TIDMIGR

RNS Number : 6124U

International Greetings PLC

04 December 2013

4(th) December 2013

International Greetings PLC ("the Company" or "the Group")

Interim Results

International Greetings PLC, one of the world's leading

designers, innovators and manufacturers of gift packaging and

greetings, stationery and creative play products, announces its

interim results for the six months ended 30 September 2013.

Financial highlights

* Sales in line with expectations at GBP113.6 million

(2012 H1: GBP115.2million), reflecting the phasing of

deliveries to customer requirements, resulting in H2

weighting

* Gross margin improved to 19.0% (2012 H1:18.4%)

* Operating profit before exceptional items up GBP0.1

million at GBP5.3 million (2012 H1: GBP5.2 million)

* Profit before tax and exceptional items up 7.9% to

GBP3.5 million (2012 H1: GBP3.3 million)

* Profit before tax in line with expectations at GBP1.7

million (2012 H1: GBP2.5 million) after planned

exceptional costs of GBP1.8 million in respect of our

new investment in Wales completed to planned

timescales, costs and service levels.(2012 H1:

GBP0.75 million)

* Debt reduction programme remains on track with net

debt level at GBP84.8 million (2012 H1: GBP84.6

million) including the capital investment in Wales

Operational highlights

* Manufacturing season in China successfully completed

on time and fully to customer requirements

* Strong manufacturing efficiencies and volume gains

achieved in Europe following investment last year

* Investment programme in Wales remains on track and on

budget

* Completed renegotiation of US banking facilities with

Sun Trust on improved terms, building on improvements

achieved with HSBC in April 2013

* Granted Royal Warrant for Gift Wrap, in addition to

established Royal Warrant for Christmas crackers

* Robust order book for the full year 2013/14, in line

with expectations

Paul Fineman, Chief Executive said:

"The first half of the year has seen a number of positive

operational developments across the Group and we are pleased to

report that all regions traded profitably during the period, with

notable improved performance in the UK and Europe and a strong

order book in the USA.

"We are particularly pleased to note the record levels of gift

wrap production and profitable sales growth in Europe following the

investment in our new, high definition printing facilities, which

underpinned this success. This bodes well for the recently

commenced project to bring similar technology to our gift wrap

plant in Wales. This exciting initiative is on track and on budget

to be operational in the Spring of 2014.

"We are confident that the Group remains well placed to meet the

needs of our customers, whilst continuing to provide excellent

customer service and innovation. We have a strong order book and

are on course to deliver targeted growth in underlying earnings per

share, whilst continuing to remain focussed on reducing

leverage."

For further information, please contact:

International Greetings plc Tel: 01525 887 310

Paul Fineman, Chief Executive

Anthony Lawrinson, Chief Financial

Officer

Cenkos Securities plc Tel: 0207 397 8900

Bobbie Hilliam

FTI Consulting Tel: 020 7831 3113

Jonathon Brill

Georgina Goodhew

Chief Executive Officer's review

Unwrapping progress

Paul Fineman

CEO

Key achievements

-- Profit before tax and exceptional items up by 7.9% to GBP3.5

million (2012 H1: GBP3.3 million)

-- Gross margin improved to 19.0% (2012 H1: 18.4%)

-- Sales in line with expectations

-- Christmas cracker manufacturing season in China successfully completed

-- Gift wrap production efficiencies and volume gains yielded in

Europe following investment last year

-- Investment programme in Wales on track and on budget

-- Re-negotiation of US banking facilities on improved terms

Overview

Sales and profit for the six months ended 30 September 2013 are

overall in line with expectations.

Operational review

We are pleased to report that all regions traded profitably

during the period, with notable improved performance in the UK and

Europe, compared to the same period last year, and a strong order

book in the USA. We are encouraged by the operational achievements,

and, in particular, an excellent performance delivered by our

manufacturing facilities throughout the Group.

In Europe, our investment during FY2013 in new state-of-the-art

high-definition printing facilities, underpinned record levels of

gift wrap production and profitable sales growth. This bodes well

for the recently commenced project to bring similar technology to

our gift wrap plant in Wales. This exciting initiative is on track

and on budget and expected to be operational in the spring of 2014.

In the meantime, our existing production facilities in the UK and

also in the USA are delivering to plan and in line with annual

forecasts.

We are also delighted with the performance of our relocated

China-based Christmas cracker manufacturing operation, where we

have produced on time and delivered in full, meeting targeted

efficiencies whilst implementing initiatives for continued

improvement.

The global nature of our business is demonstrated by the fact

that during the period our products have been distributed to over

80 countries and are sold in excess of 100,000 retail outlets

worldwide. Whilst providing our customers with a broad and flexible

portfolio of products and brands, we are experiencing increased

demand for the Group's generic brands, and, in particular, the Tom

Smith(TM) range of products. The brand's profile was further

enhanced by our participation in the Coronation Festival at

Buckingham Palace in July, following which, we were proud to

announce that the Royal Warrant granted to the Tom Smith(TM) brand

now applies to gift wrap as well as to the long-established

Christmas cracker category.

Financial review

Revenue from continuing operations for the period was in line

with expectations at GBP113.6 million (2012 H1: GBP115.2 million),

with particularly good progress in Europe where sales increased by

21%. The timing of sales at the half year merely reflects the

phasing of deliveries to customer requirements, with several major

international retailers now ordering deliveries later in the year,

resulting in H2 weighting for FY2013.

Gross profit margins at 19.0% (2012 H1: 18.4%) were 0.6% higher

with improved operational performance, particularly in China, being

the main driver. Overhead costs were steady at GBP16.5 million

(2012 H1: GBP16.5 million).

Operating profit before exceptional costs was up slightly at

GBP5.3 million (2012 H1: GBP5.2 million) while profit before tax

and exceptional items was up 7.9% to GBP3.5 million from GBP3.3

million in the equivalent period last year.

The planned exceptional charges of GBP1.8 million in respect of

our new investment in Wales and associated accelerated amortisation

of bank fees resulted in profit before tax and after exceptional

items being down 32% to GBP1.7 million (2012 H1: GBP2.5 million).

Of this charge, GBP0.6 million represents accelerated depreciation

(non-cash) on assets that will no longer be required once the new

machinery is operational and a further GBP0.8 million represents

provisions for redundancy and decommissioning costs and associated

costs that are only expected to flow out as cash in the next

financial year. The remaining GBP0.4 million is included within

finance expenses and relates to accelerated amortisation of bank

arrangement fees as a result of renegotiation of banking facilities

to accommodate the financing of the new investment.

Finance expenses before exceptional items in the period were

GBP1.8 million (2012 H1: GBP1.9 million). The Group's borrowing

costs are falling as certain qualifying leverage ratios are

achieved, triggering reduced margins on our banking facilities. Our

facilities with HSBC were increased and renewed in April 2013 on

improved terms, providing the capacity for the Group to make an

important capital investment at our manufacturing facilities in

Wales. Furthermore our US banking facilities were also renegotiated

and extended on favourable terms and at a reduced margin with

SunTrust just after the period end in October 2013. Reduction of

debt and the associated interest cost remains a key focus and our

programme for this is on-track. Finance costs after exceptional

items of GBP0.4 million (2012 H1: nil) were GBP2.2 million (2012

H1: GBP1.9 million).

The effective underlying tax rate was 25% (2012 H1: 26%). This

rate has fallen again, reflecting reductions in the UK rate of

taxation and our ability to recognise tax losses in the USA as

profitable growth continues. There are still unrecognised losses

with a tax value of $3.2 million in the USA and GBP0.7 million in

the UK which can be reflected in the balance sheet as US

profitability progresses.

Stated before exceptional items, basic earnings per share were

in line with expectations at 3.8p (2012 H1: 3.9p), and 1.4p (2012

H1: 3.4p) after exceptional items. Our primary measure of fully

diluted earnings per share before exceptional items was also in

line with expectations at 3.7p (2012 H1: 3.7p). See note 6 of the

interim financial statements.

Capital expenditure in the six months was GBP2.3 million (2012

H1: GBP1.4 million) reflecting the initial outlays on the

investment in Wales. Provided certain criteria are met, a

government grant is receivable against this investment and the

first contribution of GBP0.1 million was received in the period

slightly earlier than expected.

Cash used by operations was GBP38.9 million in line with the

prior year (2012 H1: GBP39.1 million), which reflects the

seasonality of the business as 53% of the sales in the six month

period occurred in the last two months.

Debtors and receivables at GBP68.1 million were lower than at H1

2012 (GBP69.3 million) whereas stock levels were higher at GBP67.0

million (2012 H1: GBP60.6 million). Both reflect the variable

phasing of deliveries to customer requirements in the current year

and stock build including that associated with a stronger order

book in Europe.

Net debt at 30 September 2013 was steady at GBP84.8 million

(2012 H1: GBP84.6 million) despite the effect of exchange rates

which increased debt by GBP0.2 million compared with the prior

year, and capital investment in Wales amounting to GBP1.0 million

at the end of H1.

The Board will not be declaring an interim dividend and will

keep this policy under review (2012 H1: nil).

Current trading outlook

We have a strong order book and are well placed to meet the

needs of our customers, whilst continuing to provide excellent

service levels as demonstrated by acknowledgements and awards we

are so pleased to receive.

Operational improvements, prudent investment in projects with

early pay back and a focus on customer service and innovation

continue to deliver margin and profit growth.

Sales achieved in the first half of the year reflect the

changing platform of delivery phasing required by several of the

world's major retailers.

We are on course to achieve targeted growth in underlying

earnings per share and remain focused on reducing leverage through

converting profit into cash.

Paul Fineman

CEO

Consolidated income statement

six months ended 30 September 2013

Unaudited Unaudited

six months six months 12 months

ended ended ended

30 Sep 30 Sep 31 Mar

2013 2013 2013 2012 2012 2012 2013 2013 2013

----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Before Exceptional Before Exceptional Before Exceptional

exceptional items exceptional items exceptional items

items (note 3) Total items (note 3) Total items (note 3) Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Continuing

operations

Revenue 113,556 - 113,556 115,207 - 115,207 225,211 - 225,211

Cost of sales (91,995) (1,478) (93,473) (94,056) - (94,056) (183,941) (953) (184,894)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Gross profit 21,561 (1,478) 20,083 21,151 - 21,151 41,270 (953) 40,317

19.0% 17.7% 18.4% 18.4% 18.3% 17.9%

Selling expenses (6,308) - (6,308) (6,723) (750) (7,473) (12,790) (455) (13,245)

Administration

expenses (10,228) - (10,228) (9,849) - (9,849) (18,789) (195) (18,984)

Other operating

income 315 72 387 382 - 382 803 - 803

(Loss)/profit on

sales of

property,

plant, and

equipment (6) - (6) 251 - 251 252 - 252

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Operating

profit/(loss) 5,334 (1,406) 3,928 5,212 (750) 4,462 10,746 (1,603) 9,143

Finance expenses (1,792) (403) (2,195) (1,929) - (1,929) (3,466) - (3,466)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Profit/(loss)

before tax 3,542 (1,809) 1,733 3,283 (750) 2,533 7,280 (1,603) 5,677

Income tax

(charge)/credit (886) 416 (470) (854) 224 (630) (1,890) 289 (1,601)

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Profit/(loss)

from continuing

operations for

the period 2,656 (1,393) 1,263 2,429 (526) 1,903 5,390 (1,314) 4,076

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Attributable to:

Owners of the

Parent Company 792 1,874 3,401

Non-controlling

interest 471 29 675

---------------- ----------- ----------- -------- ----------- ----------- -------- ----------- ----------- ---------

Earnings per ordinary share

Unaudited Unaudited

six months six months 12 months

ended ended ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

----------------- ----------------- -----------------

Diluted Basic Diluted Basic Diluted Basic

------------------------------- -------- ------- -------- ------- -------- -------

Adjusted earnings per share

excluding exceptional items 3.7p 3.8p 3.7p 3.9p 7.8p 8.1p

Loss per share on exceptional

items (2.4p) (2.4p) (0.5p) (0.5p) (2.0p) (2.1p)

Earnings per share from

continuing operations 1.3p 1.4p 3.2p 3.4p 5.8p 6.0p

Earnings per share 1.3p 1.4p 3.2p 3.4p 5.8p 6.0p

------------------------------- -------- ------- -------- ------- -------- -------

Consolidated statement of comprehensive income

six months ended 30 September 2013

six months six months 12 months

ended ended ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP000 GBP000 GBP000

---------------------------------------------------------- ----------- ----------- ----------

At 1 April 2013 1,263 1,903 4,076

Other comprehensive income:

Exchange difference on translation of foreign operations (1,558) (473) 633

Net (loss)/profit on cash flow hedges (net of tax) 220 (181) (5)

Other comprehensive income for period, net of tax (1,338) (654) 628

Total comprehensive income for the period, net of tax (75) 1,249 4,704

Attributable to:

Owners of the Parent Company 42 1,260 3,796

Non-controlling interests (117) (11) 908

---------------------------------------------------------- ----------- ----------- ----------

(75) 1,249 4,704

---------------------------------------------------------- ----------- ----------- ----------

Consolidated statement of changes in equity

six months ended 30 September 2013

Share

premium

and

capital Non-

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 31 March

2013 2,838 4,658 17,164 (451) 846 26,833 51,888 4,684 56,572

Profit for the

year - - - - - 792 792 471 1,263

Other comprehensive

income - - - 220 (970) - (750) (588) (1,338)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Total comprehensive

income for the

year - - - 220 (970) 792 42 (117) (75)

Equity-settled

share-based

payment - - - - - 5 5 - 5

Options exercised 51 91 - - - - 142 - 142

Equity dividends

paid - - - - - - - (1,014) (1,014)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 30 September

2013 2,889 4,749 17,164 (231) (124) 27,630 52,077 3,553 55,630

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

For the six months ended 30 September 2012

Share

premium

and

capital Non-

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

At 1 April 2012 2,750 4,480 17,164 (446) 446 23,410 47,804 4,744 52,548

Profit for the

period - - - - - 1,874 1,874 29 1,903

Other comprehensive

income - - - (181) (433) - (614) (40) (654)

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

Total comprehensive

income for the

year - - - (181) (433) 1,874 1,260 (11) 1,249

Equity-settled

share-based

payment - - - - - 55 55 - 55

Options exercised 78 159 - - - - 237 - 237

Equity dividends

paid - - - - - - - (968) (968)

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

At 30 September

2012 2,828 4,639 17,164 (627) 13 25,339 49,356 3,765 53,121

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

For the year ended 31 March 2013

Share

premium

and

capital Non-

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

At 1 April 2012 2,750 4,480 17,164 (446) 446 23,410 47,804 4,744 52,548

Profit for the

year - - - - - 3,401 3,401 675 4,076

Other comprehensive

income - - - (5) 400 - 395 233 628

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

Total comprehensive

income for the

year - - - (5) 400 3,401 3,796 908 4,704

Equity-settled

share-based

payment - - - - - 22 22 - 22

Options exercised 88 178 - - - - 266 - 266

Equity dividends

paid - - - - - - - (968) (968)

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

At 31 March

2013 2,838 4,658 17,164 (451) 846 26,833 51,888 4,684 56,572

-------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- ------

Consolidated balance sheet

six months ended 30 September 2013

Unaudited Unaudited

as at as at As at

30 Sep 30 Sep 31 March

2013 2012 2013

Note GBP000 GBP000 GBP000

----------------------------------------------------- ----- ---------- ---------- ---------

Non-current assets

Property, plant and equipment 28,732 30,360 29,993

Intangible assets 32,397 32,502 32,795

Deferred tax assets 4,007 4,159 4,250

----------------------------------------------------- ----- ---------- ---------- ---------

Total non-current assets 65,136 67,021 67,038

----------------------------------------------------- ----- ---------- ---------- ---------

Current assets

Inventory 67,032 60,615 50,114

Trade and other receivables 68,140 69,289 23,285

Cash and cash equivalents 4 1,275 3,403 2,301

----------------------------------------------------- ----- ---------- ---------- ---------

Total current assets 136,447 133,307 75,700

----------------------------------------------------- ----- ---------- ---------- ---------

Total assets 201,583 200,328 142,738

----------------------------------------------------- ----- ---------- ---------- ---------

Equity

Share capital 2,889 2,828 2,838

Share premium 3,409 3,299 3,318

Reserves 18,149 17,890 18,899

Retained earnings 27,630 25,339 26,833

----------------------------------------------------- ----- ---------- ---------- ---------

Equity attributable to owners of the Parent Company 52,077 49,356 51,888

----------------------------------------------------- ----- ---------- ---------- ---------

Non-controlling interests 3,553 3,765 4,684

----------------------------------------------------- ----- ---------- ---------- ---------

Total equity 55,630 53,121 56,572

----------------------------------------------------- ----- ---------- ---------- ---------

Non-current liabilities

Loans and borrowings 4 27,205 28,854 29,479

Deferred income 1,096 1,604 1,329

Provisions 861 899 862

Other financial liabilities 1,667 526 1,803

----------------------------------------------------- ----- ---------- ---------- ---------

Total non-current liabilities 30,829 31,883 33,473

----------------------------------------------------- ----- ---------- ---------- ---------

Current liabilities

Bank overdraft 4 3,019 5,820 336

Loans and borrowings 4 54,256 53,199 12,847

Deferred income 555 550 550

Provisions 104 172 107

Income tax payable 1,332 580 904

Trade and other payables 44,707 45,191 28,995

Other financial liabilities 11,151 9,812 8,954

----------------------------------------------------- ----- ---------- ---------- ---------

Total current liabilities 115,124 115,324 52,693

----------------------------------------------------- ----- ---------- ---------- ---------

Total liabilities 145,953 147,207 86,166

----------------------------------------------------- ----- ---------- ---------- ---------

Total equity and liabilities 201,583 200,328 142,738

----------------------------------------------------- ----- ---------- ---------- ---------

Consolidated cash flow statement

six months ended 30 September 2013

Unaudited Unaudited

six months six months 12 months

Ended ended Ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP000 GBP000 GBP000

--------------------------------------------------------- ----------- ----------- ----------

Cash flows from operating activities 1,263 1,903 4,076

Profit for the year

Adjustments for: 2,649 1,914 3,807

Depreciation

Amortisation of intangible assets 176 318 494

Finance expenses - continuing operations 2,195 1,929 3,466

Income tax credit - continuing operations 470 630 1,601

Loss/(profit) on sales of property, plant and equipment 6 (251) (252)

Loss on external sale of intangible fixed assets 10 1 -

Equity-settled share-based payment 5 55 22

--------------------------------------------------------- ----------- ----------- ----------

Operating profit after adjustments for non-cash items 6,774 6,499 13,214

Change in trade and other receivables (46,879) (48,675) (1,965)

Change in inventory (17,142) (18,116) (7,171)

Change in trade and other payables 18,657 21,754 4,356

Change in provisions and deferred income (352) (524) (901)

--------------------------------------------------------- ----------- ----------- ----------

Cash (used by)/generated from operations (38,942) (39,062) 7,533

Tax paid (39) (452) (937)

Interest and similar charges paid (1,759) (1,757) (3,285)

Receipts from sales of property for resale - - -

--------------------------------------------------------- ----------- ----------- ----------

Net cash (outflow)/inflow from operating activities (40,740) (41,271) 3,311

--------------------------------------------------------- ----------- ----------- ----------

Cash flow from investing activities

Proceeds from sale of property, plant and equipment 33 403 421

Acquisition of intangible assets (105) (88) (242)

Acquisition of property, plant and equipment (2,147) (1,339) (1,884)

Receipt of government grant 120 - -

--------------------------------------------------------- ----------- ----------- ----------

Net cash (outflow) from investing activities (2,099) (1,024) (1,705)

--------------------------------------------------------- ----------- ----------- ----------

Cash flows from financing activities

Proceeds from issue of share capital 142 237 266

Repayment of secured borrowings (4,336) (3,504) (4,060)

Net movement in credit facilities 42,642 43,543 2,748

Payment of finance lease liabilities (125) (37) (115)

New bank loans raised 3,100 - -

New finance leases (a) 2 - 1,764

Loan arrangement fees - (444) (444)

Dividends paid to non-controlling interests (1,014) (968) (968)

--------------------------------------------------------- ----------- ----------- ----------

Net cash inflow/(outflow) from financing activities 40,411 38,827 (809)

--------------------------------------------------------- ----------- ----------- ----------

Net increase in cash and cash equivalents (2,428) (3,468) 797

Cash and cash equivalents at end of period 1,965 1,223 1,223

Effect of exchange rate fluctuations on cash held (1,281) (172) (55)

--------------------------------------------------------- ----------- ----------- ----------

Cash and cash equivalents at end of the period (1,744) (2,417) 1,965

--------------------------------------------------------- ----------- ----------- ----------

(a) In 2011/12 fixed assets of GBP1,764,000 shown as acquisition

of property, plant and equipment were purchased, cash inflow from

new finance leases represents proceeds received in respect of these

assets which are now held by the Group under finance leases.

1 Accounting policies

Basis of preparation

The financial information contained in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006 and is unaudited.

The Group interim report has been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards as adopted by the EU ("Adopted IFRS"). The financial

information for the year ended 31 March 2013 is extracted from the

statutory accounts of the Group for that financial year and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The auditor's report was (i) unqualified; (ii)

did not include a reference to any matters to which the auditor

drew attention by way of emphasis without qualifying their report;

and (iii) did not contain a statement under Section 498 (2) of the

Companies Act 2006.

Going concern basis

The borrowing requirement of the Group increases steadily over

the period from July and peaks between September and November

before then reducing due to the seasonality of the business. This

is due to the sales of wrap and crackers which are mainly for the

Christmas market.

As with any company placing reliance on external entities for

financial support, the Directors acknowledge that there can be no

certainty that this support will continue although, at the date of

approval of this interim report, they have no reason to believe

that it will not do so.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

in preparing the financial statements.

The interim report does not include all the information and

disclosures required in the annual financial statements and should

be read in conjunction with the Group's annual financial statements

for the year ended 31 March 2013.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim report are consistent with those followed in the

preparation of the Group's annual financial statements for the year

ended 31 March 2013.

2 Segmental information

The Group has one material business activity being the design,

manufacture, import and distribution of gift packaging and

greetings, social expression giftware, stationery and creative play

products.

For management purposes the Group is organised into four

geographic business units.

The results below are allocated based on the region in which the

businesses are located; this reflects the Group's management and

internal reporting structure. The decision was made during 2011 to

focus Asia as a service provider of manufacturing and procurement

operations, whose main customers are our UK businesses. Both the

China factory and the majority of the Hong Kong procurement

operations are now overseen by our UK operational management team

and we therefore continue to include Asia within the internal

reporting of the UK operations, such that UK and Asia comprise an

operating segment. The chief operating decision maker is the

Board.

Intra-segment pricing is determined on an arm's length basis.

Segment results include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis.

Financial performance of each segment is measured on operating

profit. Interest expense or revenue and tax are managed on a Group

basis and not split between reportable segments.

Segment assets are all non-current and current assets, excluding

deferred tax and income tax receivable. Where cash is shown in one

segment, which nets under the Group's banking facilities, against

overdrafts in other segments, the elimination is shown in the

eliminations column. Similarly inter-segment receivables and

payables are eliminated.

UK and

Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ -------- -------- -------- --------- ------------ ---------

Six months ended 30 September

2013

Continuing operations

Revenue - external 57,631 13,316 28,323 14,286 - 113,556

- inter-segment 1,015 290 - - (1,305) -

------------------------------ -------- -------- -------- --------- ------------ ---------

Total segment revenue 58,646 13,606 28,323 14,286 (1,305) 113,556

------------------------------ -------- -------- -------- --------- ------------ ---------

Segment result before

exceptional items 3,223 679 705 1,363 - 5,970

Exceptional items (1,406) - - - - (1,406)

------------------------------ -------- -------- -------- --------- ------------ ---------

Segment result 1,817 679 705 1,363 - 4,564

------------------------------ -------- -------- -------- --------- ------------ ---------

Central administration

costs (636)

Net finance expenses (2,195)

Income tax (470)

------------------------------ -------- -------- -------- --------- ------------ ---------

Profit from continuing

operations

for the six months ended

30 September 2013 1,263

------------------------------ -------- -------- -------- --------- ------------ ---------

Balances at 30 September

2013

Continuing operations

------------------------------ -------- -------- -------- --------- ------------ ---------

Segment assets 134,248 24,703 25,921 13,691 3,020 201,583

------------------------------ -------- -------- -------- --------- ------------ ---------

Segment liabilities (75,054) (21,032) (41,555) (7,248) (1,064) (145,953)

------------------------------ -------- -------- -------- --------- ------------ ---------

Capital expenditure

- property, plant and

equipment 1,470 198 392 87 - 2,147

- intangible 24 9 72 - - 105

Depreciation 1,810 394 333 112 - 2,649

Amortisation 84 27 22 43 - 176

------------------------------ -------- -------- -------- --------- ------------ ---------

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Six months ended 30 September 2012

Continuing operations

Revenue - external 63,527 11,122 27,322 13,236 - 115,207

- inter-segment 968 143 - - (1,111) -

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Total segment revenue 64,495 11,265 27,322 13,236 (1,111) 115,207

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Segment result before exceptional items 3,277 488 1,519 826 - 6,110

Exceptional items - - - (750) - (750)

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Segment result 3,277 488 1,519 76 - 5,360

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Central administration costs (898)

Net finance expenses (1,929)

Income tax (630)

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Profit from continuing operations for the six

months ended 30 September 2012 1,903

Balances at 30 September 2012

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Continuing operations

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Segment assets 137,888 23,891 23,225 12,559 2,765 200,328

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Segment liabilities (80,031) (21,370) (40,100) (6,520) 814 (147,207)

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

Capital expenditure

- property, plant and equipment 405 91 159 684 - 1,339

- intangible 49 8 19 12 - 88

Depreciation 1,079 403 342 90 - 1,914

Amortisation 228 28 18 44 - 318

------------------------------------------------- ----------- -------- -------- --------- ------------ ---------

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Year ended 31 March 2013

Continuing operations

Revenue - external 118,765 28,499 50,104 27,843 - 225,211

- inter-segment 1,433 143 - - (1,576) -

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Total segment revenue 120,198 28,642 50,104 27,843 (1,576) 225,211

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Segment result before exceptional items 3,974 1,151 3,796 2,431 - 11,352

Exceptional items (1,084) - (64) (455) - (1,603)

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Segment result 2,890 1,151 3,732 1,976 - 9,749

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Central administration costs (606)

Net finance expenses (3,466)

Income tax (1,601)

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Profit from continuing operations for the year

ended 31 March 2013 4,076

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Balances at 31 March 2013

Continuing operations

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Segment assets 100,336 17,605 11,170 9,852 3,775 142,738

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Segment liabilities (41,297) (14,025) (27,286) (3,129) (429) (86,166)

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

Capital expenditure

- property, plant and equipment 795 153 230 706 - 1,884

- intangible 159 11 40 32 - 242

Depreciation 2,237 716 644 210 - 3,807

Amortisation 310 57 39 88 - 494

-------------------------------------------------- ----------- -------- -------- --------- ------------ --------

3 Exceptional items

Six months Six months 12 months

ended ended ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP000 GBP000 GBP000

------------------------------------------------ ----------- ----------- ----------

Restructuring of operational activities

Efficiency programmes in the UK (note a) 1,406 - 195

Accelerated amortisation of bank fees (note b) 403 - -

Bad debt provision (note c) - 750 455

China factory disruption (note d) - - 953

------------------------------------------------ ----------- ----------- ----------

Total restructuring costs 1,809 750 1,603

Income tax credit (416) (224) (289)

------------------------------------------------ ----------- ----------- ----------

1,393 526 1,314

------------------------------------------------ ----------- ----------- ----------

(a) Costs associated with major upgrade to manufacturing

facilities in Wales and restructuring of UK operations.

(b) Accelerated amortisation of bank arrangement fees as a

result of renegotiating banking facilities to fund the investment

in Wales.

(c) Bad debt arising from a major customer entering

administration.

(d) Cost associated with disruption caused by a strike in the

China factory.

4 Cash, loans and borrowing

Six months Six months 12 months

ended ended ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP000 GBP000 GBP000

------------------------------------------------------- ----------- ----------- ----------

Secured bank loan (short term) (5,242) (4,685) (4,763)

Secured bank loan (long term) (27,321) (29,340) (29,775)

Asset backed loans (35,925) (30,860) (7,683)

Revolving credit facilities (13,272) (17,839) (658)

Loan arrangement fees 299 671 553

------------------------------------------------------- ----------- ----------- ----------

Total loans (81,461) (82,053) (42,326)

Cash and bank deposits 1,275 3,403 2,301

Bank overdraft (3,019) (5,820) (336)

------------------------------------------------------- ----------- ----------- ----------

Cash and cash equivalents per cash flow statement (1,744) (2,417) 1,965

------------------------------------------------------- ----------- ----------- ----------

Finance leases (1,639) (89) (1,777)

------------------------------------------------------- ----------- ----------- ----------

Net debt used in the Chief Executive Officer's review (84,844) (84,559) (42,138)

------------------------------------------------------- ----------- ----------- ----------

5 Taxation

Six months Six months 12 months

Ended ended ended

30 Sep 30 Sep 31 Mar

2013 2012 2013

GBP000 GBP000 GBP000

------------------------------------------------------------ ----------- ----------- ----------

Current tax expenses

Current income tax charge 467 149 998

Deferred tax expense

Relating to original and reversal of temporary differences 3 481 603

------------------------------------------------------------ ----------- ----------- ----------

Total tax in income statement 470 630 1,601

------------------------------------------------------------ ----------- ----------- ----------

Taxation for the six months ended 30 September 2013 is based on

the effective rate of taxation, which is estimated to apply in each

country for the year ended 31 March 2014.

6 Earnings per share

As at 30 Sep 2013 As at 30 Sep 2012 As at 31 Mar 2013

-------------------- -------------------- --------------------

Diluted Basic Diluted Basic Diluted Basic

---------------------------------------------------- ---------- -------- ---------- -------- ---------- --------

Adjusted earnings per share excluding exceptional

items 3.7p 3.8p 3.7p 3.9p 7.8p 8.1p

Loss per share on exceptional items (2.4p) (2.4p) (0.5p) (0.5p) (2.0p) (2.1p)

---------------------------------------------------- ---------- -------- ---------- -------- ---------- --------

Earnings per share from continuing operations 1.3p 1.4p 3.2p 3.4p 5.8p 6.0p

---------------------------------------------------- ---------- -------- ---------- -------- ---------- --------

Earnings per share 1.3p 1.4p 3.2p 3.4p 5.8p 6.0p

---------------------------------------------------- ---------- -------- ---------- -------- ---------- --------

The basic earnings per share is based on the profit attributable

to equity holders of the Parent Company of GBP792,000 (2012:

GBP1,874,000) and the weighted average number of ordinary shares in

issue of 57,215,000 (2012: 55,799,000) calculated as follows:

As at As at As at

Weighted average number of shares in thousands of shares 30 Sep 2013 30 Sep 2012 31 Mar 2013

---------------------------------------------------------- ------------ ------------ ------------

Issued ordinary shares at 1 April 56,768 55,007 55,007

Shares issued in respect of exercising of share options 447 792 1,238

---------------------------------------------------------- ------------ ------------ ------------

Weighted average number of shares at end of the period 57,215 55,799 56,245

---------------------------------------------------------- ------------ ------------ ------------

Total number of options, over 5p ordinary shares, in issue at 30

September 2013 was 2,128,685.

Adjusted basic earnings per share excludes exceptional items

charged of GBP1,809,000 (2012: GBP375,000) along with the tax

relief attributable to those items of GBP416,000 (2012:

GBP112,000). This gives an adjusted profit of GBP2,185,000 (2012:

GBP2,137,000).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFERFILVIIV

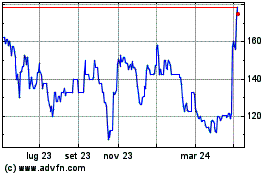

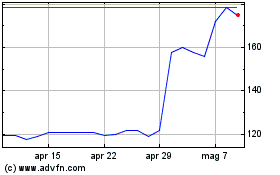

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024