TIDMKYGA

RNS Number : 3198R

Kerry Group PLC

26 October 2023

Date: 26 October 2023

LEI: 635400TLVVBNXLFHWC59

KERRY GROUP

Q3 INTERIM MANAGEMENT STATEMENT 2023

Continued volume growth with good margin improvement

OVERVIEW

* Taste & Nutrition Q3 volume growth of 1.6% and Group

Q3 volumes +0.1%

* Overall YTD pricing of 1.3%, with third quarter

pricing reflecting deflationary environment

* Group margin expansion of +100 bps in Q3, driven by

Taste & Nutrition +130bps

* Dairy Ireland YTD volumes -6.2% with margins also

impacted by challenging market conditions

* Full year earnings guidance expected to be at low end

of previously stated 1% to 5% constant currency range

* Share buyback programme of EUR300m to commence at the

beginning of November

Edmond Scanlon, Chief Executive Officer

"We delivered a good overall performance in the period recognising

varying conditions across our markets. North America saw good improvement

through the third quarter, Europe performed in line with expectations

while APMEA continued to deliver strong growth. Our unique positioning

in foodservice supported our continued strong growth in the channel.

We made good strategic progress through the period with further

footprint expansion and strategic acquisitions, and given the Group's

strong balance sheet and cash flow, we are also initiating a share

buyback programme.

Taste and Nutrition remains strongly positioned for volume growth

and margin expansion while recognising current market conditions,

however Dairy Ireland performance continues to be impacted by challenging

industry dynamics. Given this context, we expect our constant currency

earnings growth to be at the low end of our guidance range".

Markets and Performance

Given the prevailing industry dynamics through the period, the

overall demand environment remained quite resilient. Customer

innovation activity primarily focused on new taste profiles,

continued improvements to products' nutritional characteristics,

products targeting health need states, and providing more relative

value options for consumers.

Group reported revenue in the first nine months of the year

decreased by 4.2%, reflecting business volume growth of 0.4%,

pricing of 1.3% and a contribution from acquisitions of 1.1%, more

than offset by the effect of disposals of 5.1% and adverse

translation currency of 1.9%. Group EBITDA margin increased by

10bps as benefits from cost efficiency initiatives and portfolio

developments were partially offset by the mathematical impact of

passing through overall input cost inflation.

Business Reviews

Taste & Nutrition

Growth driven by continued strong foodservice performance

> Overall volume growth of 1.5% with Q3 growth of 1.6%

> Meat, Snacks and Dairy markets achieved good growth

> Pricing of 3.0% with third quarter pricing of -1.4% reflective of some input cost deflation

> EBITDA margin +20bps (Q3 +130bps) primarily reflected

benefits from cost efficiencies and portfolio developments,

partially offset by the mathematical impact of passing through

overall input cost inflation

Overall volumes in the division remained solid considering

customer and industry dynamics. Foodservice achieved high-single

digit volume growth driven by ongoing innovation with QSRs and

coffee chains on menu enhancement, seasonal products, and

back-of-house efficiency solutions. Volumes in the retail channel

were impacted by customer inventory management in North

America.

Within the division, the Food EUM achieved good volume growth

led by Meat, Snacks and Dairy. This was supported by strong

performances in savoury and culinary taste solutions, as well as

Tastesense(R) salt and sugar-reduction technologies.

Business volumes in emerging markets increased by 5.1% driven by

strong growth in the Middle East.

Within the global Pharma EUM, performance was led by good volume

growth in cell nutrition and excipients.

Americas Region

> Overall volumes -1.7% (Q3 -0.9%) with improvement in North America in Q3

> Retail channel saw softer market conditions while foodservice performed well

> Good growth in Snacks and Dairy markets

> LATAM achieved overall growth despite softer Q3 market conditions

Performance in the region reflected strong comparatives and

customer inventory reductions particularly across the Beverage,

Bakery and Meat markets in the retail channel. Innovation and new

launch activity remained strong in many categories despite these

dynamics. Foodservice delivered good growth through new taste

innovations across menus and back-of-house efficiency solutions,

particularly with QSRs and coffee chains.

Overall performance in North America improved through the

period, with volumes in the third quarter similar to the prior

year. Snacks delivered good growth driven by authentic taste-led

innovations across global leaders, emerging brands and private

label, while Dairy performed well through taste system innovations.

Within the Meat market, we continued to see good launch activity

with culinary taste and texture solutions against a backdrop of

challenging industry conditions.

LATAM achieved overall growth in the period despite softer

market conditions in the third quarter. This growth was driven by

Mexico with good performances in the Snacks and Meat markets.

Europe Region

> Overall volumes +3.7%, with Q3 growth of 2.0% in line with expectations

> Volume growth led by Meat, Snacks and Meals markets

> Growth driven by strong performances in UK and Ireland

The region achieved continued excellent growth in the

foodservice channel driven by seasonal products, new menu

innovations and ongoing nutritional profile improvements. The

retail channel delivered a solid performance in the region

considering the significant consumer inflationary environment.

Growth in Meat was driven by culinary taste and texture system

launches combined with continued nutritional enhancement

innovations. Snacks delivered strong growth through savoury taste

and Tastesense(R) salt reduction technologies, while Meals also

achieved strong growth through nutritional enhancements and

authentic taste solutions for stocks and broths.

