Half Year

Trading Update and Notice of Interim Results

- Full year 2024 revenue and medium-term financial guidance

reiterated; underpinned by OXB’s growing market share in the

expanding cell and gene therapy market

- Contracted value of client orders

in the first seven months of the year reflective of strong demand

for CDMO services at approximately £80 million

- Revenue backlog stood at

approximately £113 million at 31 July 2024; high level of GMP suite

reservation for 2025 gives increased visibility and underpins

confidence in forecasts

- With increasing demand for

services, OXB to invest in talent to support future growth,

therefore low double-digit Operating EBITDA loss expected in 2024;

2025 EBITDA profitability outlook maintained due to continued cost

discipline and a measured approach to operational spend

Oxford, UK – 8 August

2024: Oxford Biomedica plc (LSE:OXB) (“Oxford

Biomedica”, "OXB" or “the Company”), a quality and innovation-led

cell and gene therapy CDMO, today provides a trading update for the

first half of 2024.

Additionally, the

Company announces that it will report its Interim Results for

the six months ended 30 June 2024 on Monday 23 September 2024.

Strong trading for H1 2024 and

reconfirmed financial guidance

OXB has continued to see strong momentum in 2024

with revenues for the first half expected to be approximately £50

million. As previously communicated, revenues are expected to be

second-half weighted, with contracted client orders providing a

high degree of visibility. The Company reiterates revenue guidance

for the full year within the £126 million to £134 million

range.

The first half of 2024 is expected to result in

a negative Operating EBITDA with a positive Operating EBITDA

expected in the second half, due to the effectiveness of the

Company’s strategic initiatives, including streamlining of

operations and expected strong revenue growth in the second half.

With an increase in late-stage client activity expected in 2025,

OXB will invest in building its technical and operational workforce

to support this demand.

With this investment in talent to support

revenue growth, the Company expects a low double-digit Operating

EBITDA loss for the full year 2024. As communicated at the full

year results, 2024 Operating EBITDA includes a mid to high single

digit loss from the recently acquired ABL Europe business (renamed

“Oxford Biomedica (France)”), which was fully funded by cash

received from Institut Mérieux prior to completion of the

acquisition.

OXB reiterates its medium-term financial

guidance of a three-year revenue CAGR in excess of 35% for

2023-2026, to be profitable on an Operating EBITDA level in 2025,

with Operating EBITDA margins in excess of 20% by the end of

2026.

OXB’s cash position remains strong with £81

million cash as of 30 June 2024. This includes the proceeds from a

EUR 20 million (£16.9 million) investment by TSGH SAS, a subsidiary

of Institut Mérieux SA, following the acquisition of Oxford

Biomedica (France).

Strong demand for CDMO

services

Demand for OXB’s CDMO services has remained

strong across all key viral vector types. The contracted value of

client orders signed during 2024 was approximately £80 million as

at 31 July 2024, in line with the Company’s expectations. Based on

current business development activities and OXB’s growing market

share, the cadence of signing orders is expected to increase in the

second half of the year. Revenue backlog1 (including France) stood

at approximately £113 million at 31 July 2024, compared to £104

million at 31 March 2024.

GMP suite reservation for 2025 has been high,

further bolstering confidence in future revenue delivery. Clients

transitioning from early stage manufacturing to late stage and

commercial activities have moved from a batch reservation model to

a binding forecast model, providing increased revenue

visibility.

Oxford Biomedica has made significant progress

with its new commercial, multi-site, multi-vector strategy. The

Company has successfully transferred its lentiviral vector

capabilities to its Bedford, Massachusetts site and commenced its

first lentiviral vector programme in the US. Plans are underway to

enable the Company’s French sites to provide similar lentiviral

vector services by the end of 2024.

Dr. Frank Mathias, Chief Executive

Officer of Oxford Biomedica, commented: "Oxford Biomedica

has seen continued strong momentum in 2024, reinforcing our

position as a world-leading cell and gene therapy CDMO. Our

multi-site, multi-vector strategy is gaining traction, demonstrated

by our strong revenue backlog and growing order book. These strong

KPIs and high GMP suite reservation for 2025 provide us with

confidence in our growth trajectory and our ability to capitalise

on the growing opportunities in the cell and gene therapy

market.”

Notice of Interim Results

OXB expects to report its Interim Results for

the six months ended 30 June 2024 on Monday 23 September 2024. A

briefing for investors and analysts will take place at 13:00 BST /

08:00 ET at One Moorgate Place, London, EC2R 6EA.

-Ends-

Enquiries:

Oxford Biomedica

plc:

Sophia Bolhassan, Head of Investor

Relations – T: +44 (0) 1865 509 737 / E: ir@oxb.com

ICR Consilium:T: +44

(0)20 3709 5700 / E: oxfordbiomedica@icrhealthcare.com

Mary-Jane Elliott / Angela Gray / Davide

Salvi

About Oxford Biomedica

Oxford Biomedica (LSE:

OXB) is a quality and innovation-led contract development and

manufacturing organisation (CDMO) in cell and gene therapy with a

mission to enable its clients to deliver life changing therapies to

patients around the world.

One of the original

pioneers in cell and gene therapy, OXB has more than 25 years of

experience in viral vectors; the driving force behind the majority

of cell and gene therapies. OXB collaborates with some of the

world's most innovative pharmaceutical and biotechnology companies,

providing viral vector development and manufacturing expertise in

lentivirus, adeno-associated virus (AAV), adenovirus, and other

viral vector types. Oxford Biomedica's world-class capabilities

span from early-stage development to commercialisation. These

capabilities are supported by robust quality-assurance systems,

analytical methods and depth of regulatory expertise.

OXB offers a vast

number of unique technologies for viral vector manufacturing,

including a 4th generation lentiviral vector system (the

TetravectaTM system), dual plasmid system for AAV production,

suspension and perfusion process using process enhancers and stable

producer and packaging cell lines.

Oxford Biomedica, a

FTSE4Good constituent, is headquartered in Oxford, UK. It has

bioprocessing and manufacturing facilities across Oxfordshire, UK,

Lyon and Strasbourg, France, and near Boston, MA, US. Learn more

at www.oxb.com, and follow us

on LinkedIn and YouTube.

1 Revenue backlog represents ordered CDMO

revenues available to earn. The value of customer orders included

in revenue backlog only includes the value of work for which the

customer has signed a financial commitment for OXB to undertake,

whereby any changes to agreed values will be subject to either

change orders or cancellation fees.

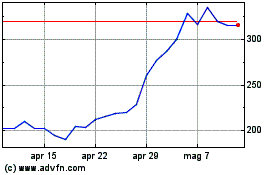

Grafico Azioni Oxford Biomedica (LSE:OXB)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Oxford Biomedica (LSE:OXB)

Storico

Da Dic 2023 a Dic 2024