RNS No 0833d

HODDER HEADLINE PLC

9th March 1998

Hodder Headline announces pre-tax profits increased by 24% for

the twelve months to 31st December 1997.

The key points are:

* Pre-tax profits #8.2 million (1996, #6.6 million)

* Earnings per share 15.8 pence (1996, 13.3 pence)

* Sales #93.2 million (1996, #92.8 million)

* Like-for-like publishing sales #91.6 million (1996, #86.4

million)

* Underlying operating cash flow #6.8 million (1996, #5.7

million)

* Net borrowings #2.5 million (1996, #3.8 million)

* Recommended final dividend of 5.0 pence net per share,

making a total dividend of 7.2 pence net per share (1996, 6.5

pence total net per share)

* Sales in the first two months of 1998 were encouraging

Tim Hely Hutchinson, Group Chief Executive, commented on the

results and prospects:

"1997 was a record year for Hodder Headline. Our operating

margins, pre-tax profits and earnings per share all grew

substantially.

These good results were achieved in uneven market conditions.

The important UK retail bookselling market was buoyant, but

this factor was offset by weak UK institutional markets and

overall weak markets overseas. Meanwhile, we continued to

invest vigorously in our publishing lists so as to be able to

provide good quality growth by gains in market share.

1998 has started well, with UK booksellers continuing to report

encouraging results. Our good presence on bestseller lists has

helped us to increase sales by 9% so far this year and the

Group is looking forward to another year of progress in 1998.

I would like to thank all those who have continued to support

the Group and have enabled it to continue prospering,

especially our authors, our customers and our staff."

Attached is a copy of the Preliminary Statement. This

comprises a shortened version of the text that will be included

in our Annual Report and Accounts 1997, to be published in

early April, together with the Group's profit and loss account,

balance sheet and cash flow statement as at 31st December 1997.

For further information, please contact:

Tim Hely Hutchinson 0171 404 5959 on 9th March 1998

Group Chief Executive 0171 873 6000 thereafter

Mark Opzoomer As above

Deputy Chief Executive

Richard Adam As above

Group Finance Director

Russell Ross-Smith 0171 404 5959

Brunswick Group Limited

9th March 1998

HODDER HEADLINE PLC

KEY FINANCIAL FIGURES

1997 1996 %

#000 #000 change

Profit & loss account

_____________________

Like-for-like publishing sales 91,582 86,374 6.0

Reported sales 93,162 92,830 0.4

Operating profit before interests

in associated undertakings

and joint ventures 8,698 7,279 19.5

Operating profit - continuing 8,898 7,469 19.1

operations

Profit before taxation 8,174 6,605 23.8

Earnings per share 15.8p 13.3p 18.8

Dividends

_________

Dividends per share (net) 7.2p 6.5p 10.8

Dividend cover (times) 2.2 2.0 10.0

Cash flow statement

___________________

Net cash inflow from continuing

operating activities before

property disposal proceeds 6,856 5,661 21.1

Operating profit conversion 79% 78% 1.3

Net cash inflow before financing 1,267 3,725 (66.0)

Balance sheet

______________

Debt (net) 2,449 3,837 (36.2)

Gearing 7% 12% (40.5)

Interest cover (times) 12.3 8.6 43.0

Net assets 35,450 33,049 7.3

Net assets per share 100.5p 93.7p 7.3

RESULTS SUMMARY & DIVIDEND

Results

Pre-tax profits increased by 24% to #8.2 million (1996, #6.6

million). Earnings per share increased by 19% to 15.8 pence

(1996, 13.3 pence), slightly less than the pre-tax profits

growth rate because of the return to a more normal tax rate of

32.0% (1996, 29.5%). The Group's sales in the year were #93.2

million (1996, #92.8 million). Like-for-like publishing sales,

excluding the effects of currency translation differences,

discontinued agency business and rationalised distribution

services, grew by 6%. Net debt was reduced at the year end to

#2.5 million (1996, #3.8 million) and net assets rose to #35.5

million (1996, #33.0 million).