APMEA Region

> Overall volume growth of 7.5% with continued strong Q3 growth of 8.2%

> Volume growth led by Meat, Meals and Dairy markets

> Growth was strong in the Middle East and South Asia Pacific

Growth in the region remained strong through the period,

particularly in the foodservice channel and within the Food EUM in

the retail channel. Excellent growth was achieved in Meat through

local authentic taste and texture solutions, while Meals and Dairy

had good growth in taste systems and Tastesense(R) salt reduction

technologies.

Within the region, strong growth was achieved in the Middle East

and South Asia Pacific, with good overall performance in China

considering market conditions through the period. In the third

quarter, the Group completed the acquisition of Greatang(1), which

broadens and deepens Kerry's capability and portfolio of local

taste solutions in the Chinese market.

(1) Acquired 100% of the share capital of Shanghai Greatang

Orchard Food Co., Ltd.

Dairy Ireland

Performance Impacted by Significant Reduction in Dairy

Prices

> Volumes -6.2% (Q3: -12.1%) as challenging industry dynamics persisted

> Pricing -6.5% (Q3: -17.6%) relating to increased

deflationary market dynamics across the period

> EBITDA Margin -110bps driven by the significant impact from changes in dairy market prices

Volumes in Dairy Ireland were lower through the period, as input

cost dynamics continued to impact overall market demand. Within

Dairy Ingredients, volumes principally reflected softer market

supply dynamics with prices continuing to reduce through the

period. Overall growth in Dairy Consumer Products was led by

Kerry's branded cheese ranges and private-label spreads.

Financial Review

At the end of September, the Group's net debt was EUR1.8

billion. The Group's consolidated balance sheet remains strong,

which will support the continued strategic development of the

business.

Share Buyback Programme

Today Kerry has announced it will commence a share buyback

programme of up to EUR300 million of Kerry Group plc ordinary

shares. The buyback is underpinned by the Group's strong balance

sheet and cash flow, and aligned to Kerry's Capital Allocation

Framework. Kerry will commence the share buyback programme at the

beginning of November 2023, and an announcement will be made

immediately prior to its formal launch.

Board Changes

The Board has agreed to appoint Dr. Genevieve Berger and

Professor Catherine Godson as non-executive directors of the

Company with effect from 1 November 2023.

Dr. Berger is a global science leader and during her executive

career held roles as the Chief Science Officer at Firmenich

International SA as well as the Chief Research & Development

Officer and Chief Science Officer at Unilever plc. Dr. Berger is

currently a non-executive director of Dassault Systèmes SE and

previously served on the boards of Air Liquide SA, Astra Zeneca plc

and Smith & Nephew plc.

Professor Godson is the Associate Dean, Research and Innovation

at University College Dublin ("UCD") School of Medicine. She has an

international reputation in scientific research gained during a

long and successful academic career in the US, Switzerland and at

UCD. Professor Godson has a broad knowledge across human health and

is a global expert on diabetes as well as cardiovascular and kidney

diseases. She currently serves on the Irish Research Council and as

a Trustee of Barts Charity, London.

Future Prospects

While market conditions remain uncertain, Kerry remains well

positioned with a good innovation pipeline.

The Group will continue to manage through the current input cost

environment in collaboration with customers. Kerry will continue to

develop the business through capital investment and acquisitions

aligned to its strategic priorities. Taste and Nutrition is

strongly positioned for volume growth and margin expansion; however

Dairy Ireland performance continues to be impacted by challenging

market conditions. Given this context, the Group expects constant

currency adjusted earnings growth to be at the low end of the

previously stated 1% to 5% guidance range.

Note: Constant currency earnings guidance includes a net

dilution of approximately 2% from portfolio developments. Foreign

exchange translation is expected to be a headwind of approximately

3% on earnings in the full year based on prevailing rates.

Disclaimer: Forward Looking Statements

This Announcement contains forward looking statements which

reflect management expectations based on currently available data.

However actual results may differ materially from those expressed

or implied by these forward looking statements. These forward

looking statements speak only as of the date they were made, and

the Company undertakes no obligation to publicly update any forward

looking statement, whether as a result of new information, future

events or otherwise.

CONTACT INFORMATION

=============================================

Investor Relations

Marguerite Larkin , Chief Financial

Officer

+353 66 7182000 | investorrelations@kerry.ie

William Lynch , Head of Investor

Relations

+353 66 7182000 | investorrelations@kerry.ie

Media

Catherine Keogh , Chief Corporate

Affairs & Brand Officer

+353 45 930188 | corpaffairs@kerry.com

Website

www.kerry.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRNKPBNOBDDPKB

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

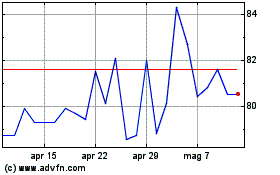

Grafico Azioni Kerry (LSE:KYGA)

Storico

Da Apr 2024 a Mag 2024

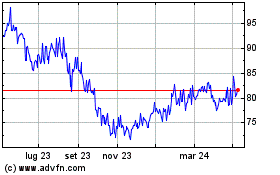

Grafico Azioni Kerry (LSE:KYGA)

Storico

Da Mag 2023 a Mag 2024