Half-Yearly Results

Octopus AIM VCT 2 plc

Half-Yearly Results

Octopus AIM VCT 2 plc announces its unaudited

half-yearly results for the six months ended 31 May 2024.

Octopus AIM VCT 2 plc (the ‘Company’) is a

venture capital trust (VCT) which aims to provide shareholders with

attractive tax-free dividends and long-term capital growth by

investing in a diverse portfolio of predominantly AIM-traded

companies. The Company is managed by Octopus Investments Limited

(‘Octopus’ or the ‘Investment Manager’).

Financial summary

|

|

Six months to

31 May 2024 |

Six months to

31 May 2023 |

Year to

30 November 2023 |

|

Net assets (£’000) |

83,409 |

88,237 |

84,690 |

|

Profit/(loss) after tax (£’000) |

5,464 |

(9,038) |

(15,709) |

|

Net asset value (NAV) per share (p) |

45.5 |

53.9 |

47.9 |

|

Total return (%)1 |

6.3 |

(8.8) |

(15.6) |

|

Dividends (p)2 |

5.4 |

2.3 |

4.1 |

|

Dividend declared (p)3 |

1.8 |

1.8 |

1.8 |

1 Total Return is an alternative performance measure

calculated as movement in NAV per share in the period plus

dividends in the period, divided by the NAV per share at the

beginning of the period.

2 The 2023 year end final dividend of 1.8p and special

dividend of 3.6p per share was paid on 27 June 2024 to shareholders

on the register on 31 May 2024.

3 The interim dividend will be paid on 28 November 2024

to shareholders on the register on 31 October 2024.

Chair’s statement

The six months to 31 May 2024 heralded the start

of a change in market sentiment, albeit at a slow pace. The main

drivers of the turnaround include better than expected UK GDP

figures, a tempering of investor outflows and ongoing corporate

activity. Additionally, inflation continued to reduce and in June

(post period end) reached the Bank of England target level of 2%.

With the earlier than expected announcement of the UK Elections in

June (and a new Labour Government now in place), this created

further confidence in the possibility of an interest rate cut in

the Summer and subsequent cuts this financial year. Furthermore,

the more stable macroeconomic outlook has provided a much-needed

boost to UK capital markets and has been a catalyst for increased

IPO activity and secondary fundraisings after two years of

depressed activity.

Despite more stable macroeconomic and market

conditions, appetite for risk remains low, with growth stocks

largely remaining out of favour. As a result, although the Net

Asset Value (NAV) of the Company grew by 6.3% after adding back the

final dividend of 1.8p and special dividend of 3.6p, it lagged the

AIM index, which grew 13.8%.

It is however encouraging to see the Company

return to growth following successive periods of negative

performance. Furthermore, we anticipate that more recent positive

macroeconomic indicators, coupled with improving market sentiment,

should hopefully lead to increasing risk appetite and interest in

the growth companies which your portfolio predominantly invests in.

Encouragingly, market commentators believe the market is showing

long-awaited signs of recovery from the lows of the last years.

Against this backdrop of challenge and some

opportunity, in accordance with our dividend policy and stated

objectives of maintaining predictable levels of returns for

investors, the Board has declared an interim dividend of 1.8p which

will be paid on 28 November 2024 to shareholders on the register on

31 October 2024.

Keith Mullins

Chair

6 August 2024

Investment Manager’s review

Overview

After a protracted period of market uncertainty, particularly for

smaller companies, the six-month period to 31 May 2024 began on a

more positive note. Improved investor sentiment buoyed by positive

UK macroeconomic data reinforced the belief by market commentators

that inflation was firmly on a downward trend and interest rates

had peaked. Encouragingly, this has continued to materialise

throughout the interim period and the inflation outlook in the UK

(and other major global economies like the US and Europe) remains

more optimistic than it has been for a while, providing further

conviction that interest rates cuts are now firmly in the near-term

horizon. Although the quantum of interest cuts this calendar year

is still not clear, what has been clear is the impact of growing

macroeconomic stability to provide the much-needed catalyst and

driver for improved capital market performance.

With the UK economy returning to growth this

year mainly on the back of improved performance of various sectors

(more noticeably services and manufacturing), UK consumer

confidence on the rise and a healthy employment market, this has

provided a stronger backdrop for market recovery. Over the period

under review, the AIM Index rose by 13.8%. This compares to a 19.6%

increase of the FTSE Small Cap Index (ex-Investment Trusts) and a

13.6% rise in the FTSE All Share Index, all on a total return

basis. The FTSE All Share Index and FTSE Small Cap Index

(ex-Investment Trusts) performed noticeably better reflecting a

higher weighting in larger companies (particularly tech companies)

that have already started to see a re-rating. However, we still

believe that UK equities remain significantly undervalued despite

the signs of market recovery. This is evident in the opportunistic

corporate activity, particularly on AIM. Furthermore, the rise in

IPOs and further fundraisings across the UK capital market over the

last few months, has planted a seed for renewed interest and

investment in the UK equity market.

