TIDMHDD

RNS Number : 2337H

Hardide PLC

18 June 2013

Press Release 18 June 2013

Hardide plc

("Hardide" or "the Company" or "the Group")

Interim Results

Hardide plc (AIM: HDD), the provider of advanced surface coating

technology, announces its interim results for the six months ended

31 March 2013.

Overview

-- Turnover decreased by 18% to GBP1.26m (H1 2012 GBP1.54m),

primarily as a result of a major inventory adjustment by a dominant

customer

-- Gross profit decreased by 23% to GBP855,000 (H1 2012: GBP1.12m)

-- Group interim loss of GBP102,000 (H1 2012: GBP201,000 profit)

-- Group EBITDA of GBP11,000 (H1 2012: GBP308,000)

-- Revenue from aerospace and advanced engineering sectors increased by 37%

-- The number of active accounts rose by 34% to 39 from 29 in H1

2012, reflecting the focus on strengthening the pipeline

-- A Technology Strategy Board grant worth up to GBP250,000 was

awarded in January 2013 to part--fund a two year project to further

develop, manufacture and test a new coating for superabrasive

materials used in 'hardfacing' tools for downhole and other

high-wear applications. Rapid technical and commercial progress was

made on the project

-- All aerospace and advanced engineering strategic development

projects progressed steadily and successfully with customer

partners

-- An independent and comprehensive testing programme was

launched to investigate further the properties and benefits of

Hardide coatings for a variety of new potential applications.

-- In January 2013, a loan note holder converted its convertible

loan note of GBP225,000 into 50,000,000 new ordinary shares of the

Company at a price of 0.45p per share ("New Ordinary Shares")

-- Cash at bank at 31 March 2013 of GBP1.39 million

Post Period Events

-- First sales of the new coating for superabrasive materials,

developed as a result of the TSB grant-funding, have been achieved

ahead of expectations

-- Patent applications have been filed in the US and UK for the

new coating for superabrasive materials

-- The business development team has been strengthened by the

appointment of two additional managers, one each in the UK and US

where they will promote applications and sales in existing and new

markets

-- An agent has been appointed for the German market in order to

widen the Company's geographic customer base and to capitalise upon

interest already expressed by potential customers in the region,

particularly in the valve and pump sectors and for cutting

blades

-- The Company is negotiating commercial agreements with two

world-leading blue chip companies which operate across a range of

advanced engineering technologies

Commenting on the interim results, Robert Goddard, chairman of

Hardide plc, said:

"Our 2013 half year results have been weakened primarily by a

rapid inventory reduction exercise by one major customer. This has

resulted in what is expected to be a short--term dip in demand and

projected to be resolved by the end of 2013. The Company is

achieving positive developments technically and with other

customers. So, while this set--back is disappointing, the

confidence of the Board remains high.

Ten new customers placing production orders were signed up

during the first six months of this year, increasing the number of

active accounts by 34% compared with the start of the year. Except

for the single large oil & gas customer, sales to other

customers remain steady. Meanwhile, the technical and commercial

aspects of the business are operating effectively and we are

investing heavily in sales and marketing activities to drive

customer penetration and diversification."

- Ends -

For further information:

Hardide plc

Robert Goddard, Chairman Tel: +44 (0) 1869 353 830

Philip Kirkham, CEO jrobinson@hardide.com

Jackie Robinson, Communications www.hardide.com

Manager

Andrew Craig/Ben Wright Tel: +44 (0) 207 496 3000

www.n1singer.com

Notes to editors:

Hardide develops, manufactures and applies nanotechnology

tungsten carbide-based coatings to a wide range of engineering

components. The Group's patented technology is unique in combining

a mix of abrasion, erosion and corrosion resistant properties in

one coating. When applied to metal components in aggressive

environments, the technology is proven to offer dramatic

improvements in component life resulting in cost savings through

reduced downtime and increased operational efficiency. Customers

include leading companies operating in oil and gas exploration and

production, valve and pump manufacturing, nuclear, advanced

engineering and aerospace industries.

CHAIRMAN'S STATEMENT

The interim results for the six months to 31 March 2013 reflect

the impact of a major inventory reduction by one dominant customer,

the effect of which was increased by unexpected delays in

well-advanced new product introductions by other customers. The

Hardide coating is performing well and is not related to these

customer delays. We expect the inventory reduction exercise to be

short-term and resolved by the end of 2013.

The Group is reporting H1 2013 revenue of GBP1.26m, a decrease

of 18% compared with the same period last year (H1 2012: GBP1.54m).

Group gross profit was GBP855,000, a fall of 23% from GBP1.12m in

H1 2012. Cost of sales decreased by 3% to GBP409,000 reflecting the

fixed nature of production staff salaries. The Group made an

operating loss of GBP102,000 (H1 2012: profit of GBP201,000), which

included the effects of the planned investment in business

development, marketing and further independent testing designed to

open new markets and accelerate customers' test cycles. Group

EBITDA was positive at GBP11,000 (H1 2012: GBP308,000).

While the half year results reflect the drop in demand from one

customer, other sales across our main sectors of oil & gas,

flow control and advanced engineering remain solid. In particular,

revenue from the aerospace and advanced engineering sectors grew by

37%. The strong rise during 2012 of the number of parts in customer

test bore fruit in the first half of 2013 as the number of active

accounts rose by 34% from 29 to 39. These include applications for

customers from sectors including motorsport, oil & gas and flow

control.

Broadening the customer base remains a key strategic objective

and significant investment is being made in 2013 to achieve this

more quickly. To this end, two further business development

managers have been appointed; one each in the UK and US, to develop

sales in existing and new markets. Also post-period, an agent has

been appointed to represent the Company in Germany, where we

believe there is high potential for us.

In January 2013, 50,000,000 New Ordinary Shares were admitted to

AIM after a loan note holder converted its GBP225,000 convertible

loan note that was issued in June 2008. Following this transaction,

the Company has one outstanding convertible loan note of

GBP633,000, which is convertible before August 2014 at a price of

0.45p per share.

In January 2013, the Company was awarded a Technology Strategy

Board grant worth up to GBP250,000 to part-fund a two-year project

to further develop, manufacture and test a new coating for

superabrasive materials used for 'hardfacing' tools in downhole and

other high--wear applications. Rapid technical and commercial

progress was made to the point that first commercial sales were

achieved shortly after the half-year. In April 2013, the Company

signed a mutually exclusive five-year supply agreement for use of

the new material in oil & gas applications with hardfacing

specialists Cutting & Wear Resistant Developments Limited of

Sheffield.

The Company is in the final stages of negotiating commercial

agreements with two world--leading blue chip engineering companies

that operate across a wide range of advanced engineering

technologies. These agreements will provide frameworks for working

in partnership to develop several new applications for the oil and

gas and industrial manufacturing sectors.

Our other strategic development programmes with aerospace and

advanced engineering customer partners continue to advance steadily

and successfully. As a result, we have ever--increasing confidence

that the extended period of product testing by our aerospace OEM

(original equipment manufacturer) customers will result in specific

approvals.

Overall, the Company is experiencing many positive customer and

technical developments so, while it is disappointing to report this

weaker set of interim financial results, the confidence of the

Board remains high.

Robert Goddard

Chairman

18 June 2013

Consolidated income statement

for the period ended 31 March 2013

6 Months 6 Months

to to Year to

31 March 31 March

2013 2012 30 Sept 2012

(unaudited) (unaudited) (audited)

GBP '000 GBP '000 GBP '000

Revenue 1,264 1,539 2,915

Cost of Sales (409) (422) (820)

Gross Profit 855 1,117 2,095

-------------------------------- ------------ ------------ -------------

Administrative expenses (844) (809) (1,573)

Depreciation (57) (51) (108)

Exceptional item: Impairment

of fixed assets - - (36)

Operating profit / (loss) (46) 257 378

-------------------------------- ------------ ------------ -------------

Finance income 1 1 2

Finance costs (57) (57) (115)

Loss on disposal of fixed

assets - -

Profit / (loss) on ordinary

activities before tax (102) 201 265

-------------------------------- ------------ ------------ -------------

Tax - - 42

Profit / (loss) for the period (102) 201 307

-------------------------------- ------------ ------------ -------------

Consolidated statement of changes

in equity for the period ended 31

March 2013

6 months 6 months

to to Year to

31 March 31 March 30 Sept 2012

2013 (unaudited) 2012 (unaudited) (audited)

GBP '000 GBP '000 GBP '000

Total equity at start of period 1,123 106 106

Profit / (loss) for the period (102) 201 307

Issue of new shares 304 714 714

Exchange differences on translation

of foreign operations 10 (9) (6)

Share options 20 - 2

Total Equity at end of period 1,355 1,012 1,123

----------------------------------------- -------------------- ---------------------- ----------------

Consolidated balance sheet at 31 March

2013

31 March 2013 31 March 30 Sept 2012

(unaudited) 2012 (unaudited) (audited)

GBP '000 GBP '000 GBP '000

Assets

Non-current assets

Investments - - -

Goodwill 69 69 69

Intangible assets 2 - -

Property, plant & equipment 374 459 379

Total non-current assets 445 528 448

-------------------------------- -------------- ------------------ -------------

Current assets

Inventories 35 25 33

Trade and other receivables 363 606 549

Other current financial assets 89 80 98

Cash and cash equivalents 1,389 1,072 1,405

Total current assets 1,876 1,783 2,085

-------------------------------- -------------- ------------------ -------------

Total assets 2,321 2,311 2,533

-------------------------------- -------------- ------------------ -------------

Liabilities

Current liabilities

Trade and other payables 276 387 480

Financial liabilities - - 257

Provisions - - -

Total current liabilities 276 387 737

-------------------------------- -------------- ------------------ -------------

Net current assets 1,600 1,396 1,348

-------------------------------- -------------- ------------------ -------------

Non-current liabilities

Financial liabilities 690 912 673

Total non-current liabilities 690 912 673

-------------------------------- -------------- ------------------ -------------

Total liabilities 966 1,299 1,410

-------------------------------- -------------- ------------------ -------------

Net assets 1,355 1,012 1,123

-------------------------------- -------------- ------------------ -------------

Equity

Share capital 2,733 2,666 2,666

Share premium 6,085 5,848 5,848

Retained earnings (7,095) (7,109) (6,993)

Share-based payments reserve 260 248 240

Translation reserve (628) (641) (638)

Total equity 1,355 1,012 1,123

-------------------------------- -------------- ------------------ -------------

Consolidated condensed cash flow statement

for the period ended 31 March 2013

6 months 6 months

to to Year to

31 March 31 March 30 Sept 2012

2013 (unaudited) 2012 (unaudited) (audited)

GBP '000 GBP '000 GBP '000

Cash flows from operating

activities

Operating profit / (loss) (46) 258 378

Impairment of intangibles 0 - -

Depreciation 57 51 108

Impairment of fixed assets - - 36

Share option charge 20 0 1

(increase) / decrease in

inventories (2) (1) (9)

(increase) / decrease in

receivables 195 (178) (139)

Increase / (decrease) in

payables (204) 16 110

Cash generated from operations 20 146 485

-------------------------------------- ------------------ ------------------ -------------

Finance income 1 1 2

Finance costs (31) (43) (83)

Tax received / (paid) - - 45

Net cash generated from operating

activities (10) 104 449

-------------------------------------- ------------------ ------------------ -------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (48) (38) (50)

Net cash used in investing

activities (48) (38) (50)

-------------------------------------- ------------------ ------------------ -------------

Cash flows from financing

activities

Net proceeds from issue of

ordinary share capital 304 714 714

Loans repaid (262) - -

Net cash used in financing

activities 42 714 714

-------------------------------------- ------------------ ------------------ -------------

Net increase / (decrease)

in cash and cash equivalents (16) 780 1,113

-------------------------------------- ------------------ ------------------ -------------

Cash and cash equivalents

at the beginning of the period 1,405 292 292

Cash and cash equivalents

at the end of the period 1,389 1,072 1,405

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDLUBBBGXR

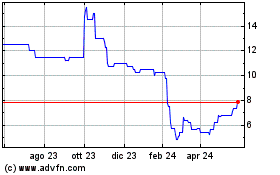

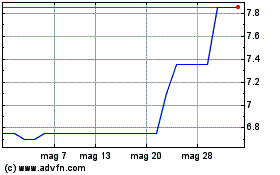

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024