TIDMIPX

Impax Asset Management Group plc

09 January 2024

Impax Asset Management Group plc

("Impax" or the "Company")

Impax to acquire fixed income assets and expand portfolio

management team in agreement with Copenhagen-based Formuepleje

London, 9 January 2024 - Impax Asset Management Group plc,

("Impax"), the specialist asset manager investing in the transition

to a more sustainable economy, announced today that its wholly

owned subsidiary Impax Asset Management Ireland Limited ("Impax

Ireland") has entered into an agreement to acquire the assets of

Absalon Corporate Credit ("Absalon"), a fixed income manager, the

completion of which is subject to certain closing conditions.

Absalon, which is part of the Formuepleje Group, based in

Copenhagen, Denmark, serves European institutional investors and

Danish high net worth individuals. As of 31 December 2023, Absalon

had approximately GBP351 million (EUR405 million) of assets under

management.

The Absalon team manages two fixed income strategies in Global

High Yield (launched in 2006) and Emerging Market Corporate Debt

(launched in 2010), which are available as Luxembourg-based SICAV

funds ("SICAV Funds") and as Danish-based funds ("Danish Funds").

The team was established by Klaus Blaabjerg, who, along with three

portfolio management colleagues, is joining Impax as part of the

acquisition. Each member of the team has more than 15 years of

experience and the team has worked together for more than 10

years.

Impax Ireland has entered into an asset purchase agreement with

the Formuepleje Group, an existing client and distribution partner

of Impax, with respect to the acquisition. The consideration is not

disclosed.

Following completion of the acquisition, the Absalon portfolio

managers will become part of Impax's growing fixed income team,

reporting to Ross Pamphilon, who in October 2023 was appointed as

Impax's Head of Fixed Income. The existing Impax fixed income team,

which is based in the United States, currently runs US Investment

Grade and US High Yield fixed income funds that are distributed to

investors in North America. Post the acquisition, the combined

global team will have pro forma fixed income assets under

management and advice of approximately GBP1.6 billion (EUR1.8

billion) as of 31 December 2023.

Upon completion of the acquisition, it is planned that Impax

Ireland, acting through a newly established Danish branch, will

become the management company, investment manager and distributor

of the former Absalon SICAV Funds, which are intended to become

part of Impax's Ireland-based UCITS range. This is subject to SICAV

Funds Board, shareholder and regulatory approval. Upon completion

of the acquisition, and subject to fund shareholder and regulatory

approval, it is also planned that Impax Ireland, acting through a

newly established Danish branch, will become the sub-investment

manager of the Danish Funds, for which Formuepleje will continue to

act as the management company and distributor.

Ian Simm, Founder and Chief Executive, Impax, said: "This is an

important step in the continued enhancement of our fixed income

offering, which we have identified as a strategic priority as we

aim to provide a wider range of solutions to our clients who are

seeking to allocate to the transition to a more sustainable

economy. The addition of this highly experienced team of credit

managers, with a successful track record, will complement our

existing fixed income capabilities, particularly in high yield. We

value highly our 15-year relationship with Formuepleje, and we are

delighted to use this opportunity to expand the partnership."

Klaus Blaabjerg, Managing Director, Absalon Corporate Credit,

said: "We are excited by the opportunity to join the Impax team and

leverage the firm's extensive resources dedicated to investing in

the transition to a more sustainable economy. This is particularly

important given that our funds are now categorized as Article 8

under SFDR. We believe that the credit markets are inefficient,

which leaves many attractive opportunities for disciplined

investors. We will continue to exploit these inefficiencies by

actively selecting undervalued credits with high spreads relative

to credit quality and default risk. We look forward to building on

our successful track record and continuing to maintain our

successful relationship with the Formuepleje team."

Peter Kjærgaard, CEO at Formuepleje, commented: "We are pleased

to continue our close relationship with the Absalon Corporate

Credit team through this agreement with Impax. Absalon Corporate

Credit has a distinctive investment philosophy which is rooted in

its academic research and the unique and experienced investment

team. We look forward to continuing to provide their two strategies

to our clients and as an integrated part of our funds."

Enquiries:

Impax Asset Management Group

plc

Ian Simm, Chief Executive +44 (0)20 3912 3000

Paul French, Head of Communications +44 (0)20 3912 3032

Montfort Communications

Gay Collins

Jack Roddan +44 (0)77 9862 6282

impax@montfort.london +44 (0)78 2567 0695

Peel Hunt LLP, Nominated Adviser

and Joint Broker

John Welch

Dan Webster

+44 (0)20 7418 8900

Berenberg, Joint Broker

James Felix

Dan Gee-Summons +44 (0)20 3207 7800

About Absalon Corporate Credit

Absalon Corporate Credit is an investment management firm

focused on credit, serving European institutional investors and

Danish high net worth individuals. Based in Copenhagen, Denmark, it

has approximately EUR405 million of assets under management and

advice (as of 31 December 2023) and is part of the Formuepleje

Group. Absalon Corporate Credit has an active bottom-up bond

selection philosophy. Looking beyond index weightings it instead

focuses on identifying undervalued bonds irrespective of their

sector or geography. The team manages two funds: Absalon Global

High Yield and Absalon Emerging Markets Corporate Debt.

About Formuepleje

Formuepleje is one of Denmark's largest independent asset

managers with more than 35 years of experience in developing

optimal investment solutions. Our investment concept focuses on

risk-adjusted returns. This means that we invest with the purpose

to achieve the highest possible return with as little a risk as

possible. The total amount of assets under management is more than

EUR9.1 billion and the customer base is around 18,000. Formuepleje

employs more than 100 people in offices in Aarhus and

Copenhagen.

About Impax

Founded in 1998, Impax is a specialist asset manager, with

approximately GBP39.1 billion as of 31 December 2023 in both listed

and private markets strategies, investing in the opportunities

arising from the transition to a more sustainable global

economy.

Impax believes that capital markets will be shaped profoundly by

global sustainability challenges, including climate change,

pollution and essential investments in human capital,

infrastructure and resource efficiency. These trends will drive

growth for well-positioned companies and create risks for those

unable or unwilling to adapt.

The company seeks to invest in higher quality companies with

strong business models that demonstrate sound management of risk.

Impax offers a well-rounded suite of investment solutions spanning

multiple asset classes seeking superior risk-adjusted returns over

the medium to long term.

Impax has approximately 300 employees(1) across its offices in

the United Kingdom, the United States, Ireland, Hong Kong and Japan

making it one of the investment management sector's largest

investment teams dedicated to sustainable development.

www.impaxam.com

(1) Full-time equivalent

Issued in the UK by Impax Asset Management Group plc, whose

shares are quoted on the Alternative Investment Market of the

London Stock Exchange. Impax Asset Management Group plc is

registered in England & Wales, number 03262305. AUM relates to

Impax Asset Management Limited, Impax Asset Management (AIFM)

Limited, Impax Asset Management Ireland Limited and Impax Asset

Management LLC. Impax Asset Management Limited and Impax Asset

Management (AIFM) Limited are authorised and regulated by the

Financial Conduct Authority and are wholly owned subsidiaries of

Impax Asset Management Group plc. Please note that the information

provided on www.impaxam.com and links from it should not be relied

upon for investment purposes.

Impax is trademark of Impax Asset Management Group Plc. Impax is

a registered trademark in the EU, US, Hong Kong and Australia. (c)

Impax Asset Management LLC, Impax Asset Management Limited and/or

Impax Asset Management (Ireland) Limited. All rights reserved.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAUWOBRSRUARAR

(END) Dow Jones Newswires

January 09, 2024 02:35 ET (07:35 GMT)

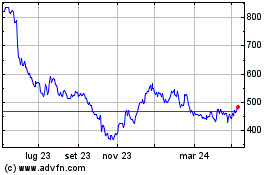

Grafico Azioni Impax Asset Management (LSE:IPX)

Storico

Da Gen 2025 a Feb 2025

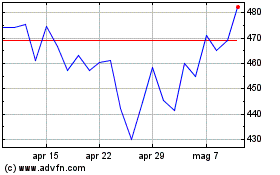

Grafico Azioni Impax Asset Management (LSE:IPX)

Storico

Da Feb 2024 a Feb 2025