The total expenses recognised for the period arising from

equity-settled share-based payments are as follows:

2014 2013

GBP000 GBP000

-------------------- ------ ------

LTIP 82 -

Share option scheme - 22

-------------------- ------ ------

82 22

-------------------- ------ ------

26 Financial instruments

a) Fair values of financial instruments

The carrying values for each class of financial assets and

financial liabilities in the balance sheet, which are given below,

are not considered to be materially different to their fair

values.

As at 31 March 2014, the Group had derivative contracts, which

were measured at Level 2 fair value subsequent to initial

recognition, to the value of a liability of GBP692,000 (2013:

liability of GBP505,000).

Trade and other receivables

The fair value of trade and other receivables is estimated as

the present value of future cash flows, discounted at the market

rate of interest at the balance sheet date if the effect is

material. Doubtful receivable provisions are established based upon

the difference between the receivable value and the estimated net

collectible amount.

Trade and other payables

The fair value of trade and other payables is estimated as the

present value of future cash flows, discounted at the market rate

of interest at the balance sheet date if the effect is

material.

Cash and cash equivalents

The fair value of cash and cash equivalents is estimated as its

carrying amount where the cash is repayable on demand. Where it is

not repayable on demand then the fair value is estimated at the

present value of future cash flows, discounted at the market rate

of interest at the balance sheet date.

Interest-bearing borrowings

Fair value, which after initial recognition is determined for

disclosure purposes only, is calculated based on the present value

of future principal and interest cash flows, discounted at the

market rate of interest at the balance sheet date. For finance

leases the market rate of interest is determined by reference to

similar lease agreements.

Derivative financial instruments

The fair value of forward exchange contracts is based on their

market price.

Fair value hierarchy

Financial instruments which are recognised at fair value

subsequent to initial recognition are grouped into Levels 1 to 3

based on the degree to which the fair value is observable. The

three levels are defined as follows:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities;

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly; and

Level 3: techniques which use inputs which have a significant

effect on the recorded fair value that are not based on observable

market data.

2014 2013

---------------- -----------------

Carrying Fair Carrying Fair

amount value amount value

Notes GBP000 GBP000 GBP000 GBP000

------------------------------------------------------------ ----- -------- ------ -------- -------

Cash and cash equivalents 16 8,111 8,111 2,301 2,301

Trade receivables 15 16,078 16,078 18,799 18,799

Other receivables 15 1,699 1,699 2,012 2,012

------------------------------------------------------------ ----- -------- ------ -------- -------

Total financial assets 25,888 25,888 23,112 23,112

------------------------------------------------------------ ----- -------- ------ -------- -------

Bank loans and overdrafts 16 40,622 40,622 43,215 43,215

Finance lease liability 20 4,689 4,689 1,777 1,777

Other financial liabilities 20 9,325 9,325 8,475 8,475

Trade payables 21 25,031 25,031 28,291 28,291

Other payables 21 787 787 704 704

------------------------------------------------------------ ----- -------- ------ -------- -------

Total financial liabilities measured at amortised cost 80,454 80,454 82,462 82,462

------------------------------------------------------------ ----- -------- ------ -------- -------

Financial liabilities at fair value through profit or loss 20 115 115 54 54

Financial liabilities at fair value through hedging reserve 20 577 577 451 451

------------------------------------------------------------ ----- -------- ------ -------- -------

Total financial liabilities at fair value 692 692 505 505

------------------------------------------------------------ ----- -------- ------ -------- -------

Total financial liabilities 81,146 81,146 82,967 82,967

------------------------------------------------------------ ----- -------- ------ -------- -------

Net financial liabilities 55,258 55,258 59,855 59,855

------------------------------------------------------------ ----- -------- ------ -------- -------

b) Credit risk

Financial risk management

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations and arises principally from the Group's

receivables from customers and investment securities.

The Group's exposure to credit risk is managed by dealing only

with banks and financial institutions with strong credit ratings.

The Group's financial credit risk is primarily attributable to its

trade receivables.

The Group has no significant concentration of credit risk

exposure as revenues are split across a large number of customers

in different geographical areas. The main customers of the Group

are large and mid-sized retailers, other manufacturers and

wholesalers of greetings products, service merchandisers and

trading companies. The Group has established procedures to minimise

the risk of default of trade receivables including detailed credit

checks undertaken before new customers are accepted and rigorous

credit control procedures after sale. These processes have proved

effective in minimising the level of impairments required.

The amounts presented in the balance sheet are net of allowances

for doubtful receivables estimated by the Group's management, based

on prior experience and their assessment of the current economic

environment.

Exposure to credit risk

The carrying amount of financial assets represents the maximum

credit exposure. Therefore, the maximum exposure to credit risk at

the balance sheet date was GBP25,888,000 (2013: GBP23,122,000)

being the total of the carrying amount of financial assets,

excluding equity investments, shown in the table above.

The maximum exposure to credit risk for trade receivables at the

balance sheet date by geographic region was:

2014 2013

GBP000 GBP000

------------ ------ ------

UK and Asia 6,850 7,357

USA 4,237 4,796

Europe 2,306 2,709

Australia 2,685 3,937

------------ ------ ------

16,078 18,799

------------ ------ ------

Credit quality of financial assets and impairment losses

The ageing of trade receivables at the balance sheet date

was:

2014 2013

------------------ ------------------

Gross Impairment Gross Impairment

GBP000 GBP000 GBP000 GBP000

------------------- ------ ---------- ------ ----------

Not past due 11,408 (5) 12,616 (43)

Past due 0-90 days 4,025 (46) 5,790 (94)

More than 90 days 926 (230) 857 (327)

------------------- ------ ---------- ------ ----------

16,359 (281) 19,263 (464)

------------------- ------ ---------- ------ ----------

There were no unimpaired balances outstanding at 31 March 2014

(2013: GBPnil) where the Group had renegotiated the terms of the

trade receivable.

The movement in the allowance for impairment in respect of trade

receivables during the year was as follows:

2014 2013

GBP000 GBP000

------------------------------- ------ ------

Balance at 1 April 464 565

Charge for the year 310 964

Unused amounts reversed (211) (262)

Amounts written off (270) (813)

Effects of movement in foreign

exchange (12) 10

------------------------------- ------ ------

Balance at 31 March 281 464

------------------------------- ------ ------

The allowance account for trade receivables is used to record

impairment losses unless the Group is satisfied that no recovery of

the amount owing is possible; at that point the amounts considered

irrecoverable are written off against the trade receivables

directly.

c) Liquidity risk

Financial risk management

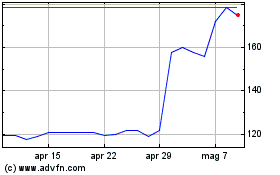

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

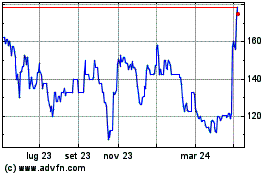

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024