All of the cash-generating units' values in use were determined

to be higher than fair value less costs to sell, thus this was used

as the recoverable amount. In all businesses the carrying value of

the goodwill was supported by the recoverable amount and there are

currently no reasonably foreseeable changes to assumptions that

would give rise to an impairment of the carrying value.

The Directors do not believe a reasonably possible change to the

assumptions would give rise to an impairment.

The Directors have considered a 3% movement in the discount rate

and a flat budget growth rate assumption in their assessment.

13 Deferred tax assets and liabilities

Recognised deferred tax assets and liabilities

Deferred tax assets and liabilities are attributable to the

following:

Assets Liabilities Net

-------------- ---------------- --------------

2014 2013 2014 2013 2014 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ------ ------ ------- ------- ------ ------

Property, plant and equipment 1,317 1,204 (1,304) (884) 13 320

Capital gains deferred - - (294) (472) (294) (472)

Tax loss carried forward 2,488 3,278 - (1) 2,488 3,277

Other temporary differences 1,458 1,125 - - 1,458 1,125

------------------------------ ------ ------ ------- ------- ------ ------

Net tax assets/(liabilities) 5,263 5,607 (1,598) (1,357) 3,665 4,250

------------------------------ ------ ------ ------- ------- ------ ------

The deferred tax asset in respect of tax losses carried forward

at 31 March 2014 of GBP2,219,000 (2013: GBP2,819,000) is comprised

of UK tax losses of GBP530,000 (2013: GBP29,000) and US losses of

GBP1,689,000 (2013: GBP2,790,000). US tax losses carried forward

will become irrecoverable in March 2027. UK tax losses may be

carried forward indefinitely. The deferred tax assets have been

recognised where the Board considers there is sufficient evidence

that taxable profits will be available against which the tax losses

can be utilised. The Board expects that the tax losses will be

recoverable against future profits but given the level of tax

losses brought forward, recoverability has been assessed on the

basis of expected profits currently forecast. Deferred tax assets

in respect of taxable losses that are expected to be recovered

outside this forecast period have not been recognised. This

includes unrecognised deferred tax assets in respect of brought

forward UK losses of GBP310,000 (2013: GBP858,000) and GBP2,194,000

(2013: GBP2,153,000) in respect of brought forward US tax

losses.

No deferred tax is recognised on unremitted earnings of overseas

subsidiaries. Overseas reserves can now be repatriated to the UK

with no tax cost. If all overseas earnings were repatriated with

immediate effect, no tax charge (2013: GBPnil) would be

payable.

The Finance Act 2013, which provides for reductions in the main

rate of corporation tax from 23% to 21% effective from 1 April 2014

and to 20% effective from 1 April 2015, was substantively enacted

on 2 July 2013. These rate reductions have been reflected in the

calculation of deferred tax at the balance sheet date.

There are no deferred tax balances with respect to cash flow

hedges.

Movement in deferred tax during the year

1 April Recognised Recognised 31 March

2013 in income in equity 2014

GBP000 GBP000 GBP000 GBP000

Property, plant and equipment 320 (635) 328 13

Capital gains deferred (472) 322 (144) (294)

Tax loss carried forward 3,277 (504) (285) 2,488

Other temporary differences 1,125 579 (246) 1,458

Net tax assets 4,250 (238) (347) 3,665

Movement in deferred tax during the prior year

1 April Recognised Recognised 31 March

2012 in income in equity 2013

GBP000 GBP000 GBP000 GBP000

Property, plant and equipment (1,466) 1,778 8 320

Capital gains deferred (494) 22 - (472)

Tax loss carried forward 3,817 (671) 131 3,277

Other temporary differences 2,783 (1,732) 74 1,125

Net tax assets 4,640 (603) 213 4,250

14 Inventory

2014 2013

GBP000 GBP000

------------------------------ ------ ------

Raw materials and consumables 4,531 5,488

Work in progress 9,435 9,100

Finished goods 34,494 35,526

------------------------------ ------ ------

48,460 50,114

------------------------------ ------ ------

Of the GBP48,460,000 (2013: GBP50,114,000) stock value

GBP43,870,000 (2013: GBP44,074,000) is held at cost and

GBP4,590,000 (2013: GBP6,040,000) is held at net realisable value.

The write down of inventories to net realisable value amounted to

GBP2,963,000 (2013: GBP2,931,000). The reversal of previous write

downs amounted to GBP226,000 (2013: GBP1,116,000). The reversal is

due to the inventory being either used or sold.

Materials, consumables, changes in finished goods and work in

progress recognised as a cost of sale amounted to GBP158,590,000

(2013: GBP159,525,000).

Part of the Group's funding is via asset backed loans from our

bankers. These loans are secured on part of the inventory and trade

receivables of the UK, European and American businesses. The amount

of the inventory that is used to secure an asset backed loan is

GBP42,298,000 (2013: GBP31,544,000). In addition bank loans to

Hoomark and International Greetings USA are secured on a freehold

property and contents, including inventory, therein.

Refer to note 17 for outstanding balance on asset backed loans

and details of the secured bank loans.

15 Trade and other receivables

2014 2013

GBP000 GBP000

------------------------------- ------ ------

Trade receivables 16,078 18,799

Prepayments and accrued income 1,770 1,486

Other receivables 1,699 2,012

VAT receivable 143 988

------------------------------- ------ ------

19,690 23,285

------------------------------- ------ ------

Part of the Group's funding is via asset backed loans from our

bankers. These loans are secured on part of the inventory and trade

receivables of the UK, European and American businesses. The amount

of the trade receivables that is used to secure the asset backed

loans is GBP12,469,000 (2013: GBP9,684,000).

Refer to note 17 for outstanding balance on asset backed

loans.

There are no trade receivables in the current year (2013:

GBPnil) expected to be recovered in more than twelve months.

The Group's exposure to credit and currency risks and impairment

losses related to trade and other receivables is disclosed in note

26.

16 Cash and cash equivalents/bank overdrafts

2014 2013

Note GBP000 GBP000

------------------------------- ------ -------- -------

Cash and cash equivalents 8,111 2,301

Bank overdrafts (2,529) (336)

--------------------------------------- -------- -------

Cash and cash equivalents per

cash flow statement 5,582 1,965

--------------------------------------- -------- -------

Net debt

2014 2013

GBP000 GBP000

----------------------------------------- --------- --------

Cash and cash equivalents 8,111 2,301

Bank loans and overdrafts 17 (40,622) (43,215)

Loan arrangement fees 253 553

Finance leases (4,689) (1,777)

----------------------------------------- --------- --------

Net debt as used in the financial review (36,947) (42,138)

----------------------------------------- --------- --------

The Group's exposure to interest rate risk and sensitivity

analysis for financial assets and liabilities are disclosed in note

26.

The bank overdrafts are secured by a fixed charge on certain of

the Group's land and buildings, a fixed charge on certain of the

Group's book debts and a floating charge on certain of the Group's

other assets.

17 Loans and borrowings

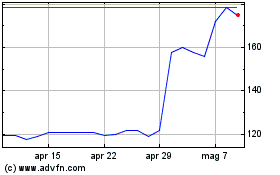

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

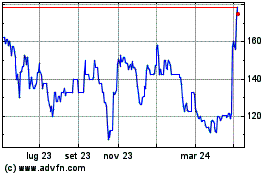

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024