Interim Results

04 Dicembre 2002 - 8:00AM

UK Regulatory

BW20021203002473 20021204T070012Z UTC

( BW)(INTERNATIONAL-GREETINGS-PLC)(IGR) Interim Results

Business Editors

UK REGULATORY NEWS

LONDON--(BUSINESS WIRE)--Dec. 4, 2002--

Profits up 30% at International Greetings

Gift wrap division back on track

Good Christmas expected

International Greetings PLC, the leading designer and manufacturer of

private label greetings products and licensed stationery, today

announced interim results for the six months ended 30 September 2002.

Highlights included:

o Pre-tax profits up 30% to �4.3 million (2001: �3.3 million(a))

o Earnings per share up 29% to 7.1p (2001: 5.5p(a))

o Dividend per share up 8% to 1.3p (2001: 1.2p)

o Over 1 billion feet of gift wrap produced by end November

o Benefits from changes at UK gift wrap division to continue in second half

o Optimistic for full year and outlook for 2003 / 04

Nick Fisher, Joint Chief Executive, commented: "It's great to return

to reporting earnings growth once again after last year's setback. We

have made good progress in resolving the production problems in the UK

gift wrap operation and we will see further benefits from this in our

full year figures.

"By November, we had produced a record one billion feet of gift wrap,

which was delivered on time and at the right cost.

(a) Excluding an exceptional cost of �317,000 in 2001.

"I am confident about the outlook for the full year, which will

include sales from our Harry Potter ranges and with a strong retail

climate this Christmas, we are optimistic about customer commitments

for next year."

For further information, please contact:

Edelman Financial

Michael Henman Tel.: +44 (0)20 7344 1200

Ben Russell Tel.: +44 (0)20 7344 1200

Chairman's Statement

I am pleased to report interim results for the six months to 31st

September 2002. Turnover for the period showed a modest increase of 3%

to �49m. However, our continuing focus on cost and efficiency

improvements has resulted in an 11% increase in operating profit(a) to

�4.8m. We have also reduced capital expenditure, tightened control of

working capital and in combination with reduced interest rates, this

has resulted in interest payable down by 49% from last year at �0.5m.

Overall , profit before taxation(a) increased to �4.3m, 30% higher than

last year.

I am particularly pleased that the changes in management and

procedures at the UK gift wrap division have delivered significant

improvements in both the operating performance and the profitability

of the Division, and we expect these benefits to continue during the

second half of the year. Recent investment in new machinery in this

division has resulted in record levels of output at increased

efficiency levels. By the end of November annual production of gift

wrap had exceeded one billion feet, and this has been achieved at the

same time as continuing to maintain our delivery performance and

customer service levels at a high level.

We are continuing to expand the group's worldwide sourcing programme

and are currently evaluating a number of alternative methods of

developing it further. This is of considerable long-term strategic

importance to the group's ability to both extend its supplier base and

reduce costs. It also enables the group to meet the increasing demand

for higher value-added, hand-made products, particularly in the card

and accessories market segment.

Design and licensing remains a key factor in the success of our

business. As a result, we were delighted to be awarded the prestigious

"Stationery Licensee of the Year Award" at the annual Licensed

Industry's Awards, recognising our commitment to licensed design

within our industry. In addition, with the recently released Harry

Potter film we expect strong demand for our products during the second

half of our financial year.

With our seasonal manufacturing peak now completed and an encouraging

current retail climate in the lead up to this year's Christmas, we are

optimistic about both our full year's performance and our customers'

commitments for Christmas 2003. Reflecting this confidence in both the

strength of our business and the market place in general, your Board

is proposing a dividend of 1.3p per share, an increase of 8% over last

year. The dividend will be paid on 15 January 2003 to all shareholders

on the register on 3 January 2003.

John Elfed Jones CBE DL

CHAIRMAN

(a) Excluding an exceptional cost of �317,000 in 2001

GROUP PROFIT AND LOSS ACCOUNT

Six months ended 30 September 2002

Unaudited Unaudited Audited

6 months to 6 months to Year ended

0 September 30 September 31 March

2002 2001 2002

�000 �000 �000

Turnover 48,950 47,355 110,653

Operating Profit (see Note 4 below) 4,790 4,009 10,142

Interest payable (531) (1,051) (1,657)

Profit before taxation 4,259 2,958 8,485

Taxation (1,330) (928) (2,516)

Profit after taxation 2,929 2,030 5,969

Dividend ( 535) (490) (1,849)

Retained Profit 2,394 1,540 4,120

Earnings per share 7.1p 5.0p 14.6p

Diluted earnings per share 7.0p 4.8p 14.2p

Dividend per ordinary share 1.3p 1.2p 4.5p

Note:

1 The figures for the year ended 31 March 2002 are an abridged

version of the published accounts which have been reported on

without qualification by the auditors, and without any statement

under Section 237(2) or (3) of the Companies Act 1985, and have

been delivered to the Registrar of Companies.

2 The calculation of earnings per share is based on 41,117,257 (6

months to 30 September 2001: 40,808,924, 12 months to 31 March

2002: 40,864,758) ordinary shares being the average number of

shares in issue during the period. The calculation of diluted

earnings per share is based on 41,890,805(6 months to 30 September

2001: 42,088,336, 12 months to 31 March 2002: 41,907,777) ordinary

shares calculated in accordance with FRS14.

3 The taxation charge for the six months ended 30 September 2002 is

based on the estimated tax rate for the full year.

4 Operating profit for the six months ended 30 September 2001 is

stated after allowing for an exceptional cost of �317,000 (12

months ended 31 March 2002: �420,000) representing full provision

against an insurance claim debtor arising from the liquidation of

the company's insurers, Independent Insurance Company, in June

2001.

Short Name: Intnl Greetings PLC

Category Code: IR

Sequence Number: 00001348

Time of Receipt (offset from UTC): 20021203T181521+0000

--30--fg/uk*

CONTACT: International Greetings PLC

KEYWORD: UNITED KINGDOM INTERNATIONAL EUROPE

INDUSTRY KEYWORD: PUBLISHING EARNINGS

SOURCE: Intnl Greetings PLC

Today's News On The Net - Business Wire's full file on the Internet

with Hyperlinks to your home page.

URL: http://www.businesswire.com

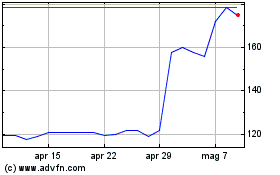

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

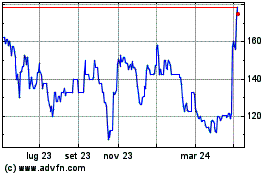

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024