Lloyds Banking Group PLC LBG ANNOUNCES RESULTS OF TENDER OFFER (4730C)

11 Ottobre 2022 - 10:06AM

UK Regulatory

TIDMLLOY

RNS Number : 4730C

Lloyds Banking Group PLC

11 October 2022

News Release

11 October 2022

Lloyds Banking Group plc ANNOUNCES RESULTS OF TENDER OFFER FOR

ONE SERIES OF ITS STERLING DENOMINATED ADDITIONAL TIER 1

SECURITIES

Lloyds Banking Group plc ("LBG") today announced the final

results of its previously announced cash tender offer (the "Offer")

for any and all of one series of its outstanding Sterling

denominated Additional Tier 1 Securities (the "Securities"). The

Offer was made on the terms and subject to the conditions set forth

in the Offer to Purchase dated 12 September 2022 (the "Offer to

Purchase"). Capitalized terms not otherwise defined in this

announcement have the same meaning as in the Offer to Purchase.

Based on information provided by the Tender Agent,

GBP924,331,000 aggregate principal amount of the Securities listed

in the table below were validly tendered and not validly withdrawn

by 11:59 p.m., New York City time, on 7 October 2022 (the

"Expiration Deadline"), as more fully set forth below. LBG has

accepted all Securities that were validly tendered and not validly

withdrawn prior to the Expiration Deadline. The Settlement Date is

expected to be 13 October 2022.

The table below sets forth, among other things, the principal

amount of the Securities validly tendered and accepted pursuant to

the Offer:

Aggregate Principal Amount

Aggregate Principal Amount Outstanding After

Securities ISIN Purchase Price (1) Accepted Completion of the Offer

-------------------------- ------------ ------------------ --------------------------- ---------------------------

LBG 7.625% Fixed Rate XS1043552188 GBP1,020 .00 GBP924,331,000 GBP135,301,000

Reset Additional Tier 1

Perpetual Subordinated

Contingent Convertible

Securities Callable 2023

(2) Per GBP1,000 in principal amount of Securities accepted for purchase.

Kroll Issuer Services Limited acted as tender agent for the

Offer. Lloyds Securities Inc. and UBS AG London Branch acted as

Dealer Managers for the Offer. Questions regarding the Offer should

be directed to:

Tender Agent

Kroll Issuer Services Limited Email: lbg@is.kroll.com

The Shard Telephone: +44 207 704 0880

32 London Bridge Street, SE1 9SG

London, United Kingdom

Dealer Managers

Lloyds Securities Inc. Tel: +1 (212) 827-3145

Email: lbcmliabilitymanagement@lloydsbanking.com

Attn: Liability Management Group

UBS AG London Branch Tel: +1 888 719 4210 (U.S. Toll Free)

Tel: +1 203 719 4210 (U.S.)

Tel: +44 20 7568 1121 (Europe)

Email: ol-liabilitymanagement-eu@ubs.com

Attn: Liability Management Group

Further Information

This announcement contains inside information in relation to the

Securities and is disclosed in accordance with the Market Abuse

Regulation (EU) 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 ("UK MAR"). For

the purposes of UK MAR and Article 2 of the binding technical

standards published by the Financial Conduct Authority in relation

to UK MAR as regards Commission Implementing Regulation (EU)

2016/1055, this announcement is made by Douglas Radcliffe, Group

Investor Relations Director.

For further information please contact:

Group Corporate Treasury:

Liz Padley

Non Bank Entities Treasurer & Head of Capital and Recovery

and Resolution

Telephone: +44 (0)20 7158 1737

Email: Claire-Elizabeth.Padley@LloydsBanking.com

Investor Relations:

Douglas Radcliffe

Group Investor Relations Director

Telephone: +44 (0)20 7356 1571

Email: Douglas.Radcliffe@LloydsBanking.com

Corporate Affairs:

Matthew Smith

Head of Media Relations

Tel: +44 (0)20 7356 3522

Email: matt.smith@lloydsbanking.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ISEGPGGUUUPPURG

(END) Dow Jones Newswires

October 11, 2022 04:06 ET (08:06 GMT)

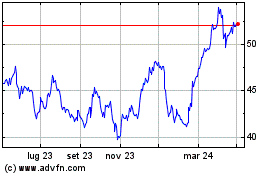

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024