Dividend

The Board is recommending payment of a final dividend of 5.0

pence net per share (1996, 4.5 pence net per share), making a

total dividend for the year of 7.2 pence net per share (1996,

6.5 pence net per share). This 11% increase in the total

dividend gives dividend cover of 2.2 times (1996, 2.0 times).

The final dividend will be payable on 19th May 1998 to

shareholders on the register at the close of business on 24th

April 1998.

REVIEW OF MARKETS, STRATEGY & PROSPECTS

The record results achieved in 1997 reflect the benefits of

publishing policies that have been developed and implemented

over at least the last three years. Building successful book

publishing programmes requires patient, thoughtful and very

detailed work but we have now created a good quality platform

for further earnings growth.

UK Consumer Publishing

Following the ending of the Net Book Agreement in 1995, a

development for which we vigorously campaigned, UK book

retailing has begun to enjoy significant growth. This has been

apparent in the specialist bookselling sector, as evidenced by

figures announced by the wholesalers who primarily serve

independent booksellers and by chains such as Waterstone's,

Dillons, Books etc and Ottakars. The chains have plans to open

more stores of all sizes. With the entry of the USA-based

Borders 'superstore' operator into the market and the early

success of the Waterstone's superstore in Glasgow, there is now

the prospect that the British reading public will have access

to perhaps 20 or 30 bookshops of over 20,000 square feet, each

carrying over 100,000 titles, within the next three years. The

new management at WH Smith has affirmed its commitment to books

and has recently increased its range of titles by 25%.

Simultaneously, most of the major supermarket chains and

Woolworths have increased space devoted to books, with

substantial consequent increases in sales. As a result of the

latter development, and to some extent discounting by other

booksellers, the quantities that can be sold of popular

bestsellers - especially in hardback editions - have risen

dramatically. At the same time, however, funding of public

libraries has fallen. It has also been a difficult time for

book clubs.

Our editorial response to these overall market developments has

been assertive. We have substantially raised the estimated

sales value thresholds beneath which we do not take on new

titles. Instead, we concentrate on acquiring or commissioning

potential retail bestsellers that can benefit from being

merchandised in the full range of outlets now available and

that do not rely on library support. In fiction publishing, for

both adults and children, and in religious publishing, this

policy has to be pursued with sensitivity. We take into account

the long-term potential of authors as much as any immediate

bestseller potential. Indeed, we have been outstandingly

successful in finding and developing new and relatively

unexposed writing talent.

Our marketing approach has also developed boldly. We are

supporting potential bestsellers with PR and marketing

campaigns of unprecedented magnitude. We have tiered our sales

forces into separate groupings to specialise in selling our

titles in each sector of the market. We have introduced

telephone selling and merchandiser operations to maximise

repeat order business, and we are currently establishing a full-

time direct sales team.

This strong but adaptable editorial and marketing approach to

Britain's radically changed consumer book marketplace delivered

strong results in 1997 and offers good growth for the future.

UK Educational, Academic & Professional Publishing

Funding of UK state schools has recently been flat. We are

campaigning, alongside other publishers, for the Government to

improve the situation either by allocating more public funds or

by introducing a greater element of parental purchase, or both.

Meanwhile we are seeking to increase our share of the schools

and colleges markets by broadening the subject areas in which

we publish, mostly concentrating on core textbook projects, and

by ever stronger marketing activity.

At least in the foreseeable future, better growth prospects are

apparent in the home learning area. In 1997, we added a very

successful range of revision guides to our Teach Yourself

series. This range will be further developed and we have plans

to expand our home learning publishing very substantially,

creating new series both under our own imprints and as own

brand titles for leading retailers.

At Arnold, we are concentrating on publishing core textbook

titles and producing, primarily for sale to professionals and

libraries, major reference works and journals that are central

to the subject areas they address.

Overseas Operations

We have been improving the quality of our overseas companies by

developing high calibre local publishing lists. Normally, the

development (from a very small base) of such lists would be a

slow process. However, our attempt to accelerate the process

by buying Moa Beckett Publishers in New Zealand at the end of

1994 has been far more successful than we dared hope at the

time. Largely because of the excellent sales of the Anne Geddes

range of books, our New Zealand company enjoyed an even better

year in 1997 than in 1996. In years when there are relatively

few new Anne Geddes titles and the markets themselves are flat

(and both these factors are likely to be present in 1998), the

inevitably slow pace of developing underlying profits growth

from local publishing will be more apparent. Nevertheless, the

local publishing strategy is valid and will produce better

results over the years ahead than could be derived from

exclusive reliance on distributing British books.

The Electronic World

The exponential worldwide growth in screen-based and other

electronic communication provides both challenges and

opportunities for any business that essentially sells

information and entertainment.

From a production point of view, we have the skills and other

resources necessary to create substantial ranges of multi-media

products. It is therefore both the perception that worldwide

markets have quickly become saturated and the fact that well

over half our sales are of novels (which nobody wants to read

on a screen) that continue to prevent us from making large

investments in electronic publishing at present. Nevertheless,

where levels of demand promise adequate profits, we are

publishing electronically. In addition to our spoken word audio

list, we are now, for example, publishing on-line journals and

CD-ROM reference and language teaching materials. We shall

continue to build our range of electronic products and this

will become increasingly important.

From a marketing point of view, Internet bookselling seems

likely to develop into an important sales channel. We are

working with Internet booksellers to make the best of this new

marketing opportunity by digitising all our marketing

information and organising promotions via the Internet. We are

ensuring that, when Hodder Headline titles compete with

American editions available via the Internet, our books are

published earlier, or simultaneously, at competitive prices and

with vigorous marketing support. By taking this positive

approach we are confident that we shall benefit to the fullest

extent from the development of this important new sales

channel.

Summary of Group Current Trading and Prospects

The Group's sales in January and February 1998 were up by 9%

compared to the same period in 1997. For this period there was

no significant difference between reported sales and like-for-

like sales.

We continue to plan for profitable growth generated by our own

editorial and marketing initiatives rather than by any expected

overall growth in our markets. However, the condition of the

UK consumer book market remains encouraging at present and, as

this market accounts for just over half of the Group's sales,

its buoyancy could be helpful.

The prospects for each of our main businesses are set out below

in the Segmental Operating Reviews. In summary, the Group is

looking forward to another year of good progress in 1998.

We are planning further ahead than ever before and we are well

advanced in acquiring and developing high quality new

publishing projects for 1999 and later years. Throughout the

Group, we continue to place great emphasis on striving to

provide the very best possible service to our authors and our

customers. It would not be possible for us to continue growing

and prospering without the support they give us in return. The

number and calibre of new authors joining us, together with the

loyalty of existing authors, is extremely encouraging and

further underpins our confidence in a bright future.

GROUP OPERATING REVIEW

Operating Profits

Group operating profits increased in the year by 19% to #8.9

million (1996, #7.5 million) with our operating margin widening

to 9.6% of sales (1996, 8.0%). Most of the profits growth came

from our largest business segment, UK Consumer Publishing, with

Headline producing excellent growth, following changes we made

in 1996, and with strong performances from all the Hodder &

Stoughton divisions. Across the Group, the key positive

factors for operating profit were improved gross margins and

increased income from joint publishing arrangements and

subsidiary rights.

Underlying Sales Growth

Like-for-like publishing sales increased by 6%. This was led by

our UK Consumer Publishing segment where like-for-like sales

grew by 10%. The Group's reported total sales grew only

slightly, to #93.2 million (1996, #92.8 million). This was a

planned and temporary pause in our sales growth as noted in

last year's Annual Report. We have been discontinuing low

margin agency and door-to-door business in overseas markets and

terminating unprofitable third party distribution contracts in

the UK. Now that these policy changes have been implemented, we

expect the Group's reported sales growth to be resumed.

Gross Margins

For the full year, the Group's gross margins increased to 47.1%

(1996, 45.5%). Improved margins from the UK Consumer Publishing

segment were the principal factor. The improvement was driven

by a reduction in the number of lower volume, lower margin

titles that were published, accompanied by significantly

increased average sales per title from the titles that we did

publish. The economies of scale involved in higher average

print runs more than offset the costs of major marketing

campaigns and incentives to retailers.

Overheads

Distribution costs rose by 4.4% to #10.0 million (1996, #9.6

million). This largely reflected the incremental costs of our

Next Day service to UK retailers, investment in direct sales

services and other pre-retailing services. These enhanced

services supported the sales and marketing initiatives

underlying the sales and margin growth in our UK Consumer

Publishing segment. Administrative expenses grew by 3.0% to

#28.7 million (1996, #27.9 million) as we continue to keep

overall costs under tight control.

Other Income

Other operating income increased to #3.5 million (1996, #2.5

million) in the year. This increase was largely due to the

continued phenomenal success of our joint publishing

arrangement for the works of Anne Geddes, the internationally

renowned photographer. Income from interests in associated

undertakings and joint ventures also grew.

SEGMENTAL OPERATING REVIEWS

UK Consumer Publishing

1997

UK Consumer Publishing operating profits increased by 35% to

#5.3 million (1996, #3.9 million) on sales up by 9% to #58.9

million (1996, #53.9 million). All divisions recorded strong

performances.

The sales growth was primarily driven by increased unit sales

per title and tight control of pricing despite pressure for

higher discounts from most retailers. All divisions continued

to implement the Group's margin-enhancing policy of forcefully

marketing fewer new titles and strongly promoting the backlist.

Prospects

The continued benefits in all the divisions of the consumer

publishing policies outlined above, together with substantial

further growth expected at Headline, offer the prospect of

another year of significant progress for Hodder Headline's UK

Consumer Publishing.

UK Educational, Academic & Professional Publishing

1997

The Group's UK Educational, Academic & Professional segment

continued to expand in 1997, with sales up by 6% to #20.6

million (1996, #19.4 million) and operating profits up by 7% to

#2.6 million (1996, #2.5 million).

Gross margins improved in the year and increased gross profits

were largely re-invested in further editorial and marketing

capacity to fuel future expansion.

Prospects

We have been developing publishing programmes that are designed

to generate editorially led growth each year in these important

publishing areas, without assuming any positive new funding

factors in the relevant markets. We therefore expect progress

to continue well.

Overseas Operations

1997

Overseas Operations sales were #17.6 million, down from #22.8

million in the prior year. As we have mentioned in previous

reports, the 1996 sales included #3.8 million of discontinued

sales from agency and door-to-door business. There were also

exchange rate differences of #0.6 million. These are the

primary reasons for the lower 1997 figure. However, very

difficult market conditions in Australia also had an impact on

sales.

Operating profits amounted to #0.9 million (1996, #1.6

million). The Anne Geddes list in New Zealand had a record

year. However, this was offset by the implications of the

difficulties in the Australian marketplace. South Africa's

contribution was similar to the previous year in a tough but

promising market.

Prospects

Overseas consumer book markets are likely to remain soft and

1998 will be a year of re-adjustment as we respond to these

conditions. However, not least thanks to a major new Anne

Geddes project scheduled for 1999, the longer term prospects

are more encouraging.

UK Distribution and Other Activities

Our wholly owned UK warehousing and customer service company,

Bookpoint, recorded a nominal operating profit in 1997 (1996,

loss #0.5 million). This improvement was achieved by driving

through productivity, quality and service gains. We also

continued to rationalise the number of third party clients

which now amounts to 26, down from over 90 three years ago.

We have not included a full report on this segment this year,

nor do we intend to in the future, now that we have returned

Bookpoint to break-even and the operation represents only 2% of

the Group's consolidated sales.

We shall continue to invest in people, training and equipment

to deliver further service improvements in 1998.

GROUP FINANCIAL REVIEW

Interest

The net interest charge of #0.7 million in 1997 was 16.2% lower

than in 1996. This was achieved through lower borrowing levels

throughout most of the year. The underlying average rate of

interest for the year was approximately 8.0%. Interest cover

improved to 12.3 times compared with 8.6 times in 1996.

Effective Tax Rate

The tax charge for the year was #2.6 million, producing an

effective tax rate of 32.0% (1996, 29.5%). This compares with

a weighted standard rate of taxation of 31.3% for the main

countries in which the Group operates. The lower 1996 effective

rate benefited from the final reinstatement of tax losses

previously utilised in Hodder & Stoughton Limited against

dividend income at a rate of 25.0% and subsequently utilised

against taxable profit at 33.0%.

Year End Net Debt and Gearing

During the year, net debt once again benefited from positive

underlying free cash flow. This resulted in net debt decreasing

from #3.8 million to #2.5 million and gearing reducing to 6.9%

from the 1996 year end level of 11.6%.

Cash Flow and Funding

In 1997 net cash flow from continuing operations, before

property disposal proceeds of #0.2 million, was #6.8 million

(1996, #5.7 million before property disposal proceeds of #3.4

million). This represents 78.8% of operating profits (1996,

77.8%) and is after a further net investment of #4.7 million

(1996, #2.8 million) in new copyright assets, as the Group

continues to add to its future publishing programme.

Underlying free cash flow, before payments in respect of

dividends, the acquisition of subsidiary undertakings and

property disposal proceeds, amounted to #3.4 million. This

compares favourably with the previous year's underlying free

cash flow of #2.8 million, especially when the #4.7 million net

investment in copyright assets made during 1997 is taken into

account.

Working capital throughout the Group was carefully managed,

with stock being reduced from 1996 levels and the ratio of

stock compared to sales continuing the previous two years'

trend by falling from 19.5% to 19.2%. In February 1998, the

Group reviewed and increased from #20.0 million to #30.0

million its bank facilities in the United Kingdom, which

comprise a mixture of two-and four-year committed facilities.

Exchange Rates

In the second half of the year, the Group changed its

accounting policy relating to the translation into sterling of

the trading results of foreign subsidiaries from year end rates

to average rates for the year. This change was made to enable

the Group's results to reflect more accurately the underlying

performance of the business, as the value of sterling

fluctuates. It has also been made in a year when the effect on

the Group's results is minimal; for example, earnings per share

have changed by less than 0.1 pence. In view of the immaterial

effect of this change of policy on the 1996 results, the latter

have not been restated.

The average exchange rates used and those that would have been

used under the previous policy, together with the Group's

associated turnover, pre-tax profits and earnings per share are

as follows:

Current Policy Previous Policy

(Average Rates (Closing Rates as

for the years at

ended 31st December)

31st December)

1996 1997 1996 1997

__________________ _______ ________ ______ ______

Exchange Rates

Australian Dollar 2.01 2.24 2.16 2.53

New Zealand Dollar 2.29 2.52 2.42 2.83

South African Rand 6.74 7.56 8.00 8.01

__________________ _______ ________ ______ ______

Results

#000 #000 #000 #000

Turnover 94,525 93,162 92,830 91,276

Pre-tax profits 6,688 8,174 6,605 8,112

Earnings per share 13.4p 15.8p 13.3p 15.7p

__________________ _______ _______ ______ _______

Purchase of Own Shares

The Directors consider that it would be beneficial to the

Company if, in certain circumstances, the Company had the power

to purchase its own Ordinary Shares. At the present time, the

Directors have no wish to exercise the power to purchase any of

the Shares of the Company. However, they consider it is

appropriate to have the flexibility to do so. Accordingly, they

will be recommending that power in certain circumstances to buy

in and cancel Ordinary Shares should be granted for a limited

period. The Directors would only implement such purchases if

they were satisfied, after careful consideration, that these

would be in the best interests of the Company and all its

shareholders and would result in an increase in expected

earnings per share. Furthermore, account would be taken of the

overall financial implications for the Company. A special

resolution will be proposed at the Company's Annual General

Meeting authorising the Directors to purchase up to a maximum

of 3,527,296 Ordinary Shares, 10 per cent of the issued share

capital of the Company.

Financial Statements

The Group's profit and loss account, balance sheet and cash

flow statement as at 31st December 1997 are set out below.

CONSOLIDATED PROFIT & LOSS ACCOUNT

YEAR ENDED 31ST DECEMBER

1997 1996

Note #000 #000

Turnover - 2 93,162 92,830

continuing operations

Cost of sales (49,314) (50,568)

_______ _______

Gross profit 43,848 42,262

Distribution costs (10,004) (9,582)

Administrative expenses (28,687) (27,854)

Other operating income 3,541 2,453

_______ ________

Operating profit - before

interests in associated undertakings

and joint ventures 8,698 7,279

Income from interests in associated

undertakings and joint ventures 200 190

_____ _____

Operating profit - continuing

operations 2 8,898 7,469

Net interest payable and

similar charges (724) (864)

Profit on ordinary activities

before taxation 8,174 6,605

Tax on profit on ordinary

activities 3 (2,616) (1,948)

_______ _______

Profit on ordinary activities

after taxation 5,558 4,657

Equity minority interests (1) 15

______ ______

Profit for the financial year 5,557 4,672

Dividends 4 (2,540) (2,292)

_______ _______

Retained profit for the financial

year transferred to reserves 3,017 2,380

======= =======

Earnings per share 5 15.8p 13.3p

CONSOLIDATED BALANCE SHEET

31ST DECEMBER

1997 1996

Note #000 #000

Fixed assets

Intangible assets 495 536

Tangible assets 3,695 3,900

Investments 358 373

_______ ______

4,548 4,809

_______ ______

Current assets

Stocks 17,880 18,144

Debtors 45,123 42,976

Cash at bank and in hand 3,492 1,341

_______ _______

66,495 62,461

Creditors : amounts falling due within one

year (29,110) (32,029)

_______ _______

Net current assets 37,385 30,432

_______ _______

Total assets less current liabilities 41,933 35,241

Creditors : amounts falling due after more

than one year (5,582) (921)

Provisions for liabilities and charges (901) (1,271)

_______ ________

Net assets 2 35,450 33,049

======== =========

Capital and reserves

Called up share capital 3,527 3,527

Share premium account 17,256 17,248

Merger reserve 3,171 3,171

Profit and loss account 11,468 9,075

_______ _______

Equity shareholders' funds 6 35,422 33,021

Equity minority interests 28 28

_______ _______

Shareholders' funds 35,450 33,049

======= =======

CONSOLIDATED CASH FLOW STATEMENT

YEAR ENDED 31ST DECEMBER

1997 1996

Note #000 #000

Net cash inflow from operating

activities

Net cash inflow from continuing operating

activities 7,038 9,119

Cash outflow in respect of prior year

acquisition and reorganisation provisions (442) (757)

____ _____

7 6,596 8,362

_____ _____

Dividends from joint ventures and associated

undertakings 186 83

_____ _____

Returns on investment and servicing of finance

Interest paid (781) (1,077)

Interest received 111 207

______ _____

Net cash outflow from returns on investment and

servicing of finance (670) (870)

_____ _____

Taxation

UK corporation tax paid (981) (519)

Overseas tax paid (302) (129)

______ _____

Tax paid (1,283) (648)

______ _____

Capital expenditure and financial investment

Purchase of tangible fixed assets (1,272) (769)

Purchase of intangible fixed assets - (30)

Proceeds from sale of tangible fixed assets 73 94

______ _____

Net cash outflow from capital expenditure and

financial investment (1,199) (705)

______ _____

Net cash outflow from the acquisition of

subsidiary undertakings - (206)

______ _____

Equity dividends paid (2,363) (2,291)

______ ____

Net cash inflow before financing 1,267 3,725

______ _____

Financing

Issue of ordinary share capital 8 23

Proceeds from new borrowings 5,000 -

Repayment of loans (142) (3,858)

Capital element of finance lease payments (504) (461)

Receipts from new finance leases - 25

______ _____

Net cash inflow/(outflow) from financing 4,362 (4,271)

______ _____

Increase / (decrease) in cash 5,629 (546)

====== ======

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

YEAR ENDED 31ST DECEMBER

1997 1996

Note #000 #000

Increase / (decrease) in cash in the year 5,629 (546)

Cash (inflow)/outflow from (increase)/decrease

in debt and leasing finance (4,354) 4,294

_______ ______

Change in debt resulting from cash flows 1,275 3,748

Other finance lease movements (73) 11

Currency translation differences 186 (4)

_____ _____

Movement in net debt in the year 1,388 3,755

Net debt at 1st January (3,837) (7,592)

_____ _____

Net debt at 31st December 8 (2,449) (3,837)

======= =======

NOTES TO THE PRELIMINARY RESULTS

1. BASIS OF PREPARATION

The figures in this Preliminary Statement represent an abridged

version of the Group's full accounts for the financial year

ended 31st December 1997, upon which the Group's auditors have

given an unqualified report dated 9th March 1998.

The 1997 Annual Report and Accounts will be posted to all

shareholders by 1st April 1998 and both this Statement and the

Annual Report and Accounts will be available on request from

the Company Secretary, Hodder Headline PLC, 338 Euston Road,

London NW1 3BH.

2. SEGMENTAL ANALYSIS

Total Intra- Ext Intra- Ext

Group ernal Total Group ernal

sales sales sales sales sales sales

_____ _____ _____ _____ _____ _____

1997 1997 1997 1996 1996 1996

#000 #000 #000 #000 #000 #000

Turnover - continuing operations

UK Consumer

Publishing 58,869 (5,181) 53,688 53,874 (4,915) 48,959

UK Educational,

Academic, &

Professional

Publishing 20,593 (604) 19,989 19,415 (485) 18,930

Overseas

Operations 17,591 (214) 17,377 22,773 (453) 22,320

UK Distribution 9,790 (7,682) 2,108 9,510 (6,889) 2,621

______ _______ _____ ______ ______ _____

106,843 (13,681) 93,162 105,572 (12,742) 92,830

======= ======== ======= ======= ======= ========

1997 1997 1996 1996

#000 #000 #000 #000

Profits

UK Consumer Publishing

- Group 5,283 3,893

- associated undertakings 40 52

_____ _____

5,323 3,945

UK Educational, Academic

& Professional Publishing 2,628 2,452

Overseas Operations 783 1,480

- Group

- joint ventures 160 138

_____ _____

943 1,618

UK Distribution 4 (546)

_____ _____

Operating profit - continuing

operations 8,898 7,469

Net interest payable and similar

charges (724) (864)

Profit before taxation 8,174 6,605

======= ======

2. SEGMENTAL ANALYSIS continued

1997 1997 1996 1996

#000 #000 #000 #000

Net assets

UK Consumer Publishing

- Group 25,980 23,946

- associated

undertakings 134 178

_______ ______

26,114 24,124

UK Educational, Academic &

Professional Publishing 5,527 4,762

Overseas Operations

- Group 4,602 6,451

- joint ventures 229 195

---- -----

4,831 6,646

UK Distribution 1,427 1,354

_____ _____

Net operating assets 37,899 36,886

Unallocated net assets:

Net borrowings (2,449) (3,837)

_____ _____

35,450 33,049

====== =====

3. TAX ON PROFIT ON ORDINARY ACTIVITIES

1997 1996

#000 #000

United Kingdom

Corporation tax at 31.5% 2,272 1,546

(1996, 33.0%)

Deferred taxation (19) 151

Adjustments in respect of (9) (31)

prior years ____ _____

2,244 1,666

Overseas tax 361 267

____ ____

2,605 1,933

Associated undertakings 11 15

____ ____

2,616 1,948

===== =====

4. DIVIDENDS ON EQUITY SHARES

1997 1997 1996 1996

Pence Pence

per per

share share

(net) #000 (net) #000

Ordinary Shares

of 10p each :

Interim paid 2.20 776 2.00 705

Final proposed 5.00 1,764 4.50 1,587

_____ _____ _____ _____

7.20 2,540 6.50 2,292

===== ===== ===== =====

5. EARNINGS PER SHARE

The calculation of earnings per share is based on the profit

for the financial year of #5,557,000 (1996, #4,672,000).

Earnings per share have been calculated using the weighted

average number of shares in issue during the year of 35,268,649

(1996, 35,249,710).

Fully diluted earnings per share would not be materially

different.

6. RECONCILIATION OF MOVEMENT IN EQUITY SHAREHOLDERS' FUNDS

1997 1996

#000 #000

Profit attributable to members

of the Company 5,557 4,672

Dividends (2,540) (2,292)

______ ______

3,017 2,380

Capital subscribed 8 23

Exchange rate differences (624) (217)

______ ______

Net movement in equity

shareholders' funds 2,401 2,186

Opening equity shareholders' 33,021 30,835

funds ______ ______

Closing equity shareholders'

funds 35,422 33,021

====== ======

7. RECONCILIATION OF OPERATING PROFIT TO NET CASH FLOW FROM

OPERATING ACTIVITIES

1997 1996

#000 #000

Operating profit - before interests 8,698 7,279

in associated undertakings and

joint ventures

Adjustments to operating profit :

Depreciation and amortisation

charges 1,391 1,393

Loss on sale of tangible

fixed assets 39 32

(Increase)/decrease in working capital :

Proceeds from sale of property

held for sale 182 3,458

Stocks (300) 117

Debtors (4,168) (6,709)

Creditors 1,105 3,455

Increase in acquisition and

reorganisation provisions 91 94

______ ______

Net cash inflow from contiuing

operations 7,038 9,119

Cash outflow in respect of prior

year acquisition and reorganisation

provisions (442) (757)

______ _____

Net cash inflow from operating

activities 6,596 8,362

====== ======

8. ANALYSIS OF CHANGES IN NET DEBT DURING THE YEAR

Effect

of

At 1st Net foreign At 31st

January cash Other excha- Decem-

nge ber

1997 flow changes rates 1997

#000 #000 #000 #000 #000

Cash at bank and in 1,341 2,007 - 144 3,492

hand

Bank overdrafts (3,620) 3,622 - (2) -

______ ______ ______ ______ ______

(2,279) 5,629 - 142 3,492

Borrowings due within

one year (142) 142 - - -

Borrowings due after one

year - (5,000) - - (5,000)

Finance leases (1,416) 504 (73) 44 (941)

______ ______ ______ ______ ______

(1,558) (4,354) (73) 44 (5,941)

______ ______ ______ ______ ______

Net debt (3,837) 1,275 (73) 186 (2,449)

====== ====== ====== ====== ======

9. COMPANY INFORMATION

The Annual General Meeting will be held at 338 Euston Road,

London NW1 3BH, at 10.00 a.m. on Wednesday 6th May 1998.

END

FR FCFCNNDKDFNK

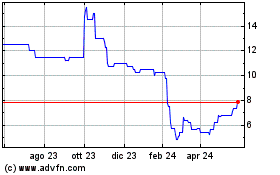

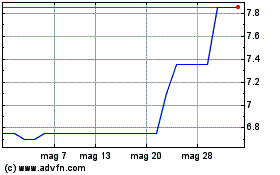

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024