RNS Number:7619N

International Greetings PLC

13 December 2006

13 December 2006

INTERNATIONAL GREETINGS PLC

("International Greetings" or "the Group")

International growth continues to strengthen performance

International Greetings PLC (AIM:IGR), the global designer and manufacturer of

greetings products, film and television character based licensed stationery,

books and gifts, today announces interim results for the six months ended 30

September 2006.

Financial highlights:

* Turnover for the period was #85.1m (2005: #83.8m)

* Operating profit of #6.2m (2005: #6.5m**)

* Interest payable during the period increased to #1m (2005: #0.7m)

* Profit before tax of #5.2m (2005: #5.8m**)

* Adjusted *profit before tax amounted to #6.2m (2005: #6.5m**)

* Basic earnings per share for the period were 8.2p (2005: 9.3p**)

* Adjusted *earnings per share were 10.1p (2005: 10.6p**)

* Interim dividend increased 12.5% to 2.25p per share reflecting the

Board's continued confidence in the Group.

Operational highlights:

* Acquisitions of Alligator Books and the remaining 50% shareholding in

the Group's Dutch joint venture, Anchor International, performing well and

providing strong potential for future growth

* Continued growth in European sales underlined by 20% increase at

Hoomark

* Focus on developing business in the mass market retail sector in

Europe following the integration of Anchor International

* Full season of manufacturing in China with all orders on time and

within budget

* New distribution channel planned for the US, offering a complete range

of greetings and stationery products to mid-size retail groups

* Licensed range of Christmas products launched for the recently

released Warner Bros film "Happy Feet"

* Licences signed for "The Simpsons Movie", "Spider-Man 3", "Shrek 3"

and "Pirates of the Caribbean 3".

Commenting on the results, Nick Fisher, Joint Chief Executive, said: "Whilst we

operate in the highly competitive UK retail sector and are not immune to its

challenges, we have completed the majority of this season's deliveries to our

customers. Internationally, we have achieved our targets both in terms of

increased sales and new market opportunities in Europe and the US, and believe

we have put in place a strong foundation for future growth.

"As the only listed company in our sector in Europe, we have reinforced our

position as an industry consolidator and we continue to identify suitable

acquisitions in all our geographic areas of operation. This is an important part

of our future growth strategy."

For further information:

Nick Fisher, Joint Chief Executive, International Greetings: 01707 630 630

Richard Sunderland/Rachel Drysdale, Tavistock Communications: 020 7920 3150

* figure excludes amortisation of goodwill of #669,000 (6 months to 30 September

2005: #520,000, 12 months to 31 March 2006: #1,031,000), exceptional item of

#304,000 (6 months to 30 September 2005: #121,000, 12 months to 31 March 2006:

#3,310,000) and profit on disposal of fixed assets of #nil (6 months to 30

September 2005: #nil, 12 months to 31 March 2006: #1,838,000).

** figure restated following adoption of FRS20 (Share based payments)

CHAIRMAN'S STATEMENT 2006

I am pleased to announce the interim results for the six months to 30 September

2006, this being the first results announcement since I became Chairman

following this year's AGM. During the period we have seen a number of exciting

developments within the Group, particularly on an international level. We have

seen impressive sales growth in Europe, bedded down two acquisitions, developed

further our US strategy and completed the first full season of production at our

factory in China.

As we have indicated in previous years, the seasonality of the Group's business

means that the first six month figures are not a reliable indicator of the full

year figures, as turnover during the months of September and October, which

straddle the half-year end, accounts for just over a third of the Group's entire

annual turnover. As a result, the interim results are extremely sensitive to the

specific timing of deliveries to our customers.

Turnover for the period was #85.1m (2005: #83.8m), with operating profit of

#6.2m (2005: #6.5m**). Net interest payable during the period increased to #1.0m

from #0.7m last year, resulting in profit before tax of #5.2m (2005: #5.8m**).

Adjusted *profit before tax amounted to #6.2m (2005: #6.5m**). Basic earnings

per share for the period were 8.2p (2005: 9.3p**), whilst adjusted *earnings per

share were 10.1p (2005: 10.6p**)

The above figures include turnover of #4.8m and profit before tax of #0.5m

attributable to the acquisitions of Alligator Books and the remaining 50%

shareholding not previously owned in the Group's Dutch joint venture, Anchor

International, which were acquired in April and July respectively this year.

Both of these acquisitions have performed well and met our expectations with

regard to turnover and profit during the period. The integration of both

businesses into our existing operational structure has proceeded smoothly and

the potential for future growth opportunities is excellent.

European sales continue to grow impressively, with a 20% like-for-like increase

in turnover of our Hoomark division. We are concentrating on developing our

European business in the mass market retail sector, where we see considerable

scope for future growth. The integration of Anchor International has enabled us

to create a European stationery and gift division, which will play an important

part in our plans for further expansion in Europe.

I am pleased to report that all orders in our new factory in China were

completed on time and within budget and we continue to look for opportunities to

further expand production in this facility.

In the US, in addition to supplying the mass market and independent retail

sectors, we are planning to develop a new distribution channel, replicating the

Anker business model in the UK which will offer a complete range of greetings

and stationery products to mid-size retail groups.

Design and licensed merchandise, as always, play an important role in our

business. We have launched licensed ranges of Christmas products for the

recently released Warner Bros film "Happy Feet", and have signed licences for

"The Simpsons Movie", "Spider-Man 3", "Shrek 3" and "Pirates of the Caribbean

3", all due to be released during 2007.

Current Trading

The UK retail sector is operating in a highly competitive business climate. In

addition, consumers are carrying out their Christmas shopping later, seeking to

benefit from intense competition between the retailers. Although we have

completed the majority of this season's deliveries to our customers, we are not

immune from this challenging retail climate.

As the only listed company in our sector in Europe, we have reinforced our

position as an industry consolidator. Having successfully integrated two

businesses in the first half of the year, we continue to look for suitable

businesses to acquire in all the geographic areas in which we operate. This is

an important part of our future growth strategy. At the same time we remain

clearly focused on maximising sales opportunities in all our existing businesses

and markets, particularly Europe and the US, and are currently working on

designs and product ranges for Christmas 2007 for all our major UK retail

customers.

Reflecting our confidence in the outcome for the full year and our future plans

for growth, we are proposing to pay an interim dividend of 2.25p a share, an

increase of 12.5% over last year. The dividend will be paid on 25 January 2007

to all shareholders on the register on 22 December 2006.

On a personal note, I am delighted to have been appointed Chairman of

International Greetings and on behalf of the Board would like to thank John

Elfed Jones for the invaluable contribution he has made during his 10 year

tenure as Chairman. John remains on the Board as a non-executive Director, so we

will continue to benefit from his considerable experience and expertise.

Keith James OBE

Chairman

* figure excludes amortisation of goodwill of #669,000 (6 months to 30 September

2005: #520,000, 12 months to 31 March 2006: #1,031,000), exceptional item of

#304,000 (6 months to 30 September 2005: #121,000, 12 months to 31 March 2006:

#3,310,000) and profit on disposal of fixed assets of #nil (6 months to 30

September 2005: #nil, 12 months to 31 March 2006: #1,838,000).

** figure restated following adoption of FRS20 (Share based payments)

International Greetings PLC Interim Report 2006

Consolidated profit and loss account for the six months

to 30 September 2006

Note Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated (restated

-see note 1) -see note 1)

#000 #000 #000

Continuing

Operations Acquisitions Total

Turnover 2 80,271 4,822 85,093 83,771 198,139

---------------------------------------------------------------------------------------------------------

Operating profit before

exceptional item 2 5,906 567 6,473 6,615 18,320

Exceptional item 4 (304) - (304) (121) (3,310)

---------------------------------------------------------------------------------------------------------

Operating profit 5,602 567 6,169 6,494 15,010

Share of operating profit of

joint venture - - - - 7

---------------------------------------------------------------------------------------------------------

6,494 15,017

Profit on disposal of fixed

assets - - - - 1,838

Net interest payable (863) (95) (958) (670) (1,801)

---------------------------------------------------------------------------------------------------------

Profit before taxation 4,739 472 5,211 5,824 15,054

Taxation 6 (1,408) (1,637) (3,106)

---------------------------------------------------------------------------------------------------------

Profit for the period 3,803 4,187 11,948

---------------------------------------------------------------------------------------------------------

Earnings per share 5

Basic 8.2p 9.3p 26.2p

Diluted 8.1p 9.1p 25.8p

---------------------------------------------------------------------------------------------------------

Statement of recognised gains and losses

for the six months to 30 September 2006

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated- (restated-

see note 1) see note 1)

#000 #000 #000

Profit for the period 3,803 4,187 11,948

Currency translation differences

arising on foreign currency net (1,512) 703 914

investments

Share based payments 112 199 423

--------------------------------------------------------------------------------------------------

Total recognised gains and losses relating

to the period 2,403 5,089 13,285

--------------------------------------------------------------------------------------------------

International Greetings PLC Interim Report 2006

Consolidated balance sheet at 30 September 2006

Unaudited Unaudited Audited

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated- (restated-

see note 1) see note 1)

Note #000 #000 #000

Fixed assets

Intangible assets - goodwill 25,422 22,318 21,339

Tangible assets 40,017 46,381 37,134

Investments - 170 173

--------------------------------------------------------------------------------------------------

65,439 68,869 58,646

Current assets

Stocks 62,254 59,605 40,008

Debtors 75,460 68,045 29,863

Investments 15 58 65

Cash at bank and in hand 10 3 11,825

--------------------------------------------------------------------------------------------------

137,739 127,711 81,761

Creditors: amounts falling due within

one year (119,053) (120,991) (56,382)

--------------------------------------------------------------------------------------------------

Net current assets 18,686 6,720 25,379

Total assets less current liabilities 84,125 75,589 84,025

Creditors: amounts falling due after

more than one year (7,155) (5,467) (6,352)

Provisions for liabilities and charges (1,548) (1,781) (1,882)

--------------------------------------------------------------------------------------------------

Net assets 75,422 68,341 75,791

--------------------------------------------------------------------------------------------------

Capital and reserves

Called up share capital 2,314 2,306 2,308

Share premium account 2,455 15,079 2,386

Potential issue of shares 1,052 672 1,052

Other reserves 12,845 724 13,964

Profit and loss account 56,756 49,560 56,081

--------------------------------------------------------------------------------------------------

Equity shareholders' funds 7 75,422 68,341 75,791

--------------------------------------------------------------------------------------------------

International Greetings PLC Interim Report 2006

Consolidated cash flow statement

for the six months to 30 September 2006

Unaudited Unaudited Audited

6 months to 6 months to 12 Months

30 Sept 2006 30 Sept 2005 to 31 Mar 2006

Note #000 #000 #000

Net cash (outflow)/inflow from

operating activities 8 (40,073) (47,311) 2,706

Returns on investments and servicing

of finance 9 (1,020) (483) (1,232)

Taxation (703) (1,642) (5,980)

Capital expenditure 9 (6,610) (4,145) 7,809

Acquisitions and disposals 9 (16,372) (13,145) (13,078)

Equity dividends paid (3,240) (2,652) (3,578)

---------------------------------------------------------------------------------------------------

Cash (outflow) before financing (68,018) (69,378) (13,353)

Financing 9 973 (76) (630)

---------------------------------------------------------------------------------------------------

(Decrease) in cash (67,045) (69,454) (13,983)

---------------------------------------------------------------------------------------------------

Reconciliation of net cash flow to movement in net (debt)/funds

for the six months to 30 September 2006

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

#000 #000 #000

(Decrease) in cash in the period (67,045) (69,454) (13,983)

Cash (outflow)/inflow from debt and lease

financing (935) 117 462

--------------------------------------------------------------------------------------------------

Change in net (debt) resulting from cash flows (67,980) (69,337) (13,521)

Translation differences 892 (564) (1,013)

--------------------------------------------------------------------------------------------------

Movement in net (debt) in the period (67,088) (69,901) (14,534)

Net (debt)/funds at beginning of period (10,744) 3,790 3,790

--------------------------------------------------------------------------------------------------

Net (debt) at end of period (77,832) (66,111) (10,744)

--------------------------------------------------------------------------------------------------

International Greetings PLC Interim report 2006

Notes:

1. Basis of preparation

The financial information contained in this interim report does not constitute

statutory accounts as defined in Section 240 of the Companies Act 1985 and is

unaudited.

The comparative figures for the year ended 31 March 2006 are an abridged version

of the published accounts and are not the company's statutory accounts for that

financial year. Those accounts have been reported on without qualification by

the auditors, and without any statement under Section 237 (2) or (3) of the

Companies Act 1985, and have been delivered to the Registrar of Companies.

The interim statement has been prepared under the same accounting policies as

those used for the financial statements for the year ended 31 March 2006, with

the exception of share options which are now accounted for under FRS20 (Share

based payments) -see note 3. The comparative figures for the 6 months ended 30

September 2005 and the year ended 31 March 2006 have been restated to

reflect this change where appropriate.

2. Acquisitions

(a) On 6 April 2006, the Group acquired 100% of the issued share capital of

Alligator Books Limited, a publisher and distributor of children's books and

stationery. An initial consideration of #2.5m was paid, #2.25m in cash and #0.25m

by the issue of 62,703 new ordinary shares. Further payments may become payable,

depending on profitability for the year ended 31 March 2007, in a mixture of

cash and shares. During the period from 7 April 2006 to 30 September 2006, the

Group's results include turnover of #3.5m, interest payable (including interest

on cash consideration) of #0.1m and profit before tax of #0.4m attributable to

Alligator.

(b) On 8 July 2006, the Group acquired the remaining 50% shareholding not

previously owned in the holding company (Leonard Henry Holdings BV) of the

Group's Dutch joint venture, Anchor International BV. Consideration of Euro1.26m

was paid, Euro1m in cash and Euro0.26m by the issue of 44,692 new ordinary shares.

During the period from 9 July 2006 to 30 September 2006, the Group's results

include turnover of #1.3m, interest payable (including interest on cash

consideration) of #nil and profit before tax of #0.1m attributable to Anchor

International BV.

3. Share based payments

The company has adopted FRS20 for the first time in this period and accordingly,

the period's operating profit is stated after charging #112,000 for the cost of

share options. The operating profits for the 6 months to 30 September 2005 and

the 12 months to 31 March 2006 have been restated to include charges of #199,000

and #423,000 respectively, and net assets as at 30 September 2005 and 31 March

2006 have been increased to reflect the tax impact of this change by #107,000

and #68,000 respectively.

4. Exceptional Item

The exceptional item of #304,000 during the six months to 30 September 2006

represents the costs incurred in merging the sales functions for the UK gift

wrap, Christmas cracker and card divisions.

The exceptional item of #121,000 during the six months to 30 September 2005

represented the costs associated with the transfer of manufacturing of greetings

cards and tags from Hatfield to a new facility in Latvia.

The exceptional items of #3,310,000 during the 12 months to 31 March 2006

represented #2,906,000 of costs incurred in restructuring the group's UK

operations and a one-off product safety recall and rectification cost of

#404,000.

5. Earnings per share

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated- (restated-

see note 1) see note 1)

Adjusted basic earnings per

share excluding exceptional

items, profit on disposal of

fixed assets and

amortisation of goodwill 10.1p 10.6p 28.0p

Loss per share on exceptional item (0.5p) (0.2p) (5.1p)

Earnings per share on profit

on disposal of fixed assets - - 5.5p

Loss per share on goodwill (1.4p) (1.1p) (2.2p)

-------------------------------------------------------------------------------------

Basic earnings per share 8.2p 9.3p 26.2p

-------------------------------------------------------------------------------------

Diluted earnings per share 8.1p 9.1p 25.8p

-------------------------------------------------------------------------------------

The calculation of basic earnings per share is based on 46,257,862 (6 months to

30 September 2005: 45,002,232, 12 months to 31 March 2006: 45,536,856) ordinary

shares being the average number of shares in issue during the period. The

calculation of diluted earnings per share is based on 47,003,239 (6 months to 30

September 2005: 45,822,342, 12 months to 31 March 2006: 46,304,602) ordinary

shares. The difference of 745,377 (6 months to 30 September 2005: 820,110, 12

months to 31 March 2006: 767,746) represents the dilutive effect of outstanding

employee share options which have been calculated in accordance with FRS 14.

Adjusted basic earnings per share excluding exceptional items, profit on

disposal of fixed assets and amortisation of goodwill is calculated after

adjusting for the exceptional item of #304,000 (6 months to 30 September 2005:

#121,000, 12 months to 31 March 2006: #3,310,000), the profit on disposal of

fixed assets of #nil (6 months to 30 September 2005: #nil, 12 months to 31 March

2006: #1,838,000), amortisation of goodwill of #669,000 (6 months to 30

September 2005: #520,000, 12 months to 31 March 2006: #1,031,000) and tax relief

attributable to these items of #113,000 (6 months to 30 September 2005: #60,000,

12 months to 31 March 2006: #1,691,000).

7. Reconciliation of movement in shareholders' funds

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated- (restated-see

see note 1) note 1)

#000 #000 #000

Profit for the period 3,803 4,187 11,948

Dividend (3,240) (2,652) (3,578)

--------------------------------------------------------------------------------------------------

563 1,535 8,370

Currency translation differences

arising on foreign currency net investments (1,512) 703 914

Share based payments 112 199 423

New share capital subscribed 468 12,541 12,879

Potential issue of shares - (254) 126

Purchase of own shares - - (538)

--------------------------------------------------------------------------------------------------

Net (reduction in)/addition to shareholders' funds (369) 14,724 22,174

Opening shareholders' funds 75,791 53,617 53,617

-------------------------------------------------------------------------------------------------

Closing shareholders' funds 75,422 68,341 75,791

-------------------------------------------------------------------------------------------------

8. Reconciliation of operating profit to net cash (outflow)/inflow from operating activities

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

(restated- (restated-

see note 1) see note 1)

#000 #000 #000

Operating profit before exceptional item 6,473 6,615 18,320

Exceptional item (304) (121) (3,310)

Depreciation charge 3,255 2,592 5,745

FRS 20 charge 112 199 423

(Increase) in stocks (20,802) (29,500) (9,650)

(Increase) in debtors (44,131) (44,241) (5,715)

Increase/(decrease) in creditors 15,512 17,087 (2,833)

Deferred income (455) (193) (632)

Goodwill amortisation 669 520 1,031

Utilisation of provisions (402) (269) (673)

-----------------------------------------------------------------------------------------------

Net cash (outflow)/inflow from operating

activities (40,073) (47,311) 2,706

----------------------------------------------------------------------------------------------

9. Gross Cash Flow

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2006 30 Sept 2005 31 Mar 2006

#000 #000 #000

Returns on investment and servicing of finance

Net interest paid (1,011) (474) (1,213)

Interest element of finance lease repayments (9) (9) (19)

-------------------------------------------------------------------------------------------

(1,020) (483) (1,232)

-------------------------------------------------------------------------------------------

Capital expenditure

Purchase of tangible fixed assets (7,005) (4,335) (11,225)

Disposal of tangible fixed assets 109 190 19,034

Disposal of investments 286 - -

-------------------------------------------------------------------------------------------

(6,610) (4,145) 7,809

-------------------------------------------------------------------------------------------

Acquisitions and disposals

Acquisition cost (13,714) (13,114) (13,047)

Net overdraft acquired with subsidiary (2,658) (31) (31)

-------------------------------------------------------------------------------------------

(16,372) (13,145) (13,078)

-------------------------------------------------------------------------------------------

Financing

New shares issued 38 41 379

Purchase of own shares - - (538)

New loan 1,203 - -

Repayment of amounts borrowed (177) (48) (99)

Capital element of finance lease payments (91) (69) (363)

Purchase of investments - - (9)

-------------------------------------------------------------------------------------------

973 (76) (630)

-------------------------------------------------------------------------------------------

10. Analysis of movement in net (debt)/funds

At Exchange Acquisition At

31 Mar 2006 Cash flow Movement of subsidiary 30 Sept 2006

#000 #000 #000 #000 #000

Cash at bank and in hand 11,825 (11,357) (458) - 10

Overdrafts (20,850) (53,030) 1,235 (2,658) (75,303)

--------------------------------------------------------------------------------------------------------

(9,025) (64,387) 777 (2,658) (75,293)

Banks loans (1,248) (1,026) 94 - (2,180)

Finance leases (471) 91 21 - (359)

--------------------------------------------------------------------------------------------------------

(1,719) (935) 115 - (2,539)

--------------------------------------------------------------------------------------------------------

Total net (debt)/funds (10,744) (65,322) 892 (2,658) (77,832)

--------------------------------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFLDFTLFLIR

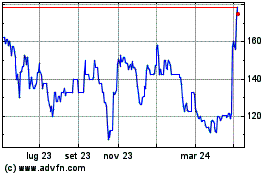

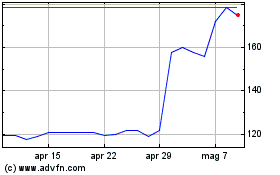

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024