These facilities provide the Group with the operational

flexibility it requires in a highly seasonal business on a cost

effective basis. As noted above, interest margins have been falling

as leverage has improved and the Group has been able to renegotiate

favourable terms on the two largest facilities during the year.

There are financial covenants attached to our facilities and the

Group comfortably complied with these throughout the year. These

covenants include:

* debt service, being the ratio of cash flow available

to finance costs on a rolling twelve-month basis;

* interest cover, being the ratio of earnings before

interest, depreciation and amortisation to interest

on a rolling twelve month basis;

* leverage being the ratio of debt to pre-exceptional

EBITDA on a rolling twelve month basis; and

* appropriate local covenants in the individual

businesses, which have asset backed facilities.

The Group has various interest rate swaps denominated in US

Dollars, Sterling and Euros to improve certainty over interest

charges. The Group adopts hedge accounting for these instruments.

No new interest rate contracts were entered into during the year.

The Group also actively manages FX transaction exposure in each of

its businesses, with advice and support from the central treasury

team.

Note 26 to the financial statements provides further information

in respect of treasury matters.

Post balance sheet event

On 5 June 2014 the Group announced the acquisition of the trade

and certain of the assets of Enper Giftwrap BV, a Dutch company

with sales of EUR5 million, for EUR1.9 million. This transaction is

expected to complete on 30 June 2014. While modest in scale, this

acquisition is an ideal step towards consolidation of the very

competitive European gift wrap marketplace. The Group's Dutch

management team plan to integrate Enper's customer base and

selected fixed assets into its own facilities within three months

of completion. We have allowed for the loss of some less profitable

customers but the synergies that should arise post integration

(2015/16 season) from such an integration into our modern printing

presses, installed in Hoogeveen in 2012, will more than offset this

and the cash payback after all costs of acquisition and integration

should be no more than four years.

This is the Group's first acquisition for some years and it is a

reflection of the our improving balance sheet and trading position

that we are now able to evaluate and execute on such opportunities

- albeit highly selectively. We do not anticipate that this

investment will impact materially on our debt reduction plans.

Conclusion

In conclusion, delivery has been ahead of plan in the year now

completed. Net debt and earnings per share performance was

especially pleasing and outperformance in the arena of cash

management is providing the Group with additional flexibility and

options to create value for shareholders in the future.

Anthony Lawrinson

Director

19 June 2014

Consolidated income statement

year ended 31 March 2014

Year ended Year ended

31 March 2014 31 March 2013

Before Exceptional Before Exceptional

exceptional items exceptional items

items (note 10) Total items (note 10) Total

Notes GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 4 224,462 - 224,462 225,211 - 225,211

Cost of sales (183,238) (2,006) (185,244) (183,941) (953) (184,894)

Gross profit 41,224 (2,006) 39,218 41,270 (953) 40,317

18.4% 17.5% 18.3% 17.9%

Selling expenses (12,108) - (12,108) (12,790) (455) (13,245)

Administration expenses (19,191) - (19,191) (18,789) (195) (18,984)

Other operating income 7 737 147 884 803 - 803

Profit on disposal of property, plant

and equipment - - - 252 - 252

Operating profit/(loss) 5 10,662 (1,859) 8,803 10,746 (1,603) 9,143

Finance expenses 8 (3,177) (439) (3,616) (3,466) - (3,466)

Profit/(loss) before tax 7,485 (2,298) 5,187 7,280 (1,603) 5,677

Income tax (charge)/credit 9 (1,840) 381 (1,459) (1,890) 289 (1,601)

Profit/(loss) for the period 5,645 (1,917) 3,728 5,390 (1,314) 4,076

Attributable to:

Owners of the Parent Company 3,010 3,401

Non-controlling interests 718 675

2014 2013

----- ------- ------ ------- ------

Notes Diluted Basic Diluted Basic

------------------------------------------------------------------------- ----- ------- ------ ------- ------

Adjusted earnings per share excluding exceptional items and LTIP charges 23 8.4p 8.6p 7.8p 7.8p

Loss per share on LTIP charges 23 (0.1p) (0.1p) - -

------------------------------------------------------------------------- ----- ------- ------ ------- ------

Adjusted earnings per share excluding exceptional items 23 8.3p 8.5p 7.8p 8.1p

Loss per share on exceptional items 23 (3.2p) (3.3p) (2.0p) (2.1p)

------------------------------------------------------------------------- ----- ------- ------ ------- ------

Earnings per share 5.1p 5.2p 5.8p 6.0p

------------------------------------------------------------------------- ----- ------- ------ ------- ------

Consolidated statement of comprehensive income

year ended 31 March 2014

2014 2013

GBP000 GBP000

---------------------------------------- ------- ------

Profit for the year 3,728 4,076

Other comprehensive income:

---------------------------------------- ------- ------

Exchange difference on translation

of foreign operations (2,257) 633

Transfer to profit and loss of maturing

cash flow hedges (net of tax) 451 446

Net loss on cash flow hedges (net

of tax) (577) (451)

---------------------------------------- ------- ------

Other comprehensive income for period,

net of tax items

which may be reclassified in to profit

and loss in subsequent periods (2,383) 628

Total comprehensive income for the

period, net of tax 1,345 4,704

Attributable to:

Owners of the Parent Company 1,366 3,796

Non-controlling interests (21) 908

---------------------------------------- ------- ------

1,345 4,704

---------------------------------------- ------- ------

Consolidated statement of changes in equity

year ended 31 March 2014

Share

premium

and capital Non--

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2012 2,750 4,480 17,164 (446) 446 23,410 47,804 4,744 52,548

Profit for the

year - - - - - 3,401 3,401 675 4,076

Other

comprehensive

income - - - (5) 400 - 395 233 628

Total

comprehensive

income for the

year - - - (5) 400 3,401 3,796 908 4,704

Equity-settled

share-based

payment (note

25) - - - - - 22 22 - 22

Options exercised

(note 22) 88 178 - - - - 266 - 266

Equity dividends

paid - - - - - - - (968) (968)

At 31 March 2013 2,838 4,658 17,164 (451) 846 26,833 51,888 4,684 56,572

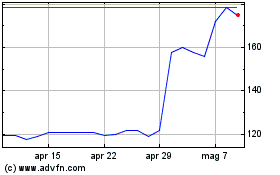

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

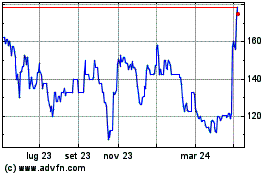

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024