RNS Number:1333N

Hardide PLC

04 December 2006

Press Release 4 December 2006

Hardide plc

("Hardide" or "the Company")

Preliminary Results for the Period to 30 September 2006

Hardide plc, the provider of unique surface engineering technology, announces

its preliminary results which cover trading for the year ended on 30 September

2006.

Highlights

* Turnover increased to #1.89 million (2005*: #0.69 million)

* Gross profit increased to #1.07 million (2005*: #0.41 million)

* Loss after tax** #0.91 million (2005*: #0.48 million)

* Successful opening of Hardide's manufacturing facility in Houston, Texas,

on budget and ahead of schedule

* Strengthened Board

* Trading improving following customer inventory reduction

* Successful fundraising of #2.34 million during the year, #1.80m cash on the

balance sheet at the period end

* The figures for 2005 cover the period from the Company's formation on 27

January 2005 to 30 September 2005.

** after #0.14m R&D tax credit

Commenting on the results, Jim Murray-Smith, Chief Executive of Hardide plc,

said: "These results are in line with expectations and demonstrate Hardide's

continued strong growth. The opening of the US manufacturing facility in

Houston, which was achieved ahead of schedule and on budget, will further drive

revenues.

"We are experiencing buoyant market conditions in all of our key markets and

have the capacity to install additional furnaces in both the UK and the US to

satisfy this increased demand."

For further information:

Hardide plc

Jim Murray Smith, Chief Executive Tel: +44 (0) 1869 353 830

jmurray-smith@hardide.com www.hardide.com

Daniel Stewart & Company plc

Paul Shackleton, Corporate Finance Tel: +44 (0) 207 776 6550

paul.shackleton@danielstewart.co.uk www.danielstewart.co.uk

Media enquiries:

Abchurch

Chris Lane / Laura Riascos de Castro Tel: +44 (0) 20 7398 7700

chris.lane@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

These results represent another year of solid growth for Hardide. The Board

took the decision in November 2005 to exploit the interest shown in Hardide's

unique technology by US-based energy companies by setting up a manufacturing

facility in Houston, Texas, the energy capital of the world. The Company

raised combined funds of #2.34 million (before expenses) in December 2005 and

May 2006 through the issue of 18,886,494 New Ordinary Shares, in part to

accelerate Hardide's development plans in Houston, and also to employ and train

additional staff to apply the Hardide process. In nine months, the site in

Houston was transformed from a greenfield project to an operational coatings

facility with local people being trained in the technology. The plant is

ideally located in the heart of the energy community, with state-of-the-art

production facilities operated by highly-qualified staff. Although early in the

site's development, the furnace has produced validation product for an existing

US customer as well as test components for both new and current customers.

The last year has again been a significant period of development for the Group

and I would like to thank Hardide's Chief Executive, Jim Murray-Smith, for

leading the management team and staff over this time.

In March 2006, Peter Davenport was appointed to the Board of Hardide as Finance

Director and I welcome him to the role. Peter has already made a major

contribution to the Hardide management team.

The Board is confident that Hardide is well-placed to make solid and continuing

progress over the next financial year and beyond as it engages new customers and

new applications in the UK and overseas.

David Chestnutt

Chairman

1 December 2006

CHIEF EXECUTIVE'S STATEMENT

The last financial year has been extremely busy for Hardide, with significant

progress made in sales and international expansion. Sales increased to #1.89

million in the year ended 30 September 2006, from #0.69 million reported for the

Group for the previous period. This represents a 73% increase over the previous

full year sales of #1.09 million for the Group's operating subsidiary, Hardide

Coatings Limited.

Substantial increases are reported across all of the Group's key sectors of oil

and gas, valves, pumps and aerospace. This performance is attributable to new

business generation, further increases in demand for parts from existing

customers, and it reflects the high level of customer satisfaction that Hardide

is delivering.

I am delighted to report that our Houston manufacturing plant opened within

budget and a month ahead of schedule on 1 September 2006.

These results were achieved despite two short-term, customer-related issues

outside of our control which affected the Company's performance against market

forecasts. As previously announced, one of the Company's major oil and gas

customers reduced its inventory during the year, resulting in lower than

expected sales. Significantly, Hardide remains the specified supplier for this

customer and orders have returned to previous levels. Furthermore, we have

recently converted two new applications for the customer, with more in trial in

both the UK and US. The strength of the oil price also led our major energy

customers to focus their resources on maintaining high levels of production; the

effect has been a slow down in field-testing and a longer conversion time for

customers intending to purchase the Hardide coating. Crucially, field-testing

continues to produce impressive results with the majority of customers going on

to incorporate the Hardide technology.

UK FACILITY

I am pleased to report a 73% like-for-like increase in sales despite the

customer inventory reduction and slowdown in testing. The high level of repeat

orders and new parts in test are a healthy indicator of customer confidence.

Aerospace activity has progressed well with Hardide Coatings Limited receiving

formal approved supplier status with BAE Systems and orders ongoing under strict

purchasing and quality procedures.

Over the last year, we have seen customers draw increasingly on our engineering

resources whereby we work closely with the customer to add value from the design

stage through to manufacture. This turnkey service sets us apart from competing

technologies and enables us to maximise the effectiveness of the coating while

giving us greater control over timelines and quality.

To nurture and support new talent in the business, we have worked closely with

Salford University, which runs the first UK MSc/PgDip in Vacuum Engineering and

Applications. The Company has staff on the management board of the course and

we see this as a valuable potential source of trained technical specialists as

the business grows.

US FACILITY

The Houston plant has received an extremely warm welcome from our existing and

prospective US customers and we have a backlog of interest from the top tier of

Houston-based energy services companies as well as the aerospace sector. There

are a number of different US parts in test which we expect will lead to further

new customers and applications. Existing US customers are committing to

increasing their order schedule now that the new plant is open and operational.

HEALTH, SAFETY AND THE ENVIRONMENT

The Group's health and safety record remains exemplary. Operating within strict

environmental frameworks is essential to working with the market-leaders in our

target sectors. We have demonstrated our commitment to environmental

responsibility by appointing an Environmental Officer to manage our activity in

this area. Over the past year, the Group has been working towards ISO 14001 and

is on-track to secure this accreditation. Hardide is committed to an

environmental supply chain and we are currently reassessing our suppliers to

ensure that they adhere to our environmental policy.

RESEARCH AND DEVELOPMENT

Last year I noted our intention to resume R&D activity into additional Hardide

coating variants. Our strategy has proven successful as we secured the US

patent for a new tungsten carbide adhesive and protective coating for industrial

diamond crystals. The Group's R&D programme is ongoing and our development of a

new low-slip coefficient coating continues to make progress. R&D will assume

even greater significance over the next twelve months as we take one of the

original UK furnaces out of commercial service and dedicate it to the

development of the next generation of ultra-high performance coatings.

MARKETING

Notable sales leads were generated at the two largest energy exhibitions of

2006; the Offshore Technology Conference in Houston, USA and the Global

Petroleum Show in Calgary, Canada. Quality leads were also created as the Group

made its debut at the Farnborough Airshow and attended the premier worldwide

valve show in Maastricht, Holland. Each of these shows has led to a number of

the new trials in the UK and US; these trials are a fundamental pre-requisite

for sales and the majority are with blue chip industrial companies.

Hardide has enjoyed a high and positive media profile over the last year

featuring in a large cross-section of quality national, business and technical

media in the UK and US. The website (www.hardide.com) was also redeveloped,

incorporating new sections and features designed specifically for our technical,

investor and media audiences.

OUTLOOK

The Company has a robust strategy where we position ourselves in close proximity

to the markets with the highest potential. I am encouraged by the market

conditions in all our operating areas and we will continue to invest in people,

equipment and R&D. I am confident that we have the technology and talent to

continue the Hardide growth story during the course of the next year and beyond.

I would like to give my personal thanks to our employees in the UK and US for

their commitment and hard work during the last year which is so crucial to our

growing business.

Jim Murray-Smith

Chief Executive Officer

1 December 2006

FINANCIAL REVIEW

The Group result for the year was a loss after tax of #906k. The last published

results for the Group were for the period 27 January to 30 September 2005, in

which the Group made a loss after tax of #481k. The increased loss was due

primarily to the investment in our new US facility, as well as the impact of a

full year's loss in the Plc of #319k (27 January to 30 September 2005: loss of

#90k). The Group's UK operating subsidiary, Hardide Coatings Limited, reduced

its full year loss from #701k in 2005 to #162k in 2006.

Having reported at the half year turnover of #1,063k, the Group was hit by a

sudden and unexpected inventory reduction by one of our largest customers over

the summer, which reduced our turnover in the second half of the year to #828k.

While this level of turnover and consequent impact on our profitability was

disappointing, it is comforting that activity with this customer has now

returned to normal levels, and the demand for Hardide coated product from the

end user has remained strong throughout the period.

On a like for like basis, turnover at our UK operating subsidiary rose from

#1.09m in 2005 to #1.89m, an increase of 73%. This increase was evenly spread

across each of our existing sales sectors (oil & gas, pumps, valves, and

aerospace). It is testament to the effectiveness of the Hardide product that

during the year we started coating production quantities of 21 new parts from

existing customers. The Group's sales to US customers rose to #367k in 2006

from #91k reported last year, which together with the number of Hardide coated

products in field trials with some of the largest US oil & gas companies,

provides sound backing for the board's decision to open a facility in Houston,

Texas.

In spite of the increase in turnover and the expansion of the Group, we have

been effective at keeping working capital under control. Levels of stock

excluding work in progress were #76k at the year end (2005: #41k), and trade

debtors reduced to #287k from #339k in 2005. The Group had a year end cash

balance of #1,803k.

There were increases in some of our costs of sales during the year. The Hardide

process uses Tungsten Hexafluoride, the cost of which has increased by 13% since

this time last year. Now that the Group is purchasing globally significant

quantities of this gas, we are exercising our purchasing power with the aim of

achieving major price reductions. We have also started to manage the entire

supply chain for certain customers as part of our competitive offering, which

increases turnover but at a lower margin.

Group overheads were #2,160k in the year, compared with #970k reported for the

previous period. Most of the increase is due to the increased length of period

reported, with additional overheads caused by the opening of our Houston

facility. During the year the Group invested in exhibiting at four major trade

shows during the year, which have provided a rich source of sales leads.

Group expenditure on fixed assets amounted to #978k in the year, of which #627k

was for our Houston plant. Of the remaining #351k, #170k was payments for the

construction of a new furnace for our Bicester plant, which was delivered in

late November. This new furnace will both increase production capacity and

allow one of our older furnaces to be taken out of front-line production and

released for research and development purposes. The arrival of the additional

furnace and the need to accommodate the overall increase in production has led

to the Group leasing additional factory space.

Given the size of the Group and its stage of development, it is appropriate that

the board has given prominence to monitoring the financial health of the Group

over the past year. The board also monitors a range of non-financial key

performance indicators including furnace performance, delivery performance and

product conformance. The board is now in the process of developing a wider

range of non-financial key performance indicators which will form the basis of

performance review in the coming year.

Peter Davenport

Finance Director

1 December 2006

HARDIDE PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended 30 September 2006

27 January -

2006 30 September 2005

Note #'000 #'000

Turnover 2 1,891 692

Cost of sales (817) (283)

Gross profit 1,074 409

Administrative expenses

Amortisation 36 40

Depreciation (325) (146)

Other administration (1,871) (864)

Total administrative expenses (2,160) (970)

Other operating income 2 68

Operating loss (1,084) (493)

Net interest 36 12

Loss on ordinary activities (1,048) (481)

before taxation

Tax on loss on ordinary 3 142 -

activities

Loss for the financial year (906) (481)

Loss per share basic and diluted 4 (0.7)p (0.4)p

All operations are continuing.

HARDIDE PLC

CONSOLIDATED BALANCE SHEET AS AT 30 SEPTEMBER 2006

30 September 30 September

2006 2005

Note #'000 #'000

Fixed assets

Intangible assets

Goodwill 71 76

Negative goodwill (81) (122)

(10) (46)

Tangible assets 1,753 1,100

1,743 1,054

Current assets

Stocks 102 63

Debtors 588 459

Cash at bank and in hand 1,803 1,107

2,493 1,629

Creditors: amounts falling due (584) (313)

within one year

Net current assets 1,909 1,316

Total assets less current 3,652 2,370

liabilities

Creditors: amounts falling due (216) (314)

after one year

Net assets 3,436 2,056

Capital and reserves

Called up share capital 1,467 1,275

Share premium account 3,345 1,262

Profit and loss account (1,376) (481)

Shareholders' funds 5 3,436 2,056

HARDIDE PLC

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 September 2006

27 January -

Note 2006 30 September 2005

#'000 #'000

Net cash outflow from operating activities 6 (581) (851)

Returns on investments and servicing of finance

Interest received 60 19

Finance lease interest paid (24) (7)

Net cash inflow from returns on investments and 36 12

servicing of finance

Taxation 35 -

Capital expenditure and financial investment

Purchase of tangible fixed assets (978) (245)

Net cash outflow from capital expenditure and financial (978) (245)

investment

Acquisitions and disposals

Net cash transferred with subsidiary undertakings - 456

Net cash inflow from acquisitions and disposals - 456

Financing

Issue of shares 2,375 1,750

Capital element of finance lease rentals (91) (20)

New finance lease agreements - 318

Expenses paid in connection with share issues (100) (313)

Net cash inflow from financing 2,184 1,735

Increase in cash 7 696 1,107

STATEMENT OF CONSOLIDATED TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 30 September 2006

27 January -

2006 30 September 2005

#'000 #'000

Loss for the financial year (906) (481)

Currency differences on foreign 11 -

currency net investments

Total recognised loss for the (895) (481)

year

HARDIDE PLC

NOTES TO THE PRELIMINARY ANNOUNCEMENT

For the year ended 30 September 2006

1. BASIS OF PREPARATION

The preliminary announcement has been prepared in accordance with applicable

accounting standards and under the historical cost convention.

The principal accounting policies of the group have remained unchanged from the

previous year.

2. SEGMENTAL INFORMATION

Turnover by origin Turnover by destination

27 January - 27 January -

2006 30 September 2005 2006 30 September 2005

#'000 #'000 #'000 #'000

UK 1,891 692 1,509 593

USA - - 367 91

Other - - 15 8

1,891 692 1,891 692

Group loss before taxation

27 January -

2006 30 September 2005

#'000 #'000

UK (584) (481)

USA (464) -

Group loss before (1,048) (481)

taxation

Group net assets

27 January -

2006 30 September 2005

#'000 #'000

UK 2,806 2,056

USA 630 -

Group net assets 3,436 2,056

3. TAXATION ON ORDINARY ACTIVITIES

(a) Analysis of credit in the year:

27 January -

2006 30 September 2005

#'000 #'000

Current tax:

Research and development tax credit 57 -

Adjustment in respect of prior years 85 -

research and development tax credits

142 -

(b) Factors affecting current tax charge:

The tax assessed on the loss on ordinary activities for the year is lower than

the standard rate of corporation tax in the UK of 19% (2005: 19%)

27 January -

2006 30 September 2005

#'000 #'000

Loss on ordinary activities before taxation (1,048) (481)

Loss on ordinary activities by rate of tax (199) (91)

Expenses not deductible for tax purposes 4 -

Capital allowances in excess of depreciation (6) (20)

Permanent differences (4) (1)

Current tax losses carried forward 216 112

Research and development tax credit 46 -

adjustment

Adjustment in respect of prior year research 85 -

and development tax credit

Total current tax (note 3(a)) 142 -

The group has unutilised tax losses in the UK of approximately #3.4m (2005:

#3.0m).

4. LOSS PER SHARE

The calculation of basic loss per share is based on the loss attributable to

ordinary shareholders of #906,000 (2005: #481,000) divided by the weighted

average number of ordinary shares in issue during the year which was 136,376,295

(2005: 127,493,242).

The issue of additional shares on the exercise of options would decrease the

basic loss per share and there is, therefore, no dilutive effect of share

options.

5. RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

27 January -

2006 30 September 2005

#'000 #'000

Loss for the financial year (906) (481)

Exchange differences 11 -

Issue of shares 2,275 2,537

Net increase in shareholders' funds 1,380 2,056

Shareholders' funds at 1 October 2005 2,056 -

Shareholders' funds at 30 September 2006 3,436 2,056

6. NET CASH OUTFLOW FROM OPERATING ACTIVITIES

27 January -

2006 30 September 2005

#'000 #'000

Operating loss (1,084) (493)

Loss on disposal of fixed assets - 4

Depreciation of tangible fixed assets 325 143

Amortisation of goodwill (36) (40)

(Increase) in stocks (39) (46)

(Increase) in debtors (22) (163)

Increase / (decrease) in creditors 275 (256)

Cash outflow from operating activities (581) (851)

7. RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET FUNDS

27 January -

2006 30 September 2005

#'000 #'000

Increase in cash 696 1,107

Cash inflow / (outflow) from finance leases 91 (405)

787 702

Net funds at 1 October 2005 702 -

Net funds at 30 September 2006 1,489 702

8. PUBLICATION OF NON-STATUTORY ACCOUNTS

The financial information set out in this preliminary announcement does not

constitute statutory accounts as defined in Section 240 of the Companies Act

1985.

The consolidated balance sheet at 30 September 2006 and the consolidated profit

and loss account, consolidated cash flow statement, statement of consolidated

total recognised gains and losses and associated notes for the year then ended

have been extracted from the Group's 2006 statutory financial statements upon

which the auditors opinion is unqualified and does not include any statement

under Section 237 of the Companies Act 1985.

Those financial statements have not yet been delivered to the registrar of

companies.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ILFVDFDLLIIR

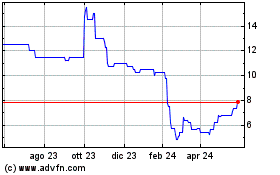

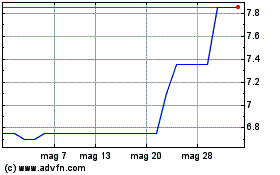

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024