TIDMHDD

RNS Number : 1024E

Hardide PLC

15 December 2009

+------------------------------------+------------------------------------------------+

| Press Release | 15 December 2009 |

+------------------------------------+------------------------------------------------+

Hardide plc

("Hardide" or "the Group")

Preliminary results for the year ended 30 September 2009

Hardide plc (AIM:HDD), the provider of unique metal surface engineering

technology, announces its preliminary results for the twelve months ended 30

September 2009.

Financial Highlights

+-----+--------------------------------------------------------------------------------+

| * | Group turnover decreased 43% to GBP1.21 million (FY 2008: GBP2.12 million) |

+-----+--------------------------------------------------------------------------------+

| * | Loss before tax and exceptional items decreased 16% to GBP1.46 million (FY |

| | 2008: loss GBP1.74 million) |

+-----+--------------------------------------------------------------------------------+

| * | Impairment of fixed assets of Houston facility of GBP0.36 million treated as |

| | an exceptional item |

+-----+--------------------------------------------------------------------------------+

| * | Decreased loss per share of 0.6 p (FY 2008: loss 1.1 p) |

+-----+--------------------------------------------------------------------------------+

| * | Successful raising of GBP1.57 million (gross) new funds; GBP1 million in loans |

| | converted into new ordinary shares |

+-----+--------------------------------------------------------------------------------+

| * | Overheads reduced by GBP600,000 (29%) compared with 2008 |

+-----+--------------------------------------------------------------------------------+

Operational Highlights

+-----+------------------------------------------------------------------------------+

| * | Successful transfer of US production to UK with no customer losses following |

| | hibernation of Houston facility |

+-----+------------------------------------------------------------------------------+

| * | Management team strengthened with the appointment of Nick King as Business |

| | Development Manager |

+-----+------------------------------------------------------------------------------+

| * | Successful development of new coating for titanium |

+-----+------------------------------------------------------------------------------+

| * | Hardide secures approval and orders from FMC Technologies (NYSE: FTI) |

+-----+------------------------------------------------------------------------------+

| * | Hardide secures approval as standard product line and orders from Flowserve |

| | Corporation (NYSE: FLS) |

+-----+------------------------------------------------------------------------------+

| * | Hardide-A coating developed as a substitute for hard chrome plating |

+-----+------------------------------------------------------------------------------+

Post-Period Events

+-----+------------------------------------------------------------------------------+

| * | Positive indications from key customers of a recovery of demand in 2010 |

+-----+------------------------------------------------------------------------------+

| * | Further strategic markets and applications review to complete in early 2010 |

+-----+------------------------------------------------------------------------------+

Commenting on the results, Dr Graham Hine, Chief Executive of Hardide plc,

said:"Hardide's growth over the last year has been adversely affected by the

economic downturn and the impact that it has had on the markets in which our key

customers are operating which include oil and gas, and construction.

"We took a number of actions throughout the year to protect and restructure the

Group's business, and to significantly reduce costs and conserve cash. This

means that we are well placed to benefit from the markets as they recover.

"The outlook at the start of the new financial year is cautious but stable as we

see signs of growth returning to our key customers' markets and with that,

confidence in their own operations and in demand for the Hardide technology."

For further information:

+-------------------------------------------+------------------------------------+

| Hardide plc | |

+-------------------------------------------+------------------------------------+

| Dr Graham Hine, Chief Executive | Tel: +44 (0) 1869 353 830 |

| Jackie Robinson, Corporate Communications | jrobinson@hardide.com |

| | www.hardide.com |

| | |

+-------------------------------------------+------------------------------------+

+----------------------------------------+---------------------------------------+

| Seymour Pierce Limited | Tel: +44 (0) 20 7107 8000 |

+----------------------------------------+---------------------------------------+

| Nicola Marrin | nicolamarrin@seymourpierce.com |

| | www.seymourpierce.com |

| | |

+----------------------------------------+---------------------------------------+

| | |

+----------------------------------------+---------------------------------------+

Notes to editors:

Hardide manufactures and applies tungsten carbide-based coatings to a wide range

of engineering components. The Group's patented technology provides a unique

combination of ultra-hardness, toughness, low friction and chemical resistance

in one coating. When applied to components, the technology is proven to offer

dramatic cost savings through reduced downtime and extended part life.

Customers include leading companies operating in oil and gas exploration and

production, valve and pumps manufacturing, general engineering and aerospace.

CHAIRMAN'S STATEMENT

Hardide plc's results for the year to 30 September 2009 reflect the economic

downturn that has affected all the sectors in which Hardide's key customers are

operating. The Group's position is in common with that of many small

manufacturers and has been further affected by aggressive de-stocking by major

customers. This caused a sharp fall-off in orders, beginning in Q2 2009, as

announced.

The Group is reporting FY 2009 sales revenue of GBP1.21 million, a decrease of

43% compared with the same period last year (FY 2008 GBP2.12 million). The Group

PBT for the year narrowed to a loss before tax and exceptional items of GBP1.46

million, a 16% reduction from the pre-tax loss of GBP1.74 million in 2008.

The reduction in demand from our customers who service the oil and gas,

construction and automotive markets was sudden and sharp and has been followed

by a prolonged period of very limited visibility of future demand. Swift and

significant management action was necessary to protect the Group's business and

restructure it so as to withstand better the effects of the manufacturing

downturn. In March 2009, the Group announced the hibernation of the Houston

manufacturing facility, a redundancy programme in the UK and a plan to

significantly reduce costs and conserve cash. These were hard decisions but

necessary to create longer term stability and preserve a solid foundation from

which the Group can re-build as markets improve. In total, these actions

delivered an annualised cost saving of GBP650,000, which resulted in an EBITDA

loss for the year of GBP1.12 million, broadly similar to the FY 2008 EBITDA loss

of GBP1.09 million. The hibernation of the Houston facility resulted in an

exceptional impairment charge of GBP364,000.

In May 2009, the board announced that it was undertaking a review of its

strategic options to further ensure the future of the Group. This culminated in

fundraising that was completed in July 2009 and raised GBP1,566,200 of new funds

with a further GBP1 million of loans being converted into new ordinary shares at

the placing price. The new money covered working capital needs, the further

development of Hardide's patented diamond coating technology and the continued

development of the US market. The board acknowledges and thanks the major

shareholders for their continued faith and support, and their further investment

in the Group.

In light of the new market conditions, in late Q4 2009, the management team,

supported by the board, began a further strategic review to revisit previous

analysis and assumptions of key markets and applications with the highest

potential for the Hardide technology. This is an in-depth process and due for

completion in early 2010. Initial findings support the current strategic plan

but the review is expected to lead to a plan to deliver short-term sales revenue

and a diversified and robust business.

While the Group's growth has been badly affected by the wider economic climate,

the board remains confident in the technology, its potential for new

applications with existing customers and in new markets, and in the recovery of

demand. Post-period, the Group has received positive indications from key

customers that demand will rise over the course of the next calendar year.

I would like to thank all staff, shareholders and members of the board for their

support and continuing confidence in the Group during this difficult year.

Thanks are also due to David Mott, who retired from the board in March 2009, for

his sound advice and guidance as a Non-Executive Director since the earliest

days of Hardide.

Robert Goddard

Chairman

14 December 2009

CHIEF EXECUTIVE OFFICER'S REVIEW

The fierce slowdown of global trade and economic activity at the end of 2008

triggered huge uncertainties in our key customers' primary markets i.e. the oil

and gas, construction and automotive industries. This quickly filtered through

the supply chain and in Q2 2009, Hardide experienced a rapid deterioration in

demand as customers radically reined in expenditure.

In March 2009, it was necessary to implement a Group-wide cost reduction plan to

re-align the business to the new market conditions. This included the

hibernation of the Houston manufacturing facility and the temporary move of all

US production to the UK, a UK redundancy programme and a re-evaluation of all

discretionary expenditure. It was extremely disappointing to have to take this

action at a time when the Hardide technology continues to gain recognition as an

'enabling' technology by blue chip customers operating in multi-billion dollar

markets. Nevertheless, the sales cycle remains frustratingly slow due to the

unique nature of the technology and the need for stringent and prolonged testing

in the majority of its current applications. By the end of March 2009, all US

sampling and production had been moved seamlessly to the UK with no loss of

customers.

UK: Hardide Coatings Limited

The UK operating company, Hardide Coatings Limited, delivered FY 2009 revenue of

GBP1.09 million, down 45% from GBP1.97 million in 2008. The UK business was

particularly hard hit by depressed activity within the oil and gas sector. Lower

oil and gas prices caused the operating companies to reduce expenditure

dramatically, cancel projects or request price concessions. This squeeze saw

discretionary drilling being put on hold as the oil price in mid-2009 sat at

around half the level of July 2008, when it had peaked at US$147. Together with

the customer de-stocking issue, this market softening was the major contributory

factor to the 2009 revenue drop. No customers reduced orders due to

dissatisfaction with the Hardide technology or service.

The UK business reported a pre-tax loss of GBP324,000, compared with a pre-tax

loss of GBP133,000 in the same period last year. While lower revenue was not

completely off-set by lower costs, overheads in the UK were reduced by 38%,

mainly due to a reduced headcount and a spending moratorium.

In February 2009, the management team was strengthened by the appointment of

Nick King as Business Development Manager for UK and Europe. He joined from

Praxair Surface Technologies Ltd., bringing more than 30 years of experience and

contacts within the surface treatment market. He has made a strong impact on the

management team, helping to shape the future direction of sales and market

development.

Throughout the year, the operations and engineering teams have concentrated on

improving delivery performance and plant efficiency, using any spare capacity to

improve general housekeeping throughout the shop floor and customer-facing

areas. This has resulted in increased yields and loading capacities, improved

plant efficiency via Total Productive Management, more robust coating practices

and standardised methods, and a more streamlined enquiry process with full

traceability. 'On-time' delivery has improved by 9% while late orders have

reduced by 37% and the average time period for a late order has been reduced by

50%. Improved design of furnace tooling for one high volume application has led

to an increase in yield of 150%. Overall the plant has recorded a 17% reduction

in reworks due to improved process and plant efficiencies.

The Airbus three-year test programme that the UK company entered into and

reported last year is advancing, with samples now undergoing extensive

corrosion, wear and metallographic testing. Interim results are encouraging.

US: Hardide Coatings, Inc.

The Houston facility reported sales revenue of $182,000 in the six months to 31

March 2009 when the plant was hibernated, and a FY 2009 loss of $1.80 million

after accounting for an impairment charge. The US business had continued to

experience an extended sales cycle which, when combined with the effects of the

depressed oilfield services market, meant that it was not possible to sustain

manufacture in the region without putting the entire Group at risk. The sales,

operations and engineering teams worked closely to ensure a seamless transition

of customers, samples and production parts to the UK. This worked well and all

customers were retained. Lead and sample times have been maintained, and in some

cases improved, despite shipping. The plant remains in place in Houston and will

be re-opened when the UK reaches capacity and/or when US sales are sufficient to

support the re-start of operations. Meanwhile, the US continues to play an

important role, both in current sales and future business growth. Two

significant new customers, FMC Technologies and Flowserve Corporation, were

gained in H2 2009 in our key sectors of oil and gas, and valves respectively.

Furthermore, the Group is in extensive test programmes with two blue chip

strategic customers in the region, both customers forming cornerstones of our

diversification strategy.

Markets

Customer and sector diversification remains a priority for the Group. The global

economic downturn has slowed our progress in achieving this strategic goal but

we are working to develop new revenue streams from existing customers and enter

new markets with proven applications. Developing these strategic relationships

with key global customers will position us to meet their needs as economic

conditions improve and embed our technology across a wider portfolio of

applications.

Our core commercial markets of oil and gas, valves and pumps have all been

affected by the global economy but remain large and profitable. We are confident

that they will remain central to the Group's growth. The management team is

undertaking a strategic review to identify and qualify additional markets and

applications which have the highest potential to deliver short term financial

returns and build a pipeline for a diversified business. This is due for

completion in early 2010.

Health, Safety and Environment

Hardide plc is committed to the highest standards of health, safety and

environmental policy and practice. The Group recorded no lost time accidents

during the reporting period and achieved a record 350 days without an entry into

the accident book.

The Group has continued to develop and improve its quality systems and methods

throughout the year. A stage 2 AS9100 audit is planned for the new calendar

year. If successful, this will replace the current ISO 9001 standard and support

the continued progress of Hardide in the aerospace market.

Technology, Research & Development

The Applications Development Committee (ADC) led by Dr Yuri Zhuk, Technical

Director, has continued to make good progress throughout the year. The committee

was formed last year to evaluate, prioritise, manage and monitor the development

of new applications in both the UK and US. The ADC works on a rotation of no

more than twelve key applications that are scored for technical and commercial

potential before being selected for development and testing. Last year, the

development of variant coatings for diamonds and titanium were identified as key

projects for R&D resources.

In March 2009, the Group was pleased to announce that it had successfully

developed a process to enable the Hardide coating of titanium. Tests are now

underway in the UK and US with blue chip customer partners. This is a

significant breakthrough for the coating of a high-performance metal commonly

used in the aerospace, defence, motorsport and general industrial applications.

Testing is continuing on the new variant coating for diamond with three customer

partners in the UK and US. This application is for a new and patented tungsten

carbide Hardide coating that offers an unprecedented combination of adhesive and

protective properties. Improved tool performance and durability is expected to

offer impressive cost savings to customers. The results are promising although

scale-up and commercialisation will require capital investment.

During the year, a new coating, Hardide-A was developed as a substitute for hard

chrome plating which is under threat from EU REACH and other similar

environmental regulations worldwide. Hard chrome plating is widely used in the

aerospace sector and many blue chip companies including the major aircraft

manufacturers have launched programs to identify and develop new coatings to

replace hard chrome. Hardide-A matches the key characteristics of hard chrome

plating including hardness and thickness, and outperforms the material in some

key protective properties. Hardide-A is currently under test and evaluation with

two leading European high-tech companies.

Outlook

Our outlook at the start of the new financial year is cautious but stable. In

the short term, a key determining factor in the timing of our return to revenue

growth is the timing of the economic recovery. When this happens, in particular

when oil and gas exploration and production expenditure returns, as it is

beginning to, we are well placed to respond rapidly and effectively. We have

retained the critical infrastructure, people, skills and knowledge-base to be

able to scale up as soon as the markets improve. As we enter the new financial

year, we are seeing signs of stability returning to our key customers' markets

and with that, confidence in their own operations and in demand for the Hardide

technology.

I would like to thank our customers for their confidence and support, and our

employees for their commitment during a turbulent year. We have gone through a

period of retrenchment and consolidation but the Group has used the downtime

wisely and enters the new financial year ready to manage the resumption of

demand.

Dr Graham Hine

Chief Executive Officer

14 December 2009

FINANCIAL REVIEW

While the 2008/09 financial year started encouragingly for the Group, in Q2 we

began to be affected badly by reduced demand in our end markets and savage

inventory cuts by our largest customers.

Our response was to reduce production resources in the UK to more closely align

with demand, and to reduce overheads (both staff and non-staff) to a size more

appropriate to the Group's needs, at the same time ensuring that we retained the

capacity, expertise and resources to deal with resumption in demand from our

existing customers and convert opportunities for new applications and customers

In spite of these actions, gross margins in the UK fell by 16%, although with

production salaries excluded variable costs of sales remained stable. Overheads

in the UK operation were reduced by GBP492,000 (38%) to GBP794,000, and the

timing of our cost reductions means that there should be a significant flow

through into the current financial year. Overall, Hardide Coatings Limited

recorded a pre-tax loss of GBP324,000 against a loss of GBP133,000 in the prior

year.

We also took the decision to hibernate our facility in Houston and transfer all

production to the UK. Hardide Coatings Inc remains as a legal entity in the US

and all the assets and fixtures at the plant have been left in-situ so that

production can be resumed when conditions allow. The hibernation has resulted in

an exceptional impairment charge against the fixed assets in Houston of $540,000

(GBP364,000). This reflects their current status as non-revenue earning, rather

than any actual change in their effectiveness or capacity.

Hardide Coatings Inc made a pre-tax loss of GBP834,000 (2008: GBP1,194,000)

before inclusion of the impairment charge. As with the UK, the timing of the

suspension of operations in March, and the presence of costs which tailed

through into the second half of the year, means that substantial cost reductions

will flow through into the current financial year.

A capital reorganisation of the Group was undertaken in the second half of the

year, including raising GBP1,566,200. The conversion of GBP1,000,000 of existing

loans into equity resulted in a one-off credit to finance costs of GBP78,000 as

these loans had been treated as combined instruments since their inception in

2007.

Overall, the actions we have taken, although painful, have substantially reduced

the break even point of the Group and resulted in a much more sustainable

business going forwards.

Peter Davenport

Finance Director

14 December 2009

CONSOLIDATED INCOME STATEMENT

for the year ended 30 September 2009

+-----------------------------------------+------+--------------+--------------+

| | | 2009 | 2008 |

| | | GBP000 | GBP000 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Revenue | | 1,209 | 2,123 |

+-----------------------------------------+------+--------------+--------------+

| Cost of sales | | (854) | (1,132) |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Gross profit | | 355 | 991 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Administrative expenses | | (1,477) | (2,081) |

+-----------------------------------------+------+--------------+--------------+

| Impairment of intangibles | | (2) | |

+-----------------------------------------+------+--------------+--------------+

| Depreciation and amortisation | | (330) | (500) |

+-----------------------------------------+------+--------------+--------------+

| Exceptional item: Impairment of fixed | | (364) | - |

| assets | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Operating loss | | (1,818) | (1,590) |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Finance income | | 14 | 37 |

+-----------------------------------------+------+--------------+--------------+

| Finance costs | | (13) | (187) |

+-----------------------------------------+------+--------------+--------------+

| Disposal of fixed asset | | (7) | - |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Loss on ordinary activities before | | (1,824) | (1,740) |

| taxation | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Taxation | | 35 | 37 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Loss on ordinary activities after | | (1,789) | (1,703) |

| taxation | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Loss per share: Basic | | (0.6)p | (1.1)p |

+-----------------------------------------+------+--------------+--------------+

| Loss per share: Diluted | | (0.2)p | (0.8)p |

+-----------------------------------------+------+--------------+--------------+

All operations are continuing.

CONSOLIDATED BALANCE SHEET

at 30 September 2009

+-----------------------------------------+------+--------------+--------------+

| | | 2009 | 2008 |

| | | GBP000 | GBP000 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Assets | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Non-current assets | | | |

+-----------------------------------------+------+--------------+--------------+

| Goodwill | | 69 | 69 |

+-----------------------------------------+------+--------------+--------------+

| Intangible assets | | 2 | 4 |

+-----------------------------------------+------+--------------+--------------+

| Property, plant & equipment | | 796 | 1,366 |

+-----------------------------------------+------+--------------+--------------+

| Total non-current assets | | 867 | 1,439 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Current assets | | | |

+-----------------------------------------+------+--------------+--------------+

| Inventories | | 26 | 44 |

+-----------------------------------------+------+--------------+--------------+

| Trade and other receivables | | 208 | 325 |

+-----------------------------------------+------+--------------+--------------+

| Other current financial assets | | 101 | 160 |

+-----------------------------------------+------+--------------+--------------+

| Cash and cash equivalents | | 932 | 995 |

+-----------------------------------------+------+--------------+--------------+

| Total current assets | | 1,267 | 1,524 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Total assets | | 2,134 | 2,963 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Liabilities | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Current liabilities | | | |

+-----------------------------------------+------+--------------+--------------+

| Trade and other payables | | 259 | 356 |

+-----------------------------------------+------+--------------+--------------+

| Financial liabilities | | 118 | 110 |

+-----------------------------------------+------+--------------+--------------+

| Total current liabilities | | 377 | 466 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net current assets | | 890 | 1,058 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Non-current liabilities | | | |

+-----------------------------------------+------+--------------+--------------+

| Financial liabilities | | 748 | 1,162 |

+-----------------------------------------+------+--------------+--------------+

| Total non-current liabilities | | 748 | 1,162 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Total liabilities | | 1,125 | 1,628 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net assets | | 1,009 | 1,335 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Equity attributable to equity holders | | | |

| of the parent | | | |

+-----------------------------------------+------+--------------+--------------+

| Share capital | | 2,541 | 1,896 |

+-----------------------------------------+------+--------------+--------------+

| Share premium | | 5,259 | 4,102 |

+-----------------------------------------+------+--------------+--------------+

| Retained earnings | | (6,481) | (4,705) |

+-----------------------------------------+------+--------------+--------------+

| Share-based payments reserve | | 274 | 347 |

+-----------------------------------------+------+--------------+--------------+

| Translation reserve | | (584) | (305) |

+-----------------------------------------+------+--------------+--------------+

| Total equity | | 1,009 | 1,335 |

+-----------------------------------------+------+--------------+--------------+

The financial statements were approved and authorised for issue by the Board on

14 December 2009.

Graham Hine

Director

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 30 September 2009

+-----------------------------------------+------+--------------+--------------+

| | | 2009 | 2008 |

| | | GBP000 | GBP000 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Cash flows from operating activities | | | |

+-----------------------------------------+------+--------------+--------------+

| Operating loss | | (1,818) | (1,590) |

+-----------------------------------------+------+--------------+--------------+

| Impairment of intangibles | | 2 | 3 |

+-----------------------------------------+------+--------------+--------------+

| Depreciation | | 330 | 497 |

+-----------------------------------------+------+--------------+--------------+

| Impairment of fixed assets | | 364 | - |

+-----------------------------------------+------+--------------+--------------+

| Share option charge | | 64 | 50 |

+-----------------------------------------+------+--------------+--------------+

| Decrease in inventories | | 18 | 55 |

+-----------------------------------------+------+--------------+--------------+

| Decrease in receivables | | 181 | 310 |

+-----------------------------------------+------+--------------+--------------+

| Decrease in payables | | (97) | (155) |

+-----------------------------------------+------+--------------+--------------+

| Exchange rate variance | | (377) | (391) |

+-----------------------------------------+------+--------------+--------------+

| Cash generated from operations | | (1,333) | (1,221) |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Finance income | | 14 | 37 |

+-----------------------------------------+------+--------------+--------------+

| Finance costs | | (75) | (108) |

+-----------------------------------------+------+--------------+--------------+

| Tax received / (paid) | | 36 | 26 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net cash generated from operating | | (1,358) | (1,266) |

| activities | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Cash flows from investing activities | | | |

+-----------------------------------------+------+--------------+--------------+

| Purchase of property, plant and | | (30) | (127) |

| equipment | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net cash used in investing activities | | (30) | (127) |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Cash flows from financing activities | | | |

+-----------------------------------------+------+--------------+--------------+

| Net proceeds from issue of ordinary | | 802 | 1,173 |

| share capital | | | |

+-----------------------------------------+------+--------------+--------------+

| Finance lease inception | | - | - |

+-----------------------------------------+------+--------------+--------------+

| Finance lease repayment | | (110) | (145) |

+-----------------------------------------+------+--------------+--------------+

| New loans raised | | 633 | 225 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net cash used in financing activities | | 1,325 | 1,253 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net increase / (decrease) in cash and | | (63) | (140) |

| cash equivalents | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Cash and cash equivalents at the | | 995 | 1,135 |

| beginning of the year | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Cash and cash equivalents at the end of | | 932 | 995 |

| the year | | | |

+-----------------------------------------+------+--------------+--------------+

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE

for the year ended 30 September 2009

+-----------------------------------------+------+--------------+--------------+

| | | 2009 | 2008 |

| | | GBP000 | GBP000 |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Exchange differences on translation of | | (279) | (335) |

| foreign operations | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Net income recognised directly in | | (279) | (335) |

| equity | | | |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Loss for the year | | (1,789) | (1,703) |

+-----------------------------------------+------+--------------+--------------+

| | | | |

+-----------------------------------------+------+--------------+--------------+

| Total recognised income and expense for | | (2,068) | (2,038) |

| the year | | | |

+-----------------------------------------+------+--------------+--------------+

PUBLICATION OF NON-STATUTORY ACCOUNTS

The financial information set out in this preliminary announcement does not

constitute statutory accounts as defined in Section 435 of the Companies Act

2006.

The consolidated balance sheet at 30 September 2009, and the consolidated income

statement and consolidated cash flow statement for the year then ended have been

extracted from the Group's 2009 statutory financial statements upon which the

auditors have reported. The auditor's report is unqualified and does not

include any statement under Sections 498 (2) (accounting records or returns

inadequate or accounts not agreeing with records) or 498 (3) (failure to obtain

necessary information and explanations) of the Companies Act 2006. Those

financial statements have not yet been delivered to the Registrar of Companies.

The auditors have made a matter of emphasis in their audit report relating to

uncertainty regarding going concern should the Group not fulfil its current plan

for revenues, costs and cashflows. These matters indicate the existence of a

material uncertainty which may cast significant doubt over the Company's ability

to continue as a going concern. The directors are confident that the plan will

either be realised given its conservative view of revenue recovery and the

actions already taken to reduce the Group's cost base, or that fresh funding

will be available.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TIBRTMMIBBTL

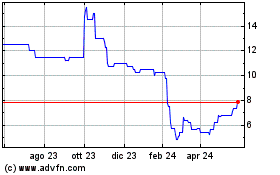

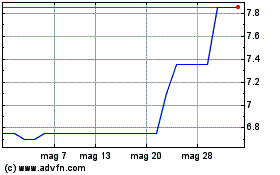

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024