Performance

On the back of improved macroeconomic conditions and market

momentum, the NAV total return grew by 6.3% in the six months to 31

May 2024. As positive market momentum continues to slowly but

surely seep back in, we expect to see the re-rating of smaller

company shares (including those on AIM), albeit at a slower pace

than its larger market peers, which has historically been the case.

The VCT rules require investment to be made at this early stage and

the benefits of doing so have been clear in past periods.

There were several positive contributors to

performance including Craneware, which has had a series of

encouraging announcements over the period under review including a

significant increase in sales and customer retention. Furthermore,

it continues to strengthen its partner program and remains well

placed to benefit from positive market and industry dynamics. Beeks

Financial has now secured contracts with three major global stock

exchanges for its Exchange Cloud product. More recently, the

company has secured a Proximity Cloud contract win as well as

preferred cloud computing and connectivity vendor status for one of

the world’s largest banking groups. Judges Scientific continued to

trade in line with market expectations over the period. Post-period

end the company acquired Rockwash Geodata, a rock cuttings and

chippings digitalisations specialist to bolt on to Geotek (acquired

in 2022) which is the group’s largest subsidiary. Diaceutics

reported a strong trading performance for the full year to

December, and now boasts a record order book of £26.5 million (up

57% year on year) and 52% recurring revenues which continue to

grow. Encouragingly, Animalcare Group disposed of one of its

non-core businesses, Identicare for £24.9 million, allowing the

company the flexibility to make a transformational acquisition, in

line with its strategic focus.

Among the detractors from performance over the

period was Equipmake Holdings, which reported disappointing full

year results. The reduced revenue and profit expectations, despite

the commercialisation progress made over the last year, have

impacted the company’s share price. Despite this, over the last few

months the company has recruited a new COO and CFO and, therefore

now has in place a stronger management team with much needed

experience in the global EV market which validates the commercial

opportunity. This, coupled with the fundraising earlier in this

year to strengthen its balance sheet, will be crucial to the

delivery of its medium-term growth plan. Management changes were

also a theme at SDI Group, which appointed an experienced new CEO

in a planned succession. This was welcomed by the market, after a

long period of uncertainty. With a refocus on both organic and

acquisitive growth, we expect to see a return to consistent

positive news flow. In its full-year trading statement to the end

of December, Sosandar reported strong third-party sales and the

launch of its first international platforms (in Canada and

Australia). The delay of the opening of its first instore retail

offering has continued to affect the share price performance.

However, its first store is now expected to open this autumn with

further openings expected this calendar year.

Portfolio activity

In the period under review the Company made seven qualifying

investments at a total cost of £2.5 million, an increase on the

£1.2 million invested in the corresponding period last year. Five

of the investments made in the period were follow-on investments

into existing holdings and two were new investments.

One of these new investments was £0.6 million

into Strip Tinning Holdings plc, an existing AIM company which are

a manufacturer of flexible electrical connectors used in the

automotive industry. The other new investment was £0.2 million into

Alusid Limited, a private company which transform waste materials

into low environmental impact tiles.

The five follow on investments into existing

holdings were GenInCode plc, Verici Dx plc, Equipmake Holdings plc,

PCI Pal plc and Cambridge Cognition Holdings plc. We invested £0.6

million into GenInCode which engage in the genetic risk assessment

for cardiovascular disease, to support their US strategy and

broader expansion. We supported Verici with £0.6 million, following

their success in agreeing an exclusive global licensing deal with

Thermo Fisher for pre-transplant prognostic testing. We made a

small investment of £0.1 million into Equipmake Holdings, an

electric drivetrain specialist focusing on retrofitting carbon

intensive vehicles and aeroplanes, most notably diesel buses. This

allowed them to further pursue the opportunities that exist. We

invested a further £0.1 million into PCI Pal, a payments solutions

and services business, to further support their expansion in the

US. We invested a further £0.3 million in Cambridge Cognition,

provider of digital solutions to assess brain health in order to

support further growth and development.

Investments disposed in the period were sold for

a net overall loss of £3.1 million over book cost. We sold the

entire holdings of Velocys plc which was the subject of a cash

takeover bid. We also disposed of our entire holding in Clean Power

Hydrogen plc, Polarean Imaging plc, Renalytix plc, LoopUp Group

plc, Cordel Group and Cirata plc as well as partially disposing of

Judges Scientific where we took significant profits and Spectral

AI. Clean Power Hydrogren had faced challenges in the development

of their technology and Cirata had largely been disposed of in

prior periods.

In the period under review £0.2 million was

invested into the FP Octopus Future Generations Fund at lower share

prices than our previous investments. The funds have had a positive

impact on returns in this period. We expect them to continue to

provide a positive return on our cash awaiting investment once

stock markets return to a more settled state and equity valuations

recover.

Unquoted investments

As stated in the investment policy, the Company is able to make

investments in unquoted companies intending to float. At 31 May

2024 9.44% (31 May 2023: 6.6% and 30 November 2023: 7.6%) of the

Company’s net assets were invested in unquoted companies. This is

as a result of increasing the valuations of Hasgrove and Popsa

Holdings to reflect the continued progress of both businesses.

Transactions with the Investment

Manager

Details of amounts paid to the Investment Manager are disclosed in

Note 8 to the financial statements.

Share buybacks

In the six months to 31 May 2024, the Company bought back 2,634,548

Ordinary shares for a total consideration of £1,234,000. It is

evident from the conversations that the Investment Manager has had

with investors and advisors that this facility remains an important

consideration. The Board remains committed to maintaining its

policy of buying back shares at a discount of approximately 4.5% to

NAV (equating to up to a 5.0% discount to the selling shareholder

after costs).

Dividend

On 27 June 2024, the Company paid a dividend of 1.8p and 3.6p per

share, being the final and special dividend for the year ended 30

November 2023. For the period to 31 May 2024, the Board has

declared an interim dividend of 1.8p. This will be paid on 28

November 2024 to shareholders on the register on 31 October 2024.

It remains the Board’s intention to maintain a minimum annual

dividend payment of 3.6p per share or a 5% yield based on the prior

year end share price, whichever is the greater. This will usually

be paid in two instalments during each year.

Principal risks and

uncertainties

The principal risks and uncertainties are set out in Note 7 to the

financial statements.

Outlook

While the market rally has not been consistent over the last six

months, we remain confident that UK markets are backed by improving

macroeconomic conditions both globally and locally, providing a

stable foundation for continued recovery. Furthermore, with the UK

General Election now in our rear-view mirror, more certainty

regarding the UK’s political direction in the short and medium term

should return. However, the focus remains on the timing of interest

cuts and its expected boost to market certainty and sentiment. With

the increasing number of IPOs and further fundraisings creating

pockets of optimism across UK markets, coupled with monetary easing

expectations in the Autumn, we expect this to feed through to a

market re-rating and increased appetite for risk. This should

directly impact the performance of UK small growth company share

prices, reflecting the positive trading progress being made by many

companies in the portfolio. The portfolio’s strength is that it is

well diversified both in terms of sector exposure and of individual

company concentration. At the period end it contained 78 holdings

(31 May 2023: 85 holdings and 30 November 2023: 83 holdings) across

a range of sectors with exposure to some exciting new technologies

in the environmental and healthcare sectors.

The Octopus Quoted Companies team

6 August 2024

Directors’ responsibilities statement

We confirm that to the best of our

knowledge:

- the half-yearly

financial statements have been prepared in accordance with

Financial Reporting Standard 104 ‘Interim Financial Reporting’

issued by the Financial Reporting Council;

- the half-yearly

financial statements give a true and fair view of the assets,

liabilities, financial position and profit or loss of the

Company;

- the half-yearly

report includes a fair review of the information required by the

Financial Conduct Authority Disclosure Guidance and Transparency

Rules, being:

- we have disclosed

an indication of the important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements;

- we have disclosed

a description of the principal risks and uncertainties for the

remaining six months of the year; and

- we have disclosed

a description of related party transactions that have taken place

in the first six months of the current financial year, that may

have materially affected the financial position or performance of

the Company during that period and any changes in the related party

transactions described in the last annual report that could do

so.

On behalf of the Board

Keith Mullins

Chair

6 August 2024

Income statement

|

|

Unaudited

Six months to

31 May 2024 |

Unaudited

Six months to 31 May 2023 |

Audited

Year to 30 November 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

(Loss)/gain on disposal of fixed asset investments |

– |

(178) |

(178) |

– |

402 |

402 |

– |

668 |

668 |

|

Gain/(loss) on disposal of current asset investments |

– |

11 |

11 |

– |

– |

– |

– |

(91) |

(91) |

|

Gain/(loss) on valuation of fixed asset investments |

– |

4,055 |

4,055 |

– |

(8,417) |

(8,417) |

– |

(14,333) |

(14,333) |

|

Gain/(loss) on valuation of current asset investments |

– |

1,743 |

1,743 |

– |

(397) |

(397) |

– |

(1,047) |

(1,047) |

|

Investment income |

872 |

– |

872 |

496 |

– |

496 |

1,194 |

– |

1,194 |

|

Investment management fees |

(178) |

(533) |

(711) |

(211) |

(633) |

(844) |

(393) |

(1,179) |

(1,572) |

|

Other expenses |

(328) |

– |

(328) |

(278) |

– |

(278) |

(528) |

– |

(528) |

|

Profit/(loss) before

tax |

366 |

5,098 |

5,464 |

7 |

(9,045) |

(9,038) |

273 |

(15,982) |

(15,709) |

|

Tax |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

Profit/(loss) after

tax |

366 |

5,098 |

5,464 |

7 |

(9,045) |

(9,038) |

273 |

(15,982) |

(15,709) |

|

Earnings per

share – basic

and diluted |

0.2p |

2.8p |

3.0p |

(0.0p) |

(5.5p) |

(5.5p) |

0.2p |

(9.8p) |

(9.6p) |

There is no other comprehensive income for the period.

- The ‘Total’ column of this statement

is the profit and loss account of the Company; the supplementary

revenue return and capital return columns have been prepared in

accordance with the AIC Statement of Recommended Practice.

- All revenue and capital items in the

above statement derive from continuing operations.

- The Company has only one class of

business and derives its income from investments made in shares and

securities and from bank and money market funds, as well as Open

Ended Investment Company (OEIC) funds.

Balance sheet

|

|

Unaudited

As at 31

May 2024 |

Unaudited

As at 31 May 2023 |

Audited

As at 30 November 2023 |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Fixed asset investments |

|

58,698 |

|

63,851 |

|

53,288 |

|

Current assets: |

|

|

|

|

|

|

|

Investments |

10,542 |

|

10,462 |

|

8,796 |

|

|

Money market funds |

23,583 |

|

13,455 |

|

21,893 |

|

|

Debtors |

268 |

|

184 |

|

152 |

|

|

Cash at bank |

974 |

|

903 |

|

1,045 |

|

|

|

35,367 |

|

25,004 |

|

31,886 |

|

|

Creditors: amounts falling due within one year |

(10,656) |

|

(618) |

|

(484) |

|

|

Net current assets |

|

24,711 |

|

24,386 |

|

31,402 |

|

Total assets

less current

liabilities |

|

83,409 |

|

88,237 |

|

84,690 |

|

Called up equity share capital |

|

18 |

|

17 |

|

18 |

|

Share premium |

|

12,015 |

|

13,637 |

|

7,619 |

|

Special distributable reserve |

|

68,902 |

|

70,902 |

|

80,043 |

|

Capital reserve realised |

|

(9,037) |

|

(6,777) |

|

(5,400) |

|

Capital reserve unrealised |

|

13,500 |

|

13,079 |

|

4,765 |

|

Capital redemption reserve |

|

3 |

|

3 |

|

3 |

|

Revenue reserve |

|

(1,992) |

|

(2,624) |

|

(2,358) |

|

Total equity

shareholders’ funds |

|

83,409 |

|

88,237 |

|

84,690 |

|

NAV per share

– basic and

diluted |

|

45.5p |

|

53.9p |

|

47.9p |

The statements were approved by the Directors and authorised for

issue on 6 August 2024 and are signed on their behalf by:

Keith Mullins

Chair

Company Number: 05528235

Statement of changes in equity

|

|

Share

capital |

Share premium |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Capital redemption reserve |

Revenue reserve1 |

Total |

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1

December 2023 |

18 |

7,619 |

80,043 |

(5,400) |

4,765 |

3 |

(2,358) |

84,690 |

|

Total comprehensive income for the period |

– |

– |

– |

(700) |

5,798 |

– |

366 |

5,464 |

| Contributions

by and distributions to

owners: |

|

|

|

|

|

|

|

|

| Repurchase and cancellation of

own shares |

– |

– |

(1,234) |

– |

– |

– |

– |

(1,234) |

| Issue of shares |

– |

4,694 |

– |

– |

– |

– |

– |

4,694 |

| Share issue costs |

– |

(298) |

– |

– |

– |

– |

– |

(298) |

|

Dividends paid2 |

– |

– |

(9,907) |

– |

– |

– |

– |

(9,907) |

|

Total contributions by

and distributions to owners |

– |

4,396 |

(11,141) |

– |

– |

– |

– |

(6,745) |

| Other

movements: |

|

|

|

|

|

|

|

|

|

Prior years’ holding losses now realised |

– |

– |

– |

(2,937) |

2,937 |

– |

– |

– |

|

Total other

movements |

– |

– |

– |

(2,937) |

2,937 |

– |

– |

– |

|

Balance as at

31 May 2024 |

18 |

12,015 |

68,902 |

(9,037) |

13,500 |

3 |

(1,992) |

83,409 |

1 The sum of these reserves is an amount of

£57,873,000 (31 May 2023: £61,501,000 and 30 November 2023:

£72,285,000) which is considered distributable to shareholders.

2 The 2023 year end final dividend of 1.8p and

special dividend of 3.6p per share was paid on 27 June 2024 to

shareholders on the register on 31 May 2024.

|

|

Share capital |

Share premium |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Capital redemption reserve |

Revenue reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1

December 2022 |

17 |

12,904 |

76,154 |

(5,843) |

21,190 |

3 |

(2,631) |

101,794 |

|

Total comprehensive income for the period |

– |

– |

– |

(231) |

(8,814) |

– |

7 |

(9,038) |

|

Contributions by and

distributions to owners: |

|

|

|

|

|

|

|

|

|

Repurchase and cancellation of own shares |

– |

– |

(1,507) |

– |

– |

– |

– |

(1,507) |

|

Issue of shares |

– |

733 |

– |

– |

– |

– |

– |

733 |

|

Share issue costs |

– |

– |

– |

– |

– |

– |

– |

– |

|

Dividends paid |

– |

– |

(3,745) |

– |

– |

– |

– |

(3,745) |

Total contributions

by

and distributions to

owners |

– |

733 |

(5,252) |

– |

– |

– |

– |

(4,519) |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Prior years’ holding gains now realised |

– |

– |

– |

(703) |

703 |

– |

– |

– |

|

Total other

movements |

– |

– |

– |

(703) |

703 |

– |

– |

– |

|

Balance as at

31 May 2023 |

17 |

13,637 |

70,902 |

(6,777) |

13,079 |

3 |

(2,624) |

88,237 |

1 The sum of these reserves is an amount of

£57,873,000 (31 May 2023: £61,501,000 and 30 November 2023:

£72,285,000) which is considered distributable to shareholders.

|

|

Share capital |

Share premium |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Capital redemption reserve |

Revenue reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1

December 2022 |

17 |

12,904 |

76,154 |

(5,843) |

21,190 |

3 |

(2,631) |

101,794 |

|

Total comprehensive income for the period |

– |

– |

– |

(602) |

(15,380) |

– |

273 |

(15,709) |

|

Contributions by and

distribution to owners: |

|

|

|

|

|

|

|

|

|

Repurchase and cancellation of own shares |

– |

– |

(3,076) |

– |

– |

– |

– |

(3,076) |

|

Issue of shares |

1 |

8,821 |

– |

– |

– |

– |

– |

8,822 |

|

Share issue costs |

– |

(468) |

– |

– |

– |

– |

– |

(468) |

|

Dividends paid |

– |

– |

(6,673) |

– |

– |

– |

– |

(6,673) |

|

Total contributions by

and distributions to owners |

1 |

8,353 |

(9,749) |

– |

– |

– |

– |

(1,395) |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Cancellation of share premium |

– |

(13,638) |

13,638 |

– |

– |

– |

– |

– |

|

Prior years’ holding gains now realised |

– |

– |

– |

3,215 |

(3,215) |

– |

– |

– |

|

Transfer between reserves |

– |

– |

– |

(2,170) |

2,170 |

– |

– |

– |

|

Total other

movements |

– |

(13,638) |

13,638 |

1,045 |

(1,045) |

– |

– |

– |

Balance as

at

30 November 2023 |

18 |

7,619 |

80,043 |

(5,400) |

4,765 |

3 |

(2,358) |

84,690 |

1 The sum of these reserves is an amount of

£57,873,000 (31 May 2023: £61,501,000 and 30 November 2023:

£72,285,000) which is considered distributable to shareholders.

Cash flow statement

|

|

Unaudited

Six months

to 31 May

2024

£’000 |

Unaudited

Six months

to 31 May

2023

£’000 |

Audited

Year to

30 November

2023

£’000 |

|

Cash flows from

operating activities |

|

|

|

|

Profit/(loss) before tax |

5,464 |

(9,038) |

(15,709) |

|

Adjustments for: |

|

|

|

|

(Increase)/decrease in debtors |

(116) |

21 |

53 |

|

Increase/(decrease) in creditors1 |

265 |

(173) |

(82) |

|

Loss/(gain) on disposal of fixed asset investments |

178 |

(402) |

(668) |

|

(Gain)/loss on disposal of current asset investments |

(11) |

– |

91 |

|

(Gain)/loss on valuation of fixed asset investments |

(4,055) |

8,417 |

14,333 |

|

(Gain)/loss on valuation of current asset investments |

(1,743) |

397 |

1,047 |

|

Cash from

operations |

(18) |

(778) |

(935) |

|

|

|

|

|

Cash flows from

investing activities |

|

|

|

|

Purchase of fixed asset investments |

(2,511) |

(1,159) |

(4,086) |

|

Proceeds from sale of fixed asset investments |

978 |

1,542 |

9,157 |

|

Purchase of current asset investments |

(192) |

(1,460) |

(2,040) |

|

Proceeds from sale of current asset investments |

200 |

– |

1,505 |

|

Net cash flows

used in investing

activities |

(1,525) |

(1,077) |

4,536 |

Cash flows from

financing activities |

|

|

|

|

Purchase of own shares |

(1,234) |

(1,507) |

(3,076) |

|

Share issues |

4,694 |

– |

7,519 |

|

Share issue costs |

(298) |

– |

(468) |

|

Dividends paid (net of DRIS) |

– |

(3,012) |

(5,370) |

|

Net cash flows

used in financing

activities |

3,162 |

(4,519) |

(1,395) |

|

|

|

|

|

|

Increase/(decrease) in cash and cash

equivalents |

1,619 |

(6,374) |

2,206 |

|

Opening cash and cash equivalents |

22,938 |

20,732 |

20,732 |

|

Closing cash and

cash equivalents |

24,557 |

14,358 |

22,938 |

Closing cash and

cash equivalents

is represented

by: |

|

|

|

|

Cash at bank |

974 |

903 |

1,045 |

|

Money market funds |

23,583 |

13,455 |

21,893 |

|

Total cash and

cash equivalents |

24,557 |

14,358 |

22,938 |

1 Net of the 2023 year end final dividend of 1.8p and

special dividend of 3.6p per share paid on 27 June 2024 to

shareholders on the register on 31 May 2024.

Notes to the financial statements

1. Basis

of preparation

The unaudited half-yearly report which covers the six months to 31

May 2024 has been prepared in accordance with the Financial

Reporting Council’s (FRC) Financial Reporting Standard (FRS) 104

Interim Financial Reporting (January 2022) and the Statement of

Recommended Practice (SORP) for Investment Companies issued by the

Association of Investment Companies in 2014 (updated in July

2022).

The Directors consider it appropriate to adopt

the going concern basis of accounting. The Directors have not

identified any material uncertainties to the Company’s ability to

continue to adopt the going concern basis over a period of at least

twelve months from the date of approval of the financial

statements. In reaching this conclusion the Directors have had

regard to the potential impact on the Company of the current

economic and geopolitical climate.

The principal accounting policies have remained

unchanged from those set out in the Company’s 2023 Annual Report

and Accounts.

2. Publication

of non-statutory

accounts

The unaudited half-yearly report for the six months ended 31 May

2024 does not constitute statutory accounts within the meaning of

Section 415 of the Companies Act 2006. The comparative figures for

the year ended 30 November 2023 have been extracted from the

audited financial statements for that year, which have been

delivered to the Registrar of Companies. The independent auditor’s

report on those financial statements, in accordance with chapter 3,

part 16 of the Companies Act 2006, was unqualified. This

half-yearly report has not been reviewed by the Company’s

auditor.

3. Earnings

per share

The earnings per share at 31 May 2024 are calculated on the basis

of 183,332,123 shares (31 May 2023: 163,971,209 and 30 November

2023: 164,257,336), being the weighted average number of shares in

issue during the period.

There are no potentially dilutive capital

instruments in issue and, so no diluted returns per share figures

are relevant.

4. Net

asset value per

share

The net asset value per share is based on net assets as at 31 May

2024 divided by 183,467,725 shares in issue at that date (31 May

2023: 163,971,209 and 30 November 2023: 176,875,405).

5. Dividends

The Directors have declared an interim dividend of 1.8p per share

(2023: 1.8p per share) payable from the special distributable

reserve. This dividend will be paid on 28 November 2024 to those

shareholders on the register at 31 October 2024. The 2023 AGM

approved final dividend of 1.8p and special dividend of 3.6p per

share was paid on 27 June 2024.

6. Buybacks

and share

issues

During the six months ended 31 May 2024 the Company repurchased the

following shares.

|

Date |

No. of

shares |

Price (p) |

Cost (£) |

|

14 December 2023 |

791,619 |

45.8 |

362,000 |

|

18 January 2024 |

408,110 |

46.6 |

190,000 |

|

22 February 2024 |

448,271 |

46.8 |

210,000 |

|

21 March 2024 |

280,039 |

48.0 |

134,000 |

|

25 April 2024 |

504,889 |

47.3 |

239,000 |

|

23 May 2024 |

201,620 |

48.9 |

99,000 |

|

Total |

2,634,548 |

|

1,234,000 |

The weighted average price of all buybacks

during the period was 46.8p per share.

During the six months ended 31 May 2024 the Company issued the

following shares:

|

Date |

No. of

shares |

Price (p) |

Net proceeds (£) |

|

14 December 2023 |

5,635,893 |

47.2 |

2,661,000 |

|

11 January 2024 |

3,555,688 |

48.3 |

1,717,000 |

|

16 May 2024 |

35,287 |

50.2 |

18,000 |

|

Total |

9,226,868 |

|

4,396,000 |

The weighted average allotment price of all shares issued during

the period net of costs was 47.7p per share.

7. Principal

risks and

uncertainties

The Company’s principal risks are: Investment risk; VCT qualifying

status risk; Operational risk; Information security risk; Valuation

risk; Legislative risk; Liquidity risk; and Economic risk. These

risks, and the way in which they are managed, are described in more

detail in the Company’s Annual Report and Accounts for the year

ended 30 November 2023. The Board has also considered emerging

risks, including geo-political tensions, adverse changes in the

global macroeconomic environment and climate change, which the

Board seeks to mitigate by setting policy and reviewing

performance. Otherwise, the Company’s principal risks and

uncertainties have not changed materially since the date of that

report.

8. Related

party transactions

The Company has employed Octopus Investments Limited (‘Octopus’ or

‘the Investment Manager’) throughout the period as Investment

Manager. Octopus has also been appointed as Custodian of the

Company’s investments under a Custodian Agreement. The Company has

been charged £711,000 by Octopus as a management fee in the period

to 31 May 2024 (31 May 2023: £844,000 and 30 November 2023:

£1,572,000). The management fee is payable quarterly and is based

on 2% of net assets measured at quarterly intervals.

The Company receives a reduction in the

management fee for the investments in other Octopus managed funds,

being the Multi Cap Income Fund, Micro Cap Growth Fund and Future

Generations Fund, to ensure the Company is not double charged on

these products. This amounted to £26,000 in the period to 31 May

2024 (31 May 2023: £29,000 and 30 November 2023: £56,000). For

further details please refer to the Company’s Annual Report and

Accounts for the year ended 30 November 2023.

As at 31 May 2024, Octopus Investments Nominees

Limited (OINL) held nil shares (2022: nil) in the Company as

beneficial owner. Throughout the period to 31 May 2024 OINL

purchased nil shares (2023: nil) at a cost of £nil (2023: £nil) and

sold nil shares (2023: 4,284) for proceeds of £nil (2023: £2,000).

This is classed as a related party transaction as Octopus, the

Investment Manager, and OINL are part of the same group of

companies. Any such future transactions, where OINL takes over the

legal and beneficial ownership of Company shares will be announced

to the market and disclosed in annual and half yearly reports.

9. Post-balance

sheet events

The following events occurred between the balance sheet date and

the signing of these financial statements:

•

Disposal of the

entire investment in Spectral MD Holdings Limited;

• Investments

totalling £322,000 into GSK plc;

• Investments

totalling £322,000 into Wise plc;

• Investments

totalling £326,000 into Bytes Technology Group plc;

• Investments

totalling £165,000 into JTC plc;

• On 20 June 2024,

the Company purchased for cancellation 439,789 Ordinary shares at a

price of 42.42p.

• On 18 July 2024,

the Company purchased for cancellation 253,990 Ordinary shares at a

price of 42.82p.

10. Fixed

asset investments

Accounting policy

The Company’s principal financial assets are its investments and

the policies in relation to those assets are set out below.

Purchases and sales of investments are

recognised in the financial statements at the date of the

transaction (trade date).

These investments will be managed and their

performance evaluated on a fair value basis in accordance with a

documented investment strategy and information about them has to be

provided internally on that basis to the Board. Accordingly, as

permitted by FRS 102, the investments are measured as being fair

value through profit or loss (FVTPL) on the basis that they qualify

as a group of assets managed, and whose performance is evaluated,

on a fair value basis in accordance with a documented investment

strategy. The Company’s investments are measured at subsequent

reporting dates at fair value.

In the case of investments quoted on a

recognised stock exchange, fair value is established by reference

to the closing bid price on the relevant date or the last traded

price, depending upon convention of the exchange on which the

investment is quoted. This is consistent with the International

Private Equity and Venture Capital Valuation (IPEV) guidelines.

Gains and losses arising from changes in fair

value of investments are recognised as part of the capital return

within the Income Statement and allocated to the capital reserve –

unrealised. The Investment Manager reviews changes in fair value of

investments for any permanent reductions in value and will give

consideration to whether these losses should be transferred to the

Capital reserve – realised.

In the preparation of the valuations of assets

the Directors are required to make judgements and estimates that

are reasonable and incorporate their knowledge of the performance

of the investee companies.

Fair value

hierarchy

Paragraph 34.22 of FRS 102 suggests following a

hierarchy of fair value measurements, for financial instruments

measured at fair value in the balance sheet, which gives the

highest priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority

to unobservable inputs (Level 3). This methodology is adopted by

the Company and requires disclosure of financial instruments to be

dependent on the lowest significant applicable input, as laid out

below:

Level 1: The unadjusted, fully accessible and

current quoted price in an active market for identical assets or

liabilities that an entity can access at the measurement date.

Level 2: Inputs for similar assets or

liabilities other than the quoted prices included in Level 1 that

are directly or indirectly observable, which exist for the duration

of the period of investment.

Level 3: This is where inputs are unobservable,

where no active market is available and recent transactions for

identical instruments do not provide a good estimate of fair value

for the asset or liability.

There have been no reclassifications between

levels in the period. The change in fair value for the current and

previous period is recognised through the profit and loss

account.

Disclosure

|

|

|

|

|

Level 1:

Quoted equity

investments

£’000 |

Level 3:

Unquoted

investments

£’000 |

Total

£’000 |

|

Cost at 1 December 2023 |

47,922 |

2,807 |

50,729 |

|

Opening unrealised gain at 1 December 2023 |

(1,903) |

4,462 |

2,559 |

|

Valuation at 1

December 2023 |

46,019 |

7,269 |

53,288 |

Purchases at cost |

1,711 |

800 |

2,511 |

|

Disposal proceeds |

(978) |

– |

(978) |

|

Loss on realisation of investments |

(178) |

– |

(178) |

|

Change in fair value in year |

3,527 |

528 |

4,055 |

|

Valuation at 31

May 2024 |

50,101 |

8,597 |

58,698 |

Cost at 31 May 2024 |

45,538 |

3,607 |

49,145 |

|

Closing unrealised gain at 31 May 2024 |

4,563 |

4,990 |

9,553 |

|

Valuation at 31

May 2024 |

50,101 |

8,597 |

58,698 |

Level 1 valuations are valued in accordance with

the bid price on the relevant date. Further details of the fixed

asset investments held by the Company are shown within the Interim

Management Report.

Level 3 investments are reported at fair value

in accordance with FRS 102 Sections 11 and 12, which is determined

in accordance with the latest IPEV guidelines. In estimating fair

value, there is an element of judgement, notably in deriving

reasonable assumptions, and it is possible that, if different

assumptions were to be used, different valuations could have been

attributed to some of the Company’s investments.

Level 3 investments include £720,000 (31 May

2023: £400,000 and 30 November 2023: £120,000) of convertible loan

notes held at cost, which is deemed to be current fair value, in

addition to this the Company holds six unquoted investments which

are classified as level 3 in terms of fair value hierarchy. These

are valued based on a range of valuation methodologies, determined

on an investment specific basis. The price of recent investment is

used where a transaction has occurred sufficiently close to the

reporting date to make this the most reliable indicator of fair

value. Where recent investment is not deemed to indicate the most

reliable indicator of fair value i.e. the most recent investment is

too distant from the reporting date for this to be deemed a

reasonable indicator, other market based approaches including

earnings multiples, annualised recurring revenues, discounted

cashflows or net assets are used to determine a fair value for the

investments.

All capital gains or losses on investments are

classified at FVTPL. Given the nature of the Company’s venture

capital investments, the changes in fair value of such investments

recognised in these financial statements are not considered to be

readily convertible to cash in full at the balance sheet date and

accordingly these gains are treated as holding gains or losses.

At 31 May 2024 there were no commitments in

respect of investments approved by the Investment Manager but not

yet completed. The transaction costs incurred when purchasing or

selling assets are written off to the Income Statement in the

period that they occur.

11. Half-Yearly

Report

The unaudited half-yearly report for the six months ended 31 May

2024 will shortly be available to view at

https://octopusinvestments.com/our-products/venture-capital-trusts/octopus-aim-vcts/

A copy of the half-yearly report will be

submitted to the National Storage Mechanism and will shortly be

available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800BW27BKJCI35L17

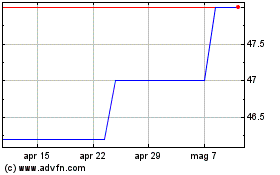

Grafico Azioni Octopus Aim Vct 2 (LSE:OSEC)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Octopus Aim Vct 2 (LSE:OSEC)

Storico

Da Feb 2024 a Feb 2025