Pantheon Resources PLC Block Listing Six Monthly return

20 Maggio 2024 - 1:12PM

RNS Regulatory News

RNS Number : 1325P

Pantheon Resources PLC

20 May 2024

Pantheon Resources

plc

Block Listing Six Monthly

return

Pantheon Resources plc ("Pantheon"

or "the Company"), gives below the information required by Schedule

6 of the AIM Rules for Companies in connection the Pantheon

Resources plc 2009 Discretionary Share Option Plan which was

updated in July 2020 (the "Scheme").

|

Name of company:

|

Pantheon Resources Plc

|

|

Name of scheme:

|

Pantheon Resources Plc 2009

Discretionary Share Option Plan

|

|

Period of return:

|

From: 18 November 2023

To: 18 May

2024

|

|

Balance of unallotted securities under scheme from previous

return:

|

23,930,000 Ordinary Shares

of £0.01 each in the Company ("Ordinary

Shares")

|

|

The

amount by which the block scheme has been increased since the date

of the last return (if any increase has been applied

for):

|

N/A

|

|

Number of securities issued/allotted under the scheme during

the period:

|

nil

|

|

Balance under the scheme not yet issued at the end of the

period subject to the block admission:

|

23,930,000 Ordinary

Shares

|

|

Number and class of securities originally

listed and the date of admission

|

32,830,000 Ordinary Shares on 18 May

2022

|

|

Total number of securities in issue at the end of

the period

|

944,218,427 Ordinary

Shares

|

|

|

|

|

Name of contact:

|

Justin Hondris

|

|

Telephone number of contact:

|

+44 20 7484 5361

|

Further information:

|

Pantheon Resources plc

|

+44 20 7484 5361

|

|

Jay Cheatham, CEO

David Hobbs, Executive

Chairman

|

|

|

Justin Hondris, Director, Finance

and Corporate Development

|

|

|

Canaccord Genuity Limited (Nominated Adviser and

broker)

|

|

|

Henry

Fitzgerald-O'Connor, James Asensio, Ana Ercegovic

|

+44 20 7523 8000

|

|

BlytheRay

|

|

|

Tim Blythe, Megan Ray, Matthew

Bowld

|

+44 20 7138 3204

|

Notes to Editors

Pantheon Resources plc is an AIM

listed Oil & Gas company focused on developing the Ahpun and

Kodiak fields located on state land on the Alaska North Slope

("ANS"), onshore USA, where it has a 100% working interest in c.

193,000 acres. In December 2023, Pantheon was the successful bidder

for an additional 66,240 acres with very significant resource

potential, contiguous to the Ahpun and Kodiak projects. Following

the issue of the new leases, which are expected to be formally

awarded in summer 2024 upon payment of the balance of the

application monies, the Company will have a 100% working interest

in c. 259,000 acres. Certified contingent resources attributable to

these projects are currently around 1.3 billion barrels of

marketable liquids, located adjacent to Alaska's Trans Alaska

Pipeline System ("TAPS") with additional IERs expected within the

next month.

Pantheon's stated objective is to

demonstrate sustainable market recognition of a value of $5-$10/bbl

of recoverable resources by end 2028. The Company is targeting

Final Investment Decision ("FID") on the Ahpun field by the end of

2025, subject to regulatory approvals, building production to at

least 20,000 barrels per day of marketable liquids into the TAPS

main oil line, and applying the resultant cashflows to support the

FID on the Kodiak field by the end of 2028.

A major differentiator to other ANS

projects is the close proximity to existing roads and pipelines

which offers a significant competitive advantage to Pantheon,

allowing for materially lower infrastructure costs and the ability

to support the development with a significantly lower pre-cashflow

funding requirement than is typical in Alaska.

The Company's project portfolio has

been endorsed by world renowned experts. Netherland, Sewell &

Associates ("NSAI") estimate a 2C contingent recoverable resource

in the Kodiak project that total 1,208 million barrels of

marketable liquids and 5,396 billion cubic feet of natural gas.

("LKA") has confirmed a combination of reserves and contingent

resources totalling 79 million barrels of marketable liquids and

424 billion cubic feet of natural gas. Cawley Gillespie &

Associates ("CGA") are working on estimates for the Ahpun western

topsets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

BLRURAARSAUVUAR

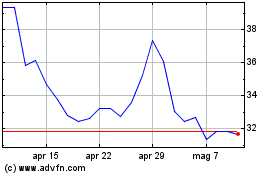

Grafico Azioni Pantheon Resources (LSE:PANR)

Storico

Da Gen 2025 a Feb 2025

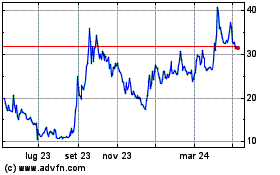

Grafico Azioni Pantheon Resources (LSE:PANR)

Storico

Da Feb 2024 a Feb 2025