TIDMIGG

RNS Number : 4053J

IG Group Holdings plc

15 August 2023

IG Group Holdings plc

L EI No: 2 1 3 8 0 0 3A5Q1 M7 A NOUD 76

15 August 2023

IG Group Holdings plc

(the 'Company')

Publication of Annual Report and Notice of Annual General

Meeting

The Company announces that its 2023 Annual General Meeting will

be held at 13:00 on Wednesday 20 September 2023 at the Company's

registered office, located at Cannon Bridge House, 25 Dowgate Hill,

London, EC4R 2YA.

The following documents will today be distributed to

shareholders:

-- Annual Report and Financial Statements for the year ended 31 May 2023 ('Annual Report'); and

-- Notice of the 2023 Annual General Meeting ('AGM').

In accordance with Listing Rule 9.6.1, copies of the documents

listed above will be submitted to the National Storage Mechanism

and will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The Annual Report and Notice of the AGM are available to view on

the Company's website using the following links:

-- Annual Report: annualreport.iggroup.com/2023

-- Notice of AGM: iggroup.com/investors/shareholder-information/general-meetings

IG Group Investors IG Group FTI Consulting Company Secretariat

Press

Martin Price Angela Warburton Edward Berry / Aurelia Gibbs

/ Simon Wright / Alayna Katherine Bell

Francis

----------------- ----------------------------- --------------------

020 7573 0020 020 7633 07703 330 199 /

/ 0099 5382 / 5395 079 7687 0961 020 7896 0011

----------------- ----------------------------- --------------------

investors@ig.com press@ig.com iggroup.sc@fticonsulting.com cosec@ig.com

----------------- ----------------------------- --------------------

Additional information

The Appendix to this announcement contains information extracted

from the 2023 Annual Report for the purposes of compliance with the

FCA's Disclosure Guidance and Transparency Rules. It should be read

in conjunction with the Company's Full Year 2023 results

announcement issued on 20 July 2023, which can be found at

www.iggroup.com . Together, these constitute the information

required by DTR 6.3.5 to be communicated to the media in unedited

full text through a Regulatory Information Service. This

information is not a substitute for reading the Company's Annual

Report in full. Page numbers and cross references in the extracted

information refer to page numbers and cross references in the 2023

Annual Report.

About IG

IG Group (LSEG:IGG) is an innovative, global fintech company

that delivers dynamic online trading platforms and a robust

educational ecosystem to power the pursuit of financial freedom for

the ambitious. For nearly five decades, the Company has evolved its

technology, risk management, financial products, content, and

platforms to meet the needs of its retail and institutional

clients. IG Group continues to innovate its offering for the new

generation of tomorrow's investors through its IG, tastytrade, IG

Prime, Spectrum, and DailyFX brands.

Established in 1974, IG Group is a London-headquartered FTSE 250

company offering its clients access to 19,000 financial markets

through its offices spread across Europe, North America, Africa,

Asia-Pacific and the Middle East.

APPIX

The principal risks set out below are extracted from pages 49 to

53 of the Annual Report and are repeated here solely for the

purpose of complying with DTR 6.3.5.

Principal Risks

Risk category Principal risks Mitigation and controls

------------------------- -------------------------- -----------------------------------------------------------

Business Model Risk Market risk -

The risk we face arising trading book and * The inherent conflict in OTC trading, is mitigated at

from the nature of non-trading book IG through the design of our business model, being

our business and (inclusive of based around the internalisation of client trading

business interest rate and hedging of residual exposures more than the

model, including market, risk) predefined Board approved limits. In short, our

credit and liquidity The risk of loss long-term interests align with those of our clients

risks, and capital due to movements

adequacy adherence. in market prices

arising from our * Additionally, our order execution system price

Risk appetite net position in improves client orders where the underlying market

In pursuit of our financial instruments. has moved against them while the order is being

business processed. We operate a real-time market position

goals, we have an monitoring system

appetite

for running modest

levels of market risk * Our scenario-based stress tests are performed on an

to facilitate the hourly basis

high-quality

instant execution of

client orders while * We have predetermined, Board-approved, market risk

accepting that periodic limits

credit risk losses

will occur in normal

business activity. * Our dynamic approach to limit management makes full

We have very little use of highly liquid markets in core hours, reducing

appetite for liquidity in less liquid periods

or regulatory capital

risk and ensure complete

compliance with

regulatory

requirements.

Emerging and evolving

risks

We monitor the emergence

of significant events

or topics which could,

if unmanaged, have

a material impact on

the Group. Such matters

include the war in

Ukraine, trade wars,

political and

legislative

changes and any other

matters which may lead

to macro market

movements.

Where such events or

topics emerge, as a

matter of course we

consider client margin

requirements, market

risk limits, broker

positions, and cash

and capital held at

each individual entity

to ensure we remain

within our risk appetite

as the external

environment

and risks we face

change.

------------------------- -------------------------- -----------------------------------------------------------

Credit risk -

client * Our approach to setting client margin requirements is

The risk that centred on protecting our clients from poor outcomes,

a client fails taking into consideration underlying market

to meet their volatility and liquidity, while simultaneously

obligations to protecting IG from exposure to debt

us, resulting

in a financial

loss. * Client positions are automatically liquidated once

they have insufficient margin on their account - this

not only protects IG against debt, but importantly

protects our clients

* Our client education offering provides information

about robust risk management practices

------------------------- -------------------------- -----------------------------------------------------------

Credit risk -

financial institution * We undertake credit reviews of financial

The risk of loss institutional counterparties upon account opening,

due to the failure which is updated periodically (or ad hoc upon an

of a financial event)

institution counterparty.

* Our credit exposures to each of our broking

counterparties are actively managed in line with

limits

* We perform daily monitoring of counterparties'

creditworthiness

-------------------------- -----------------------------------------------------------

Liquidity

The risk that * Active liquidity management within the Group is

we are unable central to our approach, ensuring sufficient

to meet our financial liquidity is in the right places at the right times

obligations.

* We conduct monthly liquidity stress tests

* We have access to committed unsecured bank facilities

and debt

-------------------------- -----------------------------------------------------------

Capital adequacy

The risk that * We conduct daily monitoring of compliance with all

we hold insufficient regulatory capital requirements. With our ICARA

capital to cover (Internal Capital Adequacy and Risk Assessment), we

our risk exposures. conduct an annual capital and liquidity assessment

including the application of a series of

stress-testing scenarios, based against our financial

projections, all of which is approved by the Board

------------------------- -------------------------- -----------------------------------------------------------

Risk category Principal risks Mitigation and controls

------------------------- ------------------------- ------------------------------------------------------------

Commercial Risk Strategic delivery

The risk that our The risk that * Regular strategy updates to the Board from the

performance our competitive Executive Directors throughout the year detailing the

is affected by adverse position weakens strategic progress of the business

market conditions, or that our profits

failure to adopt an are impacted due

effective business to the failure * External consultation and extensive market research

strategy, or competitors to adopt or implement undertaken in advance of committing to any strategy

offering more attractive an effective business to test and validate a concept

products or services. strategy, including

the risk of failing

to appropriately * Projects managed via a phased investment process,

Risk appetite integrate an acquisition. with regular review periods, to assess performance

There is little appetite and determine if further investment is justified

for activities that

threaten efficient

delivery of any core

initiatives or that

can diminish our

reputation,

although acceptance

of some strategic risk

is necessary to foster

innovation.

Emerging and evolving

risks

We closely monitor

the high-inflationary

environment and the

UK's cost of living

crisis, and their

effects

on client's ability

to trade, supplier

costs, wages, and income

from interest. As a

UK-headquartered firm

we are exposed to FX

rate fluctuations when

transferring funds

between non-UK entities.

------------------------- ------------------------- ------------------------------------------------------------

Financial market

conditions * Review of daily revenue, monthly financial

The risk that information, KPIs and regular reforecasts of expected

our performance financial performance

is affected by

client sensitivity

to adverse market * Forecasts used to determine actions necessary to

conditions, making manage performance and products in different

it harder to recruit geographical locations, with consideration given to

new clients and changes in market conditions

reducing the willingness

of existing clients

to trade. * Regular updates to investors and market analysts to

manage the impact of market conditions on performance

expectations

------------------------- ------------------------- ------------------------------------------------------------

Competitor

We operate in * Our approach to conduct demands we put the client at

a highly competitive the heart of our decision making. We do not engage in

environment and questionable practices, regardless of whether they

seek to mitigate would prove to be commercially attractive to clients

competitor risk

by maintaining

a clear distinction * Ensuring that our product offering remains attractive,

in the market. considering the other benefits that we offer our

This is achieved clients, including brand, strength of technology and

through compelling service quality

and innovative

product development

and quality of

service, all while

closely monitoring

the activity and

performance of

our competitors.

------------------------- ------------------------- ------------------------------------------------------------

Risk category Principal risks Mitigation and controls

--------------------------- -------------------- ------------------------------------------------------------

Conduct and Operational Technology

Risk and information * Maintenance of a 24/7 Incident Management function

The risks that our security

conduct poses to The risk of

the achievement of data loss * Security operations function with 24/7

fair outcomes for or that our strength-in-depth capabilities to monitor, prevent

consumers or the operations and triage cyber threats

financial markets, are affected,

and the risk of loss or clients

resulting from inadequate receive a * DOS mitigation services and 24/7 incident management

or failed internal degraded service capabilities

processes, people, or are unable

systems, or external to trade due

events. to an operational * Regular disaster-recovery capability testing

outage or

system limitations.

Risk appetite Technology * Capacity stress testing

Operational risk threats can

is present in the evolve from

normal course of poor internal * Our Change Management and Quality Assurance functions

business, and it practices undertake risk assessments, utilise defined

is not possible, and systems maintenance windows and help deploy new products and

or even desirable, or from the services

to eliminate all continuously

risks inherent in evolving cyber

our activities. We landscape. * We invest in strength-in-depth capabilities to

have no appetite mitigate the ever-present and changing cyber threats

for poor conduct-related

events.

Emerging and evolving

risks

The cyber threat

landscape continues

to evolve, with cyber

criminals and ransomware

groups constantly

changing and maturing

their attack methods

and targets. The

impact of climate

change poses risks

to business continuity

and, therefore, potential

harm to our clients

and people. Failure

to responsibly manage

our Group emissions

or to mitigate the

risks associated

with climate change

poses reputational

and regulatory risks.

The ongoing energy

crisis in South Africa,

which results in

load-shedding, is

a concern, with proactive

steps taken by the

Group to mitigate

any potential impact

on our clients and

employees.

-------------------- ------------------------------------------------------------

Financial

crime * A mature control framework for identifying and

The risk of reporting on suspicious transactions, which is

failing to designed to protect the integrity of the financial

identify and markets and provide a stable and fair-trading

report financial environment for our clients

crime. Inadequate

oversight

and client * Appropriate onboarding processes for different client

due diligence types and vendors with enhanced due diligence and

can result monitoring processes where appropriate

in clients

attempting

to use us * Segregated duties within processes to ensure adequate

to commit oversight and control over internal fraud

fraud or launder

money, third

parties trying

to access

client or

corporate

funds, or

employees

misappropriating

funds if an

opportunity

arose.

-------------------- ------------------------------------------------------------

Trading issues

The risk related * A 24/7 approach with trading desks located in London

to any issues and Australia providing 24-hour coverage. We apply

around our Board-approved Market Risk Limits and operate under a

internal hedging, robust control framework to mitigate our exposure to

client trading, loss through operational risk events which may impact

and process trading. Our order execution processes not only

for corporate comply with all regulatory requirements, but go over

actions, dividends, and above in filling client orders, on an

and stock asymmetrical basis, providing better than best

transfers. execution

-------------------- ------------------------------------------------------------

Client life

cycle management * Bespoke onboarding processes ensure we only offer

This is the products and services to clients with sufficient

risk related means and a clear understanding of the risks

to issues involved. Regular assessments of services identified

in the client as being critical to clients to ensure their

life cycle operational resiliency. Single points of failure

spanning the identified, and contingency plans set in place

customer agreement,

account set-up,

interactions, * Complete adherence to client money and asset

and appropriateness regulations, taking the highest standard set by the

of account FCA in the UK and applying them worldwide where

types and possible

product offerings.

* The use of KPIs to monitor levels of service provided

and act where needed

* We offer a plethora of high-quality, easily

accessible educational material to ensure clients can

improve their understanding of our products and the

financial markets - supporting their pursuit of

financial freedom

* We monitor for client behaviours which may indicate

levels of vulnerability and proactively engage with

them to minimise poor outcomes

-------------------- ------------------------------------------------------------

Financial

integrity * Our operational risk framework provides the base from

and statutory which our robust control environment reduces

reporting operational risk events from manifesting

issues

The risk of

production * Our automated systems enable us to flex with client

issues which trading volumes

could lead

to untimely,

incomplete, * Dedicated specialist steering committees manage and

or inaccurate oversee niche areas, such as transaction reporting,

Financial financial crime, financial reporting and forecasting,

Statements, climate responsibilities, our Internal ICARA and

transaction Annual Report production

reporting,

tax filing,

regulatory

capital, and

forecasting.

--------------------------- -------------------- ------------------------------------------------------------

Risk category Principal risks Mitigation and controls

------------------------- -------------------------- -----------------------------------------------------------

Regulatory Environment Regulatory risk

Risk The risk of investigation, * Continuous monitoring of operations to ensure they

The risk that we face enforcement, or adhere to regulatory requirements and expected

enhanced regulatory sanction by financial standards

scrutiny with a higher services regulators.

chance of regulatory This may be driven

action, or the risk by internal factors, * Continuous review of all regulatory incidents and

that the regulatory such as the strength breaches with deep dives performed on common themes

environment in any of our control

of the jurisdictions framework or our

in which we currently interpretation, * Policies and procedures are embedded across the Group

operate, or may wish understanding, with a regulatory compliant mindset

to operate, changes or implementation

in a way that has an of relevant regulatory

adverse effect on our requirements. * We operate values to always Champion the Client,

business or operations, This risk can whilst Raising the Bar

through reduction in also arise from

revenue, increases external factors,

in costs, or increases such as the current

in capital and liquidity and changing priorities

requirements. of our regulators'

policy and supervision

Risk appetite departments.

We have no appetite

to breach financial

services regulatory

requirements and we

strive to always comply

with applicable laws

and regulations.

Emerging and evolving

risks

The regulatory landscape

continues to evolve,

and we need to react

and ensure adherence

to incoming regulations

in a timely manner.

Less well-developed

regulatory frameworks,

such as digital assets,

are actively monitored

for any changes where

we may need to adapt

strategic rollouts.

The introduction of

the FCA's Consumer

Duty principle is an

example of how we plan

for change by

identifying

workstreams with owners

who are responsible

for updating steering

committees on progress.

The same approach will

be taken with incoming

DORA1, MiFID/MiFIR2

Review, EMIR3, and

any other regulatory

changes. Many of the

concepts in the FCA's

Consumer Duty, and

other incoming

regulations,

are already practiced

and well-embedded;

and are in line with

our purpose, strategic

drivers, and values

such as being 'Tuned

for Growth' and

'Champion

the Client. We welcome

their introduction

and the impact that

they will have on our

industry.

------------------------- -------------------------- -----------------------------------------------------------

Regulatory change

The risk of governments * We foster strong relationships with key regulators,

or regulators with whom we actively seek to converse to keep

introducing legislation abreast of, contribute, to and correctly implement

or new regulations regulatory changes

and requirements

in any of the

jurisdictions * We pay close regard to relevant public statements

in which we operate issued by regulators that may affect our industry

which could result

in an adverse

effect on our * The Board Risk Committee receives regular reports of

business or operations, current and emerging risks which timeline incoming,

through reduction and potential incoming, changes

in revenue, increases

in costs or increases

in capital and * The Board Risk Committee has received regular updates

liquidity requirements. on UK Consumer Duty regulation, from the early

consultation stage through to approval of the final

implementation plan

------------------------- -------------------------- -----------------------------------------------------------

Tax change

The risk of significant * We monitor developments in international tax laws to

adverse changes ensure continued compliance and ensure stakeholders

in the way we are aware of any significant adverse changes that

are taxed. might impact us

A prime example

is the imposition * Where appropriate and possible, we collaborate with

of a financial tax and regulatory authorities to provide input on

transactions tax, tax policy, or changes in law

which could severely

impact the economics

of trading and

developments in

international

tax law.

-------------------------- -----------------------------------------------------------

1 DORA - Digital Operational Resilience Act7

2 MiFID - Markets in Financial Instruments Directive

MiFIR - Markets in Financial instruments Regulation

3 EMIR - European Market Infrastructure Regulation

------------------------- -----------------------------------------------------------------------------------------

Statement of Directors' Responsibilities in respect of the

Financial Statements

The Directors are responsible for preparing the FY23 Annual

Report and Financial Statements in accordance with applicable law

and regulation.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

have prepared the Group and the Company Financial Statements in

accordance with UK-adopted International Accounting Standards.

Under company law, Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of the

profit or loss of the Group for that period. In preparing the

Financial Statements, the Directors are required to:

-- Select suitable accounting policies and then apply them consistently;

-- State whether applicable UK-adopted International Accounting

Standards have been followed, subject to any material departures

disclosed and explained in the Financial Statements;

-- Make judgements and accounting estimates that are reasonable and prudent; and

-- Prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Group and Company

will continue in business.

The Directors are responsible for safeguarding the assets of the

Group and Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are also responsible for keeping adequate

accounting records that are sufficient to show and explain the

Group's and Company's transactions and disclose with reasonable

accuracy at any time the financial position of the Group and

Company and enable them to ensure that the Financial Statements and

the Directors' Remuneration Report comply with the CA2006.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the UK governing the

preparation and dissemination of Financial Statements may differ

from legislation in other jurisdictions.

Directors' confirmations

The Directors consider that the FY23 Annual Report and Financial

Statements, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Group's and Company's position and performance, business model

and strategy.

Each of the Directors, whose names and functions are listed on

pages 58-61 confirm that, to the best of their knowledge:

-- The Group and Company Financial Statements, which have been

prepared in accordance with UK-adopted International Accounting

Standards, give a true and fair view of the assets, liabilities and

financial position of the Group and Company, and of the profit of

the Group

-- The Strategic Report includes a fair review of the

development and performance of the business and the position of the

Group and Company, together with a description of the principal

risks and uncertainties that it faces

In the case of each Director in office at the date the

Directors' Report is approved:

-- So far as the Director is aware, there is no relevant audit

information of which the Group's and Company's Auditor are

unaware

-- They have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Group's and Company's

Auditor is aware of that information

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAFLFSVTTIELIV

(END) Dow Jones Newswires

August 15, 2023 09:52 ET (13:52 GMT)

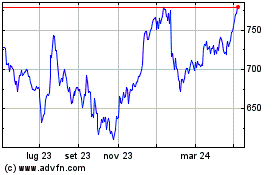

Grafico Azioni Ig (LSE:IGG)

Storico

Da Mag 2024 a Giu 2024

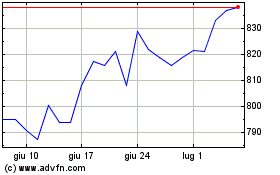

Grafico Azioni Ig (LSE:IGG)

Storico

Da Giu 2023 a Giu 2024