companies in our target sectors.

Furthermore, the pre-treatment plant investment included the installation of a '

best practice' solvent-based component cleaning process allowing us to maximise

surface preparation efficiency while exceeding environmental and safety

regulations.

Research and Development (R&D)

R&D will play a vital role by ensuring that the Company remains at the forefront

of advances in surface engineering technology. As the Company focused attention

on getting the UK and European facility fully operational, R&D has taken a back

seat over the last year. It is now our intention to further develop our R&D

activity over the next twelve months primarily to investigate additional Hardide

coating variants.

People

At the heart of Hardide lies a technically superb and dedicated team of

individuals who have channelled their talent to moving Hardide so far forward

this year. In 2005, the team was strengthened by three key management

appointments in the UK and two in the US. In the UK, Peter Davenport joined as

Chief Financial Controller bringing ten years financial management experience;

latterly with the UK subsidiary of NYSE-listed global coatings company Valspar

Corporation. Additionally, two UK-based sales and management positions were

created to spearhead our move into the international oil & gas, and aerospace

industries. Barry Vineall has been appointed Technical Sales Manager to focus

on the aerospace market and brings with him six years engineering and business

development experience from AF Aerospace. Jeff Rutland has also joined as

Projects Manager from worldwide oilfield services provider Schlumberger, where

he held engineering and management positions over a five year period. Each

brings extensive market understanding and contacts in the Company's key growth

sectors.

In Houston, Brian White and Larry Reed have been appointed as Technical Manager

and Sales Manager respectively. Brian has nearly 20 years coatings research and

development, and production experience. He joins from international product and

service supply company, Smith International, Inc. in Houston where he spent

eight years in their R&D materials and coatings operations. Larry has over 30

years sales management experience, the last ten with Cooper Cameron Valves where

he sold valves to the oil & gas, petrochemical and other industries.

I believe these appointments will enable us to develop and manage the interest

generated within each of the Company's target sectors.

Outlook

It is clear that significant progress has been made during the last year with

more than three-fold growth, an ever-increasing customer base and demand for new

applications from existing customers.

I view the future with optimism as the Company sits poised on the edge of major

breakthroughs in two immense global markets, oil & gas and aerospace, while at

the same time buoyant conditions prevail in our niche position within the valve

and pump sectors.

I believe that these encouraging conditions in the surface technology market

across the Company's chosen sectors are set to continue and will fuel demand for

Hardide's technology on the back of which I am confidant of delivering growing

returns for our shareholders.

Jim Murray-Smith

Chief Executive Officer

HARDIDE PLC

PROFORMA PROFIT & LOSS ACCOUNT

HARDIDE COATINGS LTD

Year ended Year ended

30 September 30 September

2005 2004

# #

Turnover 1,088,615 330,878

Cost of sales (458,518) (106,784)

Gross profit 630,097 224,094

Other operating income 90,869 52,587

Administrative expenses

Administration 1,190,897 1,113,686

Amortisation 4,956 4,954

Depreciation 230,997 163,243

(1,426,850) (1,281,883)

Operating loss (705,884) (1,005,202)

Interest receivable and similar income 13,026 7,631

Interest payable and similar charges (8,632) (19,366)

Loss on ordinary activities before taxation (701,490) (1,016,937)

Taxation on loss on ordinary activities - 44,246

Loss on ordinary activities after taxation (701,490) (972,691)

GROUP PROFIT AND LOSS ACCOUNT

FOR THE PERIOD ENDED 30 SEPTEMBER 2005

From 27 January

2005 to

30 September 2005

#'000

Turnover 692

Cost of sales (283)

Gross profit 409

Administrative expenses

Administration 864

Amortisation (40)

Depreciation 146

(970)

Operating loss (561)

Other income 68

Loss on ordinary activities before interest and taxation (493)

Other interest receivable 19

Interest payable and similar charges (7)

Loss on ordinary activities before taxation (481)

Taxation on loss on ordinary activities -

Loss on ordinary activities after taxation (481)

Loss per share: basic and diluted (pence per share) 0.4

There are no recognised gains or losses other than the loss for the period ended

30 September 2005 of #481,000. All results relate to acquisitions made during

the year.

GROUP BALANCE SHEET

AS AT 30 SEPTEMBER 2005

30 September

2005

#'000

Fixed assets

Tangible assets 1,100

Intangibles (46)

1,054

Current assets

Stock 63

Debtors 459

Cash at bank and in hand 1,107

1,629

Creditors: amounts falling due within one year (313)

Net current assets 1,316

Creditors: amounts falling due after one year (314)

Net assets 2,056

Capital and reserves

Called up share capital 1,275

Share premium reserve 1,262

Profit and loss account (481)

Shareholders' funds 2,056

The financial statements were approved by the board on 12th December 2005 and

signed on behalf of the board of directors.

J Murray-Smith

Director

COMPANY BALANCE SHEET

AT 30 SEPTEMBER 2005

30 September

2005

#'000

Fixed assets

Investment in subsidiaries 1,100

1,100

Current assets

Debtors 713

Cash at bank and in hand 646

1,359

Creditors: amounts falling due within one year (12)

Net current assets 1,347

Net assets 2,447

Capital and reserves

Called up share capital 1,275

Share premium reserve 1,262

Profit and loss account (90)

Shareholders' funds 2,447

The financial statements were approved by the board on 12th December 2005 and

signed on behalf of the board of directors.

J Murray-Smith

Director

GROUP CASH FLOW STATEMENT

FOR PERIOD ENDED 30 SEPTEMBER 2005

30 September

2005

#'000

Cash outflow from operating activities (851)

Returns on investment and servicing of finance

Interest element of finance lease rental payments (7)

Interest received 19

12

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (245)

Acquisitions and disposals

Net cash transferred with subsidiary undertakings 456

Net cash outflow before financing (628)

Financing

Issue of shares 1,437

Repayment of finance lease (20)

New finance lease agreements 318

1,735

Increase in cash 1,107

Notes

1. The financial information contained in this announcement does not represent

the full statutory accounts of the group.

2. Statutory accounts for the period ended 30 September 2005 have not yet been

delivered to the Registrar of Companies. They will carry an unqualified

audit report and no statement under section 237 (2) or (3) of the Companies

Act 1985.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ILFSDFILFLIE

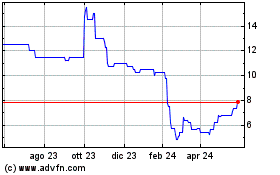

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

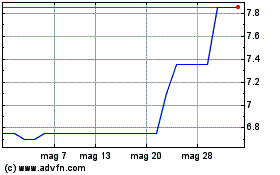

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024