RNS Number:9953Y

International Greetings PLC

26 June 2007

26 June 2007

International Greetings plc

("International Greetings" or the "Company")

Continued success in the US, Europe and Asia underpins international

diversification strategy

International Greetings PLC (AIM: IGR), the leading designer and manufacturer of

greetings, stationery and licensed published products announces results for the

year to 31 March 2007.

Financial highlights:

* Year-on-year sales maintained at #197 million

* 3% rise in pre-tax profits to #18.1 million* (2006: #17.6 million**)

* Earnings per share up 5% to 29.5p* (2006: 28.0p**)

* Recommended final dividend of 7.75p, bringing the total dividend for

the year to 10p, an increase of 11%

Operational highlights:

* Strategy for international growth progressing well:

* Non UK sales now account for 40% of turnover (2006: 38%) and expected to

continue to increase

* European turnover grew by 32% to #30.0 million (2006: #22.7 million)

* IG Asia sales up 52% to $32 million (2006: $21 million)

* Strategic acquisitions strengthen Group's product offering, and

international distribution

* Alligator Books, Anchor International and Eick Pack acquired during

the period

* Weltec, Artex and Pinwheel acquired post year-end

* Seasonal UK operating divisions restructured to ensure they remain cost

effective and efficient

Commenting on the results, Nick Fisher, joint CEO said: "These results not only

reflect a year of operational consolidation but also show clearly that our

strategy to re-position International Greetings as a truly global business, with

a diverse product range is progressing well. 40% of turnover is now derived

outside of the UK, a figure that we expect to continue to increase.

"We will continue to make acquisitions which provide us with new product ranges,

new distribution channels and access to new geographical markets, whilst at the

same time ensuring that we can achieve the maximum possible growth from our

existing businesses."

For further information:

International Greetings: 01707 630 630 Tavistock Communications: 020 7920 3150

Nick Fisher, Joint Chief Executive Jeremy Carey / Rachel Drysdale

* Adjusted to exclude exceptional costs of #1,252,000 (2006: #3,310,000), profit

on disposal of fixed assets of #2,240,000 (2006: #1,838,000), and amortisation

of goodwill of #1,458,000 (2006: #1,031,000)

** Restated following adoption of FRS20 Share based payments

Chairman's Statement 2007

As stated in my interim announcement, our strategy for growth continues to focus

upon international expansion, particularly across Europe, reducing our reliance

on the UK market which has experienced a challenging trading climate and seen

the demise of a number of retailers during the past year. Against this

background, I am pleased to report a 3% rise in adjusted profits before tax* to

#18.1m, on sales of #197m, with adjusted earnings per share* growing to 29.5p, a

5% increase.

Reflecting our continued confidence in our business and its future prospects, we

are recommending a final dividend of 7.75p, making a total of 10p for the year,

an increase of 11% on last year. This will be paid on 27th September 2007 to

shareholders on the register at 7th September 2007.

Sales outside the UK now account for 40% of the Group's turnover, up from 38%

last year. We expect this trend to continue as we develop our international

businesses. In particular, turnover of our European division grew by 32%, as a

result of acquisitions and a concerted sales effort in the region.

In addition to the Alligator and Anchor International acquisitions announced in

the Interim Report, we also completed the acquisition of Eick Pack towards the

year end. Based in Germany, this business supplies gift wrap for in-store gift

wrapping across Europe and we expect to increase our market share in this sector

in the future. Subsequent to the financial year end, we announced three further

acquisitions - Weltec, Artex and Pinwheel.

Weltec provides a step change in our photoframe business across Europe and will

operate through Anchor International based in Holland. Artex, a gift wrap

business located in Poland, gives us a manufacturing and distribution platform

from which we can continue to grow our presence in the important emerging

Eastern European market. In the UK, our children's book division, Alligator,

acquired the business of Pinwheel, a children's book publisher, complementing

their existing portfolio of children's licensed activity products.

This is my first full period as chairman. I am delighted with the strategic

progress the Group has made this year, and am confident that strong foundations

have been laid to ensure our future success.

I welcome all our new employees, particularly those working in the companies we

acquired this year, and thank all our staff for their commitment to the Group

and to serving the needs of our customers around the world.

Keith James OBE

Chairman

* adjusted to exclude exceptional costs of #1,252,000 (2006: #3,310,000), profit

on disposal of fixed assets of #2,240,000 (2006: #1,838,000), and amortisation

of goodwill of #1,458,000 (2006: #1,031,000)

Chief Executive's Report

The past year has been extremely active for all areas of the Group's business.

Consistent with our stated strategy, acquisitions have been made that have

enabled us to both enter new geographical regions and strengthen our position in

existing ones. In addition, a number of operating divisions have been

restructured and refocused to ensure all opportunities to grow organically are

maximised to their full potential.

UK

The UK market place, which historically formed the cornerstone of International

Greetings' business, has encountered some well documented difficulties in recent

years. We have experienced the closure of a number of retailers, difficult

trading conditions and intense pricing pressure. To combat this we have clearly

identified those opportunities that offer us growth potential, and have put in

place a three point strategy which reduces our reliance on our traditional

private label seasonal business.

We have reorganised our UK seasonal trading divisions into one business unit

based in South Wales; this new structure will reduce costs, streamline our

supply and logistic functions and simplify the buying process for our customers.

We are expanding our proprietary range business by developing the trading brands

of Anker, Tom Smith, Giftmaker and Copywrite, with a focus on selling higher

volumes of these branded ranges to a broader customer base throughout the UK.

We will continue to diversify our business with a highly focused acquisition

programme, investing in businesses where we can add value and which will

complement our existing operations. This is illustrated by last year's

acquisition of Alligator Books and our more recent purchase of Pinwheel

Children's Books, which takes us into a new product category that utilises our

core strengths of design, sourcing and distribution.

Europe

Mainland Europe has once again been a key growth region for the Group, achieving

a 32% increase in turnover.

The Hoomark division is targeted to manufacture and distribute greetings

products with Anchor International BV, now a wholly owned subsidiary,

concentrating on selling photographic and stationery products throughout Europe.

The acquisition of Weltec, with its associated brand of B+H, has made us a major

supplier to the German photoframes market and we intend to develop this product

category further in other European territories.

Mass market licensed stationery ranges have been developed by Copywrite for the

European market and early sales indications have been very encouraging.

The acquisition of Artex in Poland provides International Greetings with a gift

wrap manufacturing base in Eastern Europe and, coupled with our investment in

Latvia, we now feel we have the foundations in place to build a solid business

in the region.

US

Our marketing and product development strategy introduced last year to stratify

the market into entry level, mass market and premium ranges for our US retail

customer base, has performed well.

Our top end brands, marketed as premium product, feature innovative designs and

materials and, in particular, the Pepperpot brand of stationery is carving a

niche of its own in the department store and independent sectors.

The mass market product offers the largest volume of retail distribution in the

US and we continue to add new customers both for proprietary Giftwrap Company

ranges and private label brands.

Our entry level product is being marketed through the recently formed Anker USA

division, with goods initially being fulfilled direct to customers from IG Asia.

This new division has proved to be very successful and we intend to launch a

catalogue of standard products, mirroring the Anker UK collection, from March

2008 for next year's season.

Sales in the US now account for 23% of the Group's total turnover, and we

believe the US market place offers significant potential for future growth.

Far East

Last year's factory move in China and investment in a new sourcing and trading

office in Hong Kong have both yielded significant benefits to the Group. Direct

sales to customers around the globe from IG Asia now represent approximately 9%

of Group turnover, a 50% increase over last year's 6%.

In addition to the production of Christmas crackers, we have increased output of

products that require a high labour content in their manufacture, particularly

gift bags, which are a growth product in the worldwide gift wrapping sector. We

have also invested $3.7m, primarily in new printing and conversion machinery

during the past 12 months in order to obtain the benefits of lower costs through

vertical integration.

We will continue to develop our activities in Asia, to meet the demands of our

customers around the world.

Design and Licensing

Product development and design still remains a vital part of our industry and

its importance to our future development cannot be overstated. We now employ

over 120 people in the creative areas of our business and have recently

introduced an intranet based system to allow each trading division within the

Group, wherever geographically located, to share its intellectual assets with

all Group companies. This Digital Asset Management System will allow us to

minimise our design costs by maximising the potential of each design created

across the global market-place.

Licensed properties continue to feature heavily within our portfolio of

products, and we are delighted to have obtained merchandise rights for ranges of

products for the UK release this week of Shrek 3 and The Simpsons Movie in July.

Conclusion

We have now put in place a business strategy and operational structure to

deliver consistent growth for the next three years. Both organic growth and

acquisition opportunities have been identified in all the product categories and

geographical regions in which we operate. Our management teams and staff are

focused and motivated to achieve our corporate goals and we look forward to the

future with confidence.

Anders Hedlund and Nick Fisher

Joint Chief Executives

26 June 2007

Finance Review

1 Group Performance

Reported turnover for the year to 31st March 2007 amounted to #196.7m (2006:

#196.6m). With an increasing proportion of our business being overseas, the

Group's results are affected by movements in exchange rates on the translation

of the results of overseas subsidiaries, particularly in relation to the US$.

Last year the results of US$ denominated subsidiaries were translated at $1.73

compared with $1.88 this year. Excluding the effect of this, Group turnover

would have shown an increase of 2%. Overseas sales of #77.7m (2006: #74.1m)

accounted for 40% (2006: 38%) of the total, of which #45.1m (2006: #47.2m) was

in the US. Excluding the effect of exchange rates, US sales increased by 2%. IG

Asia, our Hong Kong subsidiary, performed extremely well with direct sales to

customers in the UK, Europe and US increasing by 52% to $33m, compared with $21m

last year.

The gross profit margin percentage (excluding exceptional costs) increased from

31.2% to 32.9% primarily due to a credit of #4.2m (2006: #1.3m) in relation to

compensation for gross profit on lost sales as a result of a fire at the Group's

South Wales print plant in 2005. Operating profit increased from #15.0m to

#18.2m. Adjusted operating profit* increased from #19.3m to #20.9m, an increase

of 8%. Exceptional items during the year of #1.3m relate to a restructuring of

the Group's UK operations in order to maintain competitiveness. These changes

included the relocation of production operations overseas, the integration and

relocation of Copywrite's operations into Anker and the merging of the

individual UK Christmas giftwrap, cracker and card operations into one division.

Net interest payable increased from #1.8m to #2.8m, primarily due to the cost of

acquisitions and increasing interest rates during the year.

The profit on disposal of fixed assets of #2.2m arose on the sale of the

freehold interest in the Group's property in Duxford which was no longer

required following the integration of Copywrite's operations into Anker. Net

profit before taxation increased by 17% to #17.7m, with adjusted profit before

tax* increasing 3% to #18.1m. Excluding the effect of exchange rates on the

profits of overseas subsidiaries referred to above, adjusted profit before tax

would have increased by 7%.

2 Earnings Per Share and Dividend

Adjusted basic earnings per share* for the year ended 31st March 2007 were

29.5p, an increase of 5% over last year. Basic earnings per share were 28.1p, an

increase of 7% over last year.

The final dividend proposed for the year of 7.75p (2006: 7p) makes a total

dividend for the year of 10p, an increase of 11% and is covered 2.8 times by

basic earnings per share.

* adjusted to exclude exceptional costs of #1,252,000 (2006: #3,310,000), profit

on disposal of fixed assets of #2,240,000 (2006: #1,838,000), and amortisation

of goodwill of #1,458,000 (2006: #1,031,000)

3 Balance Sheet and Cash Flow

Net debt at 31st March 2007 amounted to #38.0m, compared to #10.7m last year.

Cash paid in respect of acquisitions, including debt acquired with new

acquisitions, accounted for #16.8m of this movement. This included #10.5m

deferred consideration paid in relation to the acquisition of Anker

International PLC in May 2005. Capital expenditure of #11.9m was #6m higher

than the depreciation charge, due primarily to the #1.9m purchase of property

in the US to facilitate future growth and a total of #1.8m invested in

IG Asia's operations in China. Cash from the sale of the Group's property in

Duxford, giving rise to the #2.2m profit on disposal on fixed assets during

the year, was not received until after the year-end and is therefore not

reflected in these figures.

Shareholders' funds increased by #8.1m to #83.9m and with year-end gearing of

45% and interest covered 6.6 times by operating profit, the Group's financial

position remains strong.

4 Treasury Operations

The Board continues to assess and manage the risks associated with the treasury

function as our business develops. The Group's business has a strong seasonal

focus, resulting in large variations in working capital. As a result, the Board

considers that long term reduction of exposure to fluctuations in interest rates

on working capital is unlikely to be economically viable.

A significant proportion of the Group's purchases are denominated in US$. The

effect of exchange rate fluctuations is reduced through a combination of

measures including hedging and forward exchange contracts.

Consolidated profit and loss account for the year ended 31 March 2007

Continuing operations

Excluding acquisitions

Pre-exceptional Exceptional Acquisitions Total Total

item item (Restated -

see Note 1)

2007 2007 2007 2007 2006

Note #000 #000 #000 #000 #000

Group turnover

including share

of joint venture

turnover 185,344 - 11,757 197,101 198,139

Less: Share of

joint venture

turnover (383) - - (383) (1,585)

------------------------------------------------------------------

Group turnover 2 184,961 - 11,757 196,718 196,554

Cost of sales (123,814) (897) (8,148) (132,859) (135,121)

------------------------------------------------------------------

Gross profit 61,147 (897) 3,609 63,859 61,433

Distribution

expenses (16,818) - (400) (17,218) (16,481)

Administrative

expenses (26,433) (355) (1,675) (28,463) (29,942)

------------------------------------------------------------------

Operating profit 2 17,896 (1,252) 1,534 18,178 15,010

Share of operating

profit of joint venture - - - - 7

------------------------------------------------------------------

17,896 (1,252) 1,534 18,178 15,017

Profit on disposal of

fixed assets 2,240 - - 2,240 1,838

Net interest payable (2,477) - (280) (2,757) (1,801)

------------------------------------------------------------------

Profit on

ordinary

activities before

taxation 2-3 17,659 (1,252) 1,254 17,661 15,054

------------------------------------

Tax on profit

on ordinary

activities 4 (4,662) (3,106)

----------------------

Profit for the

financial year 12,999 11,948

----------------------

Earnings per share 7

Basic 28.1p 26.2p

Diluted 27.7p 25.8p

======================

Consolidated statement of total recognised

gains and losses for the year ended 31 March 2007 2007 2006

(Restated see

Note 1)

#000 #000

Profit for the financial year 12,999 11,948

Currency translation differences arising on

foreign currency net investments (2,598) 914

-----------------------

Total recognised gains and losses

relating to the financial year 10,401 12,862

=======

Prior year adjustment (see Notes 2(d)) 68

-------

Total gains and losses recognised since the last

annual report 10,469

=======

Consolidated balance sheet at 31 March 2007

Note 2007 2006

(Restated -

see Note 1)

#000 #000 #000 #000

Fixed assets

Intangible assets

- goodwill 26,695 21,339

Tangible assets 41,882 37,134

Investments in joint venture

- share of gross assets - 769

- share of gross liabilities - (596)

-------- --------

68,577 58,646

Current assets

Stocks 48,577 40,008

Debtors 41,283 29,931

Investments - unquoted 20 65

Cash at bank and in hand 12,990 11,825

-------- --------

102,870 81,829

Creditors: amounts falling

due within one year (79,903) (56,382)

-------- --------

Net current assets 22,967 25,447

-------- --------

Total assets less

current liabilities 91,544 84,093

Creditors: amounts

falling due after more

than one year (5,737) (6,352)

Provisions for liabilities

and charges (1,939) (1,950)

-------- --------

Net assets 83,868 75,791

======== ========

Capital and reserves

Called up share capital 2,317 2,308

Share premium account 2,515 2,386

Potential issue of

shares 6(a) & (b) 2,235 1,052

Other reserves 11,759 13,964

Profit and loss account 65,042 56,081

-------- --------

Equity shareholders'

funds 8 83,868 75,791

======== ========

Consolidated cash flow statement

for the year ended 31 March 2007

Note 2007 2006

#000 #000

Net cash inflow from operating activities 9 10,889 2,706

Returns on investments and servicing

of finance 10 (2,419) (1,232)

Taxation (3,024) (5,980)

Capital expenditure 10 (11,838) 7,809

Acquisitions and disposals 10 (16,776) (13,078)

Equity dividends paid (4,282) (3,578)

------- -------

Cash outflow before financing (27,450) (13,353)

Financing 10 (223) (630)

------- -------

Decrease in cash in the year (27,673) (13,983)

======= =======

Reconciliation of net cash flow to movement in

net (debt)/funds for the year ended 31 March 2007

Note 2007 2006

#000 #000

Decrease in cash in the year (27,673) (13,983)

Cash (inflow)/outflow from debt

and lease financing 11 (688) 462

------- -------

Change in net debt resulting from cash flows (28,361) (13,521)

Loans acquired with subsidiary (173) -

New finance leases (50) -

Translation differences 11 1,315 (1,013)

------- -------

Movement in net debt in the year (27,269) (14,534)

Net (debt)/funds at beginning of year (10,744) 3,790

------- -------

Net debt at end of year 11 (38,013) (10,744)

======= =======

Notes

1. Basis of preparation

The financial information set out above does not constitute the Company's

statutory financial statements for the years ended 31 March 2007 or 2006.

Statutory financial statements for 2006 have been delivered to the registrar of

companies, and those for 2007 will be delivered following the company's annual

general meeting. The auditors have reported on those accounts; their reports

were unqualified and did not contain statements under section 237(2) or (3) of

the Companies Act 1985.

The financial statements have been prepared in accordance with applicable

accounting standards and under the historical cost accounting rules.

In these financial statements the following new standard has been adopted for

the first time:

FRS 20 "Share-based payments". The accounting policy under this new standard is

set out below together with an indication of the effects of its adoption.

Share options are, in most cases, issued at market value at the date of grant

and consideration is accounted for when the option is exercised. The fair value

of options granted and not yet vested is recognised as an employee expense with

a corresponding increase in equity. The fair value is measured at grant date and

spread over the period during which the employees become unconditionally

entitled to the options. The fair value of the options granted is measured using

a Black Scholes model, taking into account the terms and conditions upon which

the options were granted. The amount recognised as an expense is adjusted to

reflect the number of share options ultimately expected to vest based on the

company's anticipated future staff turnover.

The corresponding amounts in these financial statements are restated in

accordance with the new policy. The impact of the adoption of FRS 20 on the

results for the year and the preceding year is set out in note 2 (d).

2. Segmental analysis

(a) Geographical area of operation

UK, Europe USA Group

& Far East

2007 2006 2007 2006 2007 2006

(restated - (restated - (restated -

see Note 1) see Note 1) see Note 1)

#000 #000 #000 #000 #000 #000

Turnover 171,500 167,344 25,218 29,210 196,718 196,554

==========================================================================

Operating

profit before

exceptional items 17,887 16,524 1,543 1,796 19,430 18,320

Exceptional

items (see below) (1,252) (3,310) - - (1,252) (3,310)

--------------------------------------------------------------------------

Operating

profit after

exceptional items 16,635 13,214 1,543 1,796 18,178 15,010

Share of

operating

profit of

joint venture - 7 - - - 7

--------------------------------------------------------------------------

16,635 13,221 1,543 1,796 18,178 15,017

Profit on

disposal of

fixed assets 2,240 1,838 - - 2,240 1,838

Net interest (1,849) (1,108) (908) (693) (2,757) (1,801)

--------------------------------------------------------------------------

Profit on

ordinary activities

before taxation 17,026 13,951 635 1,103 17,661 15,054

==========================================================================

Net assets

(restated - note 1) 76,783 68,406 7,085 7,385 83,868 75,791

==========================================================================

The above results relate entirely to continuing operations.

(b) Exceptional items

2007 2006

#000 #000

Restructuring costs (see (i) below) 1,252 2,906

Other (see (ii) below) - 404

------------------

1,252 3,310

==================

(i) During the year ended 31st March 2007 the Group incurred a number of costs

associated with the ongoing restructuring changes that commenced in the

previous year and are being undertaken in order to maintain competitiveness.

These consisted of (a) the relocation of certain UK production overseas,

(b) the relocation and integration of the Copywrite Designs Ltd stationery

division into Anker's operations and (c) the reorganisation of the individual

UK Christmas giftwrap, cracker and cards operations into one division. The

costs of these restructuring changes, primarily redundancy and machine

relocation costs amounted to #1,252,000 (2006: #2,906,000).

(ii) These represented one-off product safety recall and rectification costs

incurred in connection with one of the Group's products.

(c) Geographical analysis of turnover by destination

2007 2006

#000 #000

UK 119,043 122,443

USA 45,140 47,191

Europe 29,971 22,665

Rest of world 2,564 4,255

--------------------

196,718 196,554

====================

(d) Share based payments

The Company has adopted FRS20 for the first time in this period and accordingly

the operating profit is stated after charging #244,000 for the cost of share

options. The operating profit for the 12 months to 31st March 2006 has been

restated to include a charge of #423,000 in respect of this cost with a

corresponding reduction of #40,000 in the tax charge as a result of recognising

the associated deferred tax asset. The only impact on the net assets as at 31st

March 2006 relates to the deferred tax asset element and results in an increase

in prior year net assets of #68,000.

3. Profit on ordinary activities before taxation

2007 2006

#000 #000

Profit on ordinary activities before

taxation is stated after charging/(crediting)

Hire of plant and machinery - rentals payable

under operating leases 302 410

Hire of other assets - operating leases 1,487 1,249

Release of deferred grant income (823) (498)

Depreciation - owned 5,641 5,469

- leased 235 276

Amortisation of goodwill 1,458 1,031

===================

During the year payments were made to the group

auditor, KPMG Audit Plc as follows:

2007 2006

#000 #000

Audit of these financial statements 39 36

Amounts receivable by the auditors and their

associates in respect of:

Audit of financial statements of subsidiaries

pursuant to legislation 95 80

Other services relating to taxation 76 39

Services relating to corporate finance transactions

entered into or proposed to be entered into by or on

behalf of the Company or the Company's subsidiaries 24 64

All other services (47) 158

The credit in 2007 for all other services relates to charges for work undertaken

in 2006 in connection with the relocation of the group's Chinese factory.

4. Taxation

2007 2006

(Restated

- see Note 1)

#000 #000 #000 #000

Current tax

UK corporation tax on

profits of the year 2,271 2,885

Adjustments in respect of

previous periods (240) 22

-------- --------

2,031 2,907

Foreign tax

On profits of the year 1,591 1,369

Adjustments in respect of

previous periods 65 14

-------- --------

1,656 1,383

--------- ---------

Total current tax 3,687 4,290

Deferred taxation

Origination and reversal of

timing differences 882 (1,271)

Adjustments in respect of

previous periods 93 87

-------- --------

Total deferred tax 975 (1,184)

--------- ---------

Tax on profits on

ordinary activities 4,662 3,106

========= =========

5. Dividends paid

2007 2006

#000 #000

Final for year ended 31st March 2006

- 7.00p per share (2005: 5.75p) 3,240 2,652

Interim for year ended 31st March 2007

- 2.25p per share (2006: 2p) 1,042 926

------------------

Dividends paid 4,282 3,578

==================

6. Acquisitions

(a) On 19th November 2003, the Group acquired 100% of the issued share capital

of Hoomark Gift-Wrap Partners BV. The purchase agreement provided for future

payments of deferred consideration, based on Hoomark's profits for the 3 years

ended March 2007. At 31st March 2006, the future consideration payable was

estimated at #1,052,000, of which up to 100% was payable by the issuance of new

ordinary shares at the company's option. During the year ended 31st March 2007,

#508,000 of this amount was paid in cash. Based on Hoomark's results for the

year ended 31st March 2007, the estimated future consideration has been

increased by #83,000 less #35,000 accounted for by exchange differences. Up to

100% of the total unpaid consideration of #592,000 at 31st March 2007 may be

payable by the issue of new ordinary shares, at the company's option.

(b) On 6th April 2006 the Group acquired 100% of the issued share capital of

Alligator Books Limited, a publisher and distributor of children's books and

stationery. Initial consideration of #2.569m (including costs) was paid,

#2.319m in cash and #0.25m by the issue of 62,703 new ordinary shares.

Estimated additional consideration of #3.66m is payable, based on Alligator's

results for the year ended 31st March 2007. Up to #1.643m of the additional

consideration of #3.66m is payable by the issue of new ordinary shares, at the

company's option.

The book value and provisional fair value of assets acquired was as follows:

#000

Intangible assets 3

Tangible assets 52

Stocks 1,375

Debtors 1,569

Cash 68

Bank overdraft (1,839)

Creditors (1,004)

---------

224

Goodwill (estimated useful life of 20 years) 6,005

---------

Total Consideration 6,229

=========

Audited accounts of Alligator Books Limited for the eleven months ended

31st March 2006 reflected turnover of #5.7m, operating profit of #0.5m and

interest payable of #0.1m, resulting in a profit before tax of #0.4m.

(c) On 8th July 2006, the Group acquired the remaining 50% shareholding not

previously owned in the holding company (Leonard Henry Holdings BV) of the

Group's Dutch joint venture, Anchor International BV. Consideration of Euro1.26m

was paid, Euro1m in cash and Euro0.26m by the issue of 44,692 new ordinary shares.

The book value and provisional fair value of assets acquired was as follows:

#000

Tangible assets 12

Stock 1054

Debtors 731

Cash 75

Bank Overdraft (903)

Creditors (623)

---------

346

Less 50% share previously owned (173)

---------

Net share of assets acquired 173

Goodwill (estimated useful life of 20 years) 726

---------

Total consideration 899

=========

Audited accounts were not previously prepared by Leonard Henry Holdings BV.

Unaudited accounts for the 12 months ended 31st December 2005 reflect turnover

of Euro4.8m, operating profit of Euro0.065m and net interest payable of Euro0.049m

resulting in a profit before tax of Euro0.016m.

(d) On 23rd January 2007, the Group acquired 100% of the issued share capital

of Eick Pack Werner Eick GmbH & Co ("Eick Pack"), a manufacturer of giftwrap

counter rolls, based in Germany. Initial consideration of Euro1 was paid for the

shares. The share purchase agreement also provided for the potential repayment

of outstanding loans of Euro0.512m made by the previous shareholders to Eick Pack.

Euro0.256m was repaid on completion, with the balance of Euro0.256m repayable,

dependant on Eick Pack's profits for the years ended 31st March 2008 to 2010.

The book value and provisional fair values of assets acquired was as follows:

Book Provisional Provisional fair

Value fair value value at date of

adjustments acquisition

#000 #000 #000

Tangible assets 29 - 29

Stock 377 (38) 339

Debtors 205 - 205

Cash 19 - 19

Bank overdraft (115) - (115)

Creditors (490) - (490)

---------------------------------------

25 (38) (13)

---------------------

Goodwill (estimated useful

life of 20yrs) 13

----------------

Consideration -

================

Audited accounts were not previously prepared by Eick Pack. Unaudited accounts

for the 12 months ended 31st December 2006 reflect turnover of Euro2.6m, operating

profit of Euro0.01m and interest payable of Euro0.05m resulting in a loss before tax

of Euro0.04m.

7. Earnings per share

2007 2006

(Restated see

Note 1)

Adjusted basic earnings per share excluding

exceptional items, profit on disposal of

fixed assets and goodwill 29.5p 28.0p

Loss per share on goodwill (3.1p) (2.2p)

Loss per share on exceptional items (1.9p) (5.1p)

Earnings per share on profit on disposal of fixed assets 3.6p 5.5p

--------------------

Basic earnings per share 28.1p 26.2p

====================

Diluted earnings per share 27.7p 25.8p

====================

The basic earnings per share is based on the earnings of #12,999,000 (2006:

#11,948,000) and the weighted average number of ordinary shares in issue of

46,278,695 (2006: 45,536,856). The calculation of diluted earnings per share is

based on 46,998,106 (2006: 46,304,602) ordinary shares. The difference of

719,411 (2006: 559,291) represents the dilutive effect of outstanding employee

share options which has been calculated in accordance with FRS 22.

Adjusted basic earnings per share excluding exceptional items, profit on

disposal of fixed assets and goodwill is calculated after adjusting for

exceptional items of #1,252,000 (2006: #3,310,000), the profit on disposal of

fixed assets of #2,240,000 (2006: #1,838,000), amortisation of goodwill of

#1,458,000 (2006: #1,031,000), and the tax attributable to these items of

#192,000 (2006: tax relief of #1,691,000).

8. Reconciliation of movements in shareholders' funds

2007 2006

(Restated -

see Note 1)

#000 #000

Profit for the financial year 12,999 11,948

Dividends paid in the year (4,282) (3,578)

----------------------

Retained profit for the financial year 8,717 8,370

Other recognised gains and losses relating

to the year (net) (2,598) 914

New share capital subscribed 531 12,879

Potential issue of shares (note 6(a) and (b)) 1,183 126

Purchase of own shares - (538)

Share based payments 244 423

----------------------

Net addition to shareholders' funds 8,077 22,174

Opening shareholders' funds as previously reported 75,723 53,589

Prior year adjustment - share based payments 68 28

----------------------

Closing shareholders' funds 83,868 75,791

======================

9. Reconciliation of operating profit to net cash inflow from operating

activities

2007 2006

(Restated -

see Note 1)

#000 #000

Operating profit 18,178 15,010

Depreciation charge 5,876 5,745

(Increase) in stocks (7,521) (9,650)

(Increase) in debtors (6,917) (5,715)

Increase/(decrease) in creditors 1,403 (2,833)

Deferred income (1,227) (632)

Goodwill amortisation 1,458 1,031

Utilisation of provision (605) (673)

Charge for share based payments 244 423

----------------------

Net cash inflow from operating activities 10,889 2,706

======================

10. Gross cash flows

Cash inflow/(outflow)

2007 2006

#000 #000

Returns on investment and servicing of finance

Interest paid (2,394) (1,668)

Interest received - 455

Interest element of finance lease repayments (25) (19)

----------------------

Net cash (outflow) for returns on investment and

servicing of finance (2,419) (1,232)

======================

Capital expenditure

Purchase of tangible fixed assets (11,933) (11,225)

Disposal of tangible fixed assets 95 19,034

----------------------

Net cash (outflow)/inflow from capital expenditure (11,838) 7,809

======================

Acquisitions and disposals

Acquisition of subsidiaries (14,081) (13,047)

Net overdraft acquired with subsidiary (2,695) (31)

----------------------

Net cash (outflow) for acquisitions and disposals (16,776) (13,078)

======================

Financing

New shares issued 101 379

Purchase of own shares - (538)

Repayment of amounts borrowed (89) (99)

Capital element of finance lease payments (280) (363)

Sale/(purchase) of investments 45 (9)

----------------------

Net cash (outflow) from financing (223) (630)

======================

11. Analysis of changes in net (debt)/funds

At 1 Cash Exchange Acquisition of Inception of Other At 31 March

April flow movement subsidiary new finance changes 2007

2006 leases and

loans

#000 #000 #000 #000 #000 #000 #000

Cash at

bank and

in hand 11,825 1,746 (743) 162 - - 12,990

Overdrafts (20,850) (26,724) 1,874 (2,857) - - (48,557)

------------------------------------------------------------------------------------------------

(9,025) (24,978) 1,131 (2,695) - - (35,567)

Debt due

after one

year (1,147) - 139 (173) (973) 94 (2,060)

Debt due

within one year (101) 89 12 - (84) (94) (178)

Finance leases (471) 280 33 - (50) - (208)

------------------------------------------------------------------------------------------------

(1,719) 369 184 (173) (1,107) - (2,446)

------------------------------------------------------------------------------------------------

Total net

(debt)/funds (10,744) (24,609) 1,315 (2,868) (1,107) - (38,013)

================================================================================================

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKPKBFBKDPAB

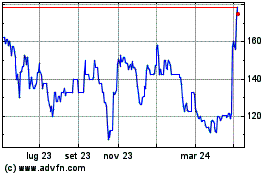

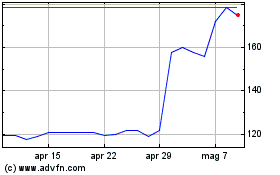

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024