Net movement in credit facilities (2,671) 2,748

Payment of finance lease liabilities (296) (115)

New bank loans raised 5,000 -

New finance leases (a) - 1,764

Loan arrangement fees (180) (444)

Dividends paid to non--controlling interests (1,014) (968)

----------------------------------------------------------------------------- ------ -------- --------

Net cash outflow from financing activities (4,631) (809)

----------------------------------------------------------------------------- ------ -------- --------

Net increase in cash and cash equivalents 3,149 797

Cash and cash equivalents at beginning of period 1,965 1,223

Effect of exchange rate fluctuations on cash held 468 (55)

----------------------------------------------------------------------------- ------ -------- --------

Cash and cash equivalents at 31 March 16 5,582 1,965

----------------------------------------------------------------------------- ------ -------- --------

(a) In the current year GBP3,239,000 of new finance leases have

been shown netted off against acquisitions of property, plant and

equipment. In the prior year, new finance leases represent proceeds

received in respect of GBP1,764,000 assets purchased in 2011/12

shown in acquisition of property, plant and equipment in that

year.

Notes to the financial statements

year ended 31 March 2014

1 Accounting policies

International Greetings plc is a public limited company,

incorporated and domiciled in England and Wales. The Company's

ordinary shares are listed on AIM.

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group"). The

Company financial statements present information about the Company

as a separate entity and not about its Group.

The Group financial statements have been prepared and approved

by the Directors in accordance with EU adopted International

Financial Reporting Standards. The Company has elected to prepare

its Company financial statements in accordance with UK GAAP;

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

Group financial statements.

Judgements made by the Directors in the application of these

accounting policies that have significant effect on the financial

statements and estimates with a significant risk of material

adjustment in the next year are discussed in the policies

below.

Going concern basis

The financial statements have been prepared on the going concern

basis.

The borrowing requirement of the Group increases steadily over

the period from July and peaks in October, due to the seasonality

of the business, as the sales of wrap and crackers are mainly for

the Christmas market, before then reducing.

As with any company placing reliance on external entities for

financial support, the Directors acknowledge that there can be no

certainty that this support will continue although, at the date of

approval of this report, they have no reason to believe that it

will not do so.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

in preparing the financial statements.

Measurement convention

The financial statements are prepared on the historical cost

basis except that financial instruments used for hedging are stated

at their fair value.

Changes in accounting policies

The accounting policies adopted in the preparation of the

financial statements are consistent with those followed in the

preparation of the Group's annual financial statements for the year

ended 31 March 2014, except for the adoption of new standards and

interpretations as of 1 April 2014.

Basis of consolidation

Subsidiaries are entities controlled by the Group. Control

exists when the Group has the power, directly or indirectly, to

govern the financial and operating policies of an entity so as to

obtain benefits from its activities. In assessing control,

potential voting rights that are currently exercisable or

convertible are taken into account. The financial statements of

subsidiaries are included in the consolidated financial statements

from the date that control commences until the date that control

ceases.

Foreign currency translation

The consolidated financial statements are presented in pounds

Sterling, which is the Company's functional currency and the

Group's presentational currency.

Transactions in foreign currencies are translated at the foreign

exchange rate ruling at the date of the transaction. Monetary

assets and liabilities denominated in foreign currencies at the

balance sheet date are translated at the foreign exchange rate

ruling at that date. Foreign exchange differences arising on

translation are recognised in the income statement.

The assets and liabilities of foreign operations, including

goodwill and fair value adjustments arising on consolidation, are

translated at foreign exchange rates ruling at the balance sheet

date. The revenues and expenses of foreign operations are

translated at an average rate for the period where this rate

approximates to the foreign exchange rates ruling at the dates of

the transactions. Exchange differences arising from this

translation of foreign operations, and of related qualifying

hedges, are taken directly to the translation reserve. They are

released into the income statement upon disposal.

Exchange differences arising from a monetary item receivable

from or payable to a foreign operation, the settlement of which is

neither planned nor likely in the foreseeable future, are

considered to form part of a net investment in a foreign operation

and are recognised in other comprehensive income in the translation

reserve. The cumulative translation differences previously

recognised in other comprehensive income (or where the foreign

operation is part of a subsidiary, the parent's interest in the

cumulative translation differences) are released into the income

statement upon disposal of the foreign operation or on loss of

control of the subsidiary that includes the foreign operation.

Classification of financial instruments issued by the Group

Financial instruments issued by the Group are treated as equity

(i.e. forming part of shareholders' funds) only to the extent that

they meet the following two conditions:

(a) they include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

(b) where the instrument will or may be settled in the Company's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Company's own

equity instruments or is a derivative that will be settled by the

Company's exchanging a fixed amount of cash or other financial

assets for a fixed number of its own equity instruments.

To the extent that this definition is not met, the proceeds of

issue are classified as a financial liability. Where the instrument

so classified takes the legal form of the Company's own shares, the

amounts presented in these financial statements for called up share

capital and share premium exclude amounts in relation to those

shares.

Trade and other receivables

Where it is likely to be materially different from the nominal

value, trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition they are measured at

amortised cost using the effective interest method, less any

impairment losses.

Trade and other payables

Where it is likely to be materially different from the nominal

value, trade and other payables are recognised initially at fair

value. Subsequent to initial recognition they are measured at

amortised cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits. Bank overdrafts that are repayable on demand and form an

integral part of the Group's cash management are included as a

component of cash and cash equivalents for the purposes of the cash

flow statement.

Interest-bearing borrowings

Interest-bearing borrowings are recognised initially at fair

value less attributable transaction costs. Subsequent to initial

recognition, interest-bearing borrowings are stated at amortised

cost using the effective interest method.

Derivative financial instruments and hedging

Derivative financial instruments

Derivative financial instruments are recognised at fair value.

The gain or loss on re-measurement to fair value is recognised

immediately in the income statement. However, where derivatives

qualify for hedge accounting, recognition of any resultant gain or

loss depends on the nature of the item being hedged.

Cash flow hedges

Where a derivative financial instrument is designated as a hedge

of the variability in cash flows of a recognised asset or

liability, or a highly probable forecast transaction, the effective

part of any gain or loss on the derivative financial instrument is

recognised as other comprehensive income in the hedging reserve.

Any ineffective portion of the hedge is recognised immediately in

the income statement.

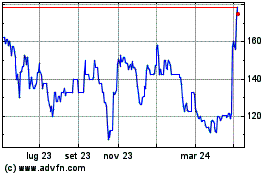

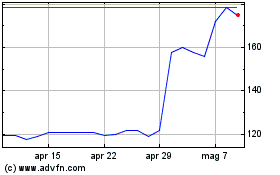

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024