RNS Number:8023J

International Greetings PLC

13 December 2007

Under Embargo 7am

13 December 2007

INTERNATIONAL GREETINGS PLC

("International Greetings" or "the Group")

INTERIM RESULTS

International Greetings PLC (AIM: IGR), the global designer and manufacturer of

greetings products, film and television character based licensed stationery,

books and gifts, today announces interim results for the six months ended 30

September 2007.

Financial highlights:

* Turnover for the period was �91.8million (2006: �85.1million)

* Operating profit of �3.9million (2006: �6.5million)

* Interest payable during the period increased to �1.7million (2006:

�0.9million)

* Profit before tax of �1.9million (2006: �5.6million)

* Basic earnings per share for the period were 3.0p (2006: 9.2p)

* Interim dividend of 2.0p (2006: 2.25p)

Operational highlights:

* Continuing difficulties with revenues and margins in the UK Greetings

Division

* Overseas operations continue to perform in line with expectations: -

- 10% increase in turnover in US Division (excluding Glitterwrap);

- 24% increase in turnover in European Gift Wrap Division

* Acquisition of Weltec photo frame business strengthens position in

German market

* Acquisition of Glitterwrap Inc in US enhancing market presence

* Acquisition (post period end) of a 50% shareholding in Artwrap Pty,

extending the Group's reach into Australia

For further information:

Keith James, Chairman, International Greetings:

Richard Day, Arden Partners Plc 020 7398 1632

Jeremy Carey/Gemma Bradley, Tavistock Communications: 020 7920 3150

CHAIRMAN'S STATEMENT

I announce below the interim results for the six months to 30 September 2007.

FINANCIAL REVIEW

Turnover for the period was �91.8m (2006: �85.1m), with operating profit of

�3.9m (2006: �6.5m). Net interest payable during the period increased to �1.7m

from �0.9m last year. The group's share of losses of associates was �0.3m (2006:

�nil), resulting in profit before tax of �1.9m (2006: �5.6m). Basic earnings per

share for the period were 3.0p (2006: 9.2p). Turnover of �4m and operating

profit of �nil was attributable to acquisitions made during the period. These

results are a reflection of the announcement made on 4th December 2007 that the

UK retail climate remains extremely tough.

OPERATIONAL REVIEW

Our US and European businesses continue to develop with a 10% increase in

turnover of the US Division (excluding Glitterwrap) and a 24% increase in

turnover of the European Gift Wrap Division. In the Far East, our strategy to

develop FOB sales direct to our global customer base is proving successful and

we expect this trend to continue. These rates of growth, together with the

acquisitions made overseas during the first half of the financial year,

illustrate the potential that exists in our global markets. The acquisition of

the Weltec photo frame business in April this year has strengthened our position

in the German market place, and we expect to achieve good sales growth during

the next financial year. The purchase of Glitterwrap Inc has enhanced our market

position in the US. It is being merged with our existing business, thereby

providing trading and cost saving benefits for both. We recently announced the

purchase of a 50% shareholding in Artwrap Pty, which gives the Group a presence

in Australia. We have identified many opportunities to sell products from other

Divisions within the Group into the Australian market. In addition, Artwrap will

obtain significant cost saving benefits from its association with us. In the US,

our 50% investment in Halloween Express involves three areas of business; the

existing franchise operation, the development of an internet site under the same

banner and the trialing of a Halloween and Christmas merchandise operation with

a view to extending the franchise business. Once the seasonal trading period has

completed, we will evaluate each of these areas to plan our forward strategy for

this investment.

In the UK, our Anker and Alligator trading divisions are performing broadly in

line with expectations. However, the UK Greetings Division continues to be

affected by the tough trading climate in this sector with both volumes and

margins under pressure.

As a result, an extensive review is underway which will lead to a restructuring

of the UK manufacturing and distribution base and its associated plants in both

Latvia and China. We expect that the outcome will be a reorganised business

compatible with the volumes and margins now attainable in this Division capable

of earning acceptable profit margins in the future.

BOARD CHANGES

In order to help implement the restructuring and improve the performance of the

UK Greetings Division, the following Board changes will take place with

immediate effect. Paul Fineman will take on the newly created role of Group

Managing Director and will be directly responsible for the restructuring of the

UK Greetings Division. Anders Hedlund will step down as Joint Chief Executive

and become Deputy Chairman. Nick Fisher, currently Joint Chief Executive, will

become Group Chief Executive.

All other Directors will maintain their existing roles and responsibilities.

DIVIDEND

Taking into account current trading and forward prospects the Board have

reviewed the level of dividend which is appropriate for the Group to pay and

proposes an interim dividend of 2p, which will be paid on 22 January 2008 to all

shareholders on the register on 21 December 2007.

OUTLOOK

As shareholders are aware, we have been aggressively pursuing a strategy to

diversify our business both geographically and into new product categories to

reduce our historical reliance on the UK multiple retail sector. The Board is

confident that this is the right strategy and that following the restructuring

of the UK manufacturing and distribution base, the business will show improved

results in the future.

Keith James OBE

Chairman

13 December 2007

CONDENSED CONSOLIDATED INCOME

STATEMENT FOR THE SIX MONTHS

ENDED 30 SEPTEMBER 2007

Unaudited

six months Unaudited six

ended 30 months ended

September 30 September 12 months to

Notes 2007 2006 31 March 2007

�000 �000 �000

Revenue 91,774 85,093 196,718

-------- -------- --------

Operating profit before

restructuring costs

and disposal of fixed

assets 3,933 6,837 20,487

Restructuring costs 4 - (304) (1,252)

Profit on disposal of

fixed assets - - 2,240

-------- -------- --------

Operating profit 3,933 6,533 21,475

Financial expenses (1,674) (958) (2,757)

-------- -------- --------

2,259 5,575 18,718

Share of loss of associates (net

of tax) (343) - -

-------- -------- --------

Profit before taxation 1,916 5,575 18,718

Taxation 2 (498) (1,317) (4,315)

-------- -------- --------

Profit for the period

attributable to equity holders of

the parent company 1,418 4,258 14,403

========= ======== ========

Earnings per share 3

Basic 3.0p 9.2p 31.1p

Diluted 3.0p 9.1p 30.6p

CONDENSED CONSOLIDATED BALANCE

SHEET AS AT 30 SEPTEMBER 2007

Unaudited Unaudited as

as at 30 at 30

September September 12 months to

2007 2006 31 March 2007

�000 �000 �000

Assets

Property, plant and equipment 43,813 40,017 41,882

Intangible assets 32,502 26,091 28,153

Investments in associates 3,630 - -

-------- -------- --------

Total non-current assets 79,945 66,108 70,035

Current assets

Inventories 66,472 62,254 48,577

Trade and other receivables 84,192 75,519 41,283

Cash and cash equivalents 20 10 12,990

Investments - 15 20

-------- -------- --------

Total current assets 150,684 137,798 102,870

-------- -------- --------

Total assets 230,629 203,906 172,905

======== ======== ========

Equity

Issued capital 2,353 2,314 2,317

Share premium 3,007 2,455 2,515

Reserves 13,298 12,845 11,759

Shares to be issued 2,091 1,052 2,235

Retained earnings 63,777 56,688 65,923

-------- -------- --------

Total equity attributable to

equity holders of the parent

company 84,526 75,354 84,749

Non-current liabilities 11,921 9,300 7,958

Current liabilities 134,182 119,252 80,198

-------- -------- --------

Total liabilities 146,103 128,552 88,156

-------- -------- --------

Total equity and

liabilities 230,629 203,906 172,905

======== ======== ========

CONSOLIDATED CASH FLOW STATEMENT

SIX MONTHS ENDED 30 SEPTEMBER 2007

Unaudited Unaudited as

as at 30 at 30

September September 12 months to

2007 2006 31 March 2007

�000 �000 �000

Cash flows from operating

activities

Profit for the period 1,418 4,258 14,403

Adjustments for:

Depreciation 2,833 3,560 5,876

Financial expenses 1,674 958 2,757

Share of loss of associates 343 - -

Gain on sale of property, plant

and equipment - - (2,240)

Equity settled share-based

payment 65 112 244

Income tax expense 498 1,317 4,315

-------- -------- --------

Operating profit before

changes in working capital

and provisions 6,831 10,205 25,355

Change in inventories (14,402) (20,802) (7,521)

Change in trade and other

receivables (43,109) (44,131) (6,917)

Change in trade and other

payables 9,665 15,512 1,804

Change in provisions and deferred

income (416) (857) (1,832)

-------- -------- --------

(41,431) (40,073) 10,889

Interest paid (2,074) (1,020) (2,419)

Income taxes paid (497) (703) (3,024)

-------- -------- --------

Net cash (outflow)/ inflow

from operating activities (44,002) (41,796) 5,446

Cash flows from investing

activities

Acquisition of subsidiaries,

including overdrafts acquired (10,555) (16,372) (16,776)

Acquisition of shares in

associates (791) - -

Payments to acquire property,

plant and equipment (3,785) (7,005) (11,933)

Receipts from sales of property,

plant and equipment 3,715 109 95

Receipt of grants 1,962 - -

Receipts from sale of

investments 20 286 45

-------- -------- --------

Net cash (outflow) from investing

activities (9,434) (22,982) (28,569)

-------- -------- --------

Cash flows from financing

activities

Proceeds from the issue of share

capital - 38 101

Repayment of loans (159) (177) (89)

Receipt of new loans - 1,203 -

Payment of finance lease

liabilities (48) (91) (280)

Equity dividends (3,629) (3,240) (4,282)

Net cash (outflow) from financing -------- -------- --------

activities (3,836) (2,267) (4,550)

-------- -------- --------

Net (decrease) in cash and cash

equivalents (57,272) (67,045) (27,673)

Cash and cash equivalents at

start of period (35,567) (9,025) (9,025)

Effect of exchange rate

fluctuations on cash held (223) 777 1,131

-------- -------- --------

Cash and cash equivalents at end

of period (93,062) (75,293) (35,567)

======== ======== ========

Reconciliation of cash and cash equivalents

Unaudited Unaudited as

as at 30 at 30

September September 12 months to

2007 2006 31 March 2007

�000 �000 �000

Cash and cash equivalents 20 10 12,990

Loans and borrowings (93,082) (75,303) (48,557)

-------- -------- --------

Cash and cash equivalents per the

cash flow statement (93,062) (75,293) (35,567)

======== ======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended

30 September 2007

Total equity

attributable to

Potential Capital equity holder

Merger Retained issue of redemption Translation of the parent

September 2007 Share Capital Share premium reserve earnings shares reserve reserve company

�000 �000 �000 �000 �000 �000 �000 �000

Balance at 1 April 2007 2,317 2,515 13,416 65,923 2,235 1,340 (2,997) 84,749

Exchange adjustment - - - - - - (578) (578)

------------------------------------------------------------------------------------------------

Net income recognised

directly in equity - - - - - - (578) (578)

Profit for the period - - - 1,418 - - - 1,418

------------------------------------------------------------------------------------------------

Total income and expense

recognised for the period - - - 1,418 - - (578) 840

Dividends paid - - - (3,629) - - - (3,629)

Equity settled transactions - - - 65 - - - 65

Shares issued 36 492 2,117 - - - - 2,645

Decrease in potential issue

of shares - - - - (144) - - (144)

------------------------------------------------------------------------------------------------

Balance at 30 September

2007 2,353 3,007 15,533 63,777 2,091 1,340 (3,575) 84,526

================================================================================================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended

30 September 2006

Total equity

attributable to

Potential Capital equity holder

September 2006 Share capital Share premium Merger Retained issue of redemption Translation of the parent

reserve earnings shares reserve reserve company

�000 �000 �000 �000 �000 �000 �000 �000

Balance at 1 April 2006 2,308 2,386 13,023 55,558 1,052 1,340 (399) 75,268

Exchange adjustment - - - - - - (1,512) (1,512)

------------------------------------------------------------------------------------------------

Net income recognised

directly in equity - - - - - - (1,512) (1,512)

Profit for the period - - - 4,258 - - - 4,258

------------------------------------------------------------------------------------------------

Total income and expense

recognised for the period - - - 4,258 - - (1,512) 2,746

Dividends paid - - - (3,240) - - - (3,240)

Equity settled transactions - - - 112 - - - 112

Shares issued 6 69 393 - - - - 468

------------------------------------------------------------------------------------------------

Balance at 30 September

2006 2,314 2,455 13,416 56,688 1,052 1,340 (1,911) 75,354

================================================================================================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended

31st March 2007

Total equity

attributable to

Potential Capital equity holder

March 2007 Share capital Share premium Merger Retained issue of redemption Translation of the parent

reserve earnings shares reserve reserve company

�000 �000 �000 �000 �000 �000 �000 �000

Balance at 1 April 2006 2,308 2,386 13,023 55,558 1,052 1,340 (399) 75,268

Exchange adjustment - - - - - - (2,598) (2,598)

------------------------------------------------------------------------------------------------

Net income recognised

directly in equity - - - - - (2,598) (2,598)

Profit for the period - - - 14,403 - 14,403

------------------------------------------------------------------------------------------------

Total income and expense

recognised for the period - - 14,403 - (2,598) 11,805

Dividends paid - - - (4,282) - - - (4,282)

Equity settled transactions - - - 244 - - - 244

Shares issued 9 129 393 - - - - 531

Increase in potential issue

of shares - - - - 1,183 - - 1,183

------------------------------------------------------------------------------------------------

Balance at 31 March 2007 2,317 2,515 13,416 65,923 2,235 1,340 (2,997) 84,749

================================================================================================

Notes

1. Accounting policies

Basis of preparation

The financial information contained in this interim report does not constitute

statutory accounts as defined in Section 240 of the Companies Act and is

unaudited.

The comparative figures for the financial year ended 31 March 2007 are not the

company's statutory accounts for that financial year. Those accounts, which have

been prepared under UK GAAP, have been reported on by the company's auditors and

delivered to the registrar of companies. The report of the auditors was (i)

unqualified (ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their report, and

(iii) did not contain a statement under section 237 (2) or (3) of the Companies

Act 1985.

The AIM rules require that the next annual consolidated financial statements of

the company for the year ended 31 March 2008 be prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by the EU

("adopted IFRSs"). This interim financial information has been prepared on the

basis of the recognition and measurement requirements of adopted IFRSs as at 30

September 2007 that are effective (or available for early adoption) as at 31

March 2008, the Group's first annual reporting date at which it is required to

use adopted IFRSs. Based on these adopted IFRSs, the directors have applied the

accounting policies which they expect to apply when the first annual IFRS

financial statements are prepared for the year ending 31 March 2008.

However, the adopted IFRSs that will be effective (or available for early

adoption) in the annual financial statements for the year ending 31 March 2008

are still subject to change and to additional interpretations and therefore

cannot be determined with certainty. Accordingly, the accounting policies for

that annual period will be determined finally only when the annual financial

statements are prepared for the year ended 31 March 2008.

Note 7 and the subsequent pages set out detailed reconciliations to show the

differences in accounting treatment as compared to the previous UK GAAP basis of

accounting. There are reconciliations for the Consolidated Income Statement

(formerly the Consolidated Profit and Loss Account) and Consolidated Balance

Sheet for the restated comparative results for the year ended 31 March 2007 and

the six months ended 30 September 2006.

2. Taxation charge

Taxation for the six months to 30 September 2007 is based on the effective rate

of taxation, which is estimated to apply for the year ending 31 March 2008

taking into account the impact on deferred tax of the reduction in tax rate to

28% from 1 April 2008.

3. Earnings per share

Unaudited Unaudited 12 months to

six months six months 31 March 2007

ended 30 ended 30

September September

2007 2006

�000 �000 �000

Earnings 1,418 4,258 14,403

------------------------------------

Adjusted basic earnings

per share excluding exceptional

restructuring costs and profit on

disposal of fixed assets 3.0p 9.7p 29.4p

Loss per share on exceptional

restructuring costs - (0.5p) (1.9p)

Earnings per share on profit on

disposal of fixed assets - - 3.6p

------------------------------------

Basic earnings per share 3.0p 9.2p 31.1p

Weighted average number of shares

- basic

46,600,114 46,257,862 46,278,695

Earnings per share

- diluted 3.0p 9.1p 30.6p

Weighted average number of shares

- diluted 47,381,362 47,003,239 46,998,106

4. Restructuring costs

The restructuring costs of �304,000 during the six months ended 30 September

2006 and �1,252,000 during the twelve months ended 31 March 2007 represent costs

incurred in relation to the restructuring of the Group's UK operations in order

to maintain competitiveness.

5. Acquisitions

The following acquisitions took place during the period. Provisional fair

values have been attributed to assets and liabilities acquired.

a) On 4 April 2007, the Group acquired 100% of the issued share capital of

Weltec Holding BV, a distributor of photographic frames based in Holland,

for Euro415,000, paid in cash. During the period 4 April 2007 to 30 September

2007, the Group's results include turnover of �2.0 million, interest payable

for �29,000 and a loss before tax of �139,000 attributable to Weltec.

b) On 17 May 2007, the group acquired the business and assets of

Przedsiebiorstwp Produckcyjno-Handlowo- Uslugowe Artex ("Artex"), a

supplier of giftwrap and greetings products based in Poland, for a

consideration of Euro760,000, paid in cash. During the period 17 May 2007 to

30 September 2007, the Group's results include turnover of �139,000 and a

loss before tax of �121,000 attributable to Artex.

c) On 27 July 2007, the Group acquired 50% of the issued share capital of

Halloween Express Inc, a franchise retailer of Halloween products based in

the USA. Initial consideration of $2.65 million was paid, $1.65 million in

cash and $1 million by the issue of 119,948 new ordinary shares. Further

additional payments of up to $5.5 million may be payable, of which $800k may

be paid by the issue of new ordinary shares, dependant on future

profitability of the business. On the same date, the Group also acquired a

50% interest in the share capital of two newly formed companies based in the

USA, Asadart LLC inc and Vizterra LLC inc. Asadart is an internet retailer

of Halloween and Christmas products and Vizterra operated as a seasonal

retailer selling Halloween and Christmas products.

During the period 27 July 2007 to 30 September 2007, the Group's results

include its share of these associates losses after tax of �343,000.

d) On 4 September 2007, the Group acquired 100% of the issued share capital

of Glitterwrap Inc, a supplier of giftwrap and partyware products based in

the USA. Initial consideration of $2.8 million was paid, $1.5 million in

cash and $1.3 million by the issue of 232,024 new ordinary shares.

Additional deferred consideration of $5.7 million is payable with up to

$3.47 million payable by the issue of new ordinary shares. During the period

4 September 2007 to 30 September 2007, the Group's results include turnover

of �1.85 million, interest payable of �29,000 and profit before tax of

�230,000 attributable to Glitterwrap.

6. Share based payments

The fair value of services received in return for share options granted to

employees are measured by reference to the fair value of share options granted.

The estimate of the fair value of the services received is measured based on the

Black Scholes model (with the contractual life of the option and expectations of

early exercise incorporated into the model). The charge for the six months ended

30 September 2007 was �65,000.

7. Transition to IFRS

As stated in the accounting policies note, these are the Group's first condensed

consolidated interim financial statements for part of the period covered by the

first IFRS annual consolidated financial statements prepared in accordance with

adopted IFRS.

An explanation of how the transition from UK GAAP to adopted IFRS has affected

the Group's financial position, financial performance and cash flows is set out

in the following tables and notes that accompany the tables. The transition to

IFRS has not resulted in any impact on cash flows. The cash flow statement has

changed in terms of presentation only. There have been no changes to the

accounting policies presented in the 2007 financial statements other than in the

areas below.

Goodwill

Subject to the transitional relief in IFRS 1, all business combinations are

accounted for by applying the purchase method. Goodwill represents amounts

arising on acquisition of subsidiaries, associates and Jointly Controlled

Entities. In respect of business acquisitions that have occurred since 1 April

2006, goodwill represents the difference between the cost of the acquisition and

the fair value of the net identifiable assets acquired. Identifiable intangibles

are those which can be sold separately or which arise from legal rights

regardless of whether those rights are separable. Provisional fair values have

been assigned to assets and liabilities in accordance with IFRS 3 'Business

combinations' and will be finalised in the financial statements for the year

ended 31 March 2008.

Goodwill is stated at cost less any accumulated impairment losses. Goodwill is

allocated to cash-generating units and is not amortised but is tested annually

for impairment. In respect of associates, the carrying amount of goodwill is

included in the carrying amount of the investment in the associate.

IFRS 1 grants certain exemptions from the full requirements of Adopted IFRSs in

the transition period. The Group elected not to restate business combinations

that took place prior to 1 April 2006. In respect of acquisitions prior to 1

April 2006, goodwill is included at 1 April 2006 on the basis of its deemed

cost, which represents the amount recorded under UK GAAP which was broadly

comparable save that only separable intangibles were recognised and goodwill was

amortised. Negative goodwill arising on an acquisition is recognised in profit

or loss.

Under UK GAAP the Group's policy was to amortise goodwill over 10 - 30 years.

Under IFRS 3 there is no amortisation of goodwill, so the goodwill amortisation

charge of �1,458,000 for the year ended 31 March 2007 and �669,000 for the six

months ended 30 September 2006 has been excluded from the restated accounts.

Forward contracts

Derivative financial instruments

Derivative financial instruments are recognised at fair value. The gain or loss

on re-measurement to fair value is recognised immediately in profit or loss.

However, where derivatives qualify for hedge accounting, recognition of any

resultant gain or loss depends on the nature of the item being hedged (see

below).

The fair value of forward exchange contracts is their quoted market price at the

balance sheet date.

Cash flow hedges

Where a derivative financial instrument is designated as a hedge of the

variability in cash flows of a recognised asset or liability, or a highly

probable forecast transaction, the effective part of any gain or loss on the

derivative financial instrument is recognised directly in the hedging reserve.

Any ineffective portion of the hedge is recognised immediately in the income

statement.

Under UK GAAP, no adjustment was made to reflect the fair value of forward

exchange contracts entered into by the Group. A charge of �401,000 (before tax

attributable of �120,000) for the year ended 31 March 2007 and �305,000 (before

tax attributable of �91,000) for the six months ended 30 September 2006 has been

included in the restated accounts to reflect the change in the fair values of

these financial instruments during these periods as the criteria for hedging was

not met.

Deferred tax

Deferred tax is provided on temporary differences between the carrying amounts

of assets and liabilities for financial reporting purposes and the amounts used

for taxation purposes. The following temporary differences are not provided for:

the initial recognition of goodwill; the initial recognition of assets or

liabilities that affect neither accounting nor taxable profit other than in a

business combination, and differences relating to investments in subsidiaries to

the extent that they will probably not reverse in the foreseeable future. The

amount of deferred tax provided is based on the expected manner of realisation

or settlement of the carrying amount of assets and liabilities, using tax rates

enacted or substantively enacted at the balance sheet date.

Under UK GAAP, the group had an unprovided deferred tax liability on gains on

capital disposals rolled over into replacement assets and where grants have

reduced the tax cost of properties for use in capital gains calculations on

future disposals. Under IFRS, there is no option to not recognise a deferred tax

liability in relation to this and therefore an adjustment has been made at 1

April 2006 and in the year ended 31 March 2007 to reflect the recognition of

this liability.

Impact on 1 April 2006

Retained earnings as at 1 April 2006 have been increased by �74,000,

representing the fair value of financial instruments after attributable tax at

the transition date and reduced by �597,000 representing the recognition of a

deferred tax liability previously unprovided.

Profit and loss account Adjusted

6 months to 30 September UK GAAP Adjustments IFRS

2006 �000 �000 �000

Revenue 85,093 - 85,093

=============================================

Operating profit before

restructuring costs

and profit on disposal of fixed

assets 6,473 364 6,837

Restructuring costs (304) - (304)

---------------------------------------------

Operating profit 6,169 364 6,533

Interest payable (958) - (958)

---------------------------------------------

Profit before taxation 5,211 364 5,575

Taxation (1,408) 91 (1,317)

Profit after taxation

attributable to

equity holders of the parent ---------------------------------------------

company 3,803 455 4,258

=============================================

Earnings per Share

Basic 8.2p 1.0p 9.2p

Diluted 8.1p 1.0p 9.1p

Profit and loss account Adjusted

Year ended 31 March 2007 UK GAAP Adjustments IFRS

�000 �000 �000

Revenue 196,718 - 196,718

---------------------------------------------

Operating profit before

restructuring costs

and profit on disposal of fixed

assets 19,430 1,057 20,487

Restructuring costs (1,252) - (1,252)

Profit on disposal of fixed

assets 2,240 - 2,240

---------------------------------------------

Operating profit 20,418 1,057 21,475

Interest payable (2,757) - (2,757)

---------------------------------------------

Profit before taxation 17,661 1,057 18,718

Taxation (4,662) 347 (4,315)

---------------------------------------------

Profit after taxation

attributable to equity

holders of the parent

company 12,999 1,404 14,403

=============================================

Earnings per Share

Basic 28.1p 2.9p 31.1p

Diluted 27.7p 2.9p 30.6p

Balance sheet Adjusted

30 September 2006 UK GAAP Adjustments IFRS

�000 �000 �000

Assets

Property, plant and

equipment 40,017 - 40,017

Intangible assets 25,422 669 26,091

---------------------------------------------

Total non-current assets 65,439 669 66,108

Current assets

Inventories 62,254 - 62,254

Trade and other receivables 75,460 59 75,519

Cash and cash equivalents 10 - 10

Investments 15 - 15

---------------------------------------------

Total current assets 137,739 59 137,798

Total assets 203,178 728 203,906

=============================================

Equity

Issued capital 2,314 - 2,314

Share premium 2,455 - 2,455

Reserves 12,845 - 12,845

Potential issue shares 1,052 - 1,052

Retained earnings 56,756 (68) 56,688

---------------------------------------------

Total equity attributable

to equity holders of the

parent company 75,422 (68) 75,354

Non-current liabilities 8,703 597 9,300

Current liabilities 119,053 199 119,252

---------------------------------------------

Total liabilities 127,756 796 128,552

---------------------------------------------

Total equity and

liabilities 203,178 728 203,906

=============================================

Balance sheet Adjusted

31 March 2007 UK GAAP Adjustments IFRS

�000 �000 �000

Assets

Property, plant and

equipment 41,882 - 41,882

Intangible assets 26,695 1,458 28,153

---------------------------------------------

Total non-current assets 68,577 1,458 70,035

Current assets

Inventories 48,577 - 48,577

Trade and other receivables 41,283 - 41,283

Cash and cash equivalents 12,990 - 12,990

Investments 20 - 20

---------------------------------------------

Total current assets 102,870 - 102,870

Total assets 171,447 1,458 172,905

=============================================

Equity

Issued capital 2,317 - 2,317

Share premium 2,515 - 2,515

Reserves 11,759 - 11,759

Potential issue shares 2,235 - 2,235

Retained earnings 65,042 881 65,923

---------------------------------------------

Total equity attributable

to equity holders of the

parent company 83,868 881 84,749

Non-current liabilities 7,676 282 7,958

Current liabilities 79,903 295 80,198

---------------------------------------------

Total liabilities 87,579 577 88,156

---------------------------------------------

Total equity and

liabilities 171,447 1,458 172,905

=============================================

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFFTFILFLID

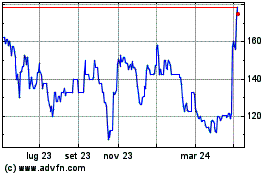

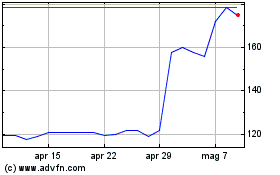

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024