RNS Number : 8395W

Hardide PLC

17 June 2008

Press Release 17 June 2008

Hardide plc

("Hardide" or "the Group")

Interim Results for the six months to 31 March 2008

Hardide plc (AIM:HDD), the provider of unique surface engineering technology, announces its interim results for the six months ended 31

March 2008.

Highlights

* Group turnover increased 14% to �1.26 million (H1 2007: �1.11 million)

* Group gross profit increased 28% to �670,000 (H1 2007: �525,000)

* Group operating loss reduced 16% to �777,000 (H1 2007: loss �921,000)

* Group loss before tax reduced to �891,000 (H1 2007: loss �909,000)

* UK operating company, Hardide Coatings Limited, achieves maiden pre tax

profit of �112,000 (H1 2007: loss �52,000)

* UK gross margins increased by 6%

* Global gas supply agreement signed in December 2007

* Ken Siddall appointed as US Managing Director in November 2007

* Hardide Coatings, Inc. achieved ISO 9001 in November 2007

Post-Period Highlights

* Hardide Coatings Limited enters into a three year coatings approval test

programme with Airbus, one of the world's leading aircraft manufacturers

* Dr. Graham Hine appointed Chief Executive Officer on 2 June 2008

Commenting on the interim results, Robert Goddard, Chairman of Hardide plc, said: "I am pleased to report an increase in Group turnover

and gross profit together with a 16% reduction in operating loss for the first six months. Our progress is evidenced by the maiden profit

achieved by Hardide Coatings Limited during the period. The number and calibre of customers with whom Hardide is now in commercial use or

test, as demonstrated by the test programme with Airbus, is testament to the growing reputation and value that customers are placing on our

technology

"The Board believes that the leadership of Graham Hine and subsequent implementation of the new strategic plan will unlock the potential

of Hardide, and create growth in shareholder value."

For further information:

Hardide plc

Robert Goddard / Peter Davenport / Jackie Robinson Tel: +44 (0) 1869 353 830

www.hardide.com

Seymour Pierce Limited

Nicola Marrin / Richard Feigen Tel: +44 (0) 20 7107 8000

nicolamarrin@seymourpierce.com / www.seymourpierce.com

richardfeigen@seymourpierce.com

Media enquiries:

Abchurch

Chris Lane / George Parker Tel: +44 (0) 20 7398 7719

george.parker@abchurch-group.com www.abchurch-group.com

Chairman's Statement

These interim results reflect the commercial and operational progress that the Group has made in the six months to 31 March 2008. I can

report a 14% increase in turnover to �1.26 million compared to H1 2007 despite the slow growth in the US business and short-term reduction

in demand from a major UK customer that occurred towards the end of the half year, Group gross profit increased by 28% to �670,000 and Group

operating loss narrowed to �777,000 from �921,000 in H1 2007. I am pleased to report that Hardide Coatings Limited, the UK business, made a

pre tax profit of �112,000 compared with a loss of �52,000 in the same period last year.

Our focus on driving down overheads and costs as well as increasing margins has started to take effect. Despite the 14% increase in

sales, cost of sales increased by only 2% to �593,000 reflecting the global gas supply agreement which was made in December 2007, and more

efficient purchasing. In the UK, gross margins continued to rise, with a 6% increase to the end of March 2008. Group overheads were also

stable with administration expenses lower than in the same period last year.

I believe that these results, together with the number and calibre of global customers with whom the technology is currently in

commercial use or test, demonstrate the fundamentally sound proposition of the Group and its technology. Since this reporting period, the

Group experienced two difficult months culminating in June 2008 with a fundraising for �1.5 million, the appointment of Dr. Graham Hine as

Chief Executive Officer and a revision of its strategic plan. The new capital will cover operating losses and the development of

applications designed to lead to near and mid-term sales revenue.

The revised strategic plan is focused on increasing cash generation in the UK operation over the next twelve months and commercialising

the significant customer interest in the US. At the same time, discretionary capital and revenue expenditure is being minimised until a firm

trend of upward sales growth is established. In addition, a group-wide Applications Development Committee, led by Dr. Yuri Zhuk, Technical

Director, has been formed to select, review and prioritise new applications to ensure that resources are concentrated on those opportunities

with the greatest potential to realise strategically or financially significant immediate to medium-term sales.

UK: Hardide Coatings Limited

Hardide Coatings Limited, the UK operating company, achieved profitability in the first half of the financial year despite the sudden

customer de-stocking issue affecting the last month of the period. Orders are now resuming from the customer, with whom the company is in

advanced discussions on two new high-potential applications. Enquiries are continually being received from existing customers to coat new

parts, which demonstrates the level of customer satisfaction in the technology.

The move into the aerospace sector is also having encouraging results. I am pleased to announce today that Hardide Coatings Limited has

entered into a three-year coatings approval test programme with Airbus, one of the world's leading aircraft manufacturers. Furthermore, the

company has confidence tests being performed at seven key aerospace industry manufacturers, a necessary precursor to gaining customer

approvals and specification. Earlier stage discussions are ongoing with several other aerospace and defence organisations. Whilst the

approvals process in the aerospace sector is lengthy, the market potential for Hardide in this sector is strong.

The production teams in the UK and US have made excellent progress in increasing the part density in the furnaces. This has increased

gross margins and capacity, deferring the requirement for immediate capital expenditure. In select cases, the higher part density has

enabled the operating companies to secure business at lower price points. In addition, development work has begun on shortening the furnace

cycle time, which will increase capacity with no additional capital outlay.

US: Hardide Coatings, Inc.

The sales cycle for the technology in the US is taking longer than expected. Record oil prices and demand for oil services have meant

that our customers in this sector have been focusing attention on production, and testing programmes have not been given priority. This has

delayed the progress of our customer trials, which can already take 18 months to complete. On the other hand, cross-selling between the UK

and US is showing good potential in the valve market that should be realised sooner. Hardide-coated valves have been successfully run

through severe duty tests and the company is in various stages of dialogue to progress to production with several US valve manufacturers.

Ken Siddall joined Hardide Coatings, Inc. in November 2007 as US Managing Director, bringing twenty years of engineering, general

management and coatings technology experience. The US business is now implementing the new strategy which will focus sales resources on

applications that build on proven successes, shorten customer design approval and testing time, and increase the customer conversion rate.

The Houston facility achieved ISO 9001 in November 2007.

Outlook

The shortfall in sales that began at the end of the H1 2008 carried on, as expected, into the second half but there are strong

indications that a recovery in orders will occur in the coming few months. As such, the Group is likely to see sales in the second half less

in total than reported for the first. By the end of the second half, the monthly rate of sales is expected to surpass that experienced

during the first half.

The Board of Hardide is focused on generating shareholder value and is confident that the Group has the strategic plan, structure,

resources, skills and talent to turn cash-positive overall within the medium term. The strategic plan has been considered and analysed and

the Board believes it to be realistic and deliverable. We will also continue to discuss opportunities with potential partners in new

international markets.

The Board expects that the leadership of Graham Hine as Chief Executive Officer will provide the direction and framework for substantial

growth in shareholder value. The Group is building on proven success by application and by customer, and developing new applications and

markets with demonstrable commercial potential. This will further strengthen the already strong foundation for future success.

Robert Goddard

Chairman

17 June 2008

Consolidated income statement for the period ended 31 March

2008

6 months to 6 months to Year to

31 March 2008 31 March 2007 30 September 2007 (unaudited)

(unaudited) (unaudited)

� '000 � '000 � '000

Revenue 1,263 1,105 2,470

Cost of Sales (593) (581) (1,180)

Gross Profit 670 525 1,290

Administrative expenses (1,217) (1,229) (2,676)

Depreciation (230) (217) (475)

Operating profit (777) (921) (1,861)

Interest income 21 24 31

Finance costs (135) (12) (26)

Profit on ordinary activities (891) (909) (1,855)

before tax

Tax 24

Profit for the period (891) (909) (1,831)

Consolidated statement of recognised income and expense for the period ended 31

March 2008

6 months to 6 months to Year to

31 March 2008 31 March 2007 30 September 2007

(unaudited) (unaudited) (unaudited)

� '000 � '000 � '000

Profit for the period (891) (909) (1,831)

Exchange differences on (47) (6) 21

translation of foreign

operations

Total recognised income and (938) (915) (1,811)

expense for the year

Consolidated balance sheet at 31 March 2008

31 March 2008 31 March 2007 30 September 2007

(unaudited) (unaudited) (unaudited)

� '000 � '000 � '000

Assets

Non-current assets

Investments

Goodwill 69 69 69

Intangible assets 6 8 7

Property, plant & equipment 1,533 1,900 1,661

Total non-current assets 1,608 1,977 1,737

Current assets

Inventories 53 125 99

Trade and other receivables 351 426 648

Other current financial assets 156 164 147

Cash and cash equivalents 544 700 1,135

Total current assets 1,104 1,416 2,029

Total assets 2,712 3,393 3,767

Liabilities

Current liabilities

Trade and other payables 377 449 512

Financial liabilities 120 114 145

Provisions - - -

Total current liabilities 497 563 657

Net current assets 607 853 1,372

Non-current liabilities

Financial liabilities 920 164 893

Total non-current liabilities 920 164 893

Total liabilities 1,417 727 1,550

Net assets 1,295 2,666 2,217

Equity

Share capital 1,467 1,467 1,467

Share premium 3,345 3,345 3,345

Retained earnings (3,967) (2,172) (3,077)

Share-based payments reserve 465 22 450

Translation reserve (16) 4 31

Total equity 1,295 2,666 2,217

Consolidated condensed cash flow statement for the period ended 31 March 2008

6 months to 6 months to Year to

31 March 2008 31 March 2007 30 September 2007

(unaudited) (unaudited) (unaudited)

� '000 � '000 � '000

Cash flows from operating activities

Operating profit (777) (921) (1,825)

Impairment of 1 1 2

intangibles

Depreciation 230 216 437

Share option charge 15 22 59

(increase) / 46 (23) 23

decrease in

inventories

(increase) / 287 11 (224)

decrease in

receivables

Increase / (135) (34) 72

(decrease) in

payables

Finance income 21 24 31

Finance costs (53) (12) (25)

Tax received / - 50 107

(paid)

Net cash generated from operating activities (366) (666) (1,343)

Cash flows from investing activities

Purchase of (98) (402) (439)

property, plant and

equipment

Net cash used in investing activities (98) (402) (439)

Cash flows from financing activities

Net proceeds from - - -

issue of ordinary

share capital

Finance lease - 22 209

inception

Finance lease (74) (57) (95)

repayment

New loans raised - - 1,000

Net cash used in financing activities (74) (35) 1,114

Net increase / (decrease) in cash and cash (537) (1,103) (668)

equivalents

Cash and cash equivalents at the beginning of the 1,135 1,803 1,803

period

Effects of foreign exchange rate changes (56) - -

Cash and cash equivalents at the end of the period 544 700 1,135

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDLBDBGGIL

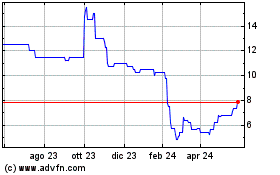

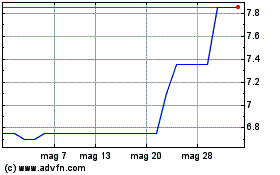

